Puerto Rico Model Performance Evaluation - Appraisal Form for Hourly, Exempt, Nonexempt, and Managerial Employees

Description

How to fill out Model Performance Evaluation - Appraisal Form For Hourly, Exempt, Nonexempt, And Managerial Employees?

Are you currently in a location where you require documents for various company or specific activities almost every workday.

There are numerous legal template forms accessible online, but finding ones you can depend on isn't easy.

US Legal Forms provides thousands of form templates, including the Puerto Rico Model Performance Evaluation - Appraisal Form for Hourly, Exempt, Nonexempt, and Managerial Employees, which can be tailored to meet federal and state regulations.

Once you find the correct form, click on Buy now.

Choose the pricing plan you want, enter the necessary details to create your account, and pay for the transaction using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Puerto Rico Model Performance Evaluation - Appraisal Form for Hourly, Exempt, Nonexempt, and Managerial Employees template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/county.

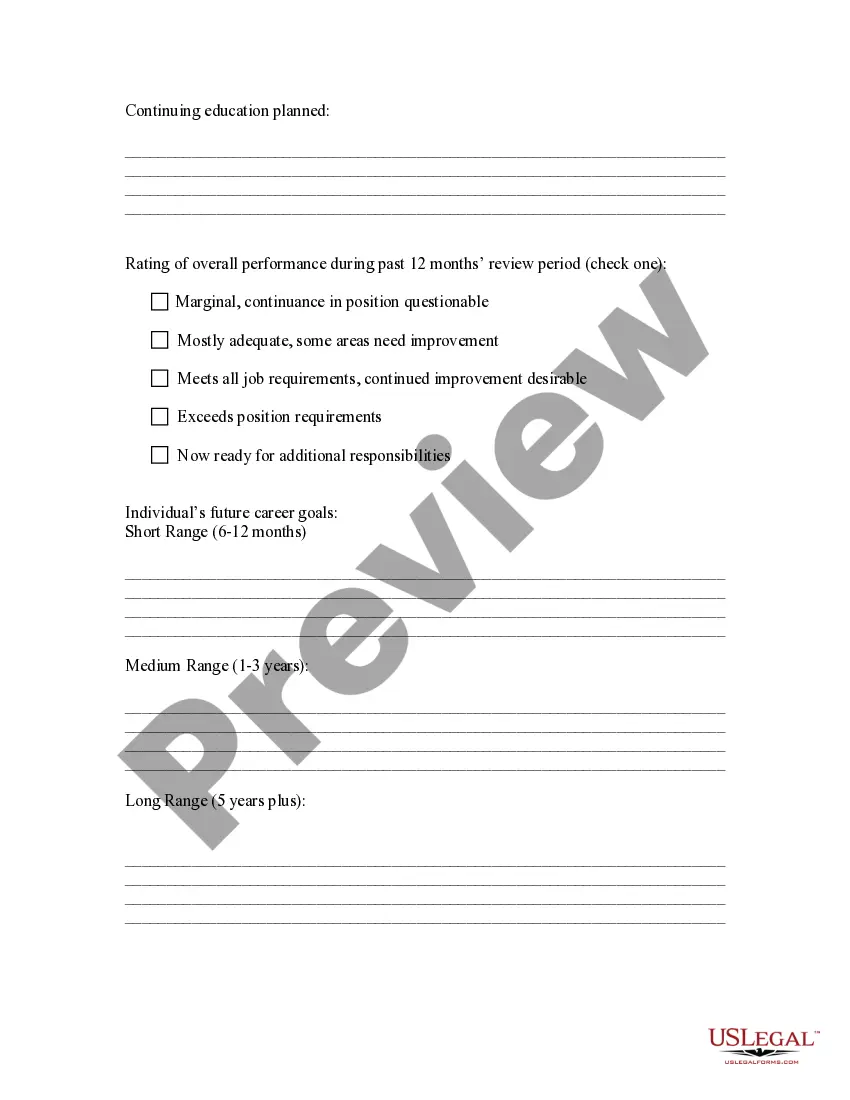

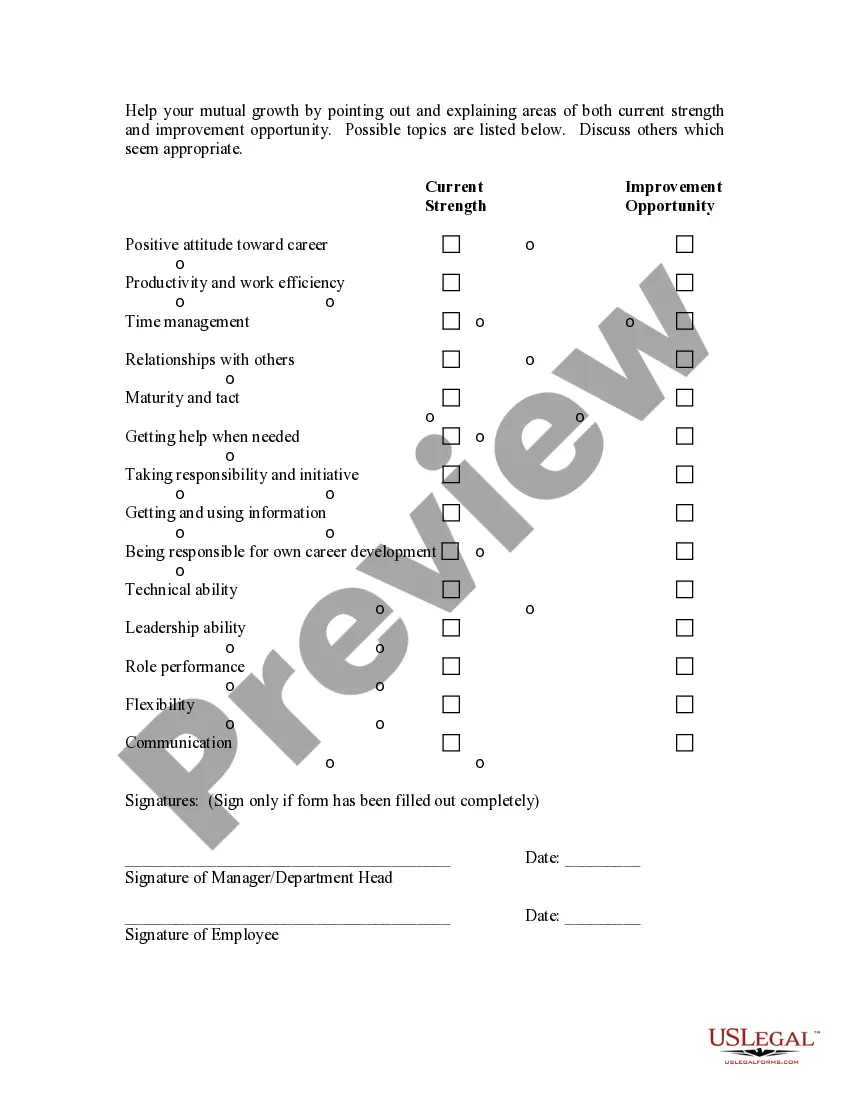

- Use the Preview option to review the document.

- Read the description to make sure you have selected the right form.

- If the form isn't what you're looking for, use the Research field to find the form that fits your needs and requirements.

Form popularity

FAQ

When you fill the form:Be honest and critical. Analyze your failures and mention the reasons for it.Keep the words minimal.Identify weaknesses.Mention your achievements.Link achievements to the job description and the organization's goals.Set the goals for the next review period.Resolve conflicts and grievances.

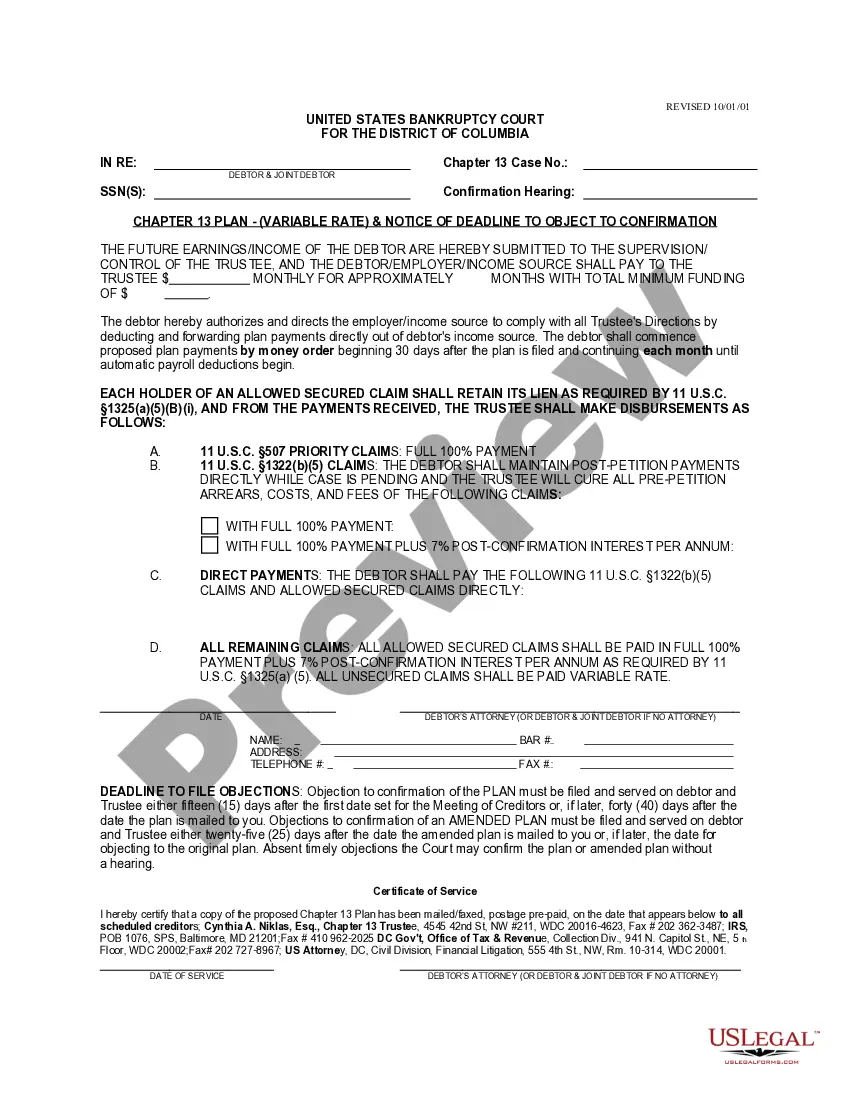

As Puerto Rico is subject to US federal law, to qualify as an exempt or "white-collar" employee, an employee must meet the requirements of the Fair Labor Standards Act (FLSA).

Puerto Rico is not an 'employment at will' jurisdiction. Thus, an indefinite-term employee discharged without just cause is entitled to receive a statutory discharge indemnity (or severance payment) based on the length of service and a statutory formula.

Executive, administrative, professional and outside sales employees: (as defined in Department of Labor regulations) and who are paid on a salary basis are exempt from both the minimum wage and overtime provisions of the FLSA.

The minimum wage under the Fair Labor Standards Act (FLSA) is generally applicable to any state, territory, or possession of the United States such as Puerto Rico, the Virgin Islands, Guam, American Samoa, and the Commonwealth of the Northern Mariana Islands (CNMI).

In addition, to be classified as exempt after July 1, 2017, a teacher in a private elementary or secondary school must be paid the greater of the following: The lowest salary paid by any California school district to an employee with a teaching credential, or.

Employees who are exempt from the FLSA's minimum wage and overtime laws include: executive, administrative, and professional employees and some computer workers; outside salespeople such as those who do sales away from the employer's place of business, like a door-to-door salesperson.

The learned professional exemption is restricted to professions where specialized academic training is a standard prerequisite for entrance into the profession. The best evidence of meeting this requirement is having the appropriate academic degree.

Companies looking to hire workers from Puerto Rico must comply with Public Law 87. It requires employers who are recruiting on the island to obtain authorization by the Secretary of Labor and Human Resources of Puerto Rico, according to Odemaris Chacon, a labor attorney with Estrella, based in Puerto Rico.

Section 403 of PROMESA modified Section 6(g) of the Fair Labor Standards Act (FLSA) to allow employers to pay employees in Puerto Rico who are under the age of 25 years a subminimum wage of not less than $4.25 per hour for the first 90 consecutive calendar days after initial employment by their employer.