South Carolina Multistate Promissory Note - Secured

Description

How to fill out Multistate Promissory Note - Secured?

If you want to access, obtain, or print legal document templates, utilize US Legal Forms, the leading selection of legal forms available online.

Take advantage of the site's straightforward and user-friendly search to find the documents you require.

Various templates for business and personal use are organized by categories and states or keywords. Use US Legal Forms to access the South Carolina Multistate Promissory Note - Secured with just a few clicks.

Every legal document template you download is yours indefinitely. You can access each form you downloaded in your account. Click the My documents section and select a form to print or download again.

Complete and download, and print the South Carolina Multistate Promissory Note - Secured with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and then click the Download button to obtain the South Carolina Multistate Promissory Note - Secured.

- You can also access forms you’ve previously downloaded in the My documents section of your account.

- If you’re using US Legal Forms for the first time, follow the steps below.

- Step 1. Make sure you have chosen the form for your correct city/state.

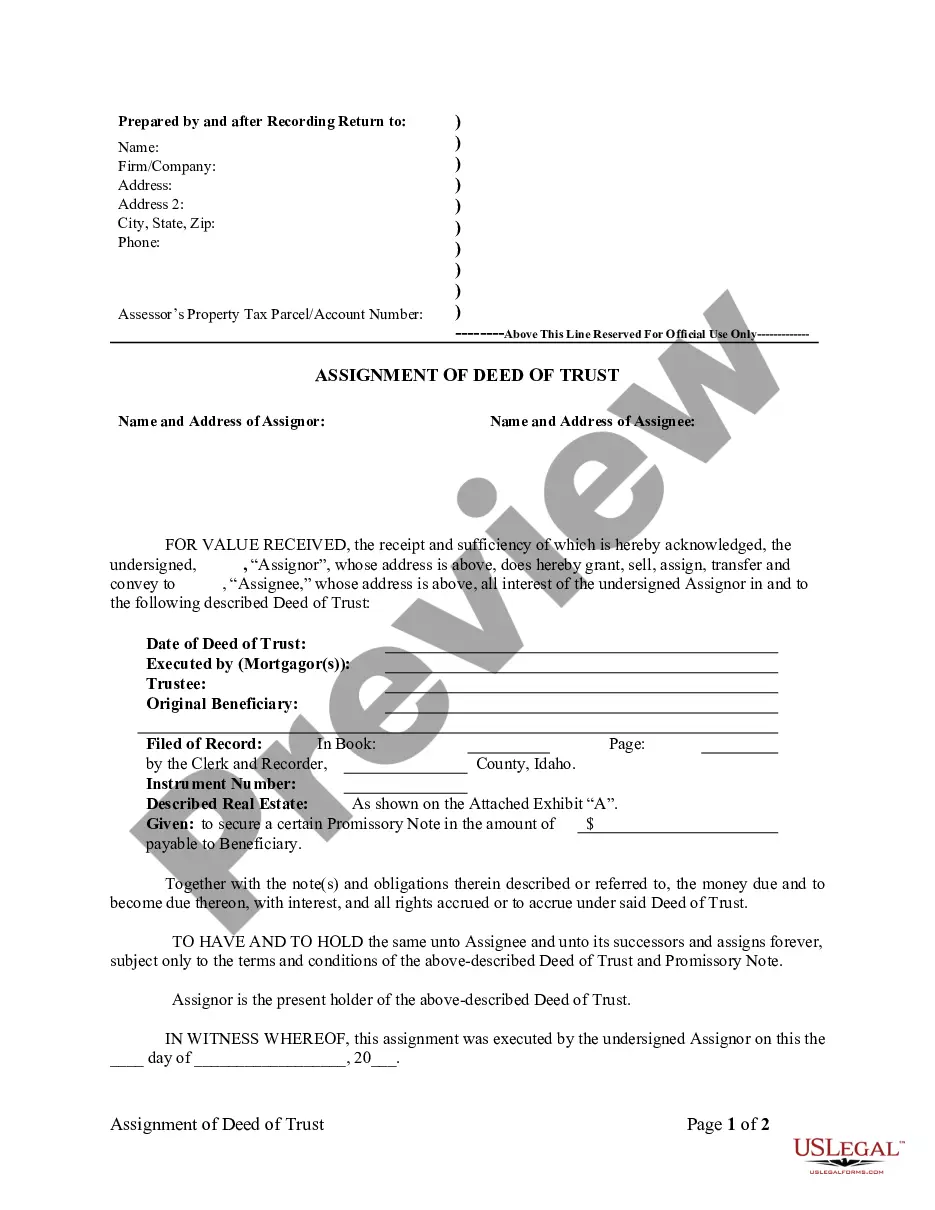

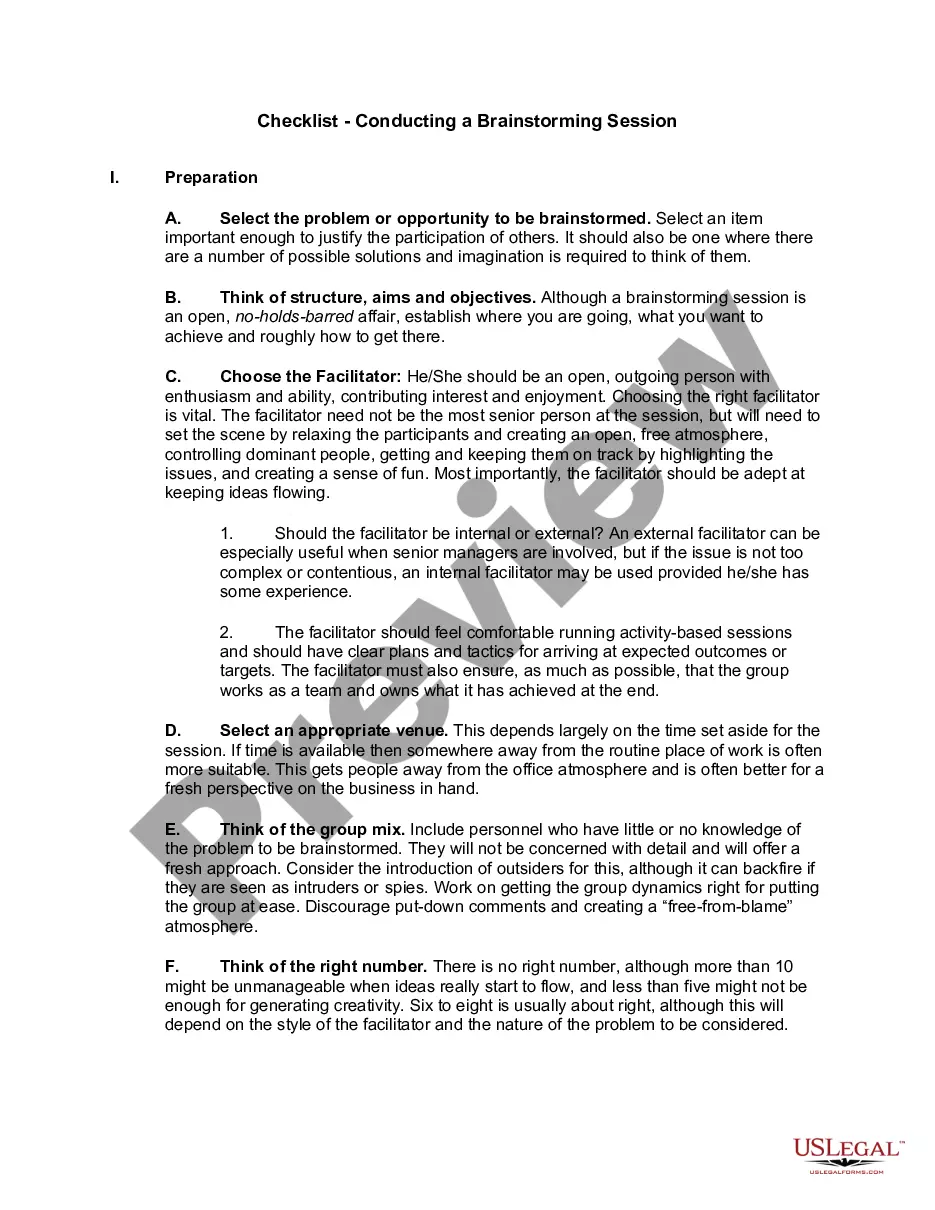

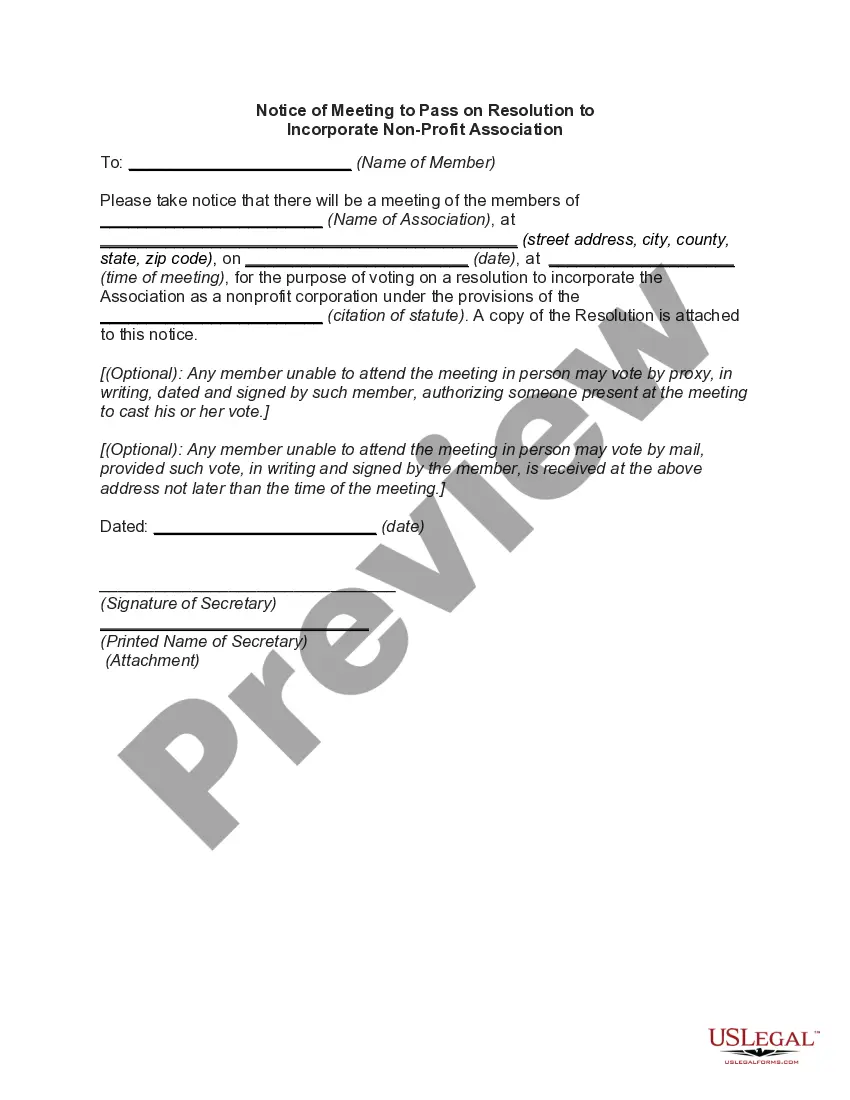

- Step 2. Use the Preview option to review the form’s content. Remember to read through the summary.

- Step 3. If you are dissatisfied with the form, utilize the Search box at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have found the form you need, click the Get now button. Select the payment plan you prefer and enter your details to sign up for an account.

- Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Fill out, modify, and print or sign the South Carolina Multistate Promissory Note - Secured.

Form popularity

FAQ

Indeed, a promissory note can be seen as a form of security, particularly when it is governed by securities laws. The South Carolina Multistate Promissory Note - Secured serves as an ideal example of how such agreements can function in a secure investment framework. If you are unsure about your specific situation, legal advice may provide you with clarity and direction. Ensure you understand your rights and obligations regarding your note.

Yes, a promissory note can be classified as a security under certain conditions set by the SEC. If the note is offered for sale to investors with an expectation of profit, it may fall under the legal definition. Understanding the characteristics of the South Carolina Multistate Promissory Note - Secured will help clarify its status. It's advisable to consult legal resources to ensure compliance.

Obtaining your promissory note is a straightforward process. You typically request it from the lender or the financial institution that issued the note. If you cannot locate it, platforms like USLegalForms provide templates and guidance for creating a new South Carolina Multistate Promissory Note - Secured. This option ensures you have the correct documentation in place.

To convert a promissory note into a security, you usually need to follow specific legal and regulatory steps. You must ensure the note meets the criteria set by the SEC and applicable state laws, including the South Carolina Multistate Promissory Note - Secured. It may involve filing the necessary paperwork, obtaining a prospectus, and possibly registering the note. Consulting legal experts can help simplify this process.

The main difference between a secured and an unsecured promissory note lies in collateral. A secured promissory note, such as the South Carolina Multistate Promissory Note - Secured, is backed by an asset, offering the lender protection in case of default. In contrast, an unsecured promissory note does not require collateral, making it riskier for the lender and potentially burdensome for the borrower if they default.

While promissory notes can be convenient, they also have drawbacks. One disadvantage is that if a borrower defaults, the lender may have to undergo legal proceedings to recover the amount owed, especially if using a South Carolina Multistate Promissory Note - Secured. Additionally, depending on the terms, interest rates may be higher compared to other types of loans, impacting overall costs.

An example of a promissory note would be a borrower signing a South Carolina Multistate Promissory Note - Secured to borrow funds for a vehicle. This document will specify the amount borrowed, the repayment schedule, and the collateral, which in this case might be the vehicle itself. Examples help clarify the practical application of promissory notes in real-life situations.

The structure of a promissory note, such as the South Carolina Multistate Promissory Note - Secured, typically includes important elements like the principal amount, interest rate, repayment terms, and maturity date. Additionally, it may outline the borrower's obligations and the remedies available to the lender if the borrower defaults. Clarity in the structure is key for both parties involved.

In South Carolina, the key elements of promissory estoppel include a clear and definite promise, reliance on that promise, and substantial detriment resulting from the reliance. When an individual or entity makes a promise that others depend on, South Carolina law seeks to enforce that commitment to prevent injustice. The South Carolina Multistate Promissory Note - Secured provides a framework that can support such promises in financial transactions. By using this note, you can establish a legally binding commitment that protects both parties' interests.

In South Carolina, a will does not need to be notarized to be valid, but notarization can simplify the probate process. Having a notarized will often strengthens its credibility and can help prevent disputes. You may also consider documenting your wishes using a South Carolina Multistate Promissory Note - Secured for any financial matters that need addressing, ensuring all relevant agreements are clear and enforceable.