Rhode Island Purchase of common stock for treasury of company

Description

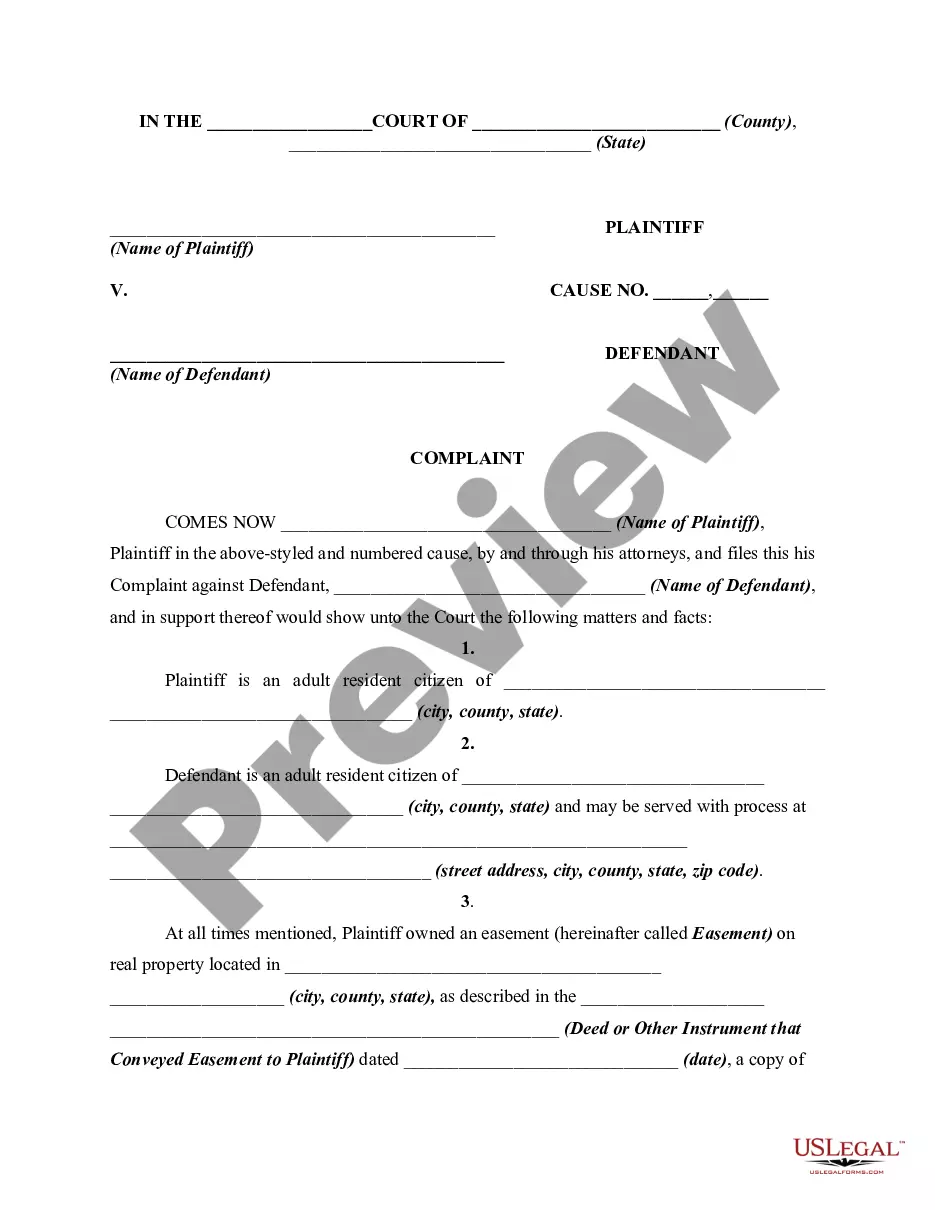

How to fill out Purchase Of Common Stock For Treasury Of Company?

If you wish to comprehensive, acquire, or print lawful papers templates, use US Legal Forms, the greatest variety of lawful varieties, which can be found on the web. Take advantage of the site`s easy and handy search to get the papers you want. A variety of templates for enterprise and specific purposes are categorized by categories and states, or search phrases. Use US Legal Forms to get the Rhode Island Purchase of common stock for treasury of company in just a number of click throughs.

Should you be currently a US Legal Forms client, log in to the account and click the Download switch to get the Rhode Island Purchase of common stock for treasury of company. You can also entry varieties you in the past saved in the My Forms tab of your account.

If you are using US Legal Forms the very first time, follow the instructions beneath:

- Step 1. Be sure you have selected the shape to the proper town/nation.

- Step 2. Use the Preview choice to look through the form`s content material. Never overlook to learn the explanation.

- Step 3. Should you be not satisfied using the type, use the Research field towards the top of the screen to find other types in the lawful type web template.

- Step 4. After you have discovered the shape you want, click the Get now switch. Pick the rates program you prefer and add your credentials to register for the account.

- Step 5. Process the deal. You can use your Мisa or Ьastercard or PayPal account to perform the deal.

- Step 6. Choose the formatting in the lawful type and acquire it on your device.

- Step 7. Comprehensive, change and print or sign the Rhode Island Purchase of common stock for treasury of company.

Every lawful papers web template you acquire is your own property permanently. You have acces to each and every type you saved with your acccount. Click the My Forms area and select a type to print or acquire once more.

Be competitive and acquire, and print the Rhode Island Purchase of common stock for treasury of company with US Legal Forms. There are many professional and express-particular varieties you can utilize for your personal enterprise or specific requires.

Form popularity

FAQ

To make an 83(b) election, you must complete the following steps within 30 days of your grant date: ? Complete the IRS 83(b) form on page 2. Mail the completed form to the IRS within 30 days of your grant date. Address it to the IRS Service Center where you file your taxes.

You don't need to do anything special. The fair market value of your award should already be included in W-2, box 1 or 1099-NEC. Additionally, the IRS no longer requires that you include your 83(b) election form with your taxes when filing.

The certified mail with the return receipt will help you confirm that the IRS received the 83(b) form.

Mail the completed form to the IRS within 30 days of your grant date. Address it to the IRS Service Center where you file your taxes. (See the chart provided on page 3.) Mail a copy of the completed form to your employer.

How To Report An 83(b) Election On A Tax Return. In the year that you made your election, your stock will be reported as income on your tax return. To file 83(b) shares on your tax return, the fair market value of the shares will be reported on a W-2 or 1099-NEC.

A Section 83(b) election is a letter that lets the Internal Revenue Service (IRS) know you'd like to have your founder stock taxed at the time of your stock purchase rather than at the time of vesting.

Example of an 83(b) Election If the total value of the company's equity increases to $100,000, then the co-founder's 10% value increases to $10,000 from $1,000. The co-founder's tax liability for year 1 will be deduced from ($10,000 - $1,000) x 20% i.e. in effect, ($100,000 - $10,000) x 10% x 20% = $1,800.

Mail to the IRS Service Center where you file your tax return ? the address for your IRS Service Center can be found here. Preferably send the letter by certified mail and request a return receipt. Mail a copy of the completed letter to your employer.

You expect the value of the stock to increase to $5 after one year, to $10 after two years, to $15 after three years, and to $20 in four years when the company goes public. If you make the 83(b) election, you would include $10,000 (10,000 shares x $1/ share) in your current year's income.