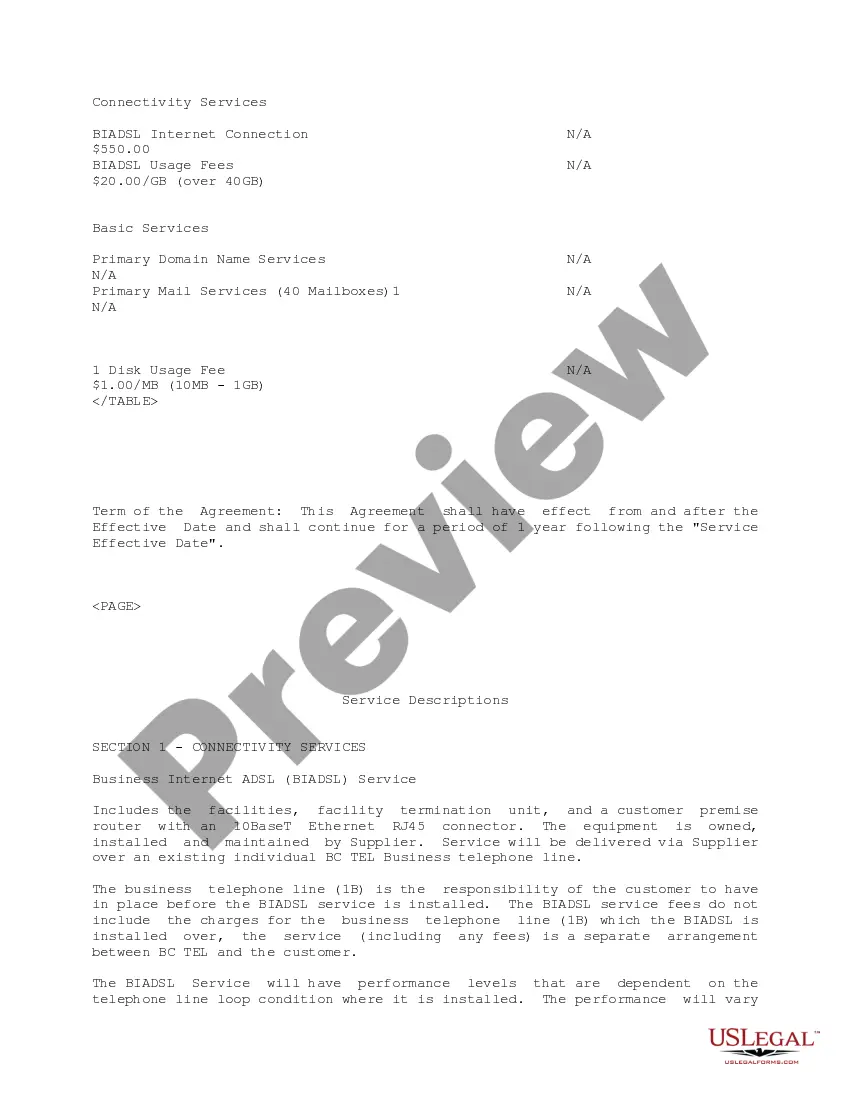

Rhode Island Internet Business Services Agreement

Description

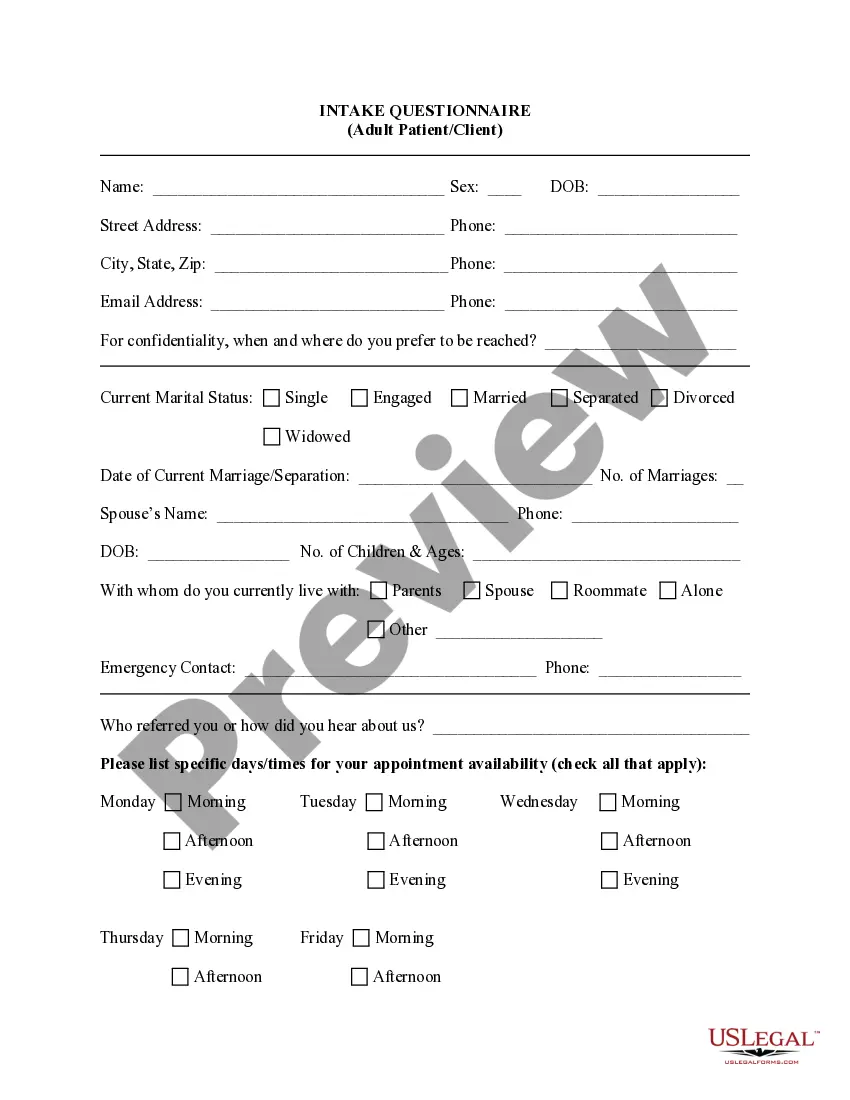

How to fill out Internet Business Services Agreement?

US Legal Forms - one of several largest libraries of lawful types in the USA - provides a variety of lawful papers layouts you may acquire or produce. Using the website, you can get a huge number of types for business and specific functions, categorized by groups, suggests, or key phrases.You can get the newest variations of types much like the Rhode Island Internet Business Services Agreement in seconds.

If you have a membership, log in and acquire Rhode Island Internet Business Services Agreement from your US Legal Forms catalogue. The Down load key can look on every kind you look at. You have accessibility to all in the past downloaded types inside the My Forms tab of the bank account.

If you would like use US Legal Forms for the first time, listed here are easy instructions to help you started:

- Make sure you have picked out the proper kind for your personal metropolis/state. Select the Review key to review the form`s content. See the kind information to ensure that you have selected the correct kind.

- When the kind doesn`t fit your needs, utilize the Lookup area near the top of the screen to get the one who does.

- If you are satisfied with the form, verify your decision by clicking the Purchase now key. Then, opt for the rates strategy you want and offer your accreditations to register for an bank account.

- Method the deal. Make use of bank card or PayPal bank account to finish the deal.

- Choose the format and acquire the form on your own device.

- Make adjustments. Complete, edit and produce and signal the downloaded Rhode Island Internet Business Services Agreement.

Each and every template you put into your account does not have an expiry date and is also your own forever. So, if you would like acquire or produce another copy, just go to the My Forms section and click about the kind you need.

Gain access to the Rhode Island Internet Business Services Agreement with US Legal Forms, the most comprehensive catalogue of lawful papers layouts. Use a huge number of skilled and express-specific layouts that satisfy your small business or specific requires and needs.

Form popularity

FAQ

Name your Rhode Island LLC. You'll need to choose a name to include in your articles before you can register your LLC. ... Choose your registered agent. ... Prepare and file articles of organization. ... Receive a certificate from the state. ... Create an operating agreement. ... Get an Employer Identification Number.

Rhode Island LLC Formation Filing Fee: $150 The primary cost when starting a Rhode Island LLC is the $150 fee ($152.50 online) to register your business with the Rhode Island Department of State' Business Division.

The sales tax is a levy imposed on the retail sale, rental or lease of many goods and services. Any sale is a retail sale if the property or service sold will be used and not resold in the regular course of business. The sales tax is imposed upon the retailer at the rate of 7% of the gross receipts from taxable sales.

The cost for domestic and foreign LLCs is $150. Make your checks or money orders payable to the RI Department of State. Foreign businesses trying to establish an LLC must include a Certificate of Good Standing or Letter of Status.

Regardless of how your LLC is structured or how much income you make, you'll need to pay a minimum of $400 to the Rhode Island Division of Taxation. Partnerships, disregarded entities, and S corporations pay the minimum business corporation tax of $400. Regular corporations pay $400 or more, depending on their profits.

You can get an LLC in Rhode Island in 3-4 business days if you file online (or 2 weeks if you file by mail).

Register your business If you are looking to start a General Partnership or Sole Proprietorship, please contact the city or town where you wish to do business. General Partnerships and Sole Proprietorships do not register with the RI Department of State.