Computer software is a general term used to describe a collection of computer programs, procedures and documentation that perform some tasks on a computer system. Software is considered personal property and may be assigned.

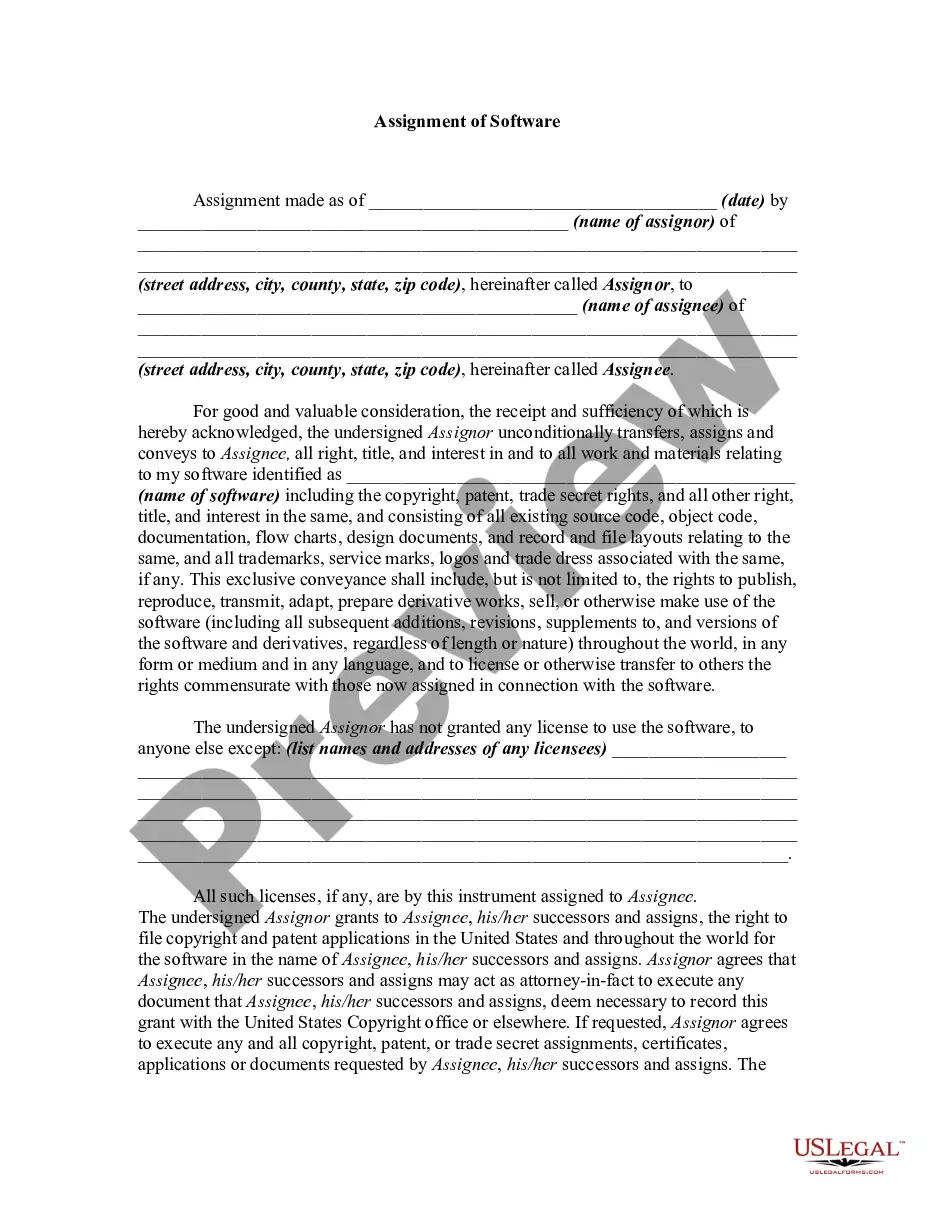

South Carolina Assignment of Software

Description

How to fill out Assignment Of Software?

Finding the appropriate legal document template can be a challenge. Certainly, there are numerous templates available online, but how do you locate the specific form you require? Visit the US Legal Forms website. The service offers thousands of templates, including the South Carolina Assignment of Software, which can be utilized for both business and personal purposes. All forms are verified by professionals and comply with federal and state regulations.

If you are already registered, Log In to your account and click the Download button to access the South Carolina Assignment of Software. Use your account to browse through the legal documents you have previously purchased. Go to the My documents section of your account to obtain another copy of the document you need.

If you are a new user of US Legal Forms, here are simple steps you can follow: First, ensure you have selected the correct form for your area/region. You can review the document using the Preview option and read the form description to confirm it is suitable for your needs. If the form does not meet your requirements, use the Search field to find the correct document. Once you are confident that the form is appropriate, click on the Get now button to acquire the document. Choose the pricing plan you desire and enter the necessary information. Create your account and complete your purchase using your PayPal account or credit card. Select the document format and download the legal document template to your device. Finally, complete, modify, print, and sign the received South Carolina Assignment of Software.

US Legal Forms is the largest collection of legal documents where you can find various document templates. Use the service to download professionally crafted documents that adhere to state requirements.

- Finding the appropriate legal document template can be a challenge.

- Certainly, there are numerous templates available online, but how do you locate the specific form you require.

- Visit the US Legal Forms website.

- The service offers thousands of templates, including the South Carolina Assignment of Software.

- All forms are verified by professionals and comply with federal and state regulations.

- If you are already registered, Log In to your account.

Form popularity

FAQ

In South Carolina, prewritten computer software delivered electronically is not subject to sales and use tax. Similarly in South Carolina, custom computer software delivered electronically is not subject to sales and use tax.

South Carolina does not tax Social Security retirement benefits. It also provides a $15,000 taxable income deduction for seniors receiving any other type of retirement income.

SC Revenue Ruling #03-5 defines an Application Service Provider (?ASP?)3 as a company that provides customers access or use of software on the company's website and concludes that charges by an Application Service Provider are subject to sales and use tax under Code Sections 12-36-910(B)(3) and 12-36-1310(B)(3).

Does North Carolina require sales tax on Software-as-a-Service (SaaS)? North Carolina generally does not require sales tax on Software-as-a-Service.

For more information, refer to SC Revenue Ruling #22-11?. INCREASE IN SOUTH CAROLINA DEPENDENT EXEMPTION (line w of the SC1040) ? The South Carolina dependent exemption amount for 2022 is $4,430 and is allowed for each eligible dependent, including both qualifying children and qualifying relatives.

South Carolina joined the majority of the US in passing the UETA act for the regulation of electronic signing and electronic transactions.

65 years of age, or. declared totally and permanently disabled by a state or federal agency having the authority to make such a declaration, or. legally blind as certified by a licensed ophthalmologist.

South Carolina taxpayers ages 65 and older do not need to file a state income tax return in most cases. If your gross income is less than the federal gross income filing requirement, you shouldn't be required to file a SC state return. In addition, Social Security benefits are not taxed by the state of South Carolina.