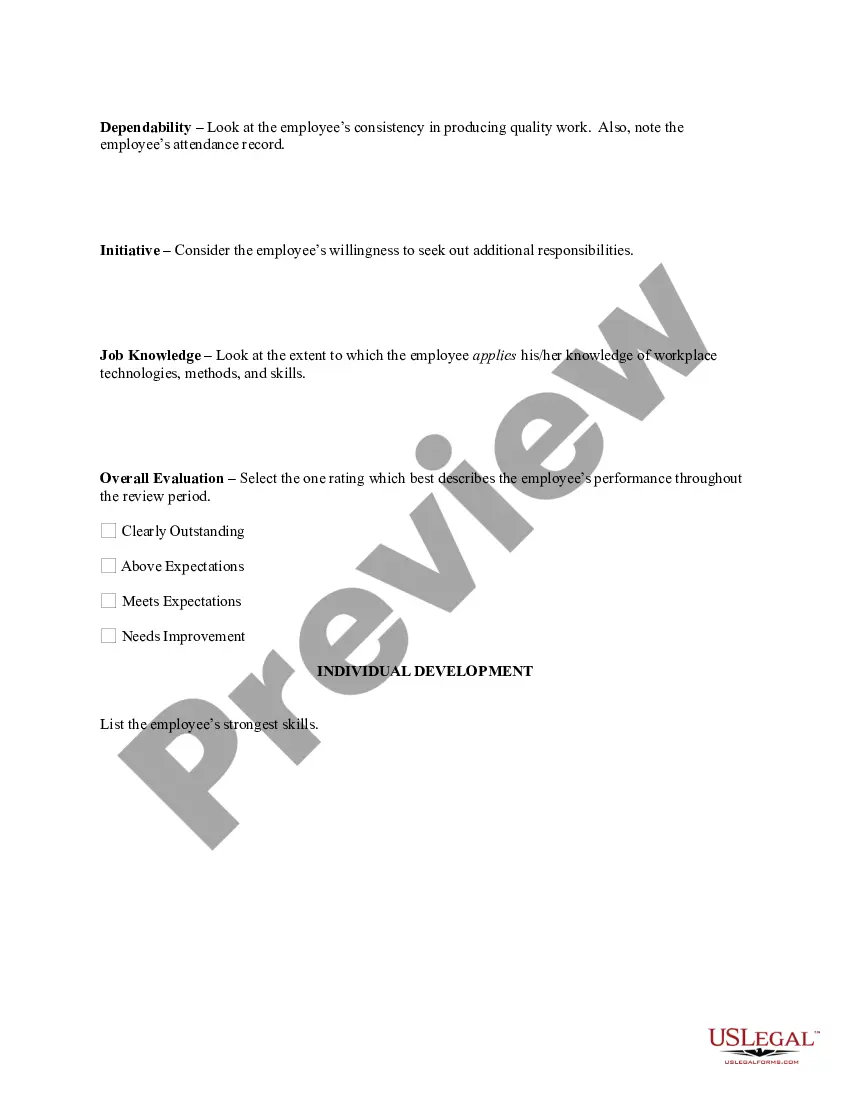

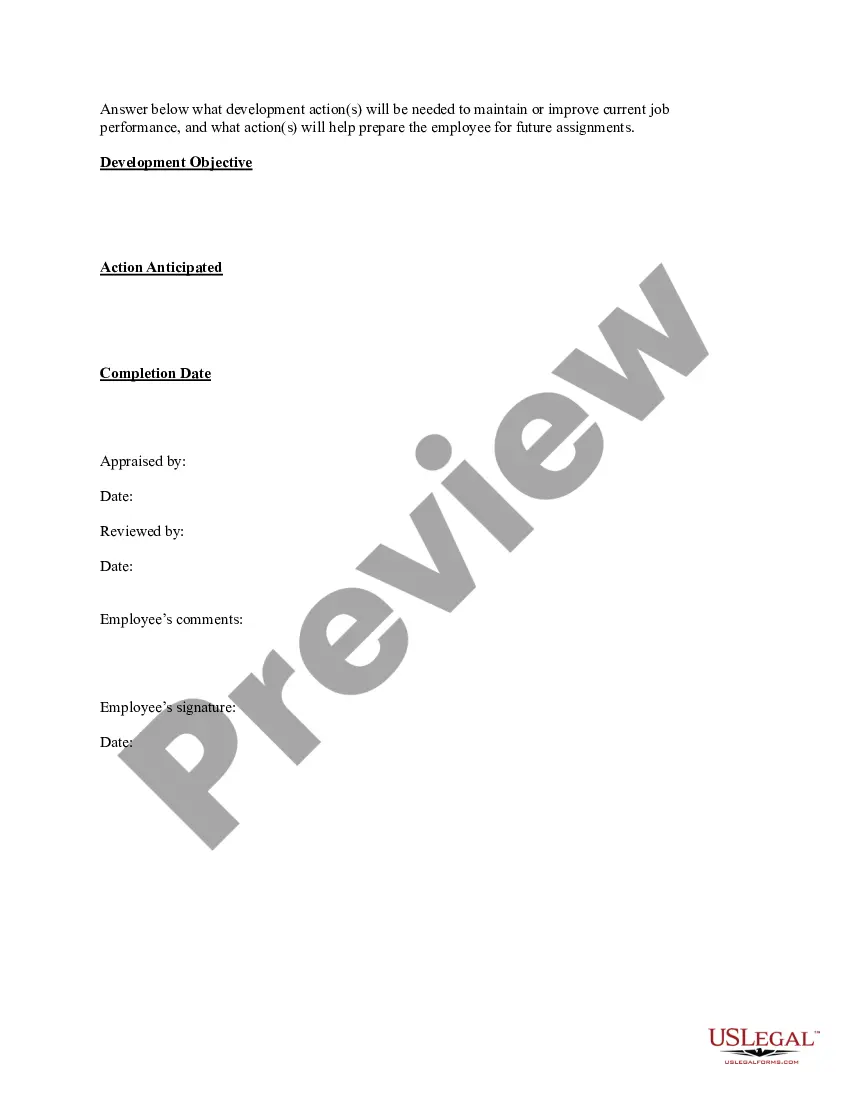

Rhode Island Sample Performance Review for Nonexempt Employees

Description

How to fill out Sample Performance Review For Nonexempt Employees?

It is feasible to invest numerous hours online attempting to locate the sanctioned document template that conforms to the state and federal requirements you will require.

US Legal Forms offers a vast array of legal forms that can be examined by experts.

You can download or print the Rhode Island Sample Performance Evaluation for Nonexempt Employees from our service.

If you are using the US Legal Forms website for the first time, follow the straightforward instructions below: First, ensure that you have selected the correct document template for the area/city of your choice.

- If you already possess a US Legal Forms account, you can Log In and click on the Obtain button.

- After that, you can complete, modify, print, or sign the Rhode Island Sample Performance Evaluation for Nonexempt Employees.

- Every legal document template you purchase is yours permanently.

- To acquire an additional copy of the purchased form, navigate to the My documents tab and click the corresponding button.

Form popularity

FAQ

In Rhode Island, the distinction between exempt and non-exempt primarily focuses on overtime eligibility and job duties. Non-exempt employees earn overtime for extra hours worked, while exempt employees typically earn a fixed salary and do not receive overtime. Understanding this difference is essential when developing a Rhode Island Sample Performance Review for Nonexempt Employees to ensure accurate assessments.

Employees who are paid less than $23,600 per year ($455 per week) are nonexempt. (Employees who earn more than $100,000 per year are almost certainly exempt.)

Rhode Island is an employment-at-will state. Therefore, an employer may generally terminate an employment relationship at any time and for any reason. However, a federal or state law, collective bargaining agreement, or individual employment contract may place further limitations on an otherwise at-will relationship.

If you are a non-exempt employee, your employer must pay you at least the federal minimum wage (currently $7.25 per hour in Texas and under federal law) and must pay you overtime pay at a rate of at least one and a half times your hourly pay rate for all hours worked over 40 in each workweek.

Rhode Island, like many other states, is an employment at will state. This means that unless an employee has an employment contract or is employed under a collective bargaining agreement, employment may be terminated by the employer for any reason or no reason at all.

Rhode Island Law Requires Meal Breaks Some states require either meal or rest breaks. Rhode Island is one of them: In Rhode Island, employers must give employees a 20-minute meal break for a six-hour shift, and a 30-minute meal break for an eight-hour shift.

Most states, including Rhode Island and Massachusetts, follow the so-called employment at will doctrine. This means that in the absence of a contract (either through a union or otherwise), an employee may be fired for any reason or no reason at all.

Examples of non-exempt employees include contractors, freelancers, interns, servers, retail associates and similar jobs. Even if non-exempt employees earn more than the federal minimum wage, they still take direction from supervisors and do not have administrative or executive positions.

Nonexempt: An individual who is not exempt from the overtime provisions of the FLSA and is therefore entitled to overtime pay for all hours worked beyond 40 in a workweek (as well as any state overtime provisions). Nonexempt employees may be paid on a salary, hourly or other basis.

Salary level test. Employees who are paid less than $23,600 per year ($455 per week) are nonexempt. (Employees who earn more than $100,000 per year are almost certainly exempt.)