South Carolina Acknowledged Receipt of Goods

Description

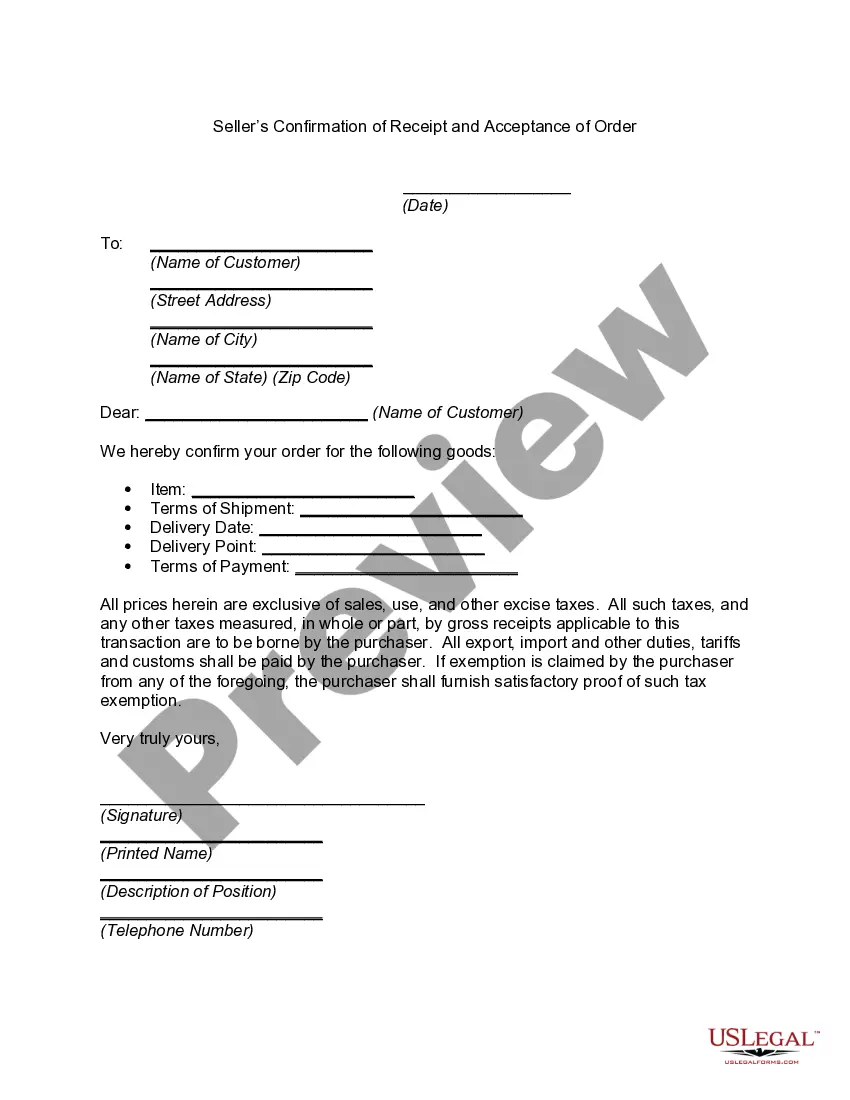

Goods are defined under the Uniform Commercial Code as those things that are movable at the time of identification to a contract for sale. (UCC ??? 2-103(1)(k)). The term includes future goods, specially manufactured goods, and unborn young of animals, growing crops, and other identified things attached to realty.

How to fill out Acknowledged Receipt Of Goods?

If you need to finalize, obtain, or create sanctioned document templates, utilize US Legal Forms, the most extensive collection of legal forms available online.

Employ the site's straightforward and user-friendly search to find the documents you need.

Numerous templates for commercial and personal purposes are categorized by types and regions, or keywords.

Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

Step 4. Once you find the form you need, click the Buy Now button. Choose the payment plan you prefer and enter your information to register for an account.

- Use US Legal Forms to locate the South Carolina Acknowledged Receipt of Goods with just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click the Download button to retrieve the South Carolina Acknowledged Receipt of Goods.

- You can also access forms you have previously obtained in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Use the Review option to examine the form's details. Don't forget to read the instructions.

Form popularity

FAQ

South Carolina does not require you to submit a copy of your federal tax return with your state return. However, it may be beneficial to keep a copy for your records and potential inquiries from the state. Knowing the connection between your federal and state returns, alongside the South Carolina Acknowledged Receipt of Goods, can enhance your filing experience.

Yes, South Carolina authorities can request your federal tax return for verification purposes. This access typically occurs if there are discrepancies or if an audit takes place. Maintaining comprehensive records, including the South Carolina Acknowledged Receipt of Goods, helps establish your financial position and can assist in these situations.

The CL-1 form is a declaration of estimated tax payment in South Carolina, designed for individuals and businesses to report their tax liability. Completing this form allows you to stay current with your tax duties and avoid penalties. Proper documentation, including the South Carolina Acknowledged Receipt of Goods, supports your information in case of inquiries about your CL-1 filing.

Yes, South Carolina requires residents to file a state tax return if their income exceeds certain thresholds. The tax filing obligations depend on various factors, including your filing status and how much you earn. Understanding your responsibilities, including the relevance of the South Carolina Acknowledged Receipt of Goods, can help streamline the filing process.

The SCDOR file number is a unique identifier assigned by the South Carolina Department of Revenue for tracking your tax filings and payments. This number is crucial when interacting with tax authorities and helps in organizing your tax documents. Safeguarding information related to the South Carolina Acknowledged Receipt of Goods can prevent errors related to your SCDOR file number.

You do not need to submit a copy of your state return when filing your federal return. Each return operates independently, so focus on providing accurate information on both forms. To avoid any misunderstandings, keep your records organized, including documents related to the South Carolina Acknowledged Receipt of Goods. This habit will support your financial practices.

To claim your South Carolina sales tax refund, you need to file the appropriate form with the South Carolina Department of Revenue. Ensure you gather all relevant receipts to support your claim. Utilizing the South Carolina Acknowledged Receipt of Goods ensures you have the proof required for a valid claim. This will help make the refund process more efficient.

You do not need to attach a copy of your federal return when filing your North Carolina state return. However, make sure to keep your documentation organized, as it may benefit you in case of discrepancies. Filing your returns accurately will ultimately help ensure the smooth handling of your taxes. Consider checking out the South Carolina Acknowledged Receipt of Goods for clarity in related processes.

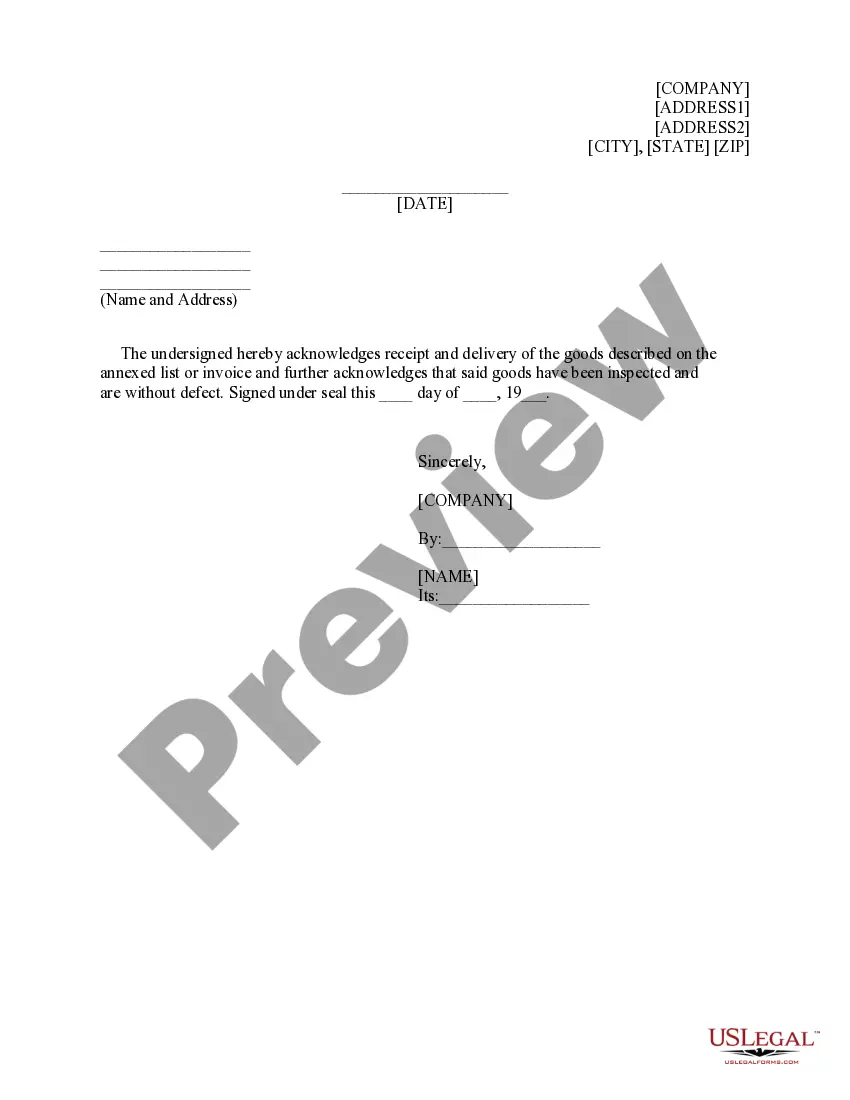

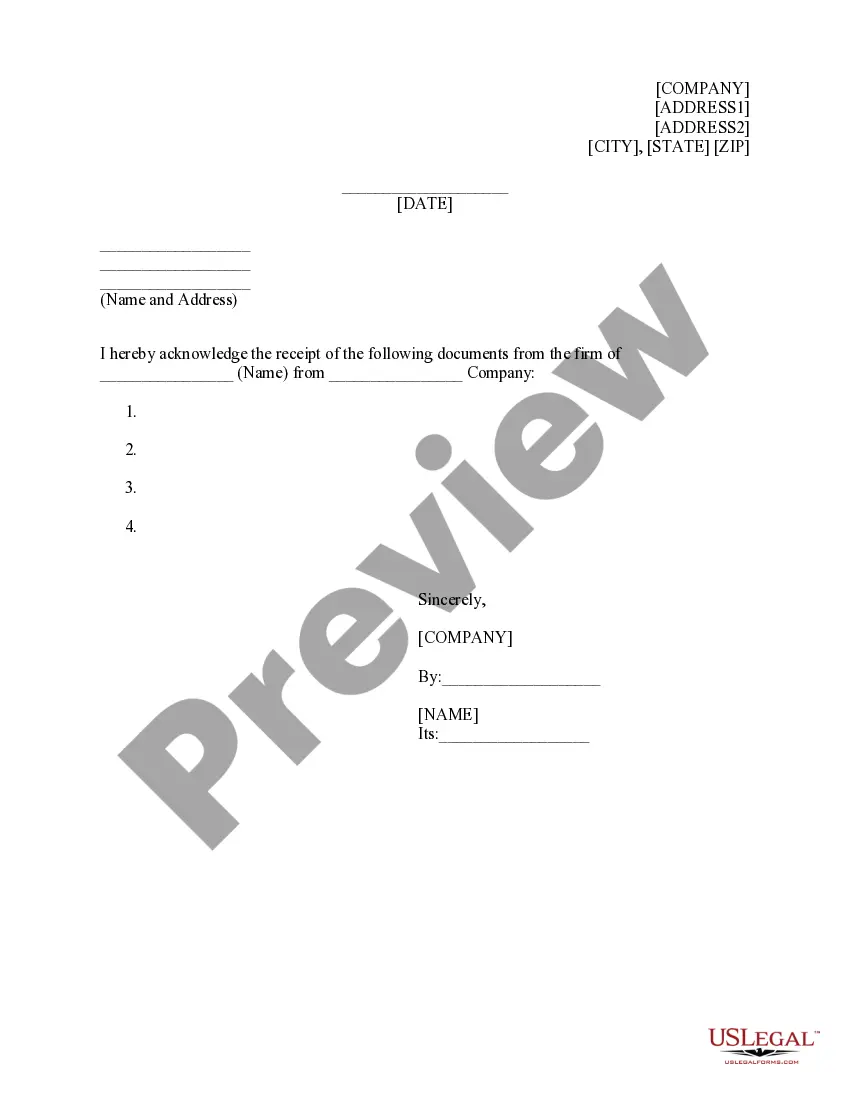

When acknowledging a receipt, a simple statement like 'I hereby acknowledge the receipt of the item described above' suffices. Be sure to include specifics about the item or document received. This clarity reinforces accountability and serves to protect your interests in any future inquiries.

To write an acknowledgment receipt, begin with a title indicating it is a receipt. Include essential details like the date, names of the involved parties, a description of what is being acknowledged, and a signature. Utilizing templates from uslegalforms can streamline this process, ensuring you create a professional acknowledgment receipt.