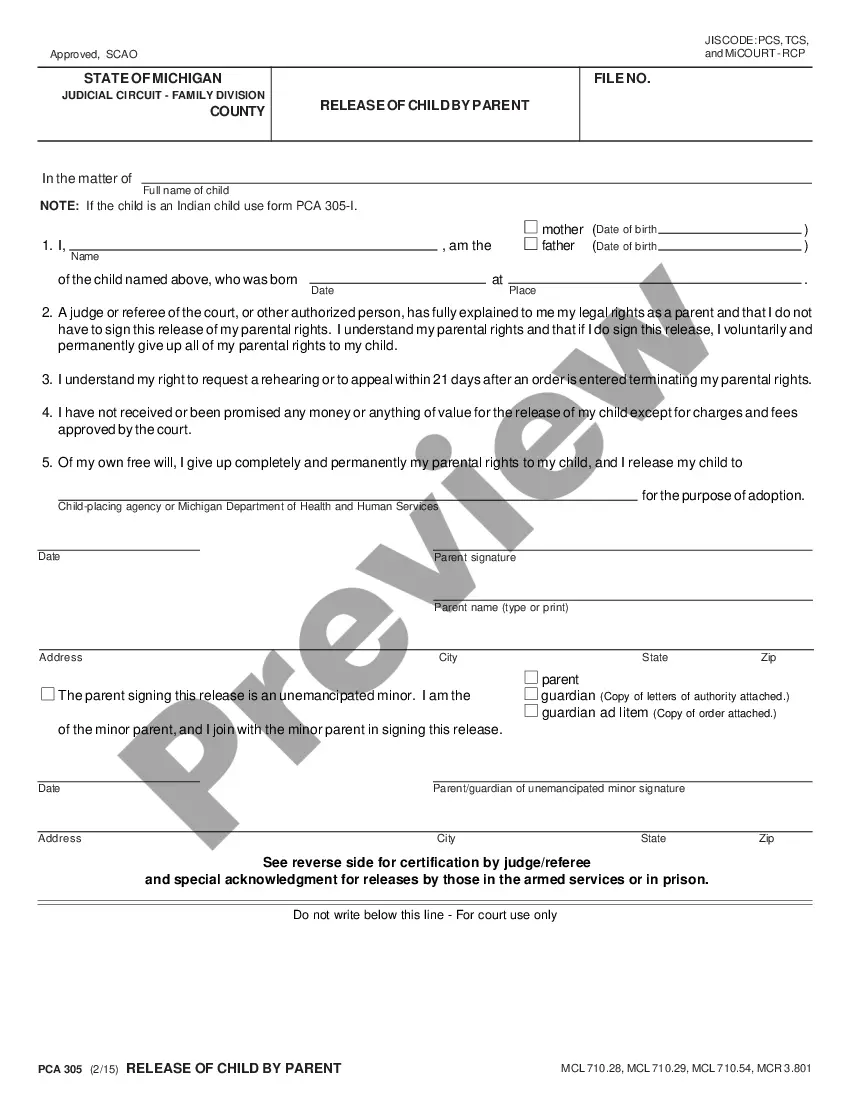

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

South Carolina Notice of Non-Responsibility of Wife for Debts or Liabilities

Description

How to fill out Notice Of Non-Responsibility Of Wife For Debts Or Liabilities?

Are you currently in a location where you need to obtain documents for either professional or personal purposes every day.

There are numerous legal document templates available online, but locating ones you can trust is not straightforward.

US Legal Forms offers thousands of form templates, such as the South Carolina Notice of Non-Responsibility of Wife for Debts or Liabilities, designed to comply with state and federal regulations.

Choose the pricing plan you prefer, fill in the necessary information to create your account, and finalize your purchase using your PayPal or Visa or Mastercard.

Select a convenient file format and download your copy.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the South Carolina Notice of Non-Responsibility of Wife for Debts or Liabilities template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and confirm it is for the correct city/county.

- Utilize the Review button to examine the form.

- Check the description to ensure you have chosen the correct form.

- If the form is not what you are searching for, use the Search field to find the form that suits your needs and requirements.

- When you find the right form, click Buy now.

Form popularity

FAQ

You are usually not legally responsible for your wife's debts in South Carolina, particularly if you have filed a South Carolina Notice of Non-Responsibility of Wife for Debts or Liabilities. This notice helps clarify financial responsibility and separates your financial obligations from those of your spouse. However, if there are joint assets or debts, this could complicate matters. Always consult with an attorney to fully understand your rights and responsibilities.

Generally, in South Carolina, you are not held liable for your spouse's debts incurred during the marriage, thanks to the South Carolina Notice of Non-Responsibility of Wife for Debts or Liabilities. This legal document allows you to assert that you are not responsible for debts your wife may have incurred independently. Keep in mind, joint accounts or co-signed loans could change this situation. It’s essential to review your financial agreements and seek advice when needed.

In South Carolina, creditors typically cannot come after you for your wife's debt, as the South Carolina Notice of Non-Responsibility of Wife for Debts or Liabilities provides a legal way to protect spouses from each other's financial obligations. This notice establishes clear boundaries regarding liability. However, if you co-sign on loans or accounts, you may still be held responsible. It’s wise to consult with a legal professional to understand your specific situation better.

In South Carolina, you may be held responsible for your spouse's debts only if they were incurred during the marriage and are considered marital debts. However, if you take proper steps, such as filing a South Carolina Notice of Non-Responsibility of Wife for Debts or Liabilities, you can protect yourself from certain financial responsibilities. Consulting with a legal advisor can further clarify your obligations.

A part year resident of South Carolina is someone who lives in the state for only a portion of the year, possibly due to relocation or temporary work. This status may affect your tax obligations, as you would only be responsible for income earned during your residency. Understanding your residency status is essential, particularly if you plan to file a South Carolina Notice of Non-Responsibility of Wife for Debts or Liabilities.

A non liable spouse is a partner who is not legally responsible for debts incurred solely by the other spouse. This situation often arises when one spouse separates financial responsibilities or formally files a South Carolina Notice of Non-Responsibility of Wife for Debts or Liabilities. Knowing your status can aid in protecting your financial interests during disputes or divorce proceedings.

In South Carolina, marital debt generally includes any debt incurred during the marriage by either spouse. This can encompass mortgages, credit card debts, and personal loans. Understanding this is crucial for those considering a South Carolina Notice of Non-Responsibility of Wife for Debts or Liabilities, as it delineates what obligations fall under marital responsibilities.

Factors for equitable relief typically include whether you had knowledge of your spouse's tax issues, whether you benefited from the unpaid taxes, and your current economic circumstances. The IRS evaluates each case based on these criteria, making it essential to understand how the South Carolina Notice of Non-Responsibility of Wife for Debts or Liabilities might apply. For guidance on building a strong case for equitable relief, explore the resources available through USLegalForms.

To qualify for innocent spouse relief, you need to provide proof showing you were unaware of the tax issues caused by your spouse’s actions. Documentation may include financial records, communication between spouses regarding finances, and any other relevant evidence. Familiarizing yourself with the South Carolina Notice of Non-Responsibility of Wife for Debts or Liabilities can help clarify your role in debt management. Consider using USLegalForms to gather the necessary paperwork and guides for your case.

In most cases, the IRS cannot pursue your wife for debts incurred solely under your name, particularly if a South Carolina Notice of Non-Responsibility of Wife for Debts or Liabilities has been filed. However, if you filed jointly, both spouses may be liable for the taxes due. It's crucial to understand the specifics of innocent spouse relief to protect her from future tax obligations. USLegalForms offers resources that can clarify these legal protections.