Rhode Island Sample Letter for Corrections to Credit Report

Description

How to fill out Sample Letter For Corrections To Credit Report?

Have you ever been in a situation where you require documentation for either business or personal purposes on a daily basis.

There are many authentic form templates accessible online, but finding trustworthy ones can be challenging.

US Legal Forms offers a multitude of document templates, such as the Rhode Island Sample Letter for Corrections to Credit Report, that are designed to comply with state and federal regulations.

Once you have the appropriate form, click Get now.

Choose the pricing plan you want, fill in the necessary information to create your account, and pay for the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Rhode Island Sample Letter for Corrections to Credit Report form.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and confirm it is for the correct city/state.

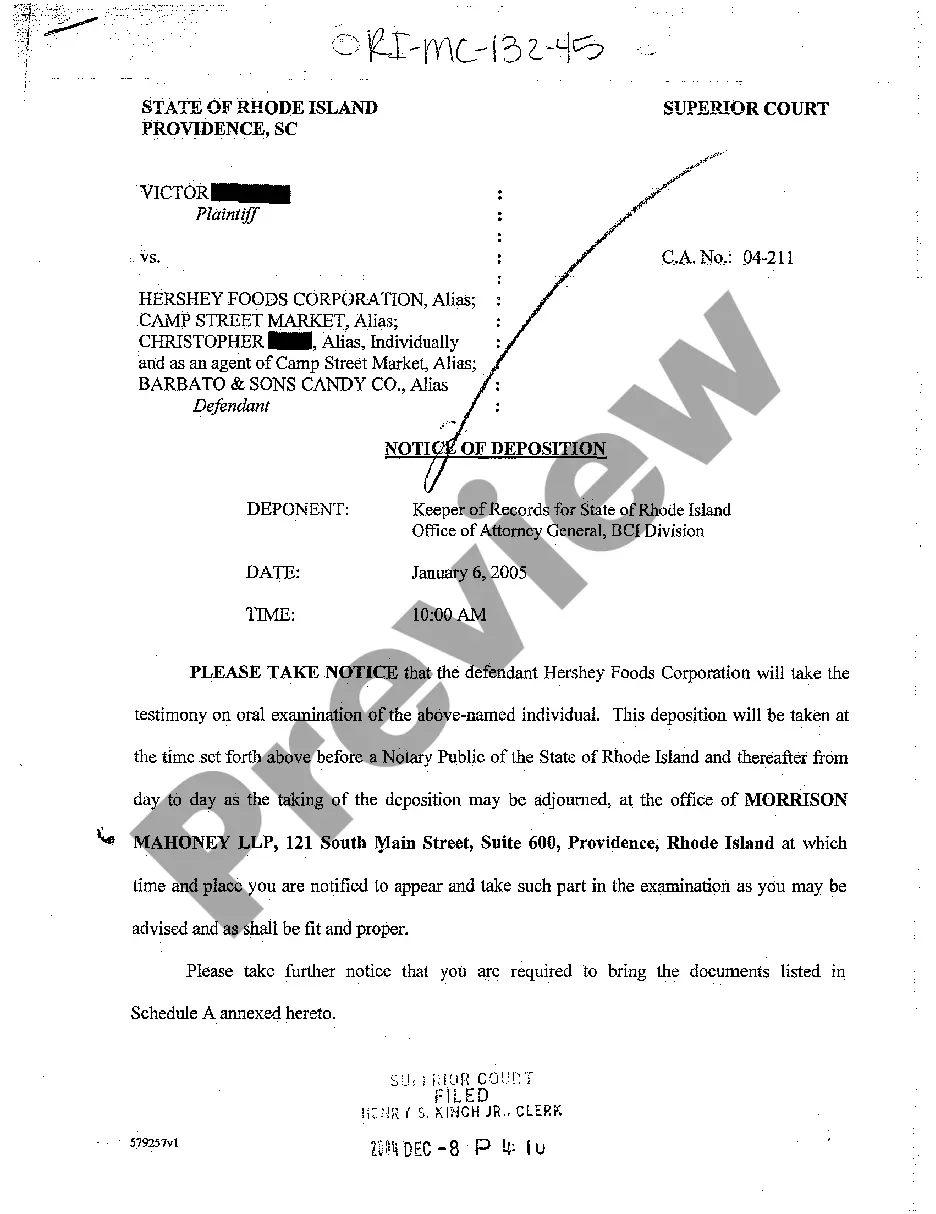

- Use the Preview button to look over the form.

- Check the details to ensure you have selected the right document.

- If the form isn’t what you seek, use the Search field to find the document that meets your needs.

Form popularity

FAQ

Making corrections to your credit report requires you to contact the credit reporting agency directly. Prepare a letter that outlines the inaccuracies, along with any evidence that supports your claim. Using the Rhode Island Sample Letter for Corrections to Credit Report will help ensure that your letter is structured properly and includes all necessary details.

To make corrections to your credit report, begin by gathering relevant documentation that backs up your claim. Reach out to the credit reporting agency with a detailed letter that specifies the corrections needed. The Rhode Island Sample Letter for Corrections to Credit Report can guide you in crafting an effective request.

Adding a notice of correction to your Experian account is straightforward. Start by logging into your Experian account and accessing the disputes area. For clarity, you might want to utilize the Rhode Island Sample Letter for Corrections to Credit Report to create a professional and effective notice.

To add a notice of correction to your TransUnion account, log into your TransUnion online account and locate the dispute section. You can submit your correction statement there. For a more formal approach, consider using the Rhode Island Sample Letter for Corrections to Credit Report to ensure your submission is clear and comprehensible.

Making corrections on a credit report involves identifying the error and providing adequate proof to the credit reporting agencies. Compile your documents and write a dispute letter detailing the necessary corrections. The Rhode Island Sample Letter for Corrections to Credit Report is an excellent resource to help you structure your letter effectively.

Adding a notice of correction to your credit report involves submitting a clear, concise statement to the credit bureau. This statement should highlight the nature of the correction and any relevant documentation. You can follow the format provided in the Rhode Island Sample Letter for Corrections to Credit Report for guidance.

To make changes to your credit report, first gather your supporting documents that justify the changes. Then, reach out to the credit reporting agency with your dispute information. Consider using the Rhode Island Sample Letter for Corrections to Credit Report to ensure you include all essential details in your communication.

You can add a notice of correction to your credit file by contacting the credit reporting agency directly. Prepare a brief statement that explains the correction and submit it along with any necessary documentation. The Rhode Island Sample Letter for Corrections to Credit Report can serve as a helpful template in this process.

To write a letter disputing an item on your credit report, start with your personal information at the top. Include a clear statement of your intention to dispute a specific entry, followed by factual details and any supporting documents. Use the Rhode Island Sample Letter for Corrections to Credit Report as a guide to ensure that your letter is effective and adheres to standard formats.

To write a letter to dispute a credit report, begin by clearly stating your identification details and the specific errors you wish to challenge. Use a Rhode Island Sample Letter for Corrections to Credit Report to guide your structure, ensuring you include any supporting documentation. Be direct and precise about the inaccurate information and request its correction. Lastly, make sure to send your letter to both the credit reporting agency and the company that provided the inaccurate information.