Rhode Island Liquidation of Partnership with Sale of Assets and Assumption of Liabilities

Description

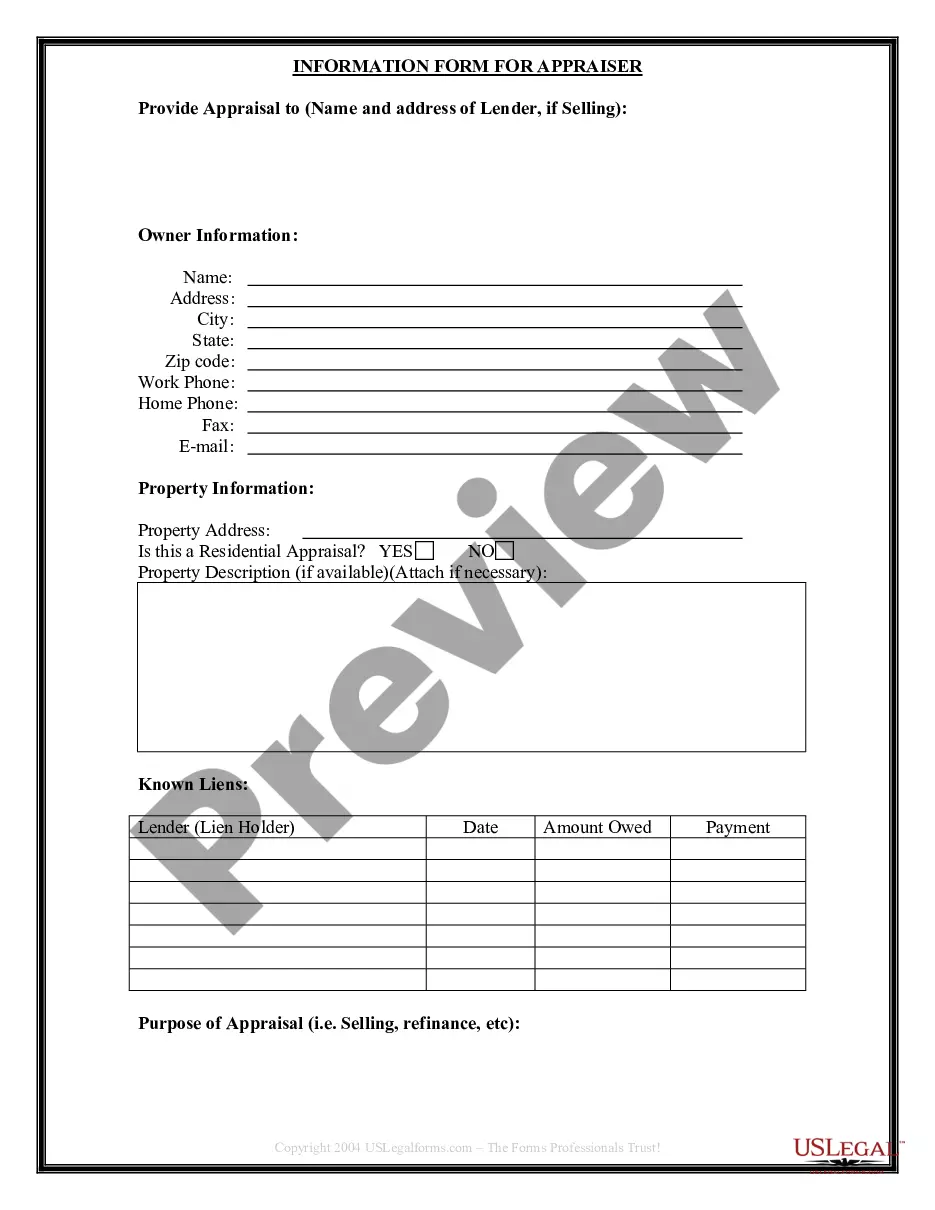

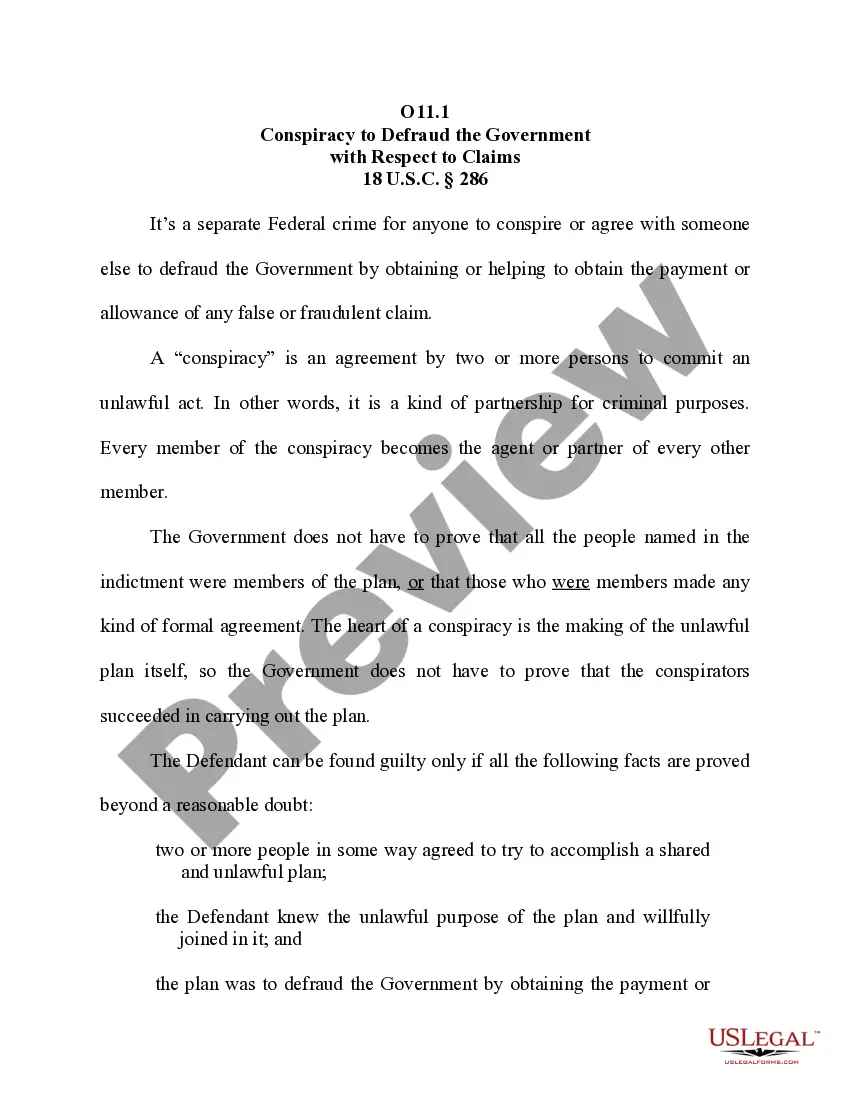

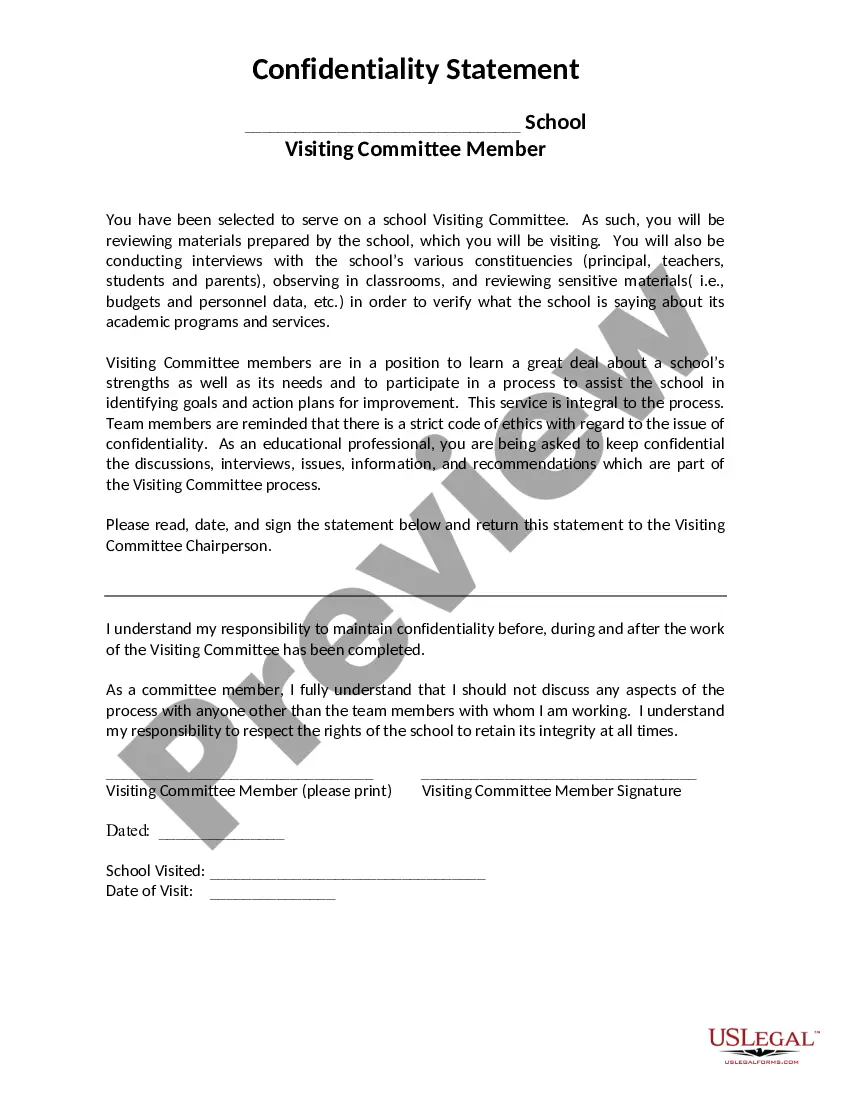

How to fill out Liquidation Of Partnership With Sale Of Assets And Assumption Of Liabilities?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a selection of legal form templates that you can obtain or create.

By utilizing the site, you'll find numerous forms for business and individual needs, categorized by types, states, or keywords.

You can find the latest versions of forms such as the Rhode Island Liquidation of Partnership with Sale of Assets and Assumption of Liabilities within moments.

If the form does not satisfy your requirements, utilize the Search field at the top of the screen to find one that does.

If you are satisfied with the form, confirm your choice by clicking the Download now button.

- If you have a subscription, Log In to obtain the Rhode Island Liquidation of Partnership with Sale of Assets and Assumption of Liabilities from the US Legal Forms library.

- The Download option will appear on each document you view.

- You can access all previously downloaded forms from the My documents section of your account.

- If you are a new user of US Legal Forms, here are simple steps to guide your start.

- Ensure you have selected the correct form for your city/region.

- Click the Review option to examine the form’s content.

Form popularity

FAQ

Typically, state law provides that the partnership must first pay partners according to their share of capital contributions (the investments in the partnership), and then distribute any remaining assets equally.

Once the debts owed to all creditors are satisfied, the partnership property will be distributed to each partner according to their ownership interest in the partnership. If there was a partnership agreement, then that document controls the distribution.

2012 Review Schedule D, Form 8949 and Form 4797 to determine the amount of gain or loss the partner reported on the sale of the partnership interest. After determining a partner sold its interest in the partnership, establish other relevant facts that can impact the tax treatment of this transaction.

If dissolution is not covered in the partnership agreement, the partners can later create a separate dissolution agreement for that purpose. However, the default rule is that any remaining money or property will be distributed to each partner according to their ownership interest in the partnership.

In an asset purchase from a partnership, the tax consequences to the buyer are the same as for an asset purchase from a corporation. In such an asset sale, the partnership is selling the various assets of the partnership separately and the aggregate purchase price is allocated among each asset acquired.

The liquidation or dissolution process for partnerships is similar to the liquidation process for corporations. Over a period of time, the partnership's non-cash assets are converted to cash, creditors are paid to the extent possible, and remaining funds, if any, are distributed to the partners.

Rights after dissolution It says that after the dissolution of the firm, all the partners or his representative are entitled to the property of the firm as applied in the payment of debts and liabilities of the firm and the surplus to be distributed among all the partners of the firm.

In an asset purchase from a partnership, the tax consequences to the buyer are the same as for an asset purchase from a corporation. In such an asset sale, the partnership is selling the various assets of the partnership separately and the aggregate purchase price is allocated among each asset acquired.

Any remaining assets are then divided among the remaining partners in accordance with their respective share of partnership profits. Under the RUPA, creditors are paid first, including any partners who are also creditors.

What is the partner's basis in property received in liquidation of his interest? When a partnership distributes property in a liquidating distribution, the recipient partner's outside basis reduced by any amount of cash included in the distribution is allocated to the distributed property.