Rhode Island Participation Agreement in Connection with Secured Loan Agreement

Description

Participations in the loan are sold by the lead bank to other banks. A separate contract called a loan participation agreement is structured and agreed among the banks. Loan participations can either be made with equal risk sharing for all loan participants, or on a senior/subordinated basis, where the senior lender is paid first and the subordinate loan participation paid only if there is sufficient funds left over to make the payments.

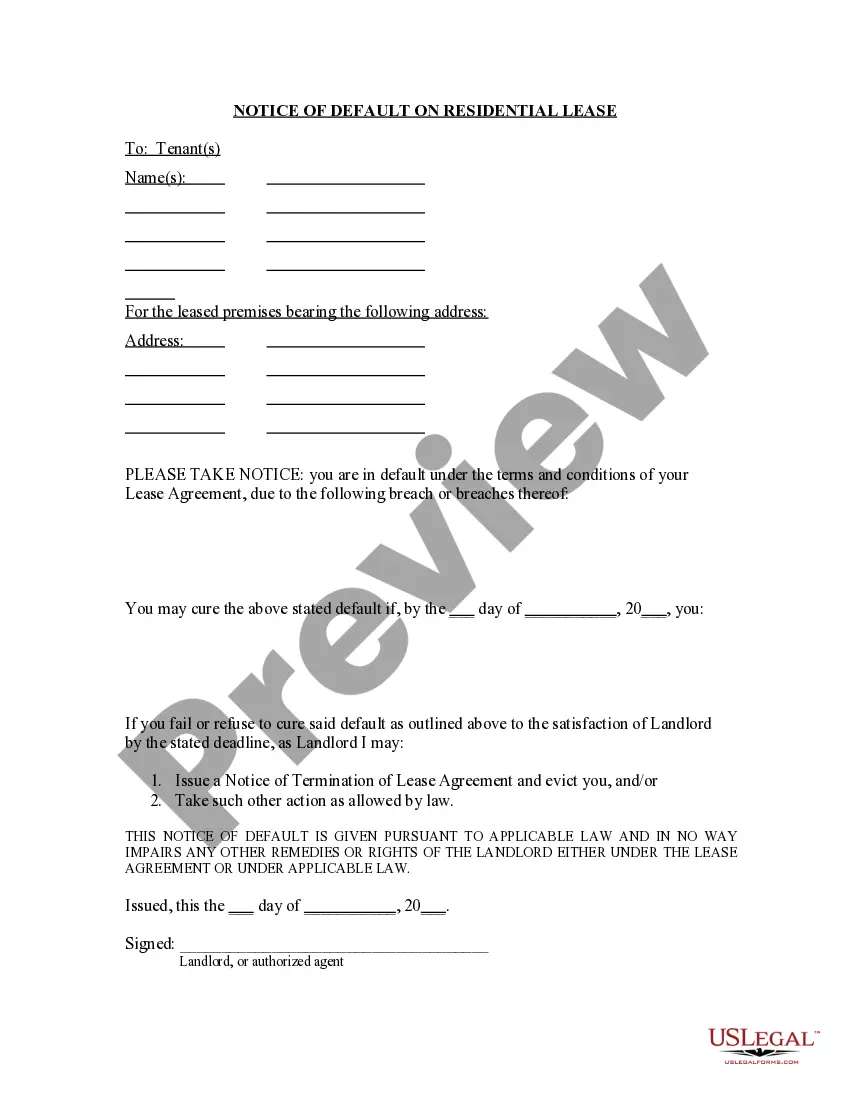

How to fill out Participation Agreement In Connection With Secured Loan Agreement?

It is feasible to spend hours online searching for the legal document format that meets the federal and state requirements you need.

US Legal Forms offers a vast collection of legal forms that are vetted by experts.

You can download or print the Rhode Island Participation Agreement Regarding Secured Loan Agreement from my service.

If available, use the Preview button to view the document template as well.

- If you possess a US Legal Forms account, you can Log In and click the Obtain button.

- Subsequently, you can complete, modify, print, or sign the Rhode Island Participation Agreement Regarding Secured Loan Agreement.

- Every legal document template you purchase is yours indefinitely.

- To retrieve another copy of a purchased form, navigate to the My documents tab and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, make sure you have chosen the appropriate document template for the location/region of your preference.

- Review the form details to ensure you have selected the exact template.

Form popularity

FAQ

For such purposes, this Agreement shall constitute a security agreement under the UCC, to secure the prompt and complete payment of a loan deemed to have been made by the Participant to the Grantor in an amount equal to the aggregate purchase price paid to the Grantor together with such other obligations of the Grantor

Participation agreements, in the form promulgated by The Loan Syndications and Trading Association, Inc. (LSTA), are widely regarded as dependable vehicles for conveying loan ownership interests from a lender to a participant as true sales in the United States.

Participation Agreement means an agreement between the Issuer and a Selling Institution in relation to the purchase by the Issuer of a Participation.

With participations, the contractual relationship runs from the borrower to the lead bank and from the lead bank to the participants, whereas with syndications, the financing is provided by each member of the syndicate to the borrower pursuant to a common negotiated agreement with each member of syndicate having a

Generally, participation agreements involve one or more participants who purchase an interest in the underlying loan, but a single lender, the lead lender, retains control over the loan and manages the relationship with the borrower.

Risk participation is an agreement where a bank sells its exposure to a contingent obligation to another financial institution. These agreements are often used in international trade, although they remain risky. Syndicated loans can lead to risk participation agreements, which sometimes involve swaps.

Lenders can sell interests in loans to other parties by assignments or participations. Each of these arrangements has different characteristics. PLC Finance examines six key points about loan participations and draws comparisons between participations and assignments.

A lender might ask for a participation arrangement if the mortgage is funding the purchase of undeveloped commercial property that will be developed and sold for profit.

The distinction is simple, but important. Generally, an assignment is the actual sale of the loan, in whole or in part. The assignee is now the owner of the loan (or the part assigned) and is considered the lender under the loan agreement.