Rhode Island Petty Cash Funds

Description

How to fill out Petty Cash Funds?

Have you ever been in a location where you need documents for occasional business or personal reasons on a daily basis.

There are many legal document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms offers a vast array of document templates, such as the Rhode Island Petty Cash Funds, designed to comply with state and federal requirements.

Once you locate the suitable document, click Purchase now.

Choose the payment plan you prefer, fill in the necessary information to create your account, and complete your purchase using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Rhode Island Petty Cash Funds template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the document you require and ensure it is for the correct city/region.

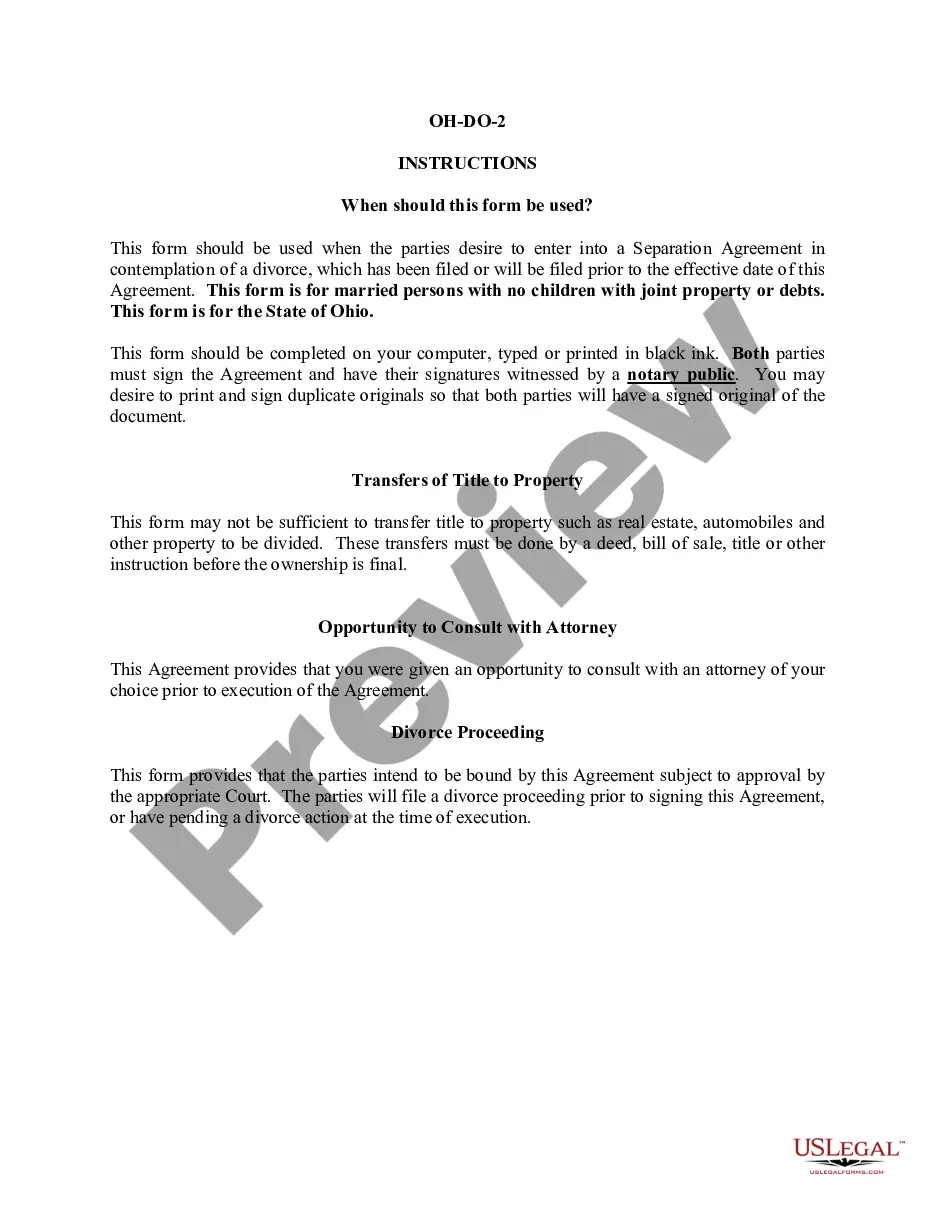

- Utilize the Preview button to review the document.

- Read the description to confirm that you have chosen the correct document.

- If the document isn’t what you are seeking, use the Lookup field to find the document that meets your requirements.

Form popularity

FAQ

A petty cash fund serves as a small amount of cash kept on hand for minor expenses. In the case of Rhode Island Petty Cash Funds, businesses allocate a specific sum for everyday costs like office supplies or employee reimbursements. Employees can access these funds without going through standard purchasing procedures, which improves efficiency. Proper tracking and reconciliation ensure that the petty cash fund remains balanced and transparent.

Yes, a petty cash fund consists of actual cash set aside for small, everyday expenses. Rhode Island Petty Cash Funds can be used to handle minor operational costs without going through the formal purchasing processes. By keeping the cash on hand, businesses can respond quickly to immediate needs while keeping track of spending through receipts and records.

The imprest petty cash policy defines a fixed amount of Rhode Island Petty Cash Funds that is maintained. The manager replenishes the fund to that fixed amount after it is used for various purchases or expenses. This system helps maintain oversight and control, as you always know exactly how much cash should be available.

To establish Rhode Island Petty Cash Funds, start by determining the amount you want to allocate for small expenses. Next, create a petty cash policy outlining who will manage the funds and how transactions will be documented. Using a reliable platform like uslegalforms can help streamline the creation process, ensuring compliance and clarity.

You should keep Rhode Island Petty Cash Funds in a secure and accessible location. A locked cash box or drawer works well to prevent unauthorized access while allowing designated employees easy access for legitimate expenses. It's important to maintain an organized record of the funds to track usage and replenish when necessary.

Setting up a petty cash system in Rhode Island requires a clear policy for usage and management. Begin by defining the fund's purpose, and who can access it, along with the maximum withdrawal limits. Next, choose a custodian to oversee the funds and create a reimbursement process for replenishing the petty cash. Using platforms like US Legal Forms can provide guidance in establishing a compliant and effective petty cash system tailored to your unique needs.

Recording a petty cash fund in Rhode Island involves maintaining a detailed log of all transactions. Each time funds are used, make an entry that notes the date, amount, purpose, and any receipts. Regularly review your log to reconcile your petty cash funds with the remaining cash. By implementing this practice, you ensure accuracy and transparency in managing your Rhode Island petty cash funds.

To start a petty cash fund in Rhode Island, first, determine the total amount needed to cover small expenses. Next, obtain approval from relevant authorities within your organization. After securing the amount, set aside the cash in a secure location, and create a log for tracking expenditures. This process will help you manage your Rhode Island petty cash funds efficiently.

Filling out a petty cash form from Rhode Island Petty Cash Funds is straightforward. You should begin by entering the date of the transaction, followed by the amount being withdrawn. Include details about the purpose of the expense and any necessary signatures. Properly filled forms guarantee that your petty cash system remains organized and accessible.

To write petty cash from Rhode Island Petty Cash Funds, start by determining the amount needed for the transaction. Next, create a petty cash voucher that includes the date, amount, purpose, and signature of the custodian. Finally, ensure that you maintain accurate records and receipts for every transaction to keep your accounts clear and transparent.