Rhode Island Affiliate Program Agreement

Description

How to fill out Affiliate Program Agreement?

You can dedicate numerous hours online attempting to locate the legitimate document format that aligns with the state and federal criteria you require.

US Legal Forms provides thousands of legal documents that are assessed by professionals.

You are able to download or print the Rhode Island Affiliate Program Agreement from their service.

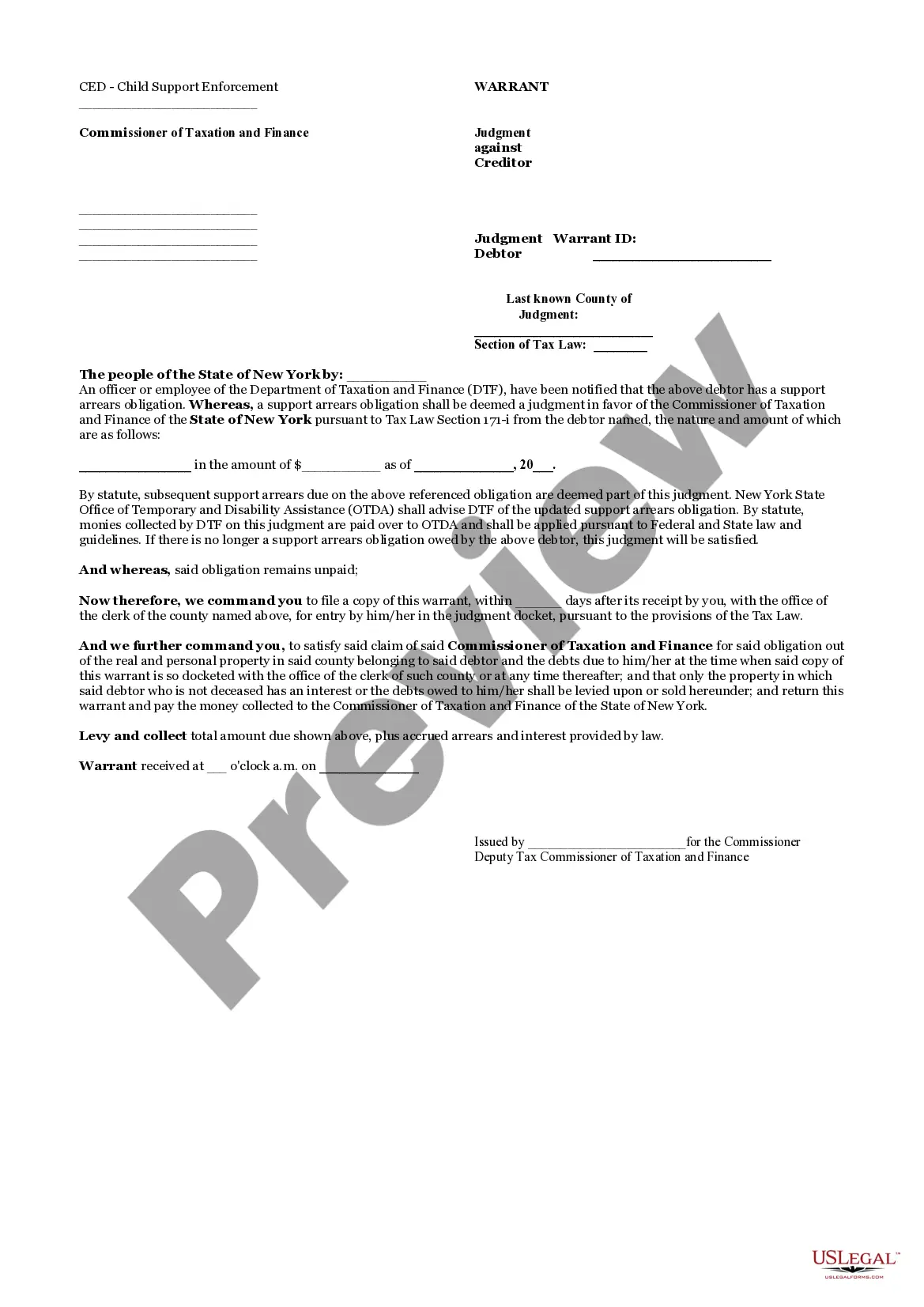

If available, utilize the Preview button to view the document format as well.

- If you already possess a US Legal Forms account, you can Log In and select the Download button.

- After that, you can complete, edit, print, or sign the Rhode Island Affiliate Program Agreement.

- Every legal document template you purchase belongs to you for a long time.

- To obtain another copy of any purchased form, navigate to the My documents tab and click on the relevant button.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

- First, ensure you have chosen the correct document format for the area/city of your preference.

- Review the form description to confirm you have selected the correct form.

Form popularity

FAQ

In an agreement, an affiliate refers to a party who promotes a business’s products or services in exchange for compensation. This term encompasses all entities involved in the promotion, detailing their rights and obligations. The Rhode Island Affiliate Program Agreement clearly sets forth these definitions, ensuring that all parties understand their roles in the partnership.

An affiliation agreement is a formal contract that defines the relationship between an affiliate and a business. This agreement details the terms of engagement, including payment structures, responsibilities, and compliance requirements. The Rhode Island Affiliate Program Agreement is a specific example that gives clarity and protection to both the business and its affiliates.

An affiliate policy outlines the guidelines and rules that govern the relationship between a business and its affiliates. This policy specifies how affiliates can promote the business, what compensation they receive, and the standards they must adhere to. Understanding the Rhode Island Affiliate Program Agreement helps you navigate this process effectively, ensuring both parties benefit from the partnership.

To offer an affiliate program, start by deciding on commission structures and program goals. After that, draft a comprehensive Rhode Island Affiliate Program Agreement that includes all critical details. Finally, promote your program through various marketing channels to attract affiliates who can drive traffic and sales to your business.

An affiliate agreement outlines the terms and conditions between a business and its affiliates. This written document typically specifies the commission rates, payment schedules, and promotional guidelines. A well-crafted Rhode Island Affiliate Program Agreement helps establish a successful partnership between you and your affiliates, ensuring mutual understanding and compliance.

Yes, earning $100 a day through affiliate marketing is possible with the right strategies and commitment. By promoting relevant products and building a strong network of affiliates, you can see significant income. Ensure you have a clear Rhode Island Affiliate Program Agreement in place to track earnings and maintain transparency with your partners.

To start an affiliate program, you can use affiliate software or platforms that simplify the setup process. By outlining your program terms in a Rhode Island Affiliate Program Agreement, you can create clarity for your affiliates about commissions and responsibilities. This structured approach helps attract potential affiliates who align with your business goals.

No, you do not need a Limited Liability Company (LLC) to become an affiliate. Many individuals operate as sole proprietors and successfully participate in affiliate marketing. However, establishing an LLC can provide legal protections and potentially advantageous tax benefits when working within the framework of a Rhode Island Affiliate Program Agreement.

Yes, Rhode Island law mandates that businesses designate a registered agent to receive legal documents on their behalf. This requirement supports the operational integrity of businesses in the state. When forming your company and drafting a Rhode Island Affiliate Program Agreement, be sure to include your registered agent information. U.S. Legal Forms simplifies this process by offering templates and resources tailored for Rhode Island businesses.

Typically, a single member LLC in Rhode Island is treated as a sole proprietorship for tax purposes. Therefore, it does not need to file Form 1065, which is required for partnerships. However, understanding the specifics of the Rhode Island Affiliate Program Agreement can help you navigate your tax duties correctly. If you have questions, U.S. Legal Forms can provide the necessary forms and insights.