Rhode Island Data Entry Employment Contract - Self-Employed Independent Contractor

Description

How to fill out Data Entry Employment Contract - Self-Employed Independent Contractor?

If you wish to be thorough, obtain, or print legal document templates, use US Legal Forms, the largest collection of legal forms, available online.

Utilize the site's simple and convenient search to locate the documents you need.

A range of templates for business and personal purposes are categorized by types and states, or keywords.

Step 4. Once you have found the form you require, click the Purchase now button. Select your preferred pricing plan and input your information to register for the account.

Step 5. Complete the payment process. You can use your credit card or PayPal account to finalize the transaction.

- Employ US Legal Forms to find the Rhode Island Data Entry Employment Contract - Self-Employed Independent Contractor in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and then click the Download button to access the Rhode Island Data Entry Employment Contract - Self-Employed Independent Contractor.

- You may also retrieve forms you previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for your specific area/region.

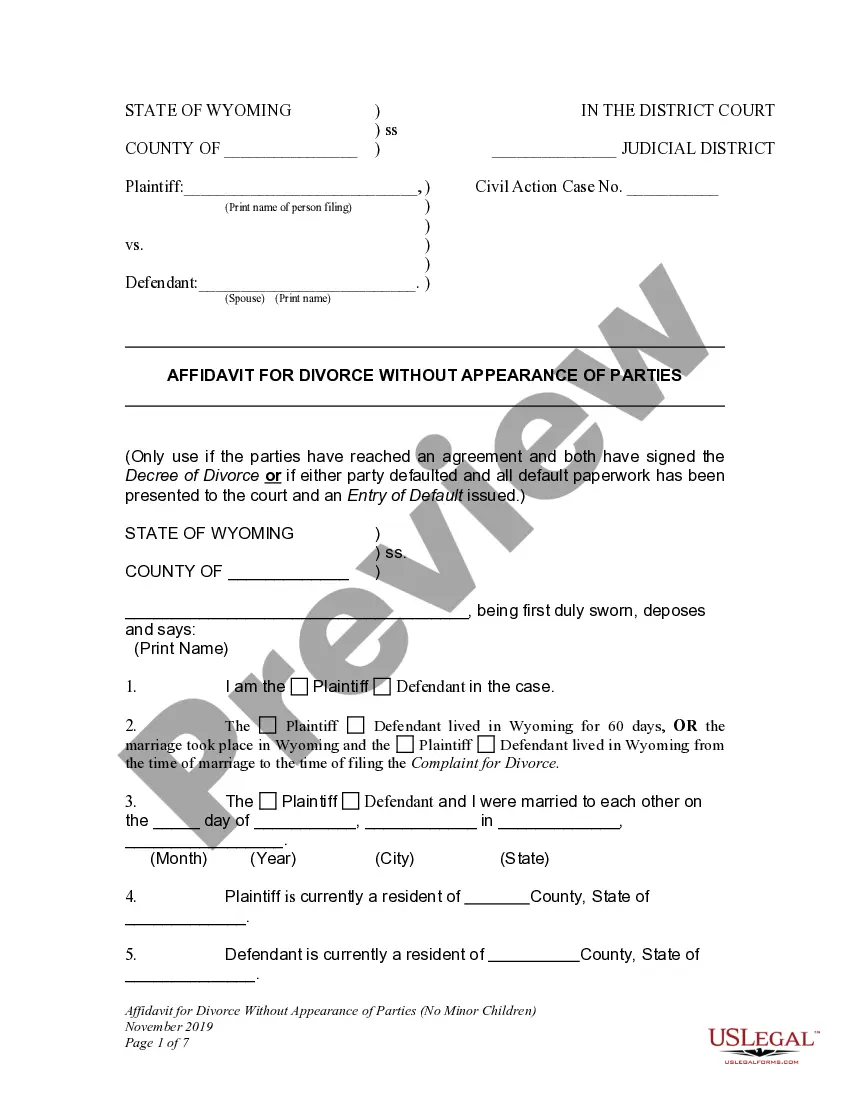

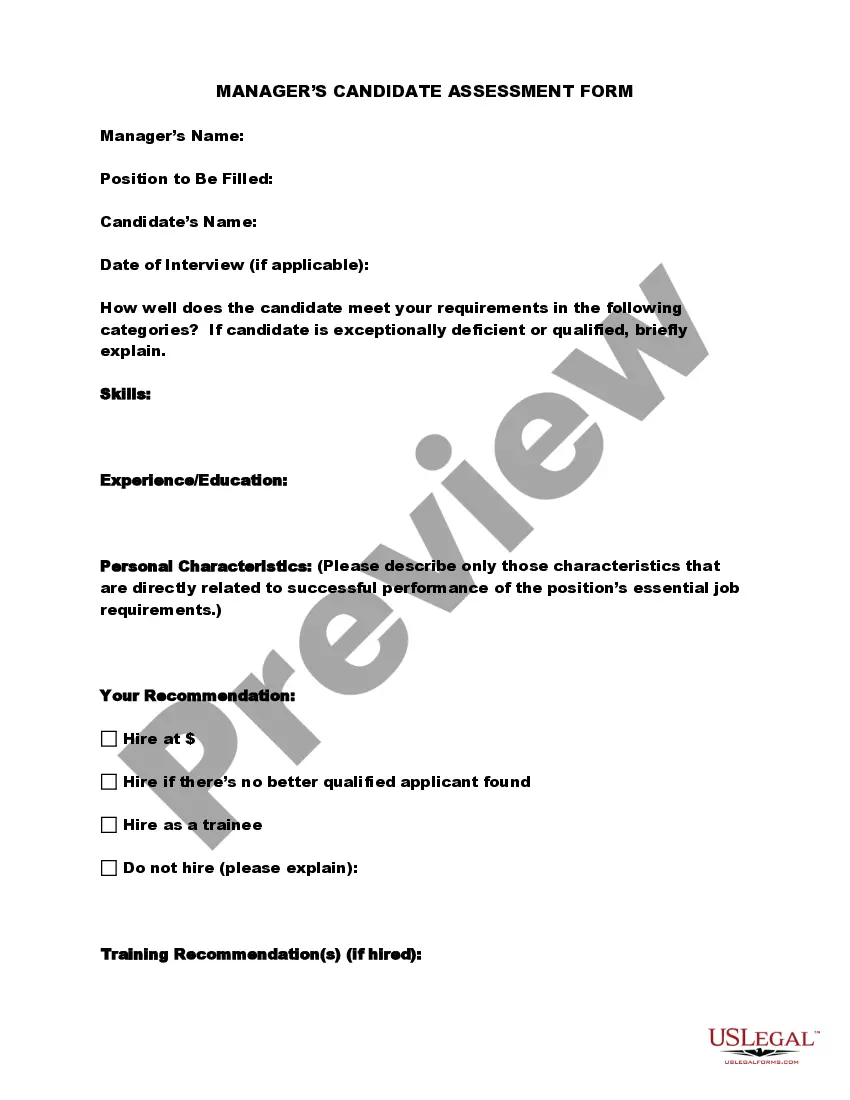

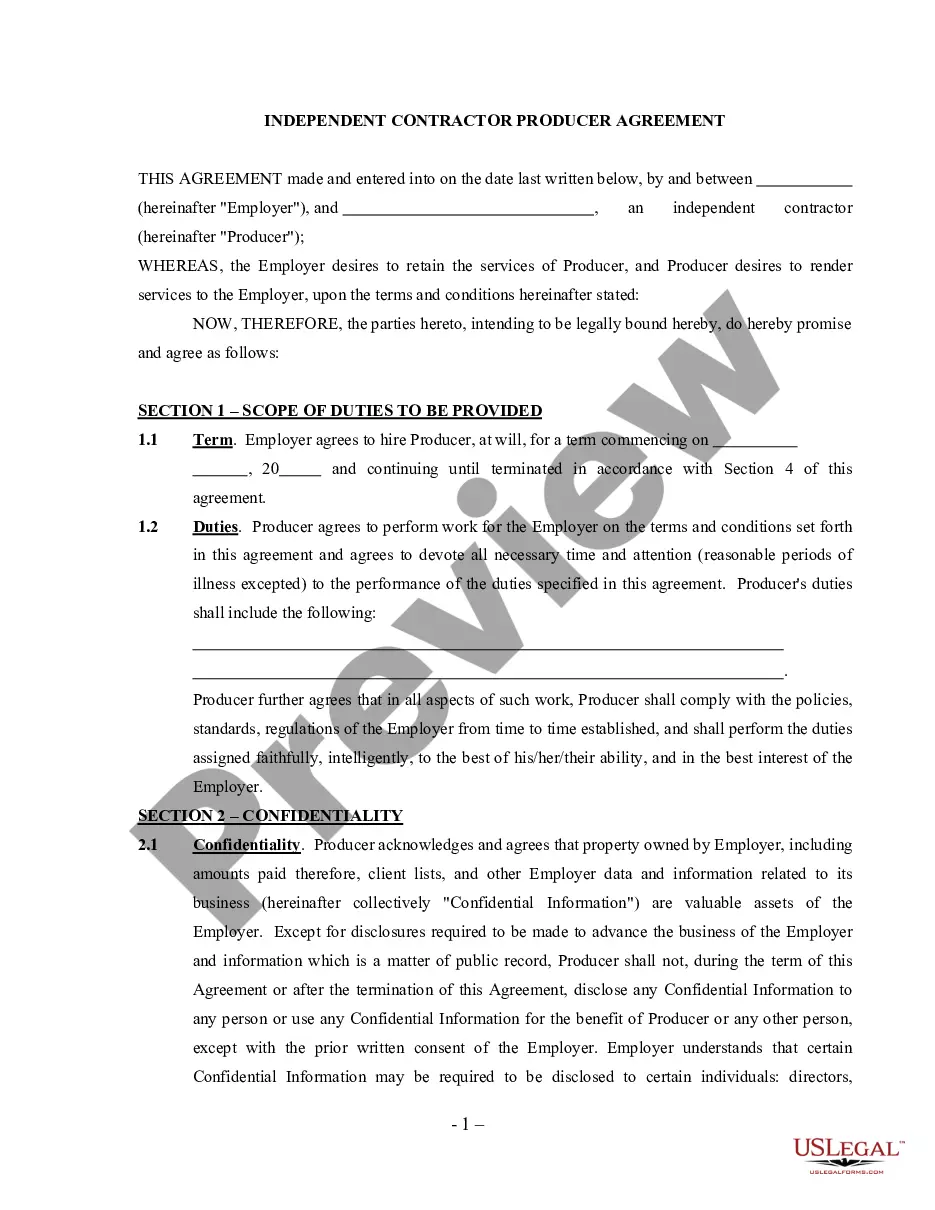

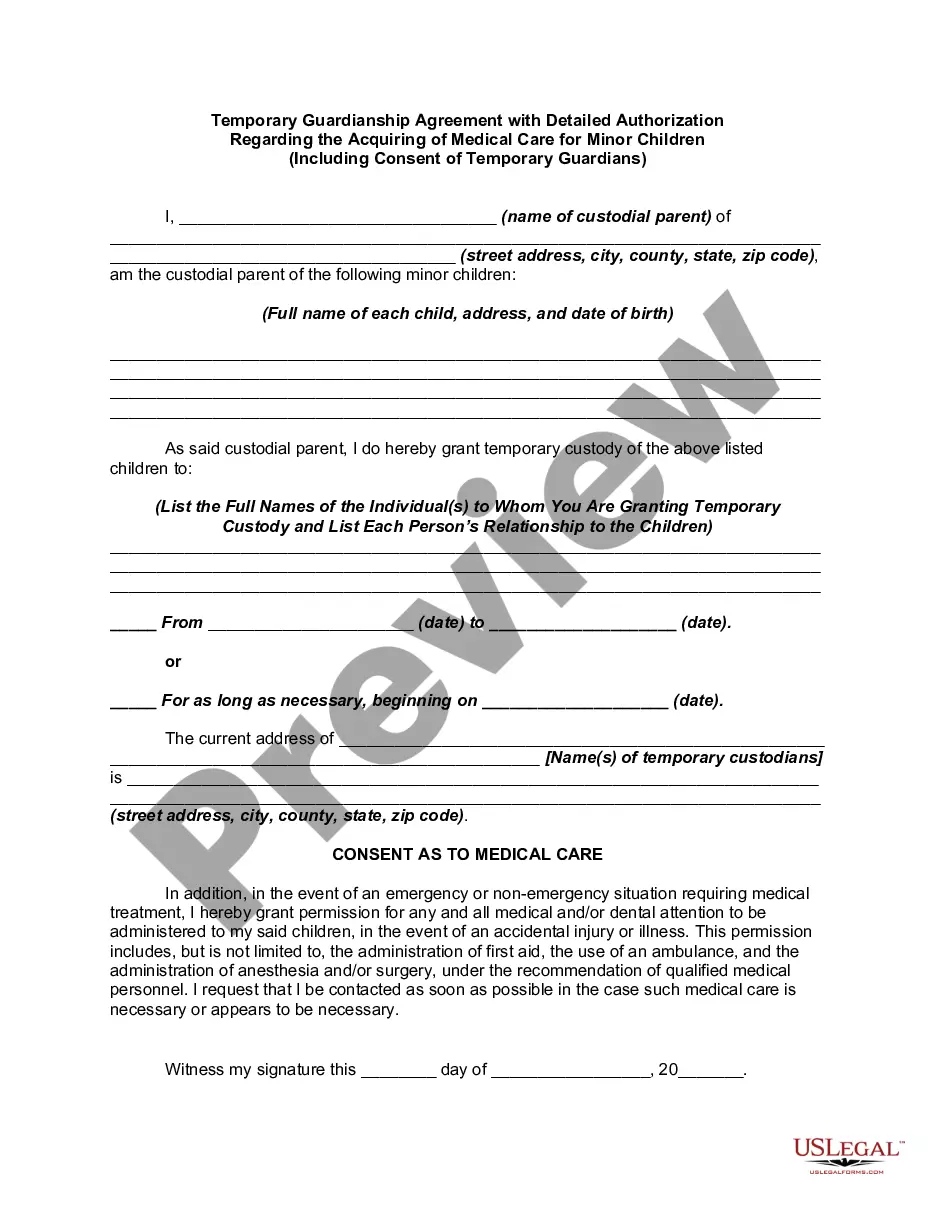

- Step 2. Utilize the Review option to check the form's details. Remember to review the information.

- Step 3. If you are not content with the form, use the Search box at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

Having a contract as an independent contractor is not strictly required, but it is highly beneficial. A contract protects your rights, outlines expectations, and defines payment terms. A Rhode Island Data Entry Employment Contract - Self-Employed Independent Contractor offers the framework needed to prevent misunderstandings with clients. It's a wise move to secure your interests and clarify your working relationship.

Yes, being self-employed and having a contract is not only possible but also beneficial. A formal agreement, like a Rhode Island Data Entry Employment Contract - Self-Employed Independent Contractor, helps define the terms of your work and establishes clear expectations from both sides. This clarity can prevent misunderstandings and disputes, ultimately promoting a smoother working relationship. A well-crafted contract demonstrates professionalism to your clients.

While it is not legally required to have a contract when you are self-employed, it is highly recommended. A contract clarifies the scope of work, payment terms, and expectations. A Rhode Island Data Entry Employment Contract - Self-Employed Independent Contractor can provide a solid framework, reducing potential conflicts with clients. Having that structure encourages professionalism and trust in your business relationships.

Independent contractors must meet certain legal requirements, including registering their business and paying appropriate taxes. In Rhode Island, understanding the nuances of the law helps protect your business. Using a Rhode Island Data Entry Employment Contract - Self-Employed Independent Contractor can also clarify your responsibilities and ensure compliance. Staying informed about the legal landscape is essential for your successful operation.

If you operate without a formal contract, your rights can become unclear. However, you still have rights under general employment laws that protect you from unfair practices. It is beneficial to have a Rhode Island Data Entry Employment Contract - Self-Employed Independent Contractor in place to ensure you understand your entitlements. In cases of disputes, having documentation can significantly support your position.

To become an independent contractor in Rhode Island, first choose a business structure, such as an LLC or sole proprietorship. Then, obtain any necessary permits or licenses, and ensure you understand your tax obligations. Finally, consider drafting a Rhode Island Data Entry Employment Contract - Self-Employed Independent Contractor to outline your services and payment terms. Following these steps helps establish your business professionally.

It is possible to work as a 1099 employee without a formal written contract, but having one is always advisable. A Rhode Island Data Entry Employment Contract - Self-Employed Independent Contractor provides clarity on the terms and expectations of your work. Without a contract, misunderstandings may arise regarding compensation and job responsibilities. Thus, it's wise to secure an agreement to protect your interests.

The primary distinction lies in the relationship dynamics. An employee works under the direct control of an employer, receiving benefits and a regular paycheck. In contrast, an independent contractor operates independently, managing their own taxes and business expenses. Understanding these differences is vital, and the Rhode Island Data Entry Employment Contract - Self-Employed Independent Contractor can provide clarity on your role.

Self-employed individuals operate their own businesses, while independent contractors provide services to clients under specific contracts. Although both categories allow for flexible work arrangements, an independent contractor usually has a defined relationship with a client. It’s essential to clearly delineate these roles in your Rhode Island Data Entry Employment Contract - Self-Employed Independent Contractor.

The terms self-employed and independent contractor are often used interchangeably; however, they serve slightly different purposes. Self-employed refers to anyone running their own business, whereas independent contractor specifically denotes a professional relationship with clients. Ultimately, the choice of term may depend on the context of your work. The Rhode Island Data Entry Employment Contract - Self-Employed Independent Contractor can help outline your exact role.