Puerto Rico Acknowledgment Form for Consultants or Self-Employed Independent Contractors

Description

How to fill out Acknowledgment Form For Consultants Or Self-Employed Independent Contractors?

If you want to compile, download, or generate approved document templates, utilize US Legal Forms, the largest assortment of legal forms, which are accessible online.

Employ the site`s straightforward and user-friendly search to find the documents you require.

An array of templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you desire, click the Get now button. Choose the payment plan you prefer and enter your details to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Utilize US Legal Forms to locate the Puerto Rico Acknowledgment Form for Consultants or Self-Employed Independent Contractors in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Puerto Rico Acknowledgment Form for Consultants or Self-Employed Independent Contractors.

- You can also access forms you have previously downloaded within the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the directions below.

- Step 1. Confirm you have selected the form for the correct city/state.

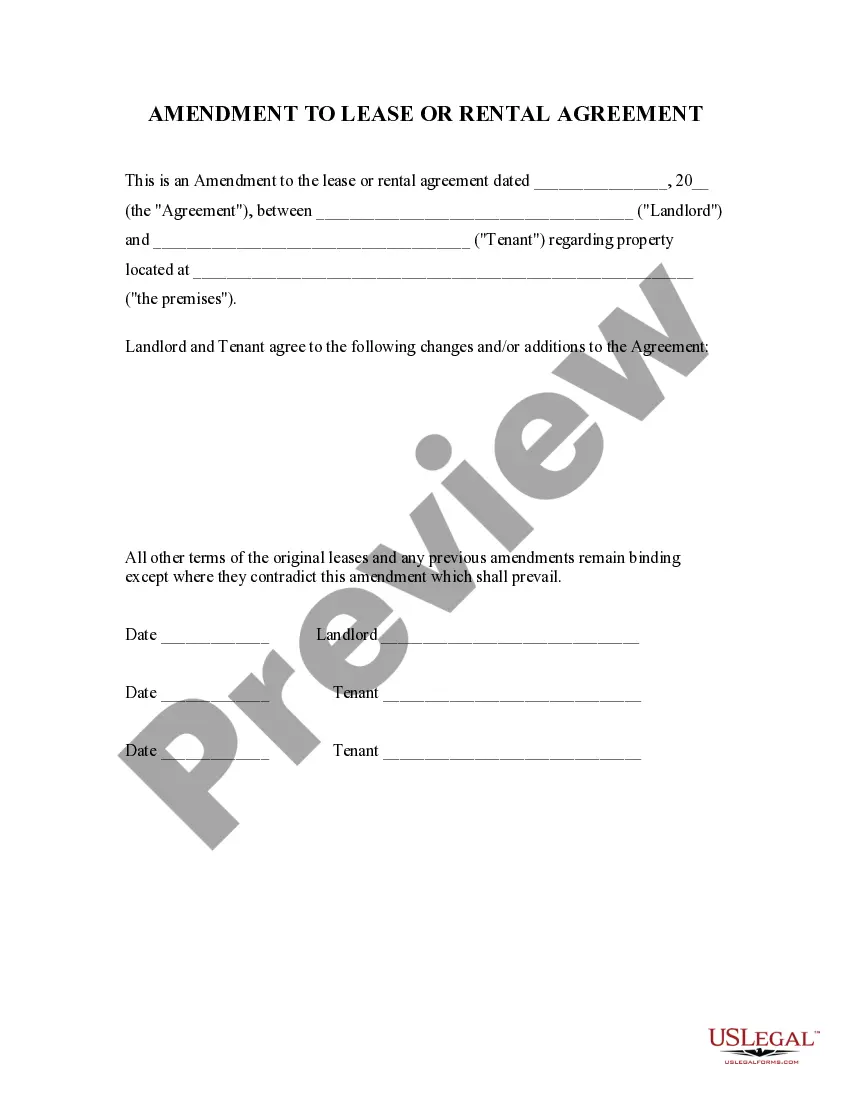

- Step 2. Use the Preview option to examine the form`s content. Don’t forget to review the details.

- Step 3. If you are not satisfied with the form, utilize the Search area at the top of the screen to discover other variations of the legal form template.

Form popularity

FAQ

You must file Form 1040-SS if you meet all three requirements below. 1. You, or your spouse if filing a joint return, had net earnings from self-employment (from other than church employee income) of $400 or more (or you had church employee income of $108.28 or moresee Church Employees, later).

About Form 1040-SS, U.S. Self-Employment Tax Return (Including the Additional Child Tax Credit for Bona Fide Residents of Puerto Rico)

A self employed person can be a sole proprietorship, an independent contractor, or a freelancer. You are considered self employed even if you are paid in cash and do not receive a 1099-MISC or 1099-NEC.

Taxpayers complete Form 8862 and attach it to their tax return if: Their earned income credit (EIC), child tax credit (CTC)/additional child tax credit (ACTC), credit for other dependents (ODC) or American opportunity credit (AOTC) was reduced or disallowed for any reason other than a math or clerical error.

As of the 2020 tax year, the IRS Form 1099-NEC is the independent contractor tax form used by businesses to report payments to a contract worker in the previous tax year. This tax form for independent contractors is filed with the IRS and is also provided to the contractor for reporting income.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

You should file Form 1040 if: Your taxable income is greater than $100,000. You itemize deductions. You receive income from the sale of property.

You will need to fill out a W-9 form if you: Classify yourself as an independent contractor or freelancer. Are not a full-time employee of the business. Will be paid more than $600 for work provided to the business.

Since these forms are virtually identical in function, the main reason to use Form 1040-SR is if you're filling out your tax return by hand rather than online. Form 1040-SR has larger type and larger boxes to write numbers in, making it slightly easier for seniors to read and fill out.

How to Fill Out a 1099-MISC FormEnter your information in the 'payer' section.Fill in your tax ID number.As a business owner, enter the contractor's tax ID number which is found on their form W-9.Fill out the account number you have assigned to the independent contractor.More items...