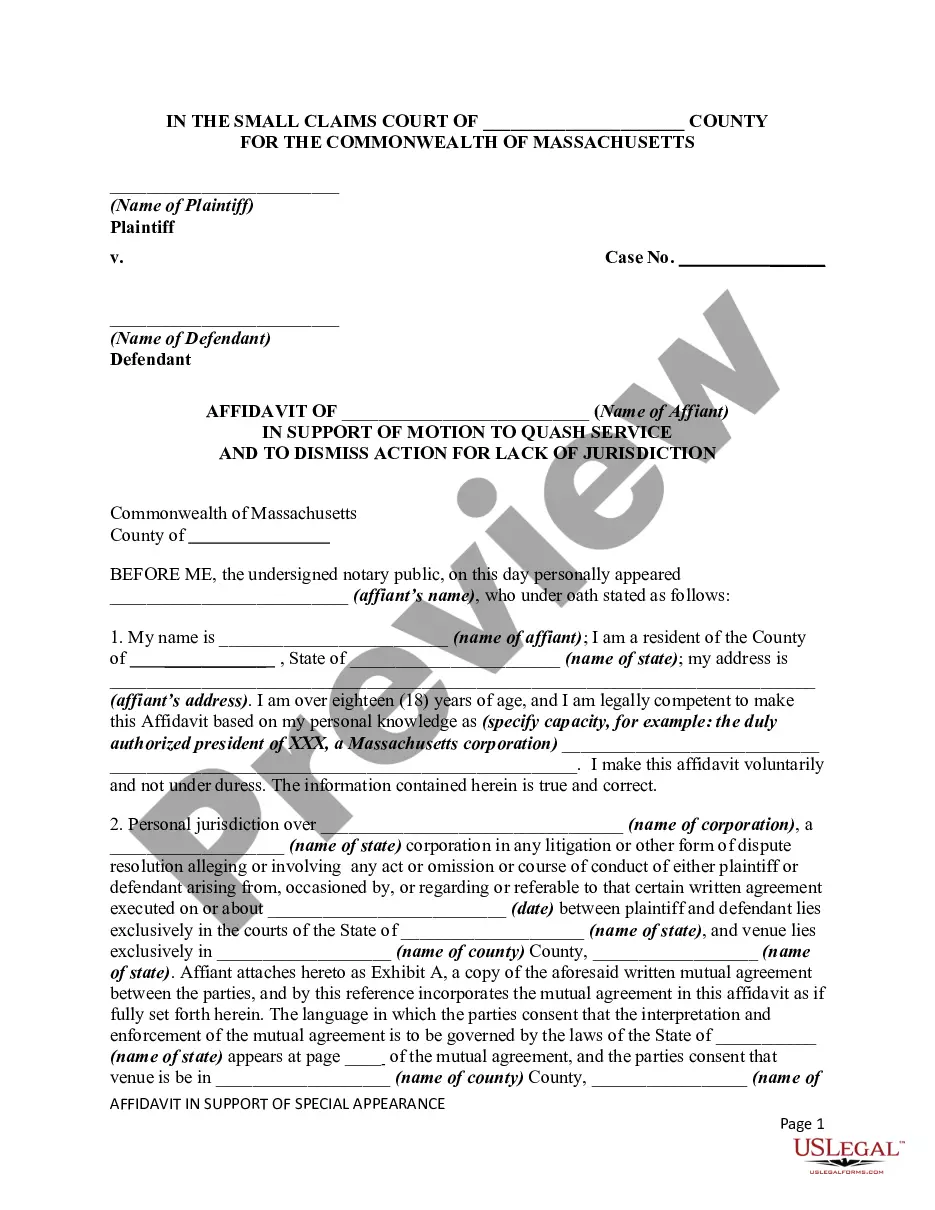

This NOTICE OF HARRASSMENT & VALIDATION OF DEBT is to be used when creditors call you repeatedly and mail you letters too. This form includes a cease and desist and a validation of debt, 2 letters in one.

Puerto Rico Notice of Harassment and Validation of Debt

Description

How to fill out Notice Of Harassment And Validation Of Debt?

Selecting the appropriate legal document template can be challenging. Certainly, there are numerous templates available online, but how do you locate the legal form you require? Utilize the US Legal Forms website. The service offers thousands of templates, including the Puerto Rico Notice of Harassment and Validation of Debt, that you can utilize for business and personal purposes. All of the documents are reviewed by professionals and comply with state and federal regulations.

If you are already registered, Log In to your account and then click the Download button to obtain the Puerto Rico Notice of Harassment and Validation of Debt. Use your account to browse the legal forms you have purchased previously. Visit the My documents section of your account and retrieve another copy of the documents you need.

If you are a new user of US Legal Forms, here are simple steps you should follow: First, ensure you have selected the correct form for your city/region. You can examine the form using the Review button and view the form outline to confirm this is suitable for you. If the form does not meet your needs, utilize the Search field to find the appropriate form. Once you are certain that the form is suitable, click on the Buy now button to acquire the form. Choose the pricing plan you need and enter the required information. Create your account and pay for the transaction using your PayPal account or credit card. Select the file format and download the legal document template to your device. Finally, complete, modify, print, and sign the received Puerto Rico Notice of Harassment and Validation of Debt.

Make the most of US Legal Forms to simplify your legal documentation process.

- US Legal Forms is the largest collection of legal forms where you can find various document templates.

- Utilize the service to obtain professionally crafted documents that adhere to state requirements.

- Access thousands of templates easily for all your legal needs.

- Benefit from expert-reviewed documents that ensure compliance with legal standards.

- Enjoy a user-friendly platform for hassle-free document acquisition.

- Make informed decisions with the help of document outlines and reviews.

Form popularity

FAQ

Puerto Rico can get out of debt by exploring various financial strategies, such as creating a budget, negotiating with creditors, or seeking professional financial advice. Additionally, understanding your rights related to the Puerto Rico Notice of Harassment and Validation of Debt can empower you to take control of your financial situation. You can also consider using resources from US Legal Forms to find legal documentation and support tailored to your needs. Taking proactive steps is essential for achieving financial freedom.

To ask for a debt validation letter, you should send a written request to the debt collector within 30 days of their initial contact. In your request, include your personal information, details about the debt, and a clear statement that you are seeking validation. This step is crucial, especially in cases involving a Puerto Rico Notice of Harassment and Validation of Debt, as it helps you assert your rights. Utilizing platforms like US Legal Forms can simplify this process by providing templates and guidance.

Yes, you can request a debt validation letter if you believe a debt collector has contacted you regarding a debt. This letter serves as proof of the debt and includes important details about the amount owed and the creditor. It is your right under the Fair Debt Collection Practices Act to receive this information, especially in cases involving a Puerto Rico Notice of Harassment and Validation of Debt. By obtaining this letter, you can better understand your financial obligations.

To respond to a debt validation letter, first, review the information provided carefully. If you believe the debt is valid, you may choose to settle it directly with the creditor. However, if you think the debt is incorrect or you dispute it, you should notify the collector in writing. Understanding your response options is vital, so refer to your Puerto Rico Notice of Harassment and Validation of Debt for more insights.

A debt validation notice must include specific information, such as the amount of the debt, the name of the creditor, and a statement of your rights. Additionally, it should inform you about how to dispute the debt if you believe it is incorrect. Ensuring that you receive a proper notice is part of your rights under the Puerto Rico Notice of Harassment and Validation of Debt. If you have questions, consider using platforms like USLegalForms for guidance.

In Puerto Rico, the statute of limitations for most debts is typically 15 years. This means that creditors have a limited time frame to legally pursue collection of a debt. After this period, you may not be held responsible for the debt in court. Understanding how the statute of limitations relates to your Puerto Rico Notice of Harassment and Validation of Debt is important for managing your financial obligations.

In general, you cannot go to jail for simply being in debt. However, failing to respond to court summons or ignoring legal obligations related to debt can lead to serious consequences. It is crucial to address any debt issues promptly rather than letting them escalate. Knowing your rights under the Puerto Rico Notice of Harassment and Validation of Debt can help you avoid such predicaments.

Receiving a debt validation notice means that a collector is seeking to confirm a debt owed to them. This notice serves to clarify the amount you owe and the creditor's identity. It's a crucial step in the debt collection process, ensuring you are informed and able to respond appropriately. Familiarizing yourself with your Puerto Rico Notice of Harassment and Validation of Debt can help you navigate this situation effectively.

You received a debt validation letter to inform you about an outstanding debt. This letter is part of the debt collector's obligation under the law, specifically aimed at ensuring transparency regarding the debt's details. It also allows you to verify the legitimacy of the debt before taking any further action. Understanding your Puerto Rico Notice of Harassment and Validation of Debt is essential in protecting your rights.

Harassment from debt collectors can include aggressive phone calls, threats, or attempts to intimidate you into paying a debt. Additionally, frequent calls at odd hours may also qualify as harassment. Awareness of what constitutes harassment is vital, especially when referring to the Puerto Rico Notice of Harassment and Validation of Debt.