Rhode Island Self-Employed Independent Contractor Pyrotechnician Service Contract

Description

How to fill out Self-Employed Independent Contractor Pyrotechnician Service Contract?

Are you in a situation where you require documents for occasional business or personal use almost every day.

There are numerous legal document templates accessible online, but locating trustworthy ones is not easy.

US Legal Forms offers a vast selection of form templates, such as the Rhode Island Self-Employed Independent Contractor Pyrotechnician Service Contract, that are designed to comply with state and federal regulations.

Once you obtain the correct form, click Purchase now.

Choose the payment plan you prefer, fill in the necessary information to create your account, and pay for the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Rhode Island Self-Employed Independent Contractor Pyrotechnician Service Contract template.

- If you do not have an account and wish to use US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/county.

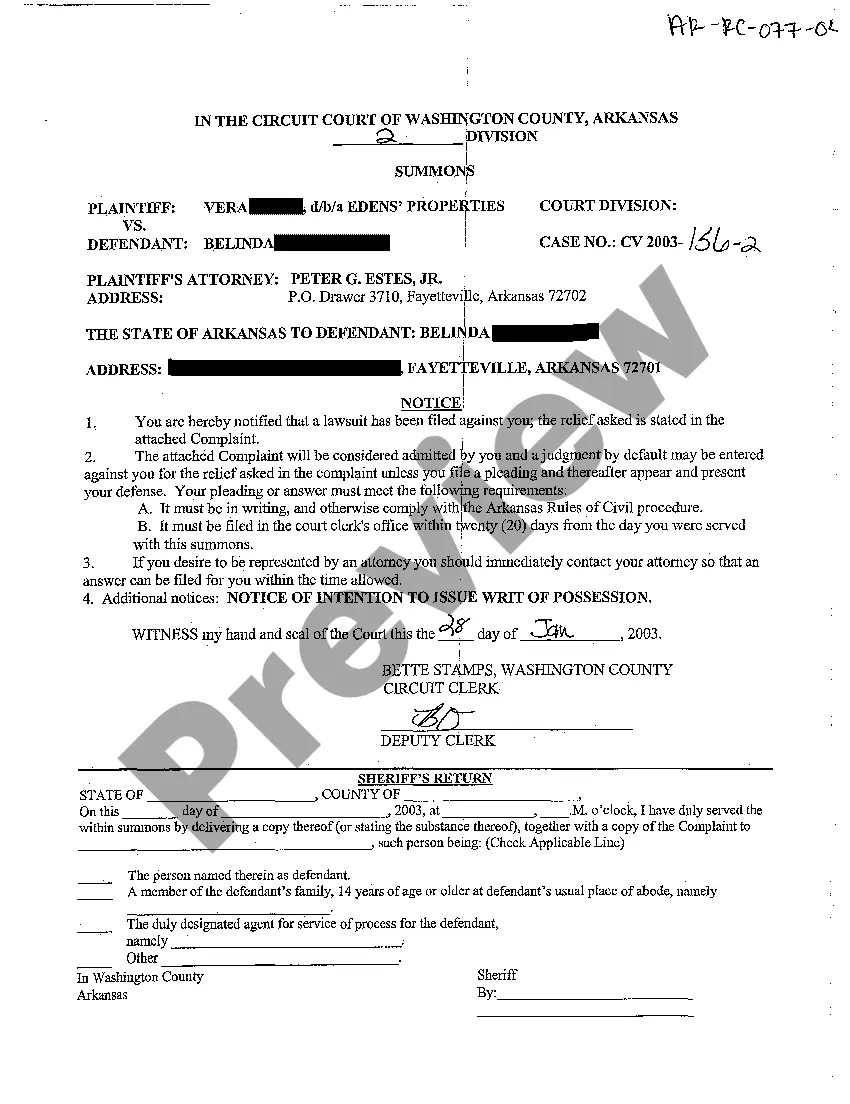

- Utilize the Review option to examine the document.

- Check the description to ensure you have selected the correct form.

- If the form isn’t what you are looking for, use the Search field to find the document that meets your needs and requirements.

Form popularity

FAQ

To become an independent contractor in Rhode Island, start by determining your business structure and registering with the state. You will also need to acquire any required licenses for your specific trade, particularly for pyrotechnics. Additionally, using a Rhode Island Self-Employed Independent Contractor Pyrotechnician Service Contract can help clarify your agreements with clients. Resources like uslegalforms can guide you in creating legally sound contracts to ensure your success.

An independent contractor must earn at least $600 from a single client in a calendar year to receive a 1099 form. This form is essential for reporting income to the IRS, and it applies to those who work under a Rhode Island Self-Employed Independent Contractor Pyrotechnician Service Contract. If you meet this income threshold, be sure to keep accurate records of your earnings and expenses. This practice will help simplify your tax process.

Establishing yourself as an independent contractor requires a few key steps. First, you need to register your business and obtain any necessary licenses or permits specific to your field, like pyrotechnics in Rhode Island. Additionally, creating a solid contract, such as a Rhode Island Self-Employed Independent Contractor Pyrotechnician Service Contract, can define your working relationship and set clear expectations with clients. Platforms like uslegalforms can help you draft these essential documents.

Both terms, self-employed and independent contractor, describe individuals who work for themselves. However, in legal contexts, 'independent contractor' often specifies a distinct classification under tax laws and regulations. When discussing your rights and obligations regarding a Rhode Island Self-Employed Independent Contractor Pyrotechnician Service Contract, using the term 'independent contractor' may provide clearer understanding. Therefore, it's important to choose the term that best fits your situation.

employed person can be referred to in various ways, including independent contractor, freelancer, or business owner. Each term reflects the individual's independence in managing their work and finances. When discussing a Rhode Island SelfEmployed Independent Contractor Pyrotechnician Service Contract, you highlight their role as a professional providing specific services. This recognition is important in establishing a clear business relationship.

Yes, independent contractors are generally considered self-employed individuals. Both terms refer to people who provide services without being tied to an employer. When you enter into a Rhode Island Self-Employed Independent Contractor Pyrotechnician Service Contract, you engage as a self-employed professional, managing your business operations. This distinction can be beneficial for tax purposes and legal responsibilities.

Typically, an independent contractor cannot be called an employee due to the differences in their working relationship. Employees work under the direction of an employer, while independent contractors operate independently. However, it is crucial to understand the context of your Rhode Island Self-Employed Independent Contractor Pyrotechnician Service Contract to avoid misclassification. Clarity in this area can protect both parties legally.

Creating an independent contractor agreement involves several key steps. Start by clearly defining the scope of work, payment terms, and deadlines. You can easily draft a Rhode Island Self-Employed Independent Contractor Pyrotechnician Service Contract using templates available on platforms like uslegalforms. This ensures your agreement is comprehensive and legally sound.

Yes, a 1099 employee is considered self-employed. This designation means they operate their own business, receiving compensation without tax withholdings. When you engage in a Rhode Island Self-Employed Independent Contractor Pyrotechnician Service Contract, you typically receive a 1099 form to report your income. Understanding this classification can help you navigate your tax obligations effectively.

To get authorized as an independent contractor in the US, you must complete several steps. First, register your business with the appropriate state and local authorities. Next, obtain any necessary permits or licenses specific to your trade, including those for pyrotechnics. When working under a Rhode Island Self-Employed Independent Contractor Pyrotechnician Service Contract, using resources like USLegalForms can simplify the process of obtaining the required documentation and ensure compliance with state regulations.