No particular language is necessary for the acceptance or rejection of a claim or for subsequent notices and reports so long as the instruments used clearly convey the necessary information.

South Carolina Acceptance of Claim and Report of Past Experience with Debtor

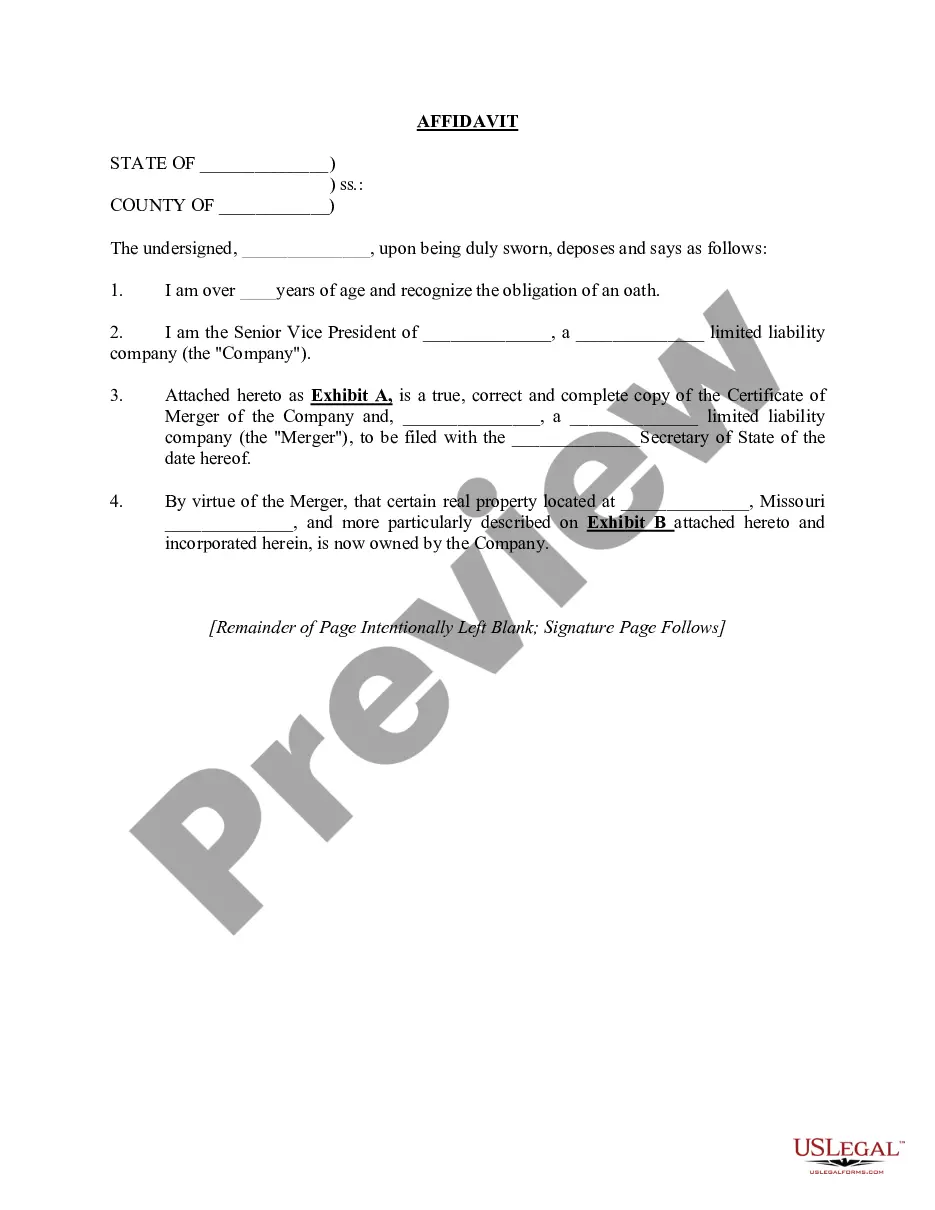

Description

How to fill out Acceptance Of Claim And Report Of Past Experience With Debtor?

You can spend hours online searching for the proper legal document format that complies with the state and federal requirements you need. US Legal Forms offers a wide array of legal templates that are vetted by professionals.

It is easy to download or print the South Carolina Acceptance of Claim and Report of Past Experience with Debtor from our service.

If you already have a US Legal Forms account, you may Log In and then click the Acquire option. After that, you may fill out, edit, print, or sign the South Carolina Acceptance of Claim and Report of Past Experience with Debtor. Each legal document format you obtain is yours permanently. To get another copy of any purchased form, go to the My documents tab and click the appropriate option.

Complete the transaction. You can use your credit card or PayPal account to purchase the legal document. Select the format of the file and download it to your device. Make modifications to your document if necessary. You are allowed to fill out, edit, sign, and print the South Carolina Acceptance of Claim and Report of Past Experience with Debtor. Obtain and print numerous document templates using the US Legal Forms Website, which offers the most comprehensive selection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you are using the US Legal Forms website for the first time, follow the simple steps outlined below.

- First, ensure that you have selected the correct format for your county/city of choice.

- Review the document description to confirm that you have chosen the right form.

- If available, use the Review option to examine the format as well.

- To locate another version of the document, utilize the Look for field to find the format that meets your needs and specifications.

- Once you have found the format you want, click on Acquire now to continue.

- Choose the pricing plan you want, enter your details, and register for your account on US Legal Forms.

Form popularity

FAQ

Yes, a debt collector can sue you in South Carolina to recover owed debts. They must follow legal procedures, including filing a proper claim under the South Carolina Acceptance of Claim and Report of Past Experience with Debtor. If the debt is undisputed, the collector has the right to seek a judgment. However, understanding your own rights can help you respond effectively to any legal actions.

In South Carolina, various parties can object to a proof of claim, including the debtor or the representative of the estate. Under the South Carolina Acceptance of Claim and Report of Past Experience with Debtor, objections may arise if the claim is deemed invalid or if the amount is contested. This process helps ensure that only legitimate claims receive payment. Therefore, both creditors and debtors need to understand their rights and obligations.

If a creditor fails to file a proof of claim within the designated time period, they may lose their right to collect that debt from the debtor's estate. This is a significant aspect of the South Carolina Acceptance of Claim and Report of Past Experience with Debtor. Consequently, unpaid debts may go unresolved without proper legal claim. Therefore, it is crucial for creditors to adhere to filing deadlines to protect their financial interests.

Creditors in South Carolina typically have a limited time frame to collect debts from an estate. Under the South Carolina Acceptance of Claim and Report of Past Experience with Debtor, they usually must file their claims within eight months of the first publication of notice to creditors. It's essential to act quickly, as delays can lead to the loss of claims. Keeping track of this timeline allows creditors to enforce their rights effectively.

In South Carolina, the creditor must file the proof of claim with the court to make a legal claim against the debtor's estate. This process is part of the South Carolina Acceptance of Claim and Report of Past Experience with Debtor. Timely filing ensures that the creditor can participate in any distribution of the estate's assets. A failure to file on time may prevent recovery of the owed debt.

A debtor may want to file a motion to impose the automatic stay when facing imminent foreclosure or repossession of assets. This legal measure pauses collection activities and gives the debtor time to reorganize their finances. Understanding the South Carolina Acceptance of Claim and Report of Past Experience with Debtor can help clarify the debtor's rights during this process. If you're considering bankruptcy or need assistance, uslegalforms offers tools and templates to help you prepare your motion effectively.

In South Carolina, the statute of limitations for debt collection is three years. This means that creditors have three years from the date of your last payment or acknowledgment to file a lawsuit against you for unpaid debt. It's important to understand this timeline when dealing with debts and to consider how South Carolina Acceptance of Claim and Report of Past Experience with Debtor might influence your situation. If you have any concerns about your debt or legal options, uslegalforms can provide resources to help you navigate these challenges.

To answer a summons for debt collection in South Carolina, you must respond within 30 days and outline your defense against the claim. This response needs to be filed with the court and served to the creditor, detailing any disputes you have regarding the debt. Consulting resources like US Legal Forms can offer guidance, making the process straightforward within the context of the South Carolina Acceptance of Claim and Report of Past Experience with Debtor.

Writing a notice to creditors requires you to clearly state the relevant details, including the debtor's information, the amount owed, and any deadlines for response. It is essential to be concise and professional in this notice to maintain clarity and compliance with legal standards. You can find templates and guides on US Legal Forms to help you craft a notice that meets the requirements within the South Carolina Acceptance of Claim and Report of Past Experience with Debtor.

Filling out a creditor's claim involves completing a specific form that outlines the amount owed and the nature of the debt. In South Carolina, you need to include supporting documents that validate your claim and file it within the appointed time frame. Using resources from platforms like US Legal Forms can simplify this process and help ensure compliance with the South Carolina Acceptance of Claim and Report of Past Experience with Debtor.