Puerto Rico Closing of Ways Code or Ordinance

Description

How to fill out Closing Of Ways Code Or Ordinance?

Have you been inside a place that you need documents for sometimes company or specific functions almost every day? There are plenty of legitimate file themes available on the Internet, but locating kinds you can trust is not simple. US Legal Forms offers a large number of type themes, much like the Puerto Rico Closing of Ways Code or Ordinance, that are created to satisfy federal and state needs.

When you are already informed about US Legal Forms web site and have your account, basically log in. Afterward, you can obtain the Puerto Rico Closing of Ways Code or Ordinance format.

Should you not come with an account and need to start using US Legal Forms, adopt these measures:

- Find the type you need and ensure it is for your correct town/region.

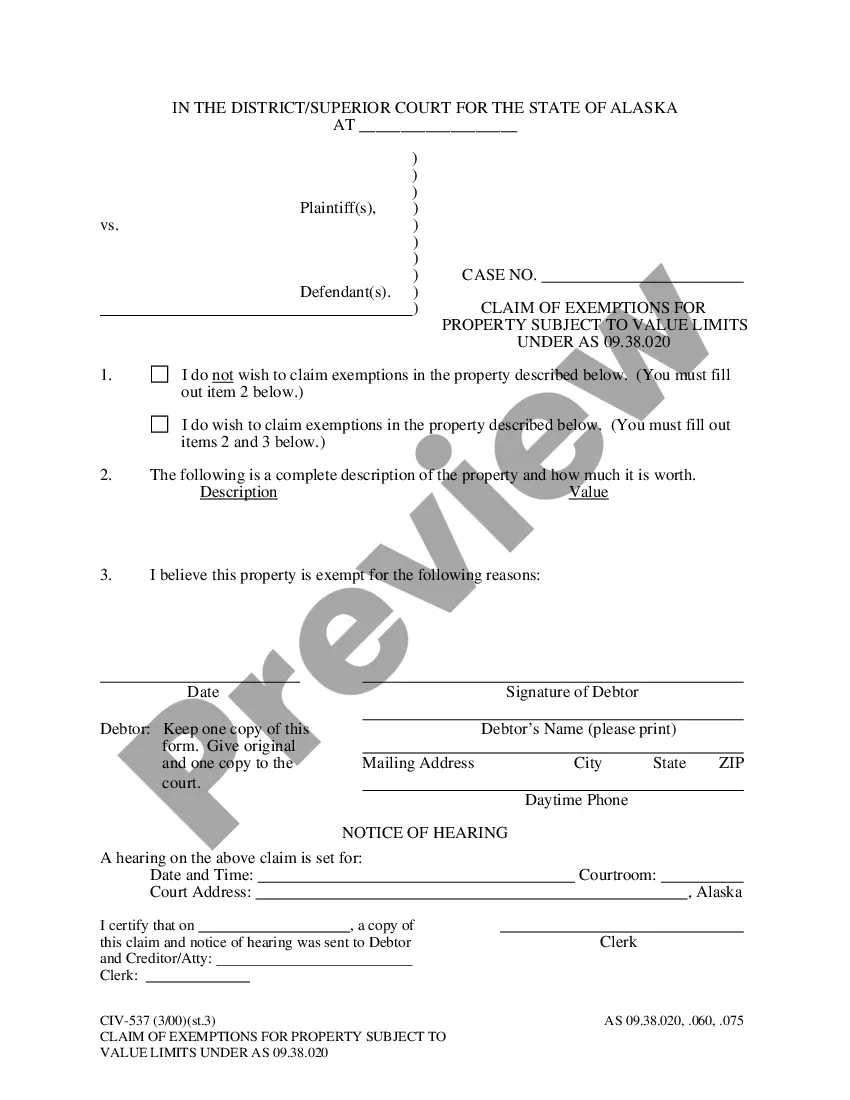

- Make use of the Review switch to review the shape.

- Look at the information to ensure that you have selected the right type.

- If the type is not what you`re looking for, take advantage of the Lookup area to find the type that fits your needs and needs.

- Once you discover the correct type, click Get now.

- Choose the prices program you want, fill out the necessary information and facts to produce your account, and buy your order utilizing your PayPal or charge card.

- Select a convenient document structure and obtain your copy.

Get each of the file themes you might have purchased in the My Forms menu. You may get a more copy of Puerto Rico Closing of Ways Code or Ordinance whenever, if needed. Just select the required type to obtain or produce the file format.

Use US Legal Forms, one of the most extensive assortment of legitimate forms, to save lots of some time and stay away from mistakes. The support offers skillfully created legitimate file themes which can be used for a variety of functions. Create your account on US Legal Forms and begin generating your daily life a little easier.

Form popularity

FAQ

You'll then need to file a Certificate of Dissolution with the Government of Puerto Rico's Registry of Corporations and Entities. The form can be filed online, in person, or by mail. The certificate must include the following information: The name of the LLC.

The Puerto Rico Codes 2018 and the 2018 International Codes® (I-Codes®) provide minimum requirements to safeguard the public health, safety and general welfare of the occupants of new and existing buildings and structures.

Act No. 164 of 2009(See), General Corporations Act, places Puerto Rico at the forefront of laws on legal entities. This statute is intended to streamline the management of these legal entities and simplify the procedures contemplated therein.

Tax Free First Year: Puerto Rico offers a tax deduction of 100% on real estate and personal property taxes during the first-year of operations. One Shareholder: A minimum of only one shareholder is allowed for Puerto Rico corporations. No Authorized Capital: There is no authorized minimum capital requirement.

As of November 28, 2020, inheritances are distributed in two parts. 50% is of free disposition and the other half (legitimate) is divided equally among the forced heirs, which are the children and now include the widow or widower.

If you're a sole proprietor, your business's legal name is your first and last name. Either way, if you want to do business under a name other than your legal business name, you're required by Puerto Rico law to file a DBA.

Not any different than the USA. Number of house Name of Street. City, puerto Rico. Zip code. One thing that is added is the name of the barrio or urbanization (subdivision) So a typucal address may be: 1645 Asomante St. Urb Altamesa. Carolina, Puerto Rico. 00934.

Puerto Rico LLC Cost. The initial cost to start an LLC in Puerto Rico is $250 to register your business with the Department of State. After that, you'll have a yearly recurring cost of $150 for your Annual Fee, which keeps your LLC current with the state.