A receipt is an acknowledgment in writing that something of value, or cash, has been placed into the possession of an individual or organization. It is a written confirmation of payment.

Rhode Island Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift

Description

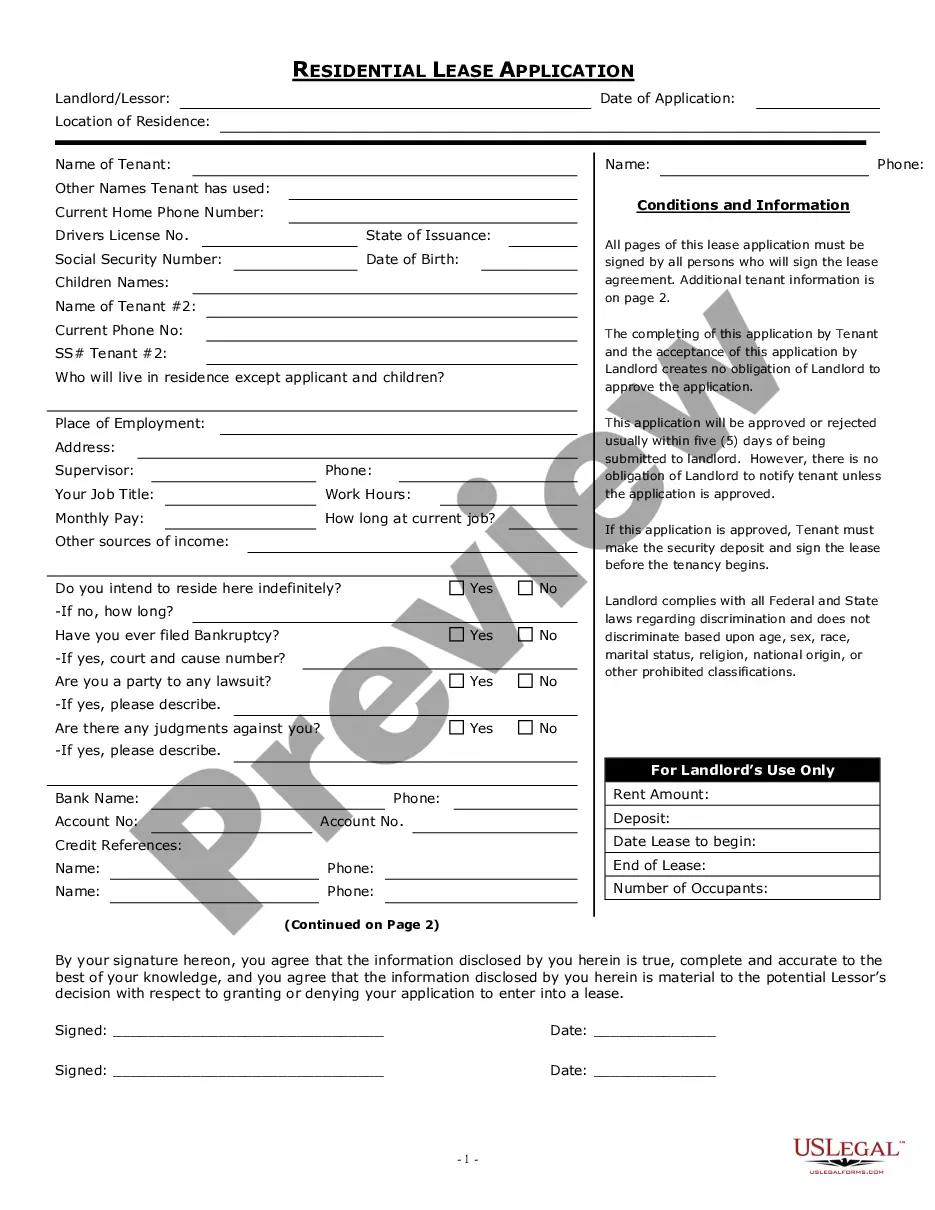

How to fill out Acknowledgment By A Nonprofit Church Corporation Of Receipt Of Gift?

US Legal Forms - one of the largest collections of legal templates in the United States - offers an assortment of legal document formats that you can download or print.

By utilizing the website, you can access thousands of forms for business and personal purposes, categorized by types, states, or keywords. You can find the most recent forms, including the Rhode Island Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift, in just a few minutes.

If you already have a subscription, Log In to download the Rhode Island Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift from the US Legal Forms repository. The Download button will appear on every form you view. You can access all previously saved forms in the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Choose the format and download the form to your device. Edit the document. Fill out, modify, print, and sign the downloaded Rhode Island Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift. Each template saved in your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the desired form. Access the Rhode Island Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift through US Legal Forms, the most comprehensive library of legal document formats. Utilize a vast selection of professional and state-specific templates to meet your business or personal needs.

- If you are using US Legal Forms for the first time, follow these simple steps to begin.

- Make sure you have chosen the correct form for your state/region.

- Click the Preview button to examine the form’s details.

- Review the form information to confirm it is the right one for you.

- If the form does not meet your requirements, utilize the Search box at the top of the page to find a suitable alternative.

- Once satisfied with the form, complete your selection by clicking the Acquire now button.

- Then, select the pricing plan you prefer and provide your details to create an account.

Form popularity

FAQ

To acknowledge in-kind gifts, you provide a detailed description of the items received along with their estimated value. A Rhode Island Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift may say something like, 'Thank you for donating 50 community meals valued at $500 on February 20, 2023.' This recognition helps the donor understand the impact of their contribution and creates a record needed for tax deductions.

What's the best format for your donation receipt?The name of the organization.A statement confirming that the organization is a registered 501(c)(3) organization, along with its federal tax identification number.Date that the donation was made.Donor's name.Type of contribution made (cash, goods, services)More items...

Nonprofits often look for ways to reward their volunteers for their services. There is no tax problem when a volunteer is given rewards of nominal value such as free food and drink at a thank-you party or a certificate of appreciation. However, more substantial rewards could result in taxable income to the volunteers.

How do you acknowledge a donation?The name of your donor.The full legal name of your organization.A declaration of your organization's tax-exempt status.Your organization's employer identification number.The date the gift was received.A description of the gift and the amount received.More items...

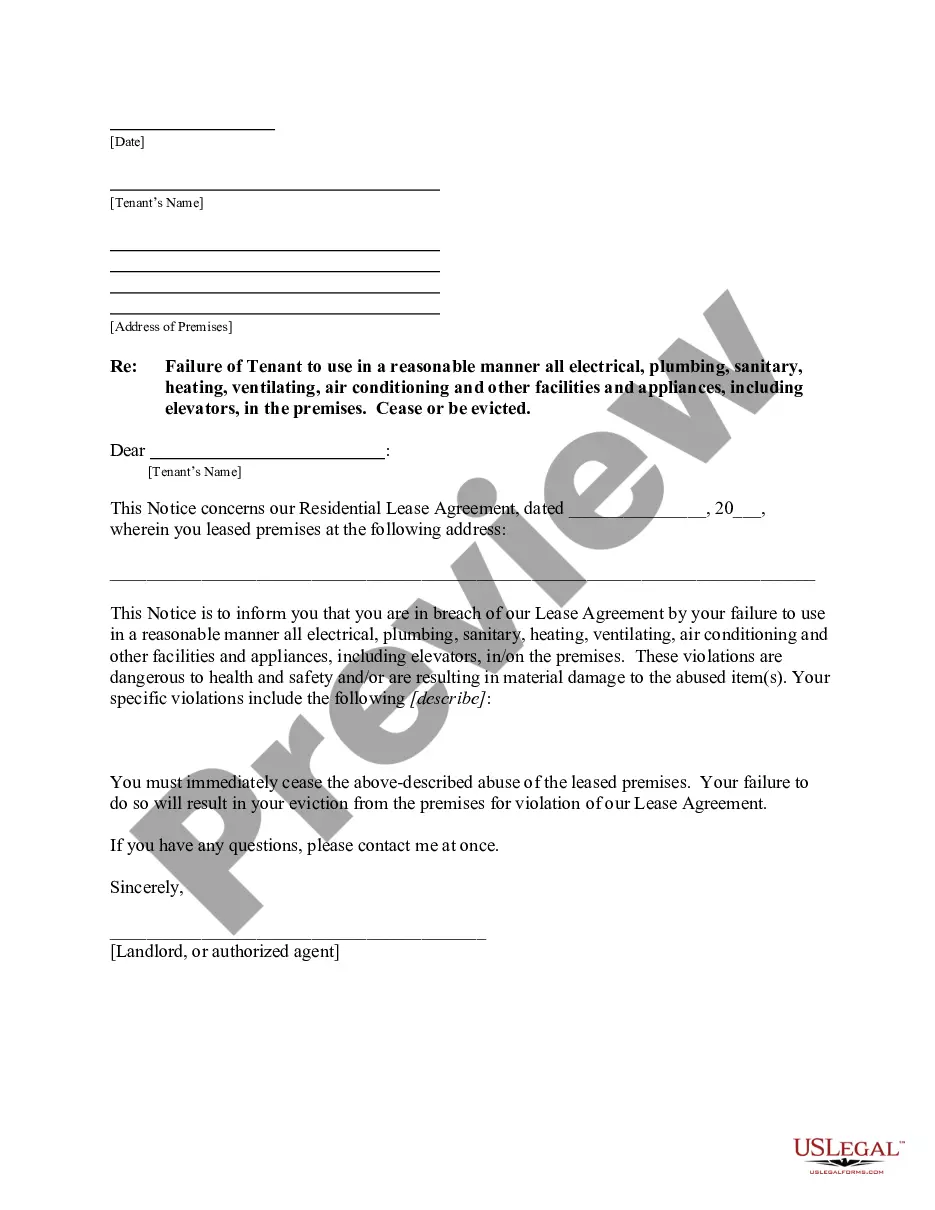

A way to do this is by acknowledging the gift. The nonprofit may desire to state something like: Thank you for your contribution of insert detailed description of goods/services donated that your charitable organization received on dates.

Thank you for your great generosity! We, at charitable organization, greatly appreciate your donation, and your sacrifice. Your support helps to further our mission through general projects, including specific project or recipient. Your support is invaluable to us, thank you again!

Some nonprofits offer their donors a premium (a small gift) when they make a contribution at a certain level or become members of the organization. Offering your donors a gift has several benefits.

15 creative ways to say thank you to your donorsSend a handwritten letter.Make the phone call.Organize an office tour.Highlight donors on social media and website.Send small gifts.Send a welcome package.Send birthday/anniversary cards.Send a thank you video.18-Jun-2021

Non-Cash Donations Generally speaking, to acknowledge the receipt of a gift with an estimated value of $250 or more, the charity should provide at a minimum: A description of non-cash property transferred to the charity. The charity should not attempt to value the property; that is donor's responsibility.

Each donor receipt should include the name of the donor as well....Whatever the form, every receipt must include six items to meet the standards set forth by the IRS:The name of the organization;The amount of cash contribution;A description (but not the value) of non-cash contribution;More items...?