Puerto Rico Amendment of terms of Class B preferred stock

Description

How to fill out Amendment Of Terms Of Class B Preferred Stock?

Have you been inside a placement in which you need documents for possibly company or individual uses almost every day? There are plenty of lawful papers themes available on the Internet, but locating versions you can rely on isn`t easy. US Legal Forms offers a huge number of form themes, like the Puerto Rico Amendment of terms of Class B preferred stock, which can be published in order to meet state and federal specifications.

Should you be presently knowledgeable about US Legal Forms internet site and also have a merchant account, basically log in. Afterward, it is possible to acquire the Puerto Rico Amendment of terms of Class B preferred stock design.

If you do not have an profile and need to begin to use US Legal Forms, follow these steps:

- Discover the form you will need and make sure it is for your right metropolis/state.

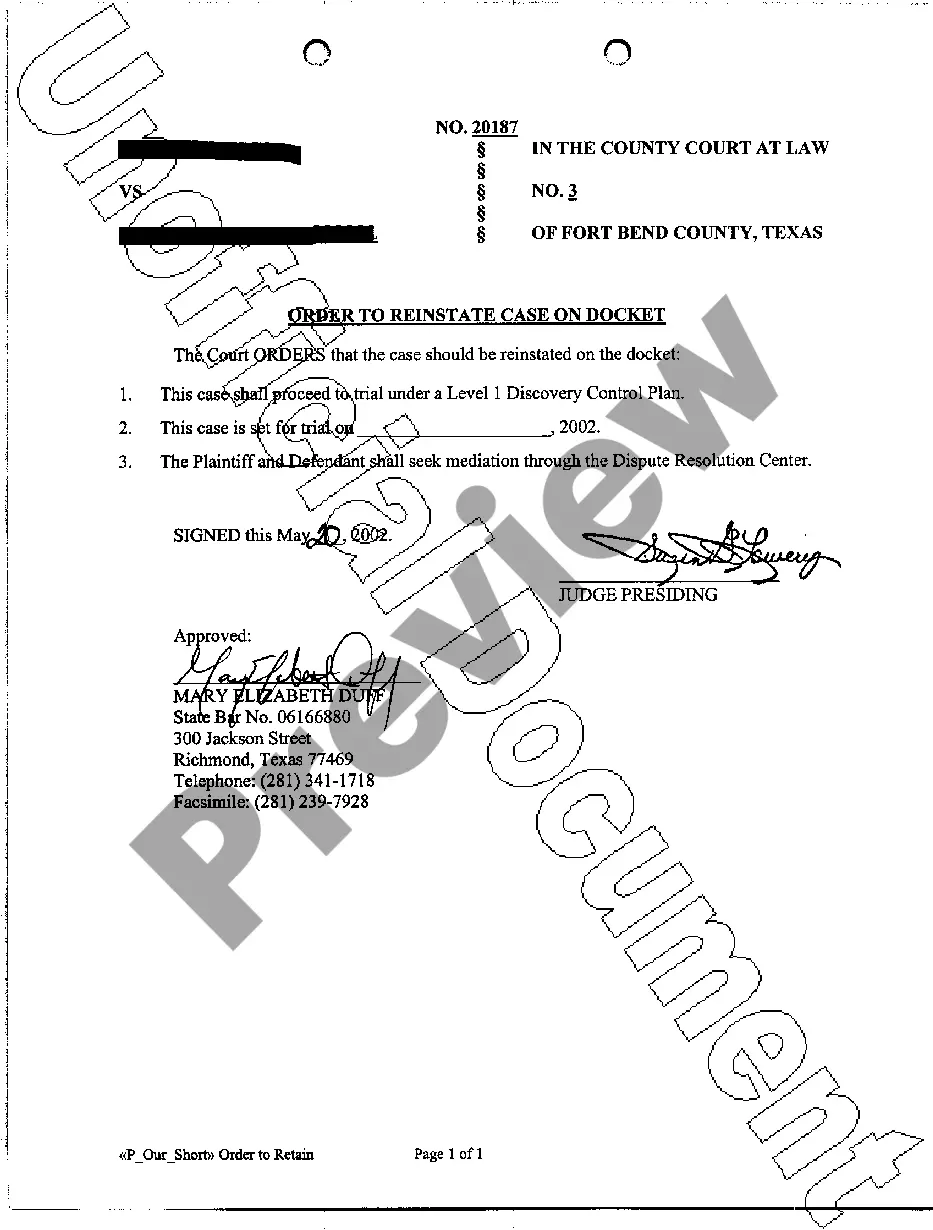

- Utilize the Review option to check the shape.

- Browse the outline to actually have chosen the correct form.

- If the form isn`t what you are trying to find, use the Lookup discipline to get the form that meets your requirements and specifications.

- Once you get the right form, click Get now.

- Pick the prices program you desire, complete the necessary details to create your bank account, and buy an order using your PayPal or Visa or Mastercard.

- Decide on a practical file formatting and acquire your version.

Get all the papers themes you possess bought in the My Forms menus. You can aquire a more version of Puerto Rico Amendment of terms of Class B preferred stock at any time, if required. Just click on the needed form to acquire or printing the papers design.

Use US Legal Forms, one of the most considerable collection of lawful types, to save time as well as prevent errors. The service offers expertly produced lawful papers themes which can be used for a range of uses. Generate a merchant account on US Legal Forms and commence creating your lifestyle easier.

Form popularity

FAQ

If the assessment results in an extinguishment, then the difference between the consideration paid (i.e., the fair value of the new or modified preferred stock) and the carrying value of the original preferred stock should be recognized as a reduction of, or increase to, retained earnings as a deemed dividend.

Redeemable preferred shares trade on many public stock exchanges. These preferred shares are redeemed at the discretion of the issuing company, giving it the option to buy back the stock at any time after a certain set date at a price outlined in the prospectus.

Preferreds technically have an unlimited life because they have no fixed maturity date, but they may be called by the issuer after a certain date. The motivation for the redemption is generally the same as for bonds?a company calls in securities that pay higher rates than what the market is currently offering.

Basically, when shares are bought back by the promoters they are extinguished (destroyed). These shares can be re-issued but after a period of time (normally 3 yrs).

Preferred shares are so called because they give their owners a priority claim whenever a company pays dividends or distributes assets to shareholders. They offer no preference, however, in corporate governance, and preferred shareholders frequently have no vote in company elections.