Rhode Island Producer Agreement - Self-Employed Independent Contractor

Description

How to fill out Producer Agreement - Self-Employed Independent Contractor?

Finding the right authorized file template might be a battle. Of course, there are a variety of web templates available on the Internet, but how do you find the authorized kind you will need? Take advantage of the US Legal Forms website. The assistance provides a huge number of web templates, like the Rhode Island Producer Agreement - Self-Employed Independent Contractor, which can be used for enterprise and personal needs. All of the types are examined by pros and meet federal and state requirements.

If you are presently signed up, log in for your bank account and click the Obtain switch to find the Rhode Island Producer Agreement - Self-Employed Independent Contractor. Utilize your bank account to look with the authorized types you have purchased in the past. Visit the My Forms tab of your own bank account and have yet another copy of the file you will need.

If you are a whole new user of US Legal Forms, here are straightforward guidelines that you should follow:

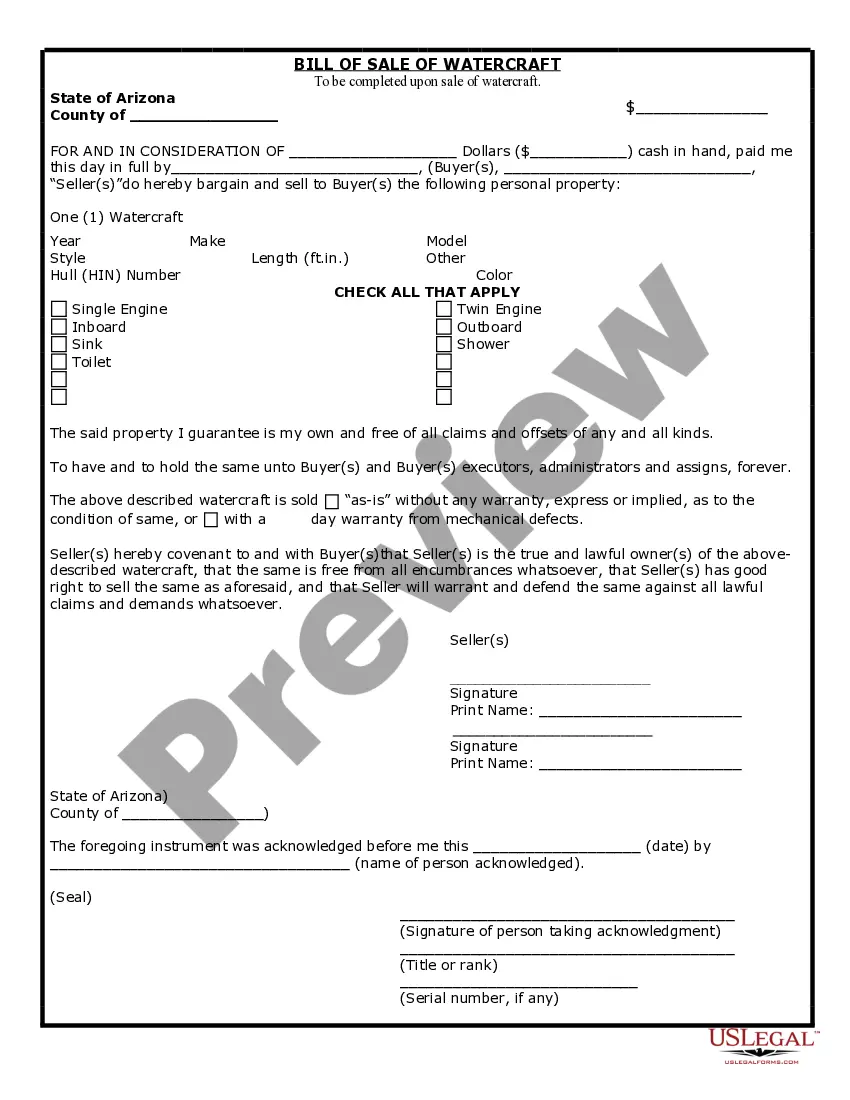

- Initial, ensure you have chosen the correct kind to your city/region. You may look over the form using the Review switch and read the form outline to ensure it is the best for you.

- When the kind fails to meet your requirements, use the Seach field to discover the appropriate kind.

- Once you are sure that the form would work, click the Buy now switch to find the kind.

- Choose the rates program you would like and enter in the essential information. Create your bank account and purchase an order using your PayPal bank account or bank card.

- Opt for the submit structure and down load the authorized file template for your product.

- Complete, edit and print and signal the acquired Rhode Island Producer Agreement - Self-Employed Independent Contractor.

US Legal Forms will be the biggest collection of authorized types in which you can discover a variety of file web templates. Take advantage of the company to down load skillfully-created paperwork that follow status requirements.

Form popularity

FAQ

Yes. There are many independent music producers. To be an independent music producer, you need to have access to production equipment and a recording studio. You may choose to start your own record label, or produce music for people without representing them as a label or manager.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

Is A Music Producer An Independent Contractor? There may be instances where music producers are not signed to record labels and record labels aren't always signing these music producers to record labels. Typically, these people will serve as independent contractors. They may receive recurring income from work.

The record royalty for a producer is usually between 3% to 4% of the record's sales price or 20% to 25% of the artist's royalties. On a CD that sells for $10.98, the producer's royalty would be about 33 cents for each copy sold and for a digital download of an album priced at $9.98 the producer receives 30 cents.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

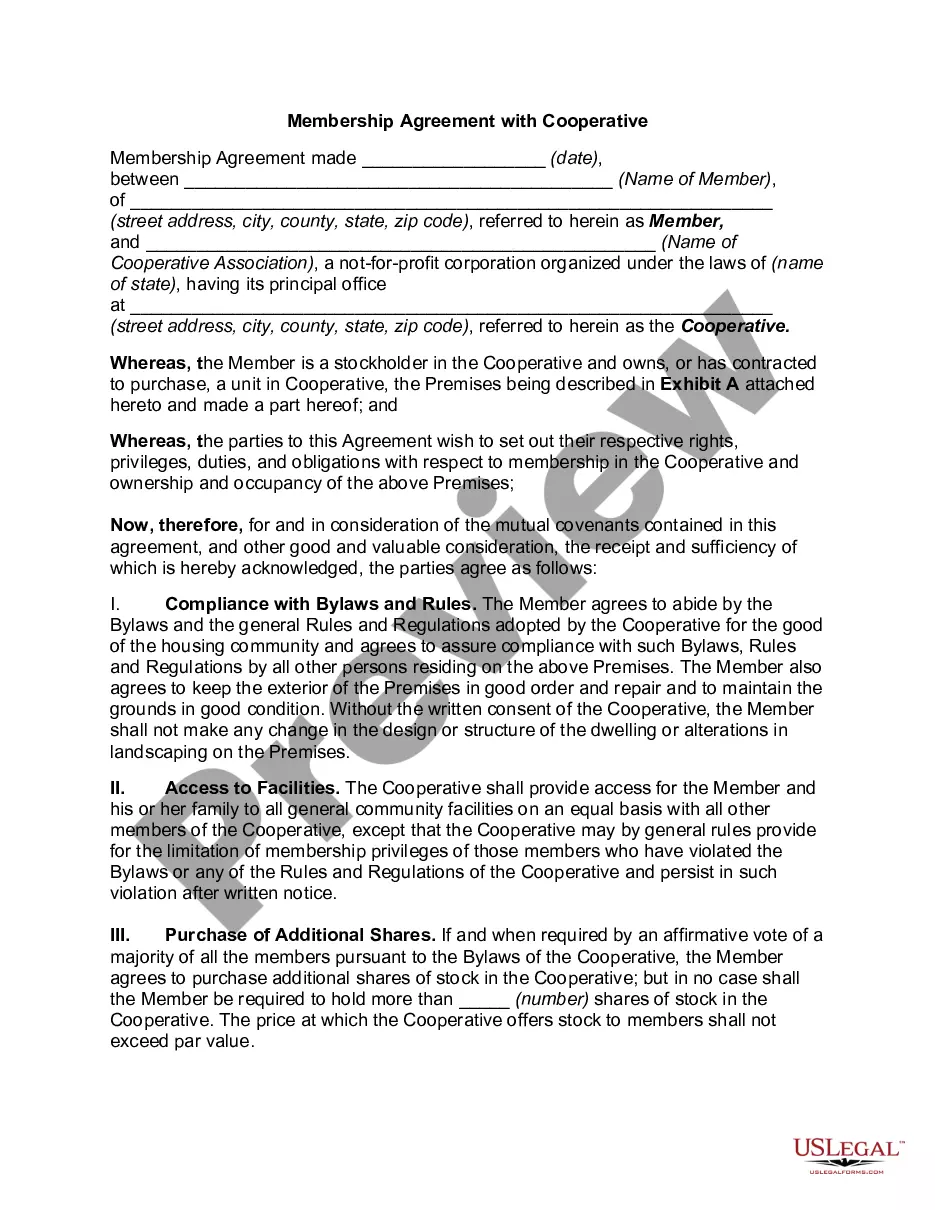

Producer is retained only for the purposes and to the extent set forth in this agreement, and Producer's relationship to the Agency shall be that of an independent contractor.

As an independent he still has to sign non-compete and non-disclosure agreements. But Cress strongly recommends that producers treat their crew as employees. A payroll service can take care of the taxes, insurance, and legality.

Do producers own masters? the answer is, Yes they do. Producers own masters to compositions that they originally compose from scratch. An artist that acquires the rights to use the composition for a song will own the copyright to the lyrics.

HOW TO START AN LLC AS A PRODUCER IN 7 STEPS!Choosing a Name for Your LLC.Determine the Members of the LLC.Get an Employer ID for Your LLC.Register Your LLC with Your State.Create an Operating Agreement for Your LLC.Register for State Taxes, Including Sales Taxes.Register Your LLC in Other States.14-Sept-2020