Puerto Rico Subordination by Mineral Owners of Rights to Make Use of the Surface Estate - Transfer

Description

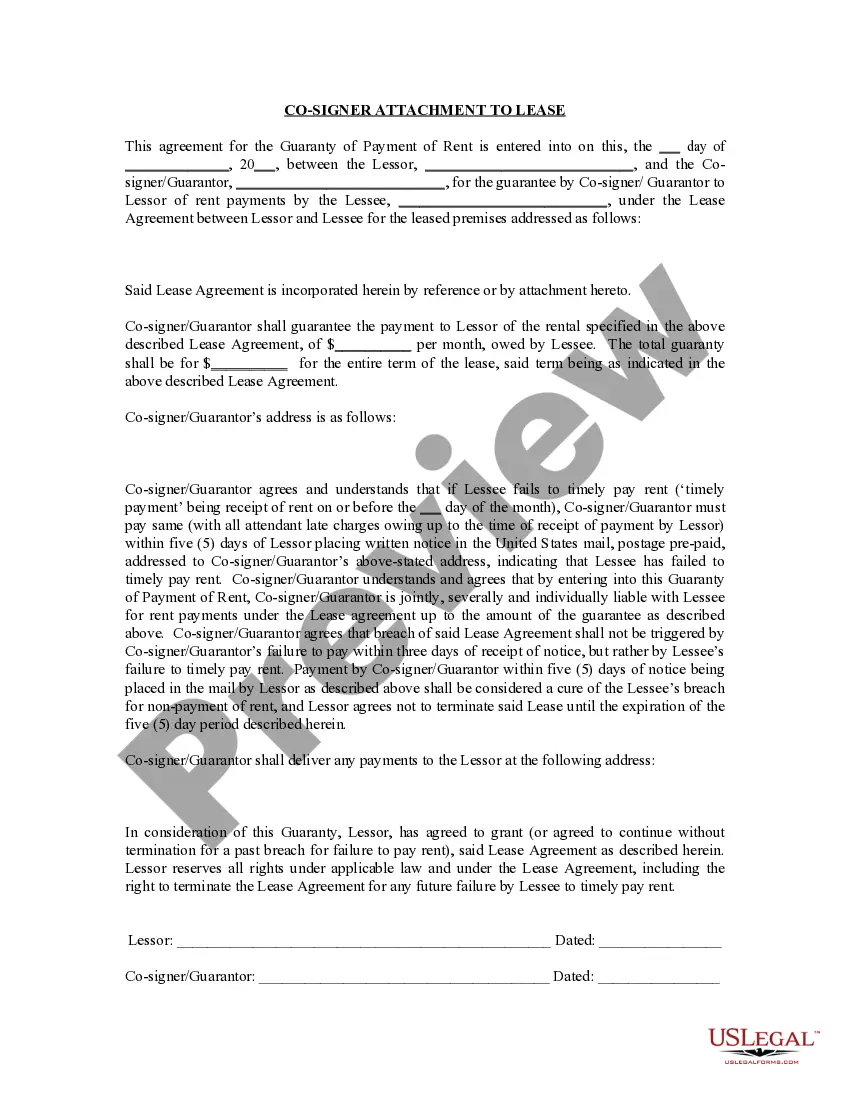

How to fill out Subordination By Mineral Owners Of Rights To Make Use Of The Surface Estate - Transfer?

Are you presently within a place the place you need documents for sometimes enterprise or specific uses almost every working day? There are a lot of legal file templates available on the Internet, but locating types you can depend on isn`t straightforward. US Legal Forms gives a huge number of type templates, much like the Puerto Rico Subordination by Mineral Owners of Rights to Make Use of the Surface Estate - Transfer, which are created to satisfy federal and state demands.

When you are currently acquainted with US Legal Forms website and have your account, merely log in. Following that, you may acquire the Puerto Rico Subordination by Mineral Owners of Rights to Make Use of the Surface Estate - Transfer template.

Should you not have an bank account and would like to begin to use US Legal Forms, adopt these measures:

- Find the type you require and make sure it is for that correct city/area.

- Utilize the Review key to check the form.

- See the explanation to ensure that you have chosen the correct type.

- In the event the type isn`t what you`re seeking, take advantage of the Search field to find the type that suits you and demands.

- Whenever you obtain the correct type, just click Buy now.

- Select the rates plan you desire, fill in the required information to produce your account, and pay money for your order utilizing your PayPal or Visa or Mastercard.

- Select a convenient paper formatting and acquire your copy.

Discover every one of the file templates you might have bought in the My Forms menu. You can get a additional copy of Puerto Rico Subordination by Mineral Owners of Rights to Make Use of the Surface Estate - Transfer whenever, if required. Just go through the needed type to acquire or print out the file template.

Use US Legal Forms, probably the most comprehensive collection of legal kinds, to save lots of time as well as avoid errors. The assistance gives professionally created legal file templates which you can use for a selection of uses. Produce your account on US Legal Forms and commence creating your daily life easier.

Form popularity

FAQ

County Records and Tax Assessor's Office and Documents It gives you a clear indication of the direction to search for mineral ownership rights. The deed contains the description of the property, rights-of-way, oil and gas liens, mineral rights and easements.

Whether mineral rights transfer with the property depends on the estate type. If it's a severed estate, surface rights and mineral rights are separate and do not transfer together. However, if it's a unified estate, the land and the mineral rights can be conveyed with the property.

Cons of Selling Your Mineral Rights Loss of Potential Future Income: When you sell your mineral rights, you also give up any potential future income from those rights. This can be a significant loss if the mineral rights end up producing more than expected or if there are new discoveries in the future.

Mineral rights can expire if the owner does not renew them or if they go unclaimed for a certain period of time. Mineral rights can also be sold, fractionalized, or transferred through gifting or inheritance.

Taxes: The #1 reason for selling mineral rights is taxes. If you inherited mineral rights and then sold them for $100,000, you could pay only $5,250 in taxes and keep $94,750. If you collect royalty income of $100,000, you could pay $30,000+ in taxes and only keep $70,000 and it would takes years to collect.

Yes, it can be beneficial to sell your mineral rights for a fair price, even producing rights. First, sellers must be aware of the different stages of the production process. They must also know the value their minerals and royalties command in every development stage.

The value of mineral rights per acre differs from state to state. Typically, the price ranges from $100 to $5,000 per acre in several states. In Texas, the average price per acre for non-producing mineral rights is usually between $0 and $250 per acre, as a general guideline.

Unsolicited purchase offers are happening in greater numbers and for greater ? sometimes much greater ? amounts than in the past. The upshot? Sometimes selling makes good sense. Indeed, depending on your situation, the sale of your mineral rights can represent a prudent ? and even compelling ? opportunity.