Puerto Rico Self-Employed Auto Detailing Services Contract

Description

How to fill out Self-Employed Auto Detailing Services Contract?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a wide array of legal form templates you can download or create.

By utilizing the website, you can find thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can access the most recent versions of forms such as the Puerto Rico Self-Employed Auto Detailing Services Contract in just a few moments.

If you already have an account, Log In and download the Puerto Rico Self-Employed Auto Detailing Services Contract from your US Legal Forms library. The Download button will appear on every form you view. You can access all previously saved forms in the My documents section of your account.

Select the format and download the form to your device.

Make modifications. Fill out, edit, and print and sign the saved Puerto Rico Self-Employed Auto Detailing Services Contract.

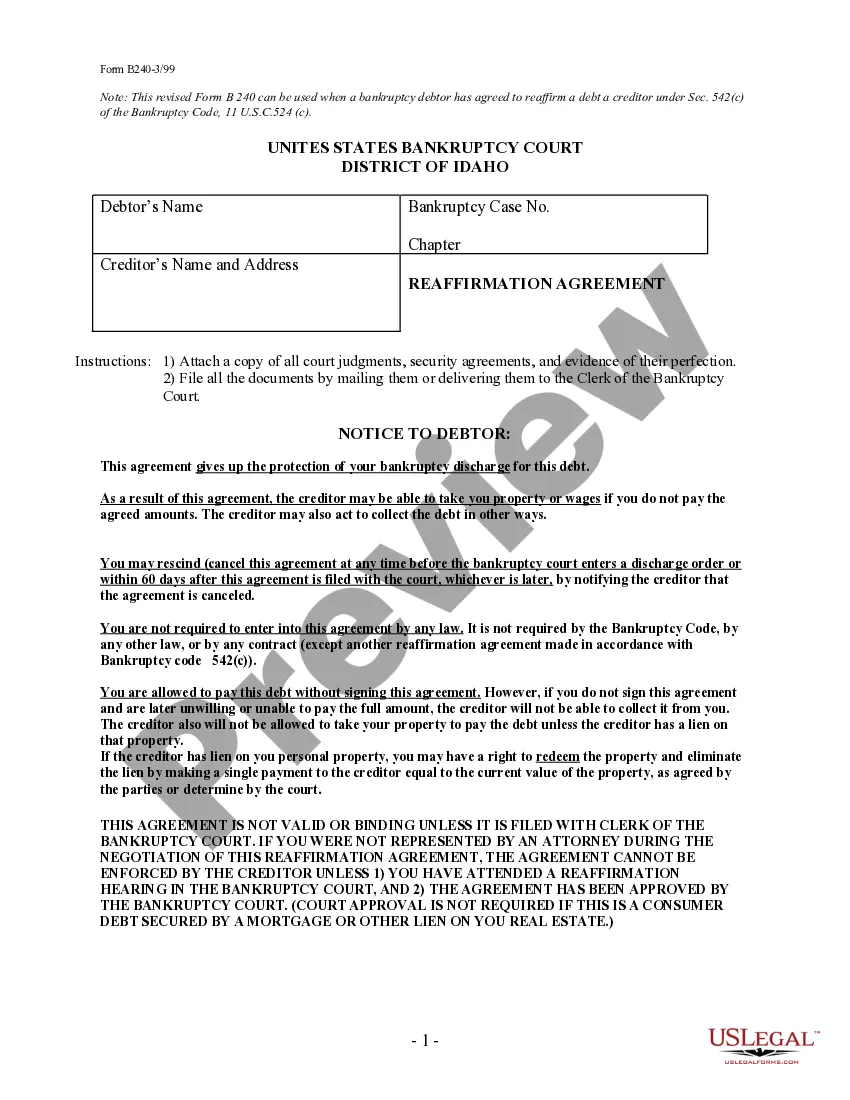

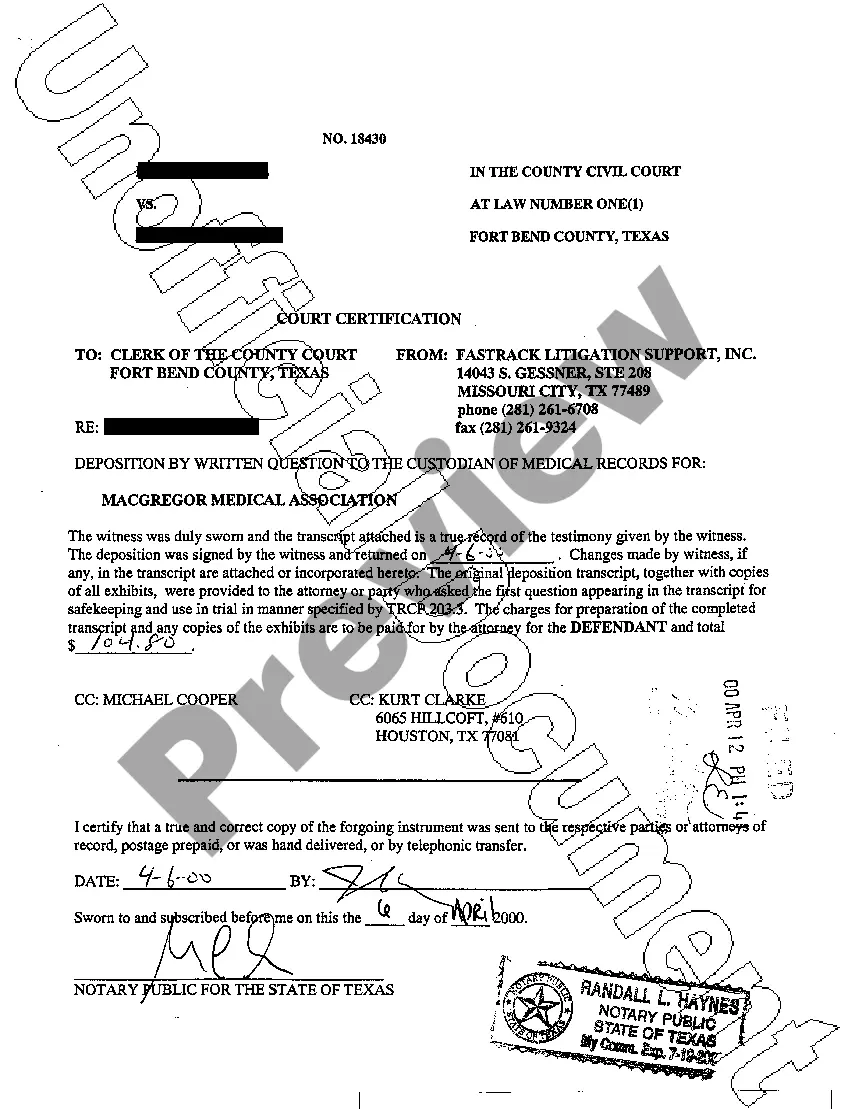

- Ensure you have chosen the correct form for your city/state. Click the Preview button to review the form's content.

- Read the form details to confirm that you have selected the appropriate form.

- If the form does not meet your needs, use the Search box at the top of the screen to find one that does.

- Once you are satisfied with the form, verify your selection by clicking the Purchase Now button.

- Then, select the payment plan you prefer and provide your information to register for the account.

- Process the purchase. Use your credit card or PayPal account to complete the transaction.

Form popularity

FAQ

Yes, professional services are generally taxable in Puerto Rico. This includes services provided by self-employed individuals, such as those offering Puerto Rico Self-Employed Auto Detailing Services. It is important to understand the tax implications to ensure compliance and avoid penalties. Utilizing resources from uslegalforms can help you stay informed about tax regulations and ensure your business operates smoothly.

Yes, you can work remotely from Puerto Rico, making it an attractive option for many professionals. If you are self-employed and offer services like Puerto Rico Self-Employed Auto Detailing Services, you can enjoy the beautiful surroundings while working. However, ensure that you meet all legal requirements, including business registration and tax compliance. Platforms like uslegalforms can assist you in understanding the necessary steps for operating your business remotely.

The 183 day rule in Puerto Rico refers to a tax residency requirement that considers individuals as residents if they spend 183 days or more in the territory during the year. This rule is crucial for those considering self-employment, including Puerto Rico Self-Employed Auto Detailing Services. Understanding this rule helps you navigate tax obligations and benefits accurately. For clarity on residency and tax implications, consult resources or professionals familiar with Puerto Rican law.

A merchant registration certificate in Puerto Rico is a document that allows individuals and businesses to legally operate within the territory. If you are planning to offer Puerto Rico Self-Employed Auto Detailing Services, obtaining this certificate is essential. It ensures compliance with local laws and regulations, enabling you to build credibility with your clients. To simplify the process, you can use platforms like uslegalforms to access the necessary forms and guidance.

A merchant certificate is an official document that permits individuals or businesses to operate legally in Puerto Rico. It serves as proof that you are registered with the Department of Treasury and allows you to conduct business transactions. For those involved in services like the Puerto Rico Self-Employed Auto Detailing Services Contract, having a merchant certificate is crucial for maintaining legal operations. Utilize uslegalforms to simplify your understanding and application process for this certificate.

Yes, you need a merchant registration in Puerto Rico to work freelance. This registration legitimizes your business activities and allows you to enter into contracts, such as the Puerto Rico Self-Employed Auto Detailing Services Contract. By obtaining a merchant registration, you ensure compliance with local laws and gain access to various business benefits. Uslegalforms offers resources to help you navigate this process smoothly.

If you have a foreign LLC and want to operate in Puerto Rico, you need to register it with the Department of State. This involves submitting an application along with your LLC's formation documents and any necessary fees. Registering your foreign LLC allows you to enter into contracts, including a Puerto Rico Self-Employed Auto Detailing Services Contract. Uslegalforms can guide you through the registration process to ensure everything is done correctly.

Yes, Puerto Rico requires a business license for most commercial activities, including those related to the Puerto Rico Self-Employed Auto Detailing Services Contract. Obtaining a business license helps ensure that your services meet local regulations. You can apply for a license through the local government office in your municipality. It's essential to check specific local requirements to ensure compliance.

Yes, you can establish an LLC for your car detailing business in Puerto Rico. An LLC provides liability protection and enhances your business credibility. When combined with a Puerto Rico Self-Employed Auto Detailing Services Contract, it creates a solid foundation for your business operations. This combination can safeguard your assets and clarify your business structure, ensuring smooth operations.

An auto detailing business can be quite profitable, especially with the right marketing strategies and customer service. Many detailers report profit margins ranging from 30% to 50%, depending on their service offerings and operational costs. Utilizing a Puerto Rico Self-Employed Auto Detailing Services Contract can help streamline your processes, ensuring you maximize profits while providing quality services. It also aids in building trust with clients, which is crucial for growth.