Rhode Island Deed and Assignment from individual to A Trust

Description

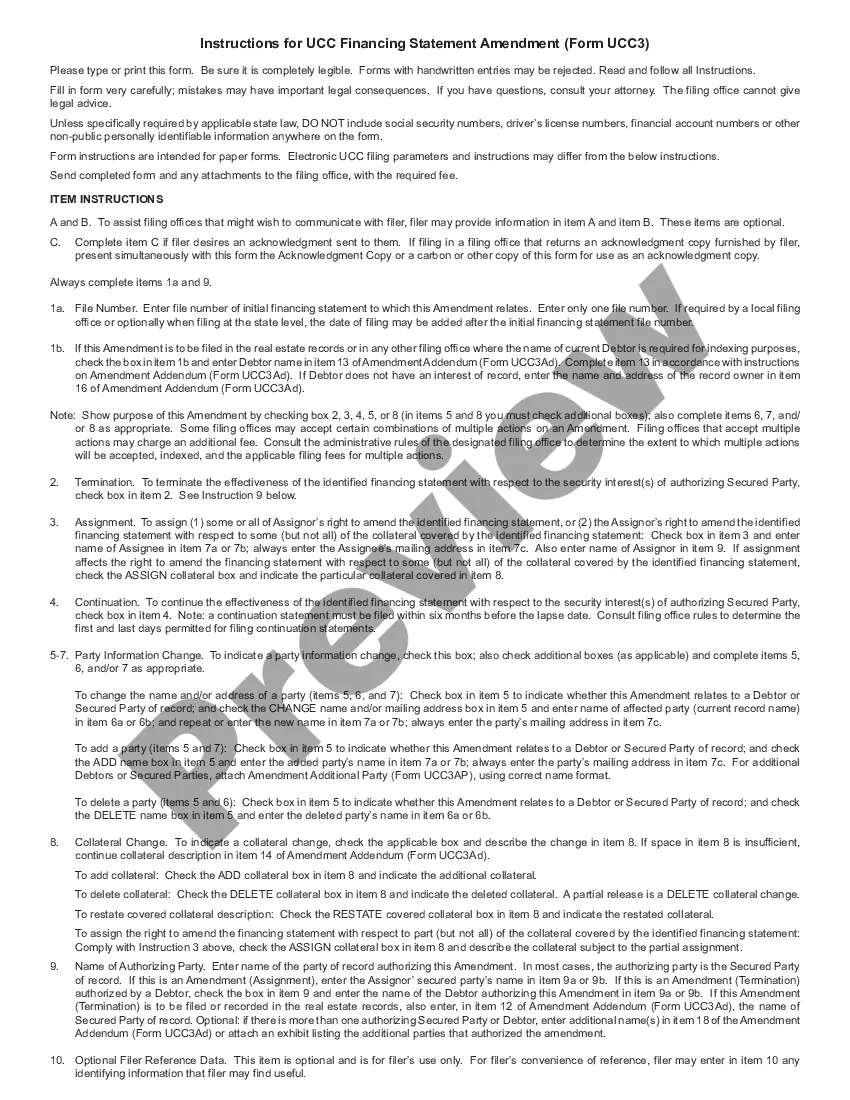

How to fill out Deed And Assignment From Individual To A Trust?

US Legal Forms - one of many biggest libraries of lawful forms in the States - offers a variety of lawful papers web templates it is possible to obtain or printing. Making use of the website, you may get thousands of forms for business and personal purposes, categorized by groups, suggests, or keywords.You can get the most up-to-date variations of forms such as the Rhode Island Deed and Assignment from individual to A Trust within minutes.

If you already possess a registration, log in and obtain Rhode Island Deed and Assignment from individual to A Trust through the US Legal Forms library. The Download key will show up on every type you see. You get access to all previously downloaded forms from the My Forms tab of your respective bank account.

If you wish to use US Legal Forms for the first time, allow me to share easy recommendations to get you began:

- Ensure you have picked out the right type for your personal area/region. Go through the Preview key to examine the form`s content. Browse the type explanation to ensure that you have chosen the right type.

- If the type doesn`t match your specifications, use the Research industry on top of the display to get the one which does.

- Should you be happy with the form, affirm your choice by clicking on the Purchase now key. Then, pick the prices prepare you want and supply your accreditations to sign up for the bank account.

- Procedure the transaction. Make use of credit card or PayPal bank account to accomplish the transaction.

- Find the format and obtain the form in your gadget.

- Make changes. Fill out, modify and printing and indicator the downloaded Rhode Island Deed and Assignment from individual to A Trust.

Each web template you added to your account lacks an expiry time and is your own property eternally. So, in order to obtain or printing another backup, just proceed to the My Forms portion and click on about the type you require.

Obtain access to the Rhode Island Deed and Assignment from individual to A Trust with US Legal Forms, the most considerable library of lawful papers web templates. Use thousands of expert and express-specific web templates that satisfy your company or personal requires and specifications.

Form popularity

FAQ

The key disadvantages of placing a house in a trust include the following: Extra paperwork: Moving property in a trust requires the house owner to transfer the asset's legal title. This involves preparing and signing an additional deed, and some people may consider this cumbersome.

For instance, personal property is relatively simple to transfer into a trust. It merely requires a signed statement that lists the assets being transferred. If the personal property is titled in the grantor's name, such as a boat or a motor vehicle, it must be transferred with the correct type of deed. How to Transfer Property into a Trust - White and Bright, LLP whiteandbright.com ? how-to-transfer-prope... whiteandbright.com ? how-to-transfer-prope...

This transfer doesn't usually lead to an immediate tax obligation, meaning no tax is levied for merely changing the ownership. However, the trust, which now owns the stock, may become liable for taxes on dividends and capital gains from the stock. What Are The Tax Consequences of Transferring Stock Into This? yahoo.com ? news ? tax-consequences-tra... yahoo.com ? news ? tax-consequences-tra...

But if you have over $166,250 in your account, you should consider transferring it to your Trust so that your Beneficiary can receive their inheritance outside of Probate. To leave your bank account to someone else while keeping it out of a Trust, add a payable-on-death Beneficiary to your account.

The assets you cannot put into a trust include the following: Medical savings accounts (MSAs) Health savings accounts (HSAs) Retirement assets: 403(b)s, 401(k)s, IRAs. Any assets that are held outside of the United States. Cash. Vehicles. What Assets Cannot Be Placed in a Trust? - SmithTaire Legal smithtaire.com ? blog ? what-assets-cannot-be-pla... smithtaire.com ? blog ? what-assets-cannot-be-pla...

In real estate law, "assignment" is simply the transfer of a deed of trust from one party to another. This usually happens when the beneficiary of a trust deed sells their loan to another lender. Trust Deed: What It Is, How It Works, Example Form - Investopedia investopedia.com ? terms ? trustdeed investopedia.com ? terms ? trustdeed

However, there are a few asset types that generally shouldn't go in a living trust, including retirement accounts, health savings accounts, life insurance policies, UTMA or UGMA accounts and vehicles.

The assets you cannot put into a trust include the following: Medical savings accounts (MSAs) Health savings accounts (HSAs) Retirement assets: 403(b)s, 401(k)s, IRAs. Any assets that are held outside of the United States. Cash. Vehicles.