"Data Input Sheet" is a American Lawyer Media form. This is a form is an instructional form on how to fill out the different real estate forms.

Rhode Island Data Input Sheet

Description

How to fill out Data Input Sheet?

If you wish to comprehensive, down load, or print legal document themes, use US Legal Forms, the most important collection of legal varieties, that can be found online. Use the site`s simple and handy search to discover the paperwork you will need. Numerous themes for enterprise and specific purposes are sorted by classes and claims, or key phrases. Use US Legal Forms to discover the Rhode Island Data Input Sheet in just a couple of click throughs.

When you are already a US Legal Forms buyer, log in to your account and then click the Acquire key to have the Rhode Island Data Input Sheet. You can even access varieties you earlier acquired in the My Forms tab of the account.

Should you use US Legal Forms initially, follow the instructions beneath:

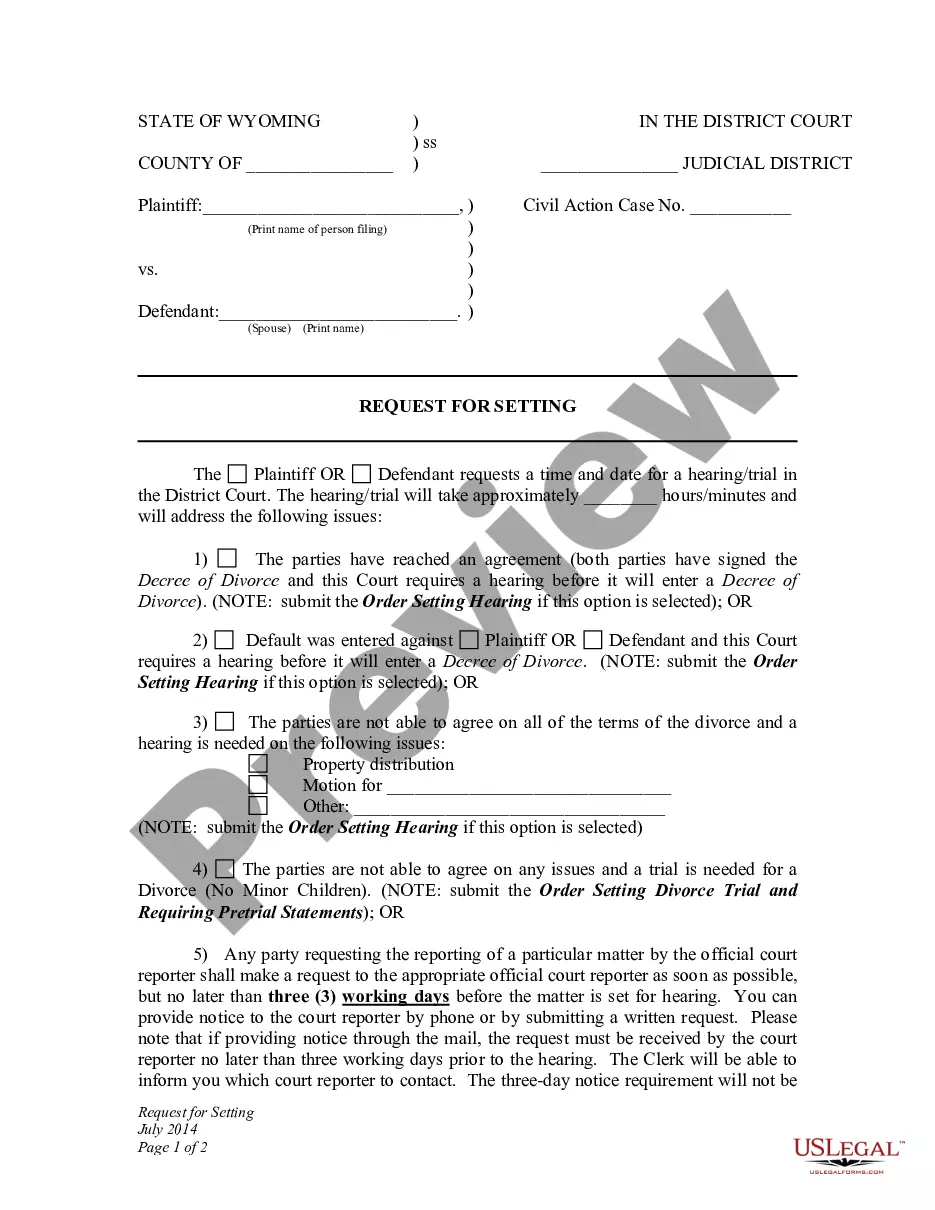

- Step 1. Be sure you have chosen the form for the appropriate town/region.

- Step 2. Utilize the Review method to look through the form`s content material. Do not forget to read the explanation.

- Step 3. When you are not satisfied with the type, use the Look for field near the top of the screen to find other variations in the legal type design.

- Step 4. When you have found the form you will need, click the Buy now key. Select the rates program you favor and include your references to sign up for the account.

- Step 5. Procedure the financial transaction. You can use your credit card or PayPal account to accomplish the financial transaction.

- Step 6. Pick the structure in the legal type and down load it in your product.

- Step 7. Complete, edit and print or indication the Rhode Island Data Input Sheet.

Each legal document design you purchase is your own property permanently. You have acces to every type you acquired within your acccount. Click on the My Forms portion and select a type to print or down load yet again.

Contend and down load, and print the Rhode Island Data Input Sheet with US Legal Forms. There are thousands of professional and express-certain varieties you can utilize to your enterprise or specific needs.

Form popularity

FAQ

Like most other states in the Northeast, Rhode Island has both a statewide income tax and sales tax. The income tax is progressive tax with rates ranging from 3.75% up to 5.99%. The highest marginal rate applies to taxpayers earning more than $155,050 for tax year 2022.

If you are a Rhode Island resident and you are required to file a federal return, you must also file a Rhode Island return. Even if you are not required to file a federal return, you may still have to file a Rhode Island return if your income exceeds the amount of your personal exemption.

Although Rhode Island's criminal records are in the public domain and accessible for free, the cost of making copies of these documents must be borne by the person making the request.

Rhode Island has a graduated individual income tax, with rates ranging from 3.75 percent to 5.99 percent. Rhode Island also has a flat 7.00 percent corporate income tax rate. Rhode Island has a 7.00 percent state sales tax rate and does not levy local sales taxes. Rhode Island Tax Rates, Collections, and Burdens taxfoundation.org ? location ? rhode-island taxfoundation.org ? location ? rhode-island

If you are a Rhode Island resident and you are required to file a federal return, you must also file a Rhode Island return. Even if you are not required to file a federal return, you may still have to file a Rhode Island return if your income exceeds the amount of your personal exemption. What are Rhode Island's Filing Requirements? TaxSlayer ? en-us ? articles ? 3600... TaxSlayer ? en-us ? articles ? 3600...

As of 2023, nine states ? Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming ? do not levy a state income tax. New Hampshire Department of Revenue Administration. Frequently Asked Questions - Interest & Dividend Tax. 9 States With No Income Tax - NerdWallet nerdwallet.com ? article ? taxes ? states-with... nerdwallet.com ? article ? taxes ? states-with...

Attention Rhode Island businesses?for tax periods beginning January 1, 2023, larger business registrants will be required to use electronic means to file returns and remit taxes to the State of Rhode Island. KLR | New Electronic Filing and Payment Mandate for Rhode Island? kahnlitwin.com ? blogs ? tax-blog ? new-electroni... kahnlitwin.com ? blogs ? tax-blog ? new-electroni...

Rhode Island Withholding Account Number If you are a new business, register online with the RI Department of Revenue. ... If you already have a Rhode Island Withholding Account Number, you can find it on previous correspondence from the RI Department of Revenue or by contacting the agency at 401-574-8829.