South Carolina Simple Equipment Lease

Description

How to fill out Simple Equipment Lease?

If you wish to be thorough, acquire, or print official document templates, utilize US Legal Forms, the best collection of legal forms, available online.

Make use of the site’s straightforward and user-friendly search to retrieve the documents you need.

A variety of templates for business and personal purposes are categorized by type and state, or keywords.

Every legal document format you purchase is yours permanently. You will have access to all forms you downloaded in your account.

Go ahead and acquire, and print the South Carolina Simple Equipment Lease with US Legal Forms. There are countless professional and state-specific forms available for your business or personal requirements.

- Use US Legal Forms to obtain the South Carolina Simple Equipment Lease in just a few clicks.

- If you are an existing US Legal Forms user, Log In to your account and click the Download button to access the South Carolina Simple Equipment Lease.

- You can also find documents you’ve previously downloaded in the My documents section of your account.

- If you are new to US Legal Forms, execute the steps below.

- Step 1. Make sure you have selected the form for the correct region/country.

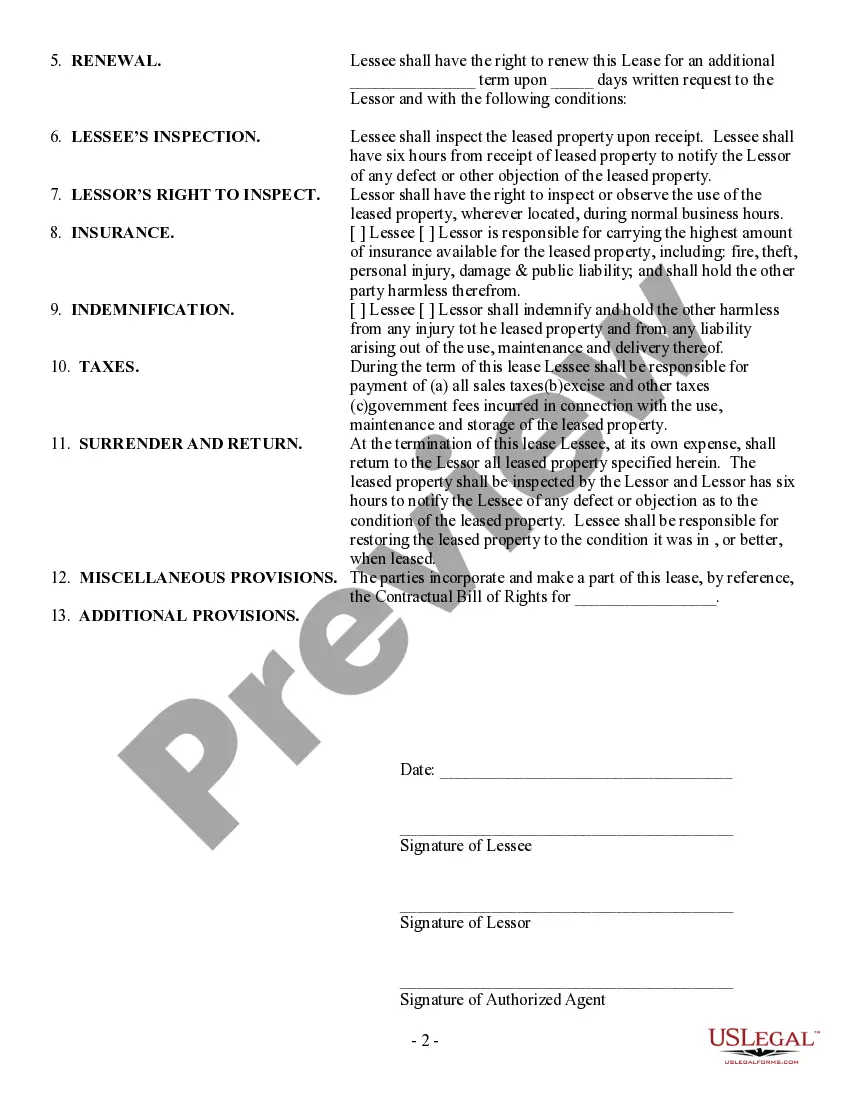

- Step 2. Utilize the Preview option to review the document’s content. Don’t forget to check the summary.

- Step 3. If you are dissatisfied with the document, use the Search box at the top of the page to find alternative versions of the legal document format.

- Step 4. Once you have located the form you need, click on the Buy Now option. Choose the payment plan you prefer and enter your details to create an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Step 6. Select the format of your legal document and download it to your device.

- Step 7. Fill out, modify, and print or sign the South Carolina Simple Equipment Lease.

Form popularity

FAQ

For Clicklease, a credit score of 600 is typically acceptable, making it accessible to a wider range of customers seeking a South Carolina Simple Equipment Lease. While each application is evaluated on its own, having a credit score in this range can open doors. It's always a good idea to communicate with Clicklease to discuss your specific needs and get tailored advice. They can help you navigate the leasing process smoothly.

The minimum credit score for a lease often ranges from 600 to 620, depending on the leasing company and the type of equipment. Factors such as income, business history, and the nature of the lease can influence your eligibility. If you're considering a South Carolina Simple Equipment Lease, being informed can help you prepare a strong application. Consulting with experts can ensure you understand the landscape of leasing in your area.

Generally, a credit score of 620 or higher is advisable for getting an equipment lease. However, different equipment providers and leasing companies may have varied minimum requirements. Understanding your specific situation is crucial, and working with companies like US Legal Forms can provide valuable insights and options. They can guide you through the leasing process to find solutions that work for you.

Yes, it is possible to get approved for a lease with a 600 credit score, especially for a South Carolina Simple Equipment Lease. Many leasing companies consider multiple aspects of your financial situation, not just your credit score. If you have steady income or a solid business plan, you might still qualify. Always explore your options and consult with leasing professionals to find the best fit.

To lease equipment in South Carolina, you typically need a credit score of at least 650. However, each leasing company has its criteria, and some may approve leases with lower scores, depending on other factors. It's essential to check with specific lenders to understand their requirements. A strong application can increase your chances of approval.

Yes, for a lease to be considered legal in South Carolina, it typically must be signed by both parties. A signature indicates mutual agreement to the terms outlined in the document. Even if the lease is verbal, getting it in writing helps avoid potential disputes in the future.

Setting up an equipment lease involves drafting an agreement that includes all the necessary information about the leased equipment, term length, payment, and responsibilities of both parties. Use a reputable template to help cover all essential details. Using resources like UsLegalForms can guide you in creating a complete South Carolina Simple Equipment Lease.

Typically, leases in South Carolina do not need to be notarized to be enforceable. However, having a lease notarized can add an extra layer of protection and legitimacy. Always ensure that the lease terms are clear, whether they are notarized or not.

Yes, a handwritten lease agreement can be legally binding in South Carolina as long as it includes the essential terms such as parties' names, descriptions of the equipment, and payment conditions. However, it is strongly recommended to be clear and comprehensive. Using a structured template can help avoid misunderstandings.

Leasing equipment to your LLC involves drafting a formal lease agreement that outlines the terms between you and your LLC as separate entities. Specify the equipment details, payment terms, and responsibilities for maintenance and insurance. This arrangement can be beneficial for tax purposes and maintaining liability separation.