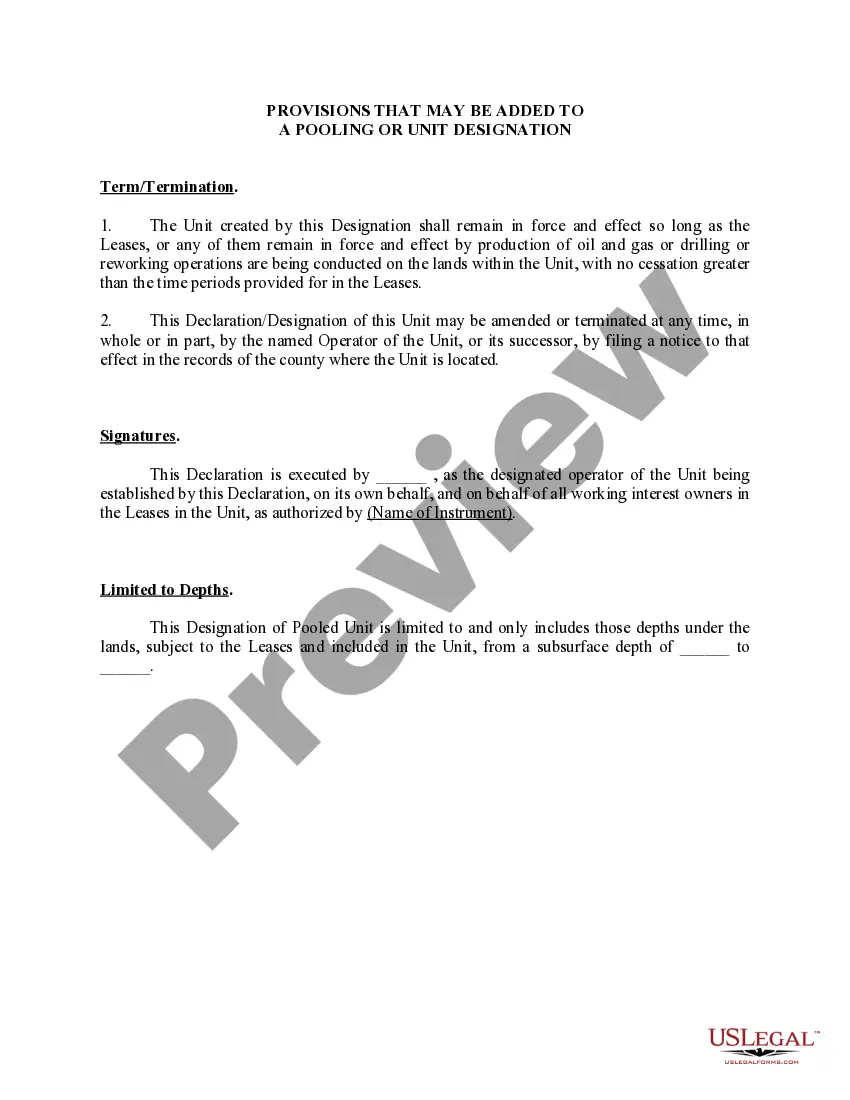

Puerto Rico Provisions That May Be Added to A Pooling Or Unit Designation

Description

How to fill out Provisions That May Be Added To A Pooling Or Unit Designation?

Are you presently in a situation in which you will need documents for possibly business or individual reasons virtually every day time? There are tons of legal document themes accessible on the Internet, but finding types you can trust is not effortless. US Legal Forms gives a huge number of develop themes, much like the Puerto Rico Provisions That May Be Added to A Pooling Or Unit Designation, which can be written to satisfy federal and state demands.

Should you be already acquainted with US Legal Forms web site and also have your account, just log in. Next, you may download the Puerto Rico Provisions That May Be Added to A Pooling Or Unit Designation design.

If you do not have an bank account and want to begin using US Legal Forms, abide by these steps:

- Get the develop you want and make sure it is for that proper area/area.

- Take advantage of the Review button to review the form.

- Look at the information to actually have chosen the appropriate develop.

- In the event the develop is not what you`re trying to find, utilize the Look for industry to find the develop that fits your needs and demands.

- Once you get the proper develop, click Purchase now.

- Pick the rates program you would like, complete the desired information and facts to generate your account, and purchase an order utilizing your PayPal or Visa or Mastercard.

- Decide on a hassle-free paper file format and download your duplicate.

Get every one of the document themes you may have purchased in the My Forms menu. You can aquire a further duplicate of Puerto Rico Provisions That May Be Added to A Pooling Or Unit Designation anytime, if required. Just click on the needed develop to download or produce the document design.

Use US Legal Forms, the most extensive collection of legal kinds, to save lots of some time and avoid faults. The assistance gives professionally manufactured legal document themes which can be used for a selection of reasons. Make your account on US Legal Forms and initiate producing your life a little easier.

Form popularity

FAQ

You can claim exemption from withholding only if both the following situations apply: For the prior year, you had a right to a refund of all federal income tax withheld because you had no tax liability. For the current year, you expect a refund of all federal income tax withheld because you expect to have no liability.

If the tax rate entered into box 3b is ?00.00?, the exemption code ?04? is used to indicate ?Exempt under tax treaty?. Exempt Code ?00? may be used to indicate that a tax rate greater than zero has been applied. Box 3b Tax Rate.

Box 3a Exemption Code. If the tax rate entered into box 3b is ?00.00?, the exemption code ?04? is used to indicate ?Exempt under tax treaty?. Exempt Code ?00? may be used to indicate that a tax rate greater than zero has been applied.

Residency Status However, If you are a Canadian resident, you will report the 1042S as your foreign income such as investment income, as well as taxes withheld on the ?Foreign? slip in your Canadian tax return.

Recipients of income under Exemption Code 03 have no U.S. tax return filing obligation unless the recipient is a U.S. person such as a resident alien individual based on a tax return election.

Form 1042-S is your record of all distributions, including dividends, short-term capital gains, long-term capital gains, and/or return of capital, and redemptions from accounts owned by nonresident aliens or representatives of foreign entities. Distributions are identified by the appropriate income code.

By placing a ?0? on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. 2. You can choose to have no taxes taken out of your tax and claim Exemption (see Example 2).

Form 1042-S should be filed regardless of whether tax is withheld or not. Furthermore, one form must be completed for each tax rate. This is for any given type of income that's paid to the same earner. Although Form 1042-S can be filed the old-fashioned way, the IRS does permit electronic filing of the form.