Rhode Island Corporate Resolution for Nonprofit Organizations

Description

How to fill out Corporate Resolution For Nonprofit Organizations?

Are you presently in a role where you need documents for potential business or personal use every day.

There are numerous legal document templates available online, but locating reliable ones is not simple.

US Legal Forms offers thousands of form templates, including the Rhode Island Corporate Resolution for Nonprofit Organizations, crafted to meet state and federal requirements.

You can find all the form templates you have purchased in the My documents section.

You can obtain another copy of the Rhode Island Corporate Resolution for Nonprofit Organizations anytime if needed. Just click on the relevant form to download or print the document template.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Rhode Island Corporate Resolution for Nonprofit Organizations template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for your correct state/region.

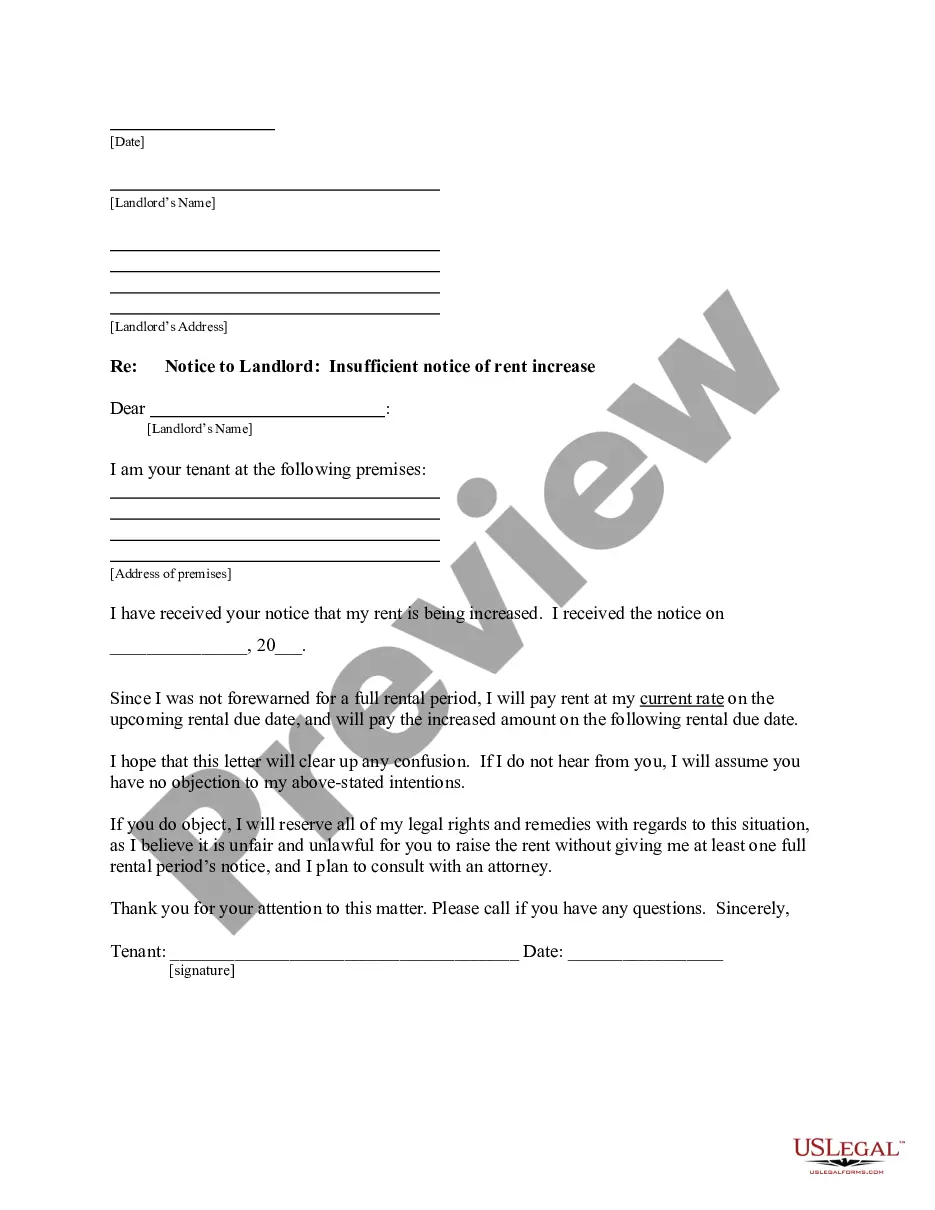

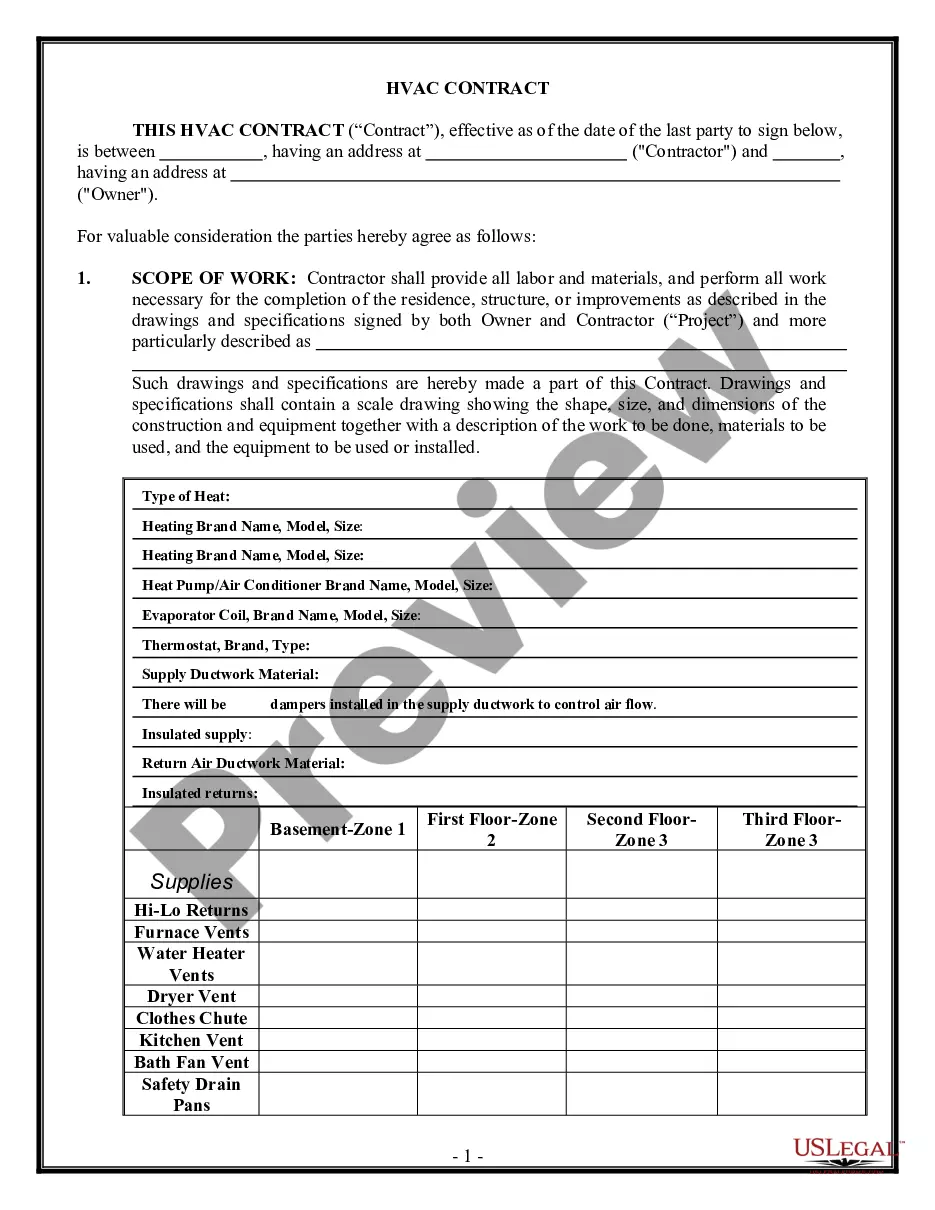

- Use the Preview option to review the form.

- Read the description to confirm that you have selected the correct form.

- If the form isn’t what you’re looking for, utilize the Search field to find the form that meets your needs and specifications.

- Once you find the appropriate form, click on Get now.

- Choose the payment plan you desire, complete the required information to create your account, and pay for your order using your PayPal or credit card.

- Select a suitable file format and download your copy.

Form popularity

FAQ

There are three types of nonprofit corporations in California: public benefit, mutual benefit, and religious.

A resolution can be made by a corporation's board of directors, shareholders on behalf of a corporation, a non-profit board of directors, or a government entity. The length of the resolution isn't important. It only needs to be as long as what you need to say.

Nonprofit organizations can be formed as a corporation, or as an unincorporated business form. 's Nonprofit Organizations section contains information and resources for small business owners who are interested in forming a nonprofit (tax-exempt) organization.

The corporation is the most common, and usually best, form for a nonprofit organization.

Nonprofit corporations often deal with government agencies on issues of public concern, which may involve applying for grants, loans or other governmental approvals. In many situations, the government agency requires a corporate resolution to verify the board's approval for making the government application.

They are only required when the board of directors makes a significant business decision. A corporate resolution creates a paper trail of an important decision in case it ever needs to be reviewed by shareholders, officers, or the IRS.

In general, the SEC guidelines permit resolutions only from shareholders who have continuously held at least $2,000 of the company's stock for a year or longer. If a shareholder meets these requirements, then the board can choose to bring up the resolution for a vote at the next shareholder meeting.

Traditionally, when starting a nonprofit, the best choice for legal structure is to form a nonprofit corporation at the state level and to apply for 501(c)(3) tax exemption at the federal level.

Differences Between Nonprofit Corporations and Unincorporated Nonprofits. While unincorporated nonprofit associations are formed simply by two or more people coming together with the common goal of providing a public good or service, nonprofit corporations are separate legal entities.

Labeling a vote a resolution means that the board believed the issue was important enough to separate it from standard voting issues. A resolution is considered an official board action and it requires a quorum. Board directors must document all official board actions, including resolutions, in their meeting minutes.