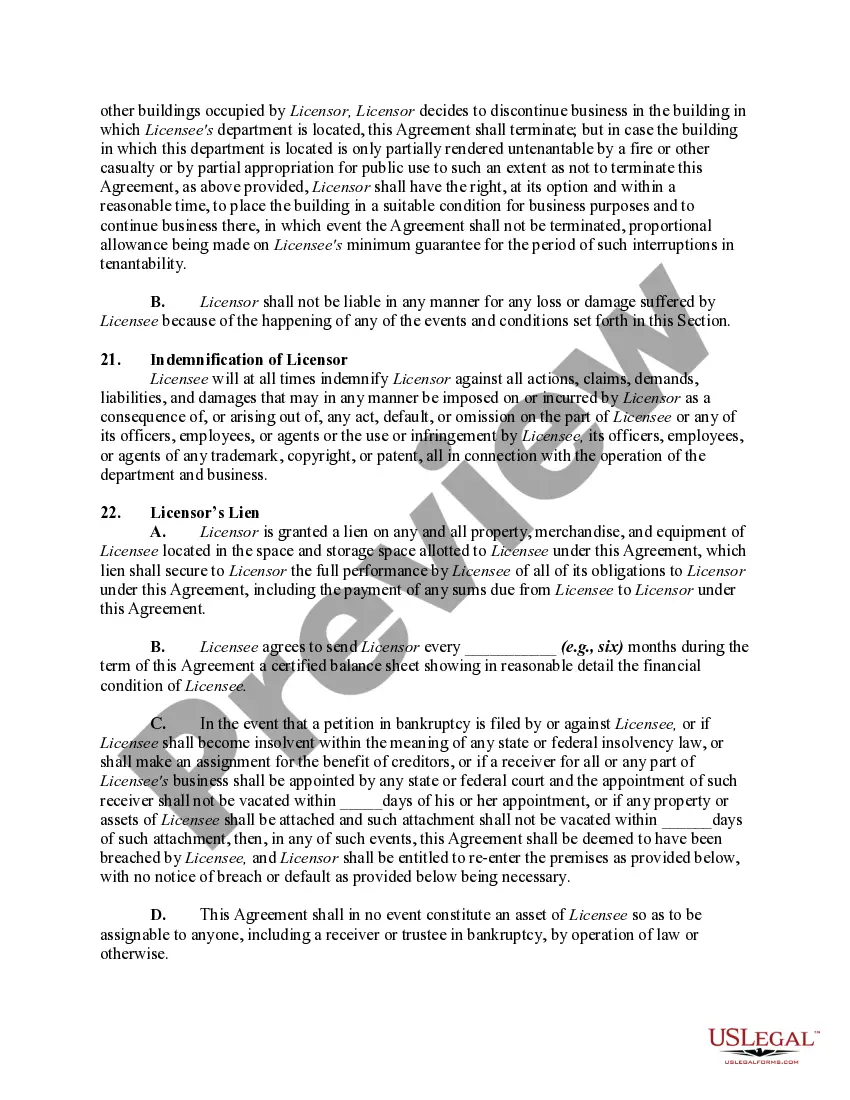

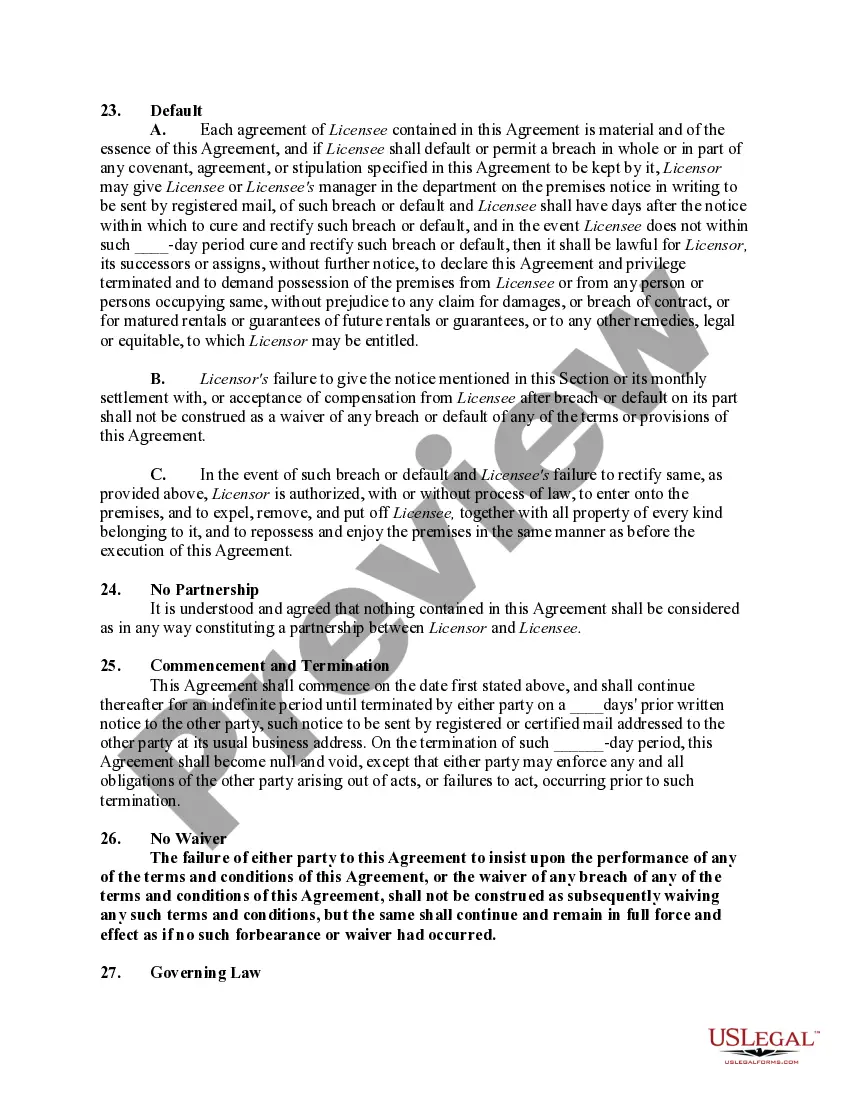

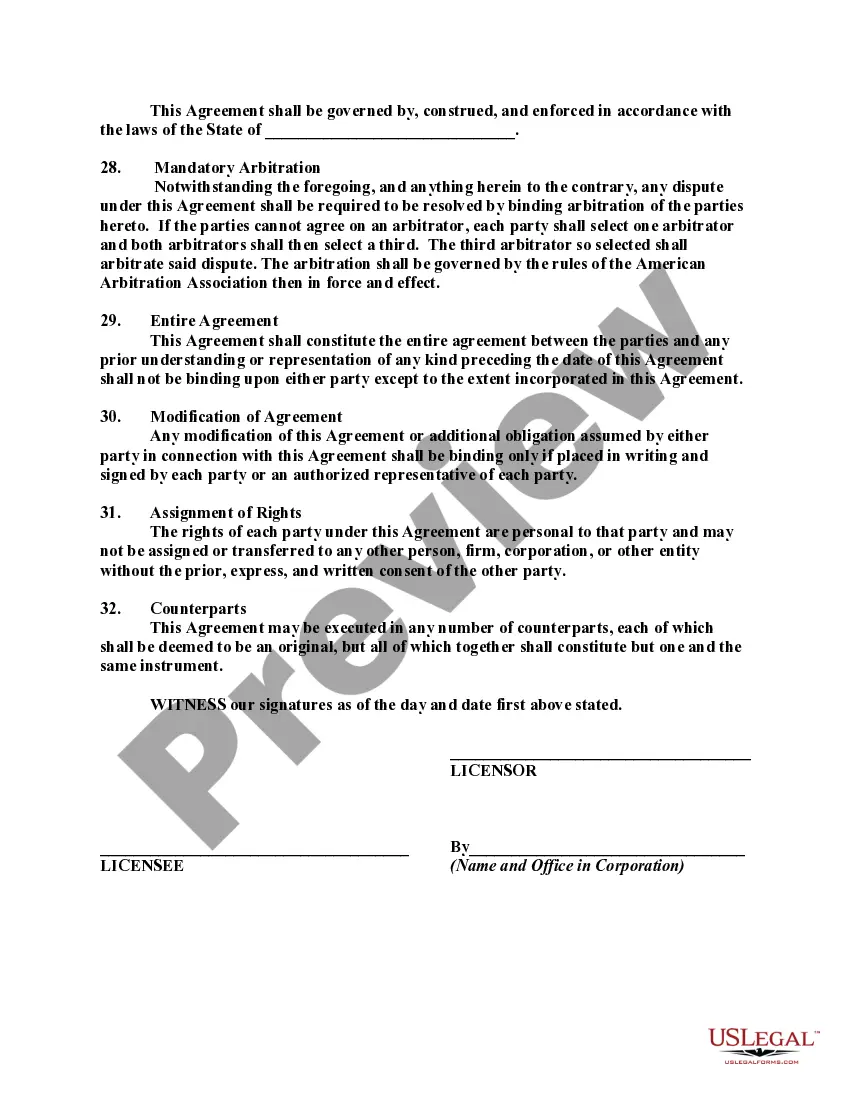

A license gives the permission of the owner to an individual or an entity to use real property for a specific purpose. A license is not an interest in land, but is a privilege to do something on the land of another person. This form is a generic sample of a license for a business to operate a concession in a department store and may be referred to when preparing such a form for your particular state.

South Carolina Operation of a Concession in a Department Store

Description

How to fill out Operation Of A Concession In A Department Store?

If you desire to aggregate, acquire, or create sanctioned document templates, utilize US Legal Forms, the largest collection of legal forms accessible online.

Employ the site’s simple and user-friendly search feature to find the forms you require. Numerous templates for commercial and personal purposes are organized by categories, states, or keywords.

Utilize US Legal Forms to procure the South Carolina Operation of a Concession in a Department Store in just a few clicks.

Every legal template you download is yours permanently. You have access to every form you have downloaded in your account. Go to the My documents section and select a form to print or download again.

Be proactive and download, and print the South Carolina Operation of a Concession in a Department Store with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- When you are already a US Legal Forms subscriber, Log In to your account and click on the Download button to obtain the South Carolina Operation of a Concession in a Department Store.

- You can also access forms you previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the very first time, adhere to the instructions outlined below.

- Step 1. Ensure you have selected the form for your specific region/state.

- Step 2. Use the Preview option to review the contents of the form. Don’t forget to read the instructions.

- Step 3. If you are dissatisfied with the form, utilize the Search area at the top of the page to find other types within the legal form format.

- Step 4. After locating the desired form, click the Buy Now button. Choose the pricing plan you prefer and input your details to register for the account.

- Step 5. Complete the transaction. You can use your Visa or MasterCard or PayPal account to finalize the transaction.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Fill out, modify, and print or sign the South Carolina Operation of a Concession in a Department Store.

Form popularity

FAQ

To sell food in South Carolina, you must obtain a food service permit from your local health department. Additionally, if you plan to operate a concession in a department store, you may need a special permit or approval from the store management. It is important to ensure compliance with all local and state regulations regarding food safety and business operations. For those seeking to navigate the requirements for a South Carolina operation of a concession in a department store, uslegalforms can provide valuable resources and templates to simplify the licensing process.

Yes, South Carolina imposes sales tax on certain services, though many services are exempt. The taxability often depends on the nature of the service provided. If you operate a concession in a department store, understanding which services are taxable and how they impact your operations is essential for maintaining compliance and avoiding unexpected costs.

The hospitality tax in South Carolina is a local tax applied to the sale of certain goods and services in the hospitality industry, such as food, beverages, and accommodations. This tax is typically imposed by municipalities or counties to fund tourism and related projects. Businesses involved in a South Carolina Operation of a Concession in a Department Store should be aware of these taxes to ensure compliance and effective financial planning.

In South Carolina, maintenance services are generally taxable. However, specific exemptions may apply, especially in cases where the service relates to real property improvements. If you're considering a South Carolina Operation of a Concession in a Department Store and need maintenance services, consulting a tax professional can provide clarity on potential tax liabilities.

Yes, nonprofits can be exempt from sales tax in South Carolina, but certain conditions apply. To qualify, organizations must operate exclusively for charitable, religious, or educational purposes. If your nonprofit engages in a South Carolina Operation of a Concession in a Department Store, you will need to obtain an exemption certificate and ensure compliance with tax regulations.

A concession in a department store refers to a retail operation where a third-party vendor sells their products within the store. This setup allows the vendor to benefit from the foot traffic of the department store, while the store receives a share of the revenue. In South Carolina, operation of a concession in a department store requires adherence to specific regulations and agreements, ensuring a smooth collaboration between the vendor and store. Understanding these aspects can help you navigate the process more effectively.

Anyone in South Carolina selling physical goods directly to consumers needs a retail license. This includes all types of businesses, from standalone stores to concessions in department stores. Acquiring a retail license is vital for lawful sales operations and tax responsibilities. For those engaged in the South Carolina Operation of a Concession in a Department Store, it is a significant part of running a compliant business.

Yes, you need a South Carolina retail license if you plan to sell tangible products. This license allows you to collect sales tax from your customers, which you must remit to the state. When operating a concession in a department store, having a retail license represents a fundamental legal requirement. This step supports the integrity of your South Carolina Operation of a Concession in a Department Store.

In South Carolina, anyone engaging in business activities, including retail operations, must obtain a business license. This requirement applies to both brick-and-mortar stores and online retailers, such as those selling on Etsy. If you operate a concession in a department store, ensuring you have this license is key to lawful operation. Proper compliance can enhance the credibility of your South Carolina Operation of a Concession in a Department Store.

Section 12-36-2120 in South Carolina addresses the state's sales tax exemptions. It outlines specific categories of sales that may not incur sales tax, which is crucial for anyone operating a concession in a department store. Familiarizing yourself with this section helps you determine your tax obligations. It’s essential for smooth operations under the South Carolina Operation of a Concession in a Department Store.