South Carolina Miller Trust Forms for Medicaid

Description

How to fill out Miller Trust Forms For Medicaid?

Selecting the appropriate legitimate document design can be a challenging task.

Clearly, there are numerous templates accessible online, but how do you find the legitimate format you need.

Utilize the US Legal Forms website.

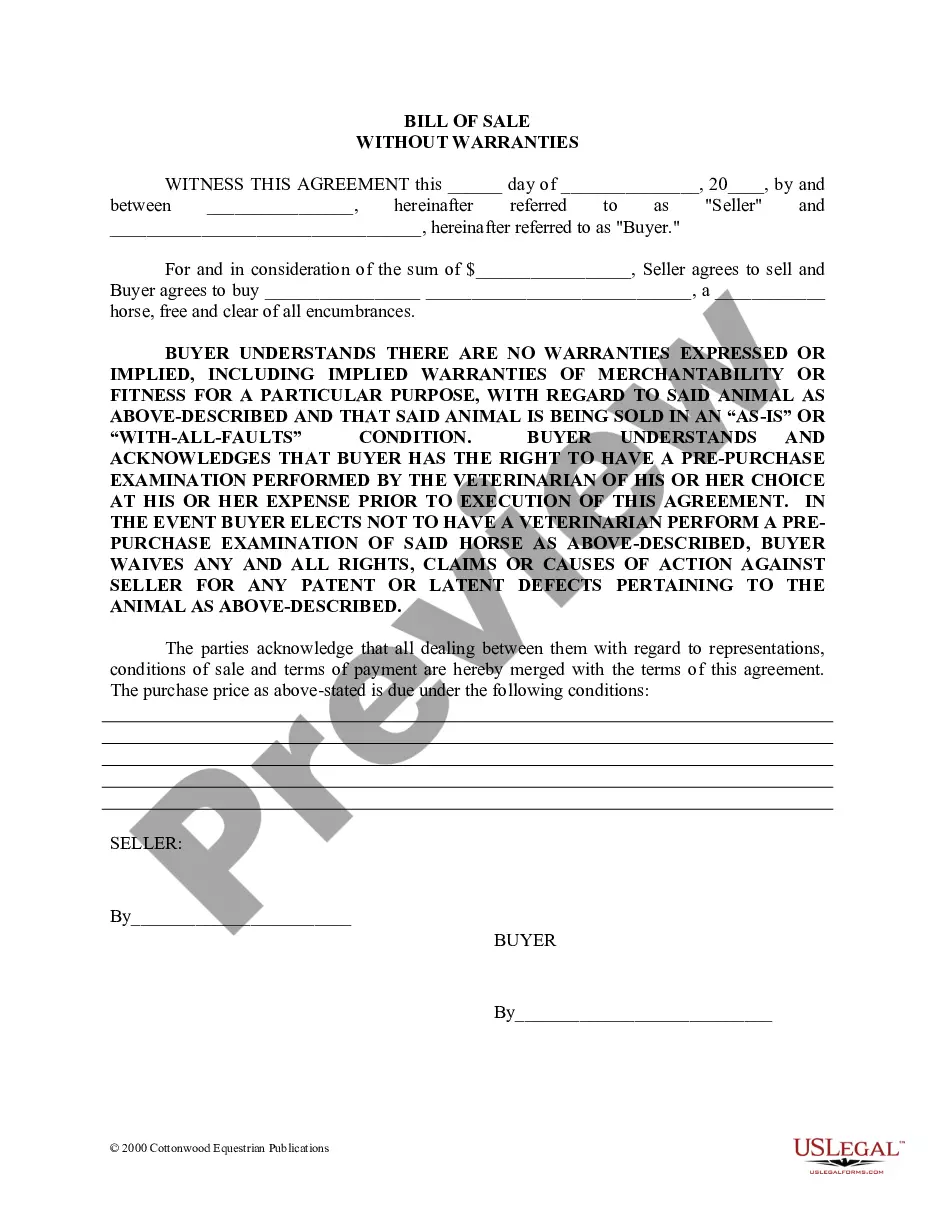

First, ensure you have selected the correct form for your area/region. You can review the form using the Preview button and read the form description to confirm it is the right one for you.

- This service offers thousands of templates, including the South Carolina Miller Trust Forms for Medicaid, which you can use for both business and personal purposes.

- All documents are reviewed by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and click on the Download button to retrieve the South Carolina Miller Trust Forms for Medicaid.

- Use your account to browse the legitimate documents you have previously ordered.

- Visit the My documents tab of your account to obtain another copy of the documents you need.

- If you are a new user of US Legal Forms, here are some straightforward tips you can follow.

Form popularity

FAQ

A trust can be a valuable tool in your Medicaid planning strategy, particularly when it comes to protecting assets. By creating a South Carolina Miller Trust, you can preserve your income and qualify for Medicaid benefits without losing your financial security. This type of trust allows you to funnel excess income into the trust while ensuring that you meet Medicaid’s income criteria.

In South Carolina, the income limit to qualify for Medicaid varies based on the individual’s household size and specific program. Generally, the monthly income limit is around $2,742 for an individual. Understanding the nuances can be challenging, but utilizing South Carolina Miller Trust Forms for Medicaid can assist in restructuring your income to meet eligibility requirements more effectively.

Yes, you can use a Miller trust to qualify for Medicaid, as it helps to keep your excess income within allowable limits. When properly established, a Miller trust ensures that your monthly income does not disqualify you from receiving essential medical assistance. Utilizing South Carolina Miller Trust Forms for Medicaid is vital for this purpose. For clarity on this process, don’t hesitate to consult a legal professional.

To protect your assets from Medicaid in South Carolina, you can create a Miller trust, among other strategies. This trust enables you to manage your excess income while remaining eligible for Medicaid benefits. You should experiment with various options and speak to an attorney to determine the best approach for your situation and review South Carolina Miller Trust Forms for Medicaid for guidance.

A Miller trust allows individuals to become eligible for Medicaid by placing excess income into the trust. The income deposited into the trust does not count against your Medicaid limit, allowing you to qualify for assistance. The trust then pays for your care needs while ensuring compliance with South Carolina Miller Trust Forms for Medicaid. This setup can provide peace of mind for both you and your family.

Using a Medicaid trust, including a Miller's trust, can have drawbacks, such as restrictions on access to assets. You may lose control over the assets placed in the trust since they are managed by a trustee. Additionally, funding the trust may limit your financial flexibility. It’s essential to understand these potential downsides to make informed decisions about South Carolina Miller Trust Forms for Medicaid.

Certain trusts are exempt from Medicaid’s asset evaluation, such as special needs trusts and pooled trusts designed for the disabled. In addition, irrevocable trusts that meet specific criteria may also be exempt. Understanding the nuances of South Carolina Miller Trust Forms for Medicaid can help clarify which assets you can protect. Legal advice is valuable to navigate these complexities.

To establish a Miller's trust, you will need to create a legal document that identifies you as the trust maker. This document must comply with the specific requirements of South Carolina Miller Trust Forms for Medicaid. It’s crucial to outline how income will be managed for Medicaid eligibility. Consider consulting with a legal expert to ensure all requirements are met for your unique situation.

To prevent Medicaid estate recovery in South Carolina, consider setting up a Miller trust using South Carolina Miller Trust Forms for Medicaid. This strategy can help you protect your assets from being claimed after your death. Additionally, transferring your assets to non-countable ones before applying for Medicaid can further safeguard your estate. Speaking with experts, like those at uslegalforms, can provide you with tailored advice for your situation.

The asset limit for Medicaid in South Carolina typically remains around $2,000 for an individual. This limit may change, so it's wise to check for updates regularly. If you have higher assets, utilizing South Carolina Miller Trust Forms for Medicaid can help you manage these efficiently and possibly keep your eligibility intact. Staying informed and planning ahead is key to navigating Medicaid eligibility.