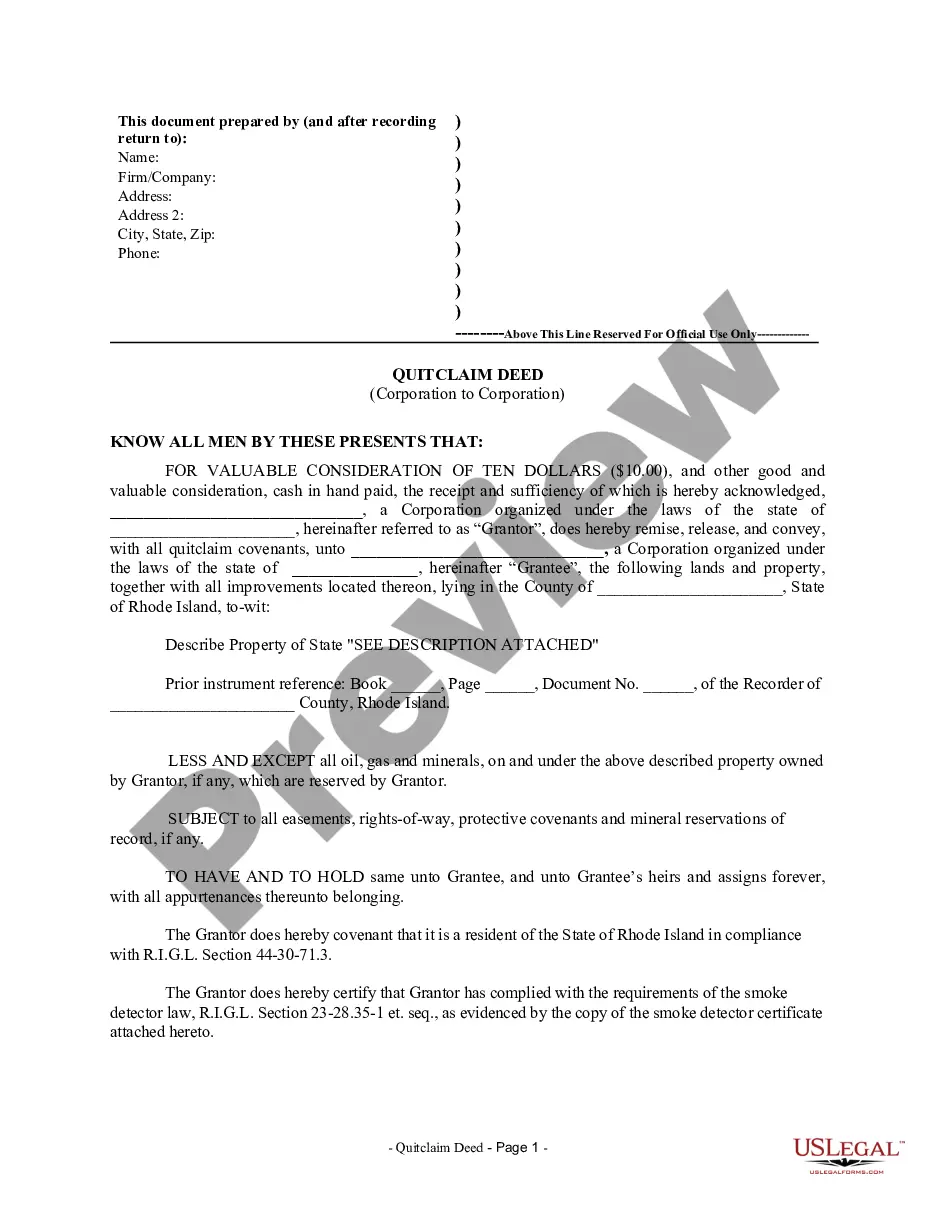

Rhode Island Quitclaim Deed from Corporation to Corporation

Description

How to fill out Rhode Island Quitclaim Deed From Corporation To Corporation?

The work with papers isn't the most simple task, especially for people who almost never deal with legal papers. That's why we recommend making use of accurate Rhode Island Quitclaim Deed from Corporation to Corporation templates created by professional attorneys. It allows you to prevent troubles when in court or handling official institutions. Find the files you require on our site for high-quality forms and exact explanations.

If you’re a user with a US Legal Forms subscription, simply log in your account. When you are in, the Download button will immediately appear on the file web page. Soon after downloading the sample, it will be stored in the My Forms menu.

Users with no a subscription can quickly create an account. Look at this simple step-by-step guide to get your Rhode Island Quitclaim Deed from Corporation to Corporation:

- Be sure that the sample you found is eligible for use in the state it is needed in.

- Verify the file. Use the Preview feature or read its description (if available).

- Buy Now if this sample is what you need or go back to the Search field to find another one.

- Choose a convenient subscription and create your account.

- Use your PayPal or credit card to pay for the service.

- Download your document in a wanted format.

After doing these simple steps, you can complete the form in an appropriate editor. Check the completed data and consider requesting a legal representative to examine your Rhode Island Quitclaim Deed from Corporation to Corporation for correctness. With US Legal Forms, everything gets much simpler. Try it now!

Form popularity

FAQ

Quitclaim deeds do not rid the grantor of tax obligations.However, once a grantee accepts a clear title on the property, they inherit the responsibility of paying the newly acquired property taxes. The grantor no longer is obligated to pay future taxes on the property.

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.

A Quitclaim Deed must be notarized by a notary public or attorney in order to be valid.Consideration in a Quitclaim Deed is what the Grantee will pay to the Grantor for the interest in the property.

Fill out the quit claim deed form, which can be obtained online, or write your own using the form as a guide. The person giving up the interest in the property is the grantor, and the person receiving the interest is the grantee.

Quitclaim deeds are not taxable when they transfer ownership to a spouse or a qualifying charity. Other transactions may be liable to property and gift taxes. The quitclaim process is an easy way to transfer an interest in property where no money changes hands.

The drawback, quite simply, is that quitclaim deeds offer the grantee/recipient no protection or guarantees whatsoever about the property or their ownership of it. Maybe the grantor did not own the property at all, or maybe they only had partial ownership.

How to Quitclaim Deed to LLC. A quitclaim deed to LLC is actually a very simple process. You will need a deed form and a copy of the existing deed to make sure you identify titles properly and get the legal description of the property.