Rhode Island Employee Separation Report

Description

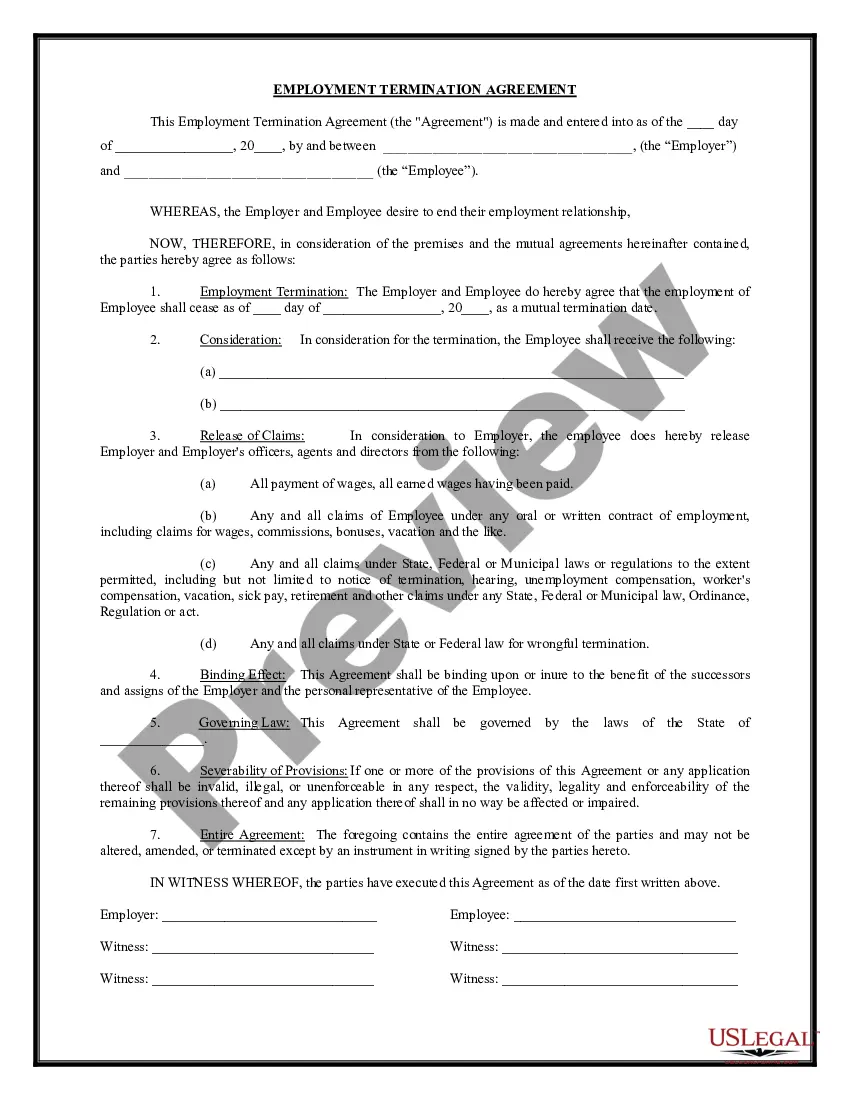

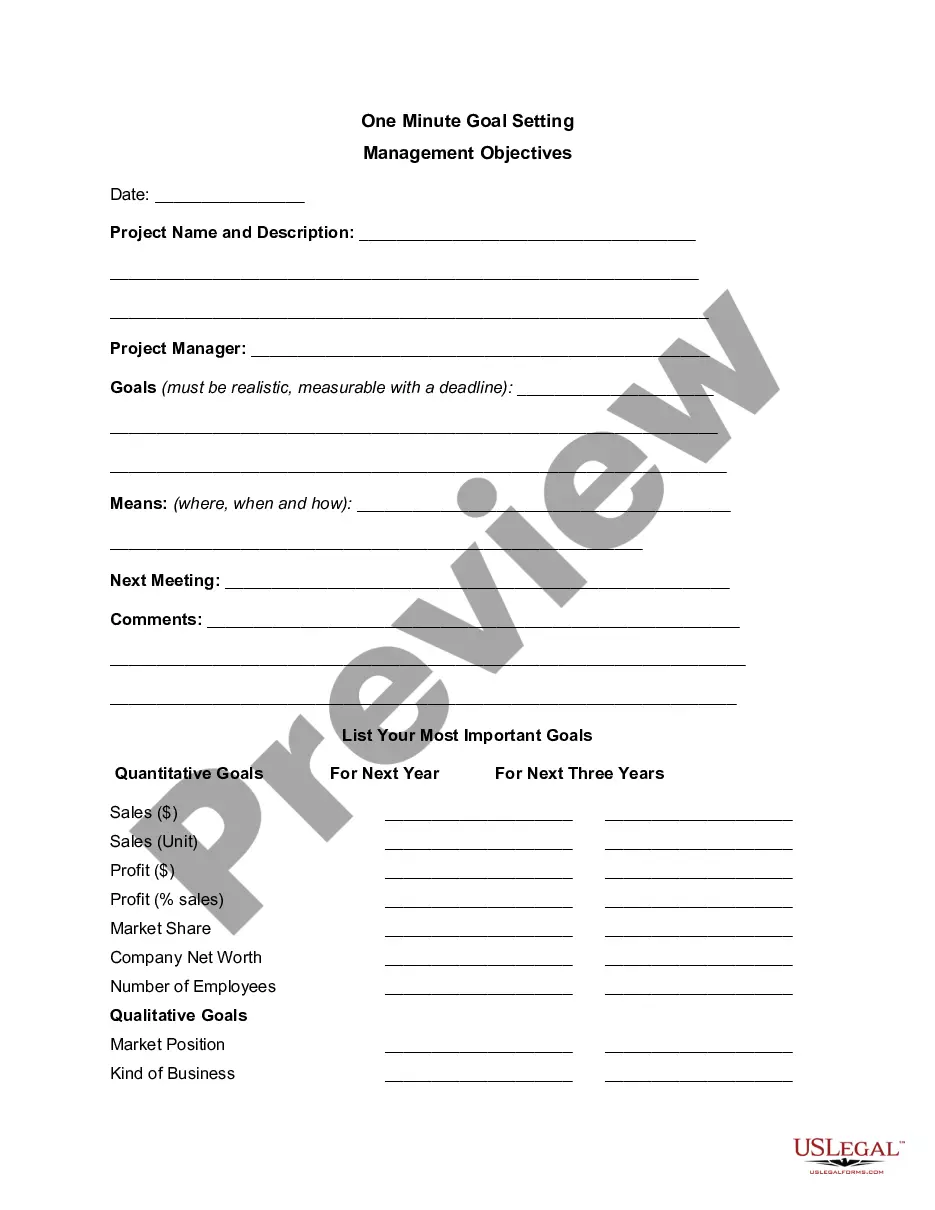

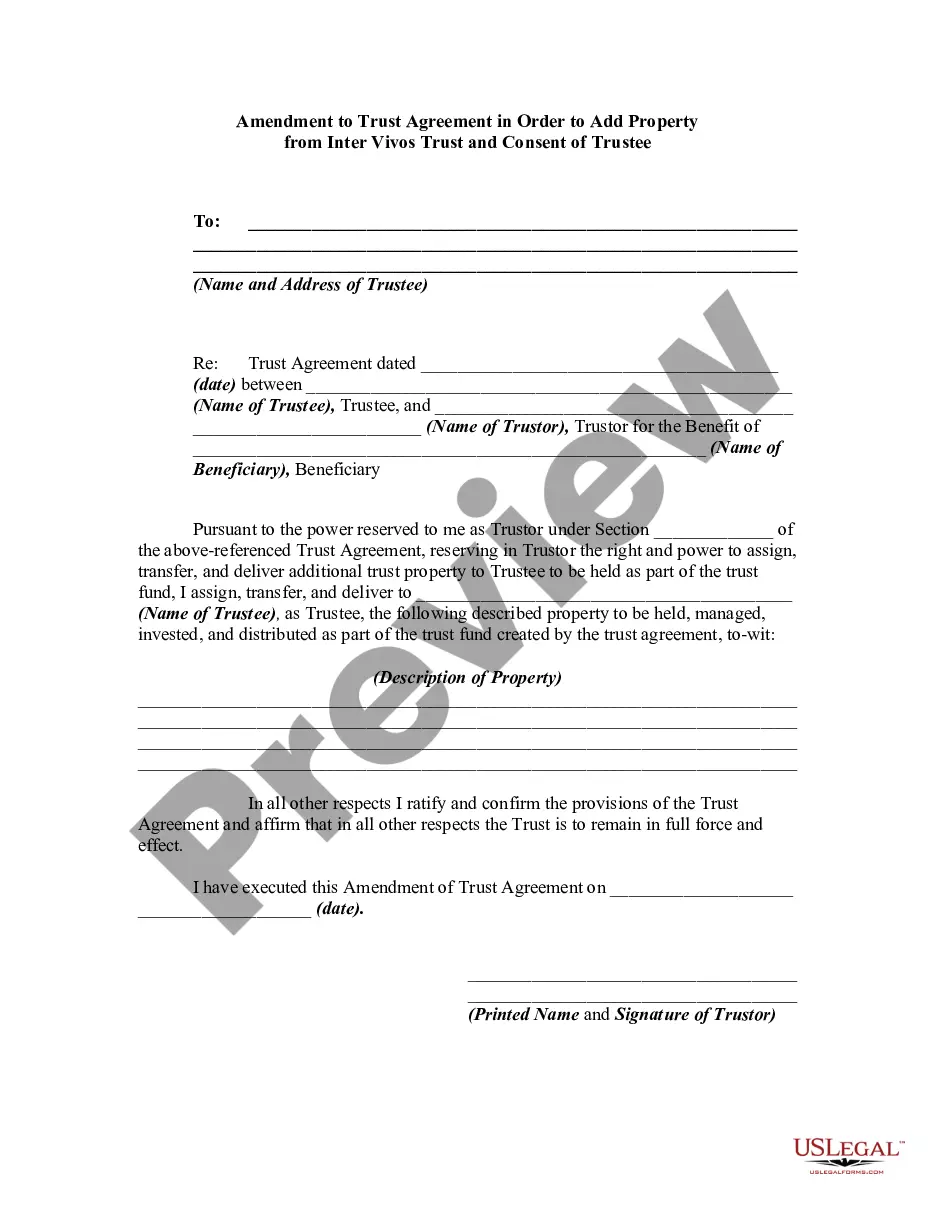

How to fill out Employee Separation Report?

If you need to acquire, obtain, or print authorized document layouts, utilize US Legal Forms, the largest collection of authorized templates, available online.

Take advantage of the site’s user-friendly and convenient search to find the documents you require.

Various templates for business and personal purposes are categorized by types and jurisdictions, or keywords.

Every authorized document template you purchase is yours indefinitely.

You have access to every form you acquired with your account. Click on the My documents section and select a form to print or download again. Be proactive and obtain, and print the Rhode Island Employee Separation Report with US Legal Forms. There are numerous professional and state-specific documents you can utilize for your business or personal needs.

- Use US Legal Forms to obtain the Rhode Island Employee Separation Report in just a few clicks.

- If you are currently a US Legal Forms user, Log In to your account and click on the Acquire button to retrieve the Rhode Island Employee Separation Report.

- You can also access forms you previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these instructions.

- Step 1. Confirm you have selected the form for the correct city/state.

- Step 2. Utilize the Review option to examine the form’s details. Don’t forget to read the summary.

- Step 3. If you are not satisfied with the document, use the Search field at the top of the screen to locate alternative versions of your authorized document template.

- Step 4. Once you have found the form you desire, click on the Buy now button. Choose the payment plan you prefer and enter your details to register for an account.

- Step 5. Process the transaction. You may use your Visa or MasterCard or PayPal account to complete the transaction.

- Step 6. Choose the format of your authorized document and download it onto your device.

- Step 7. Complete, modify, and print or sign the Rhode Island Employee Separation Report.

Form popularity

FAQ

The duration of your claim is equal to 33% of your total base period wages divided by your basic weekly benefit rate (not including dependent's allowance). The most you are allowed to collect is an amount equal to 26 full weeks. You may claim these weeks any time you are unemployed during your benefit year.

Can I collect UI benefits if I receive severance pay? You will have your payment delayed by the number of weeks of severance pay received from your employer. Any severance pay received will be allocated on a weekly basis from your last day of work for a period not to exceed 26 weeks.

Don't wait to apply for benefits, even if you're not sure about your current eligibility. Get your claim in the system so you can receive the maximum benefits you are eligible for. Report your severance pay when you file the claim, and your unemployment compensation will be calculated for you.

Unemployment claimants can earn more and keep more of your benefits while working part-time. You can now earn up to 150% of your weekly benefit rate and still receive a partial benefit. For example, that means if your weekly benefit amount is $100, you can earn up to $149 working part time.

You must certify for payments by logging in to UI Online once every week to collect benefits. You can also certify by phone at (401) 415-6772.

If you were fired because you lacked the skills to perform the job or simply weren't a good fit, you won't necessarily be barred from receiving benefits. However, if you were fired for misconduct relating to your job, you will be disqualified from receiving benefits.

The following federal programs will be ending: Pandemic Unemployment Assistance (PUA): unemployment benefits for those who were not normally eligible for unemployment, such as independent contractors, small business owners, and people out of work due to COVID-19 related illness or quarantine.

For new claims with an effective date of July 4, 2021 or later, the maximum weekly benefit rate for Unemployment Insurance will increase to $661 per beneficiary, an increase of $62 from last year's maximum of $599. For beneficiaries with the maximum five dependents the maximum weekly benefit rate will be $826.

How Long Do I Have to Work For to Collect Unemployment in Rhode Island? There is no minimum amount of time or wages an employer has to meet in order to qualify under unemployment compensation. To qualify for unemployment insurance in RI, you must have worked during a minimum of two quarters of the base period.

Form TX-17 "Quarterly Tax and Wage Report" - Rhode Island.