Puerto Rico Agreement for Auditing Services between Accounting Firm and Municipality

Description

How to fill out Agreement For Auditing Services Between Accounting Firm And Municipality?

Discovering the right authorized document template could be a battle. Naturally, there are tons of layouts available on the Internet, but how would you discover the authorized type you want? Use the US Legal Forms web site. The service delivers thousands of layouts, including the Puerto Rico Agreement for Auditing Services between Accounting Firm and Municipality, which you can use for business and private requires. All of the types are inspected by pros and satisfy federal and state demands.

If you are previously authorized, log in for your profile and click on the Acquire option to find the Puerto Rico Agreement for Auditing Services between Accounting Firm and Municipality. Use your profile to check with the authorized types you have acquired previously. Proceed to the My Forms tab of your profile and obtain one more backup from the document you want.

If you are a brand new consumer of US Legal Forms, listed here are simple instructions so that you can adhere to:

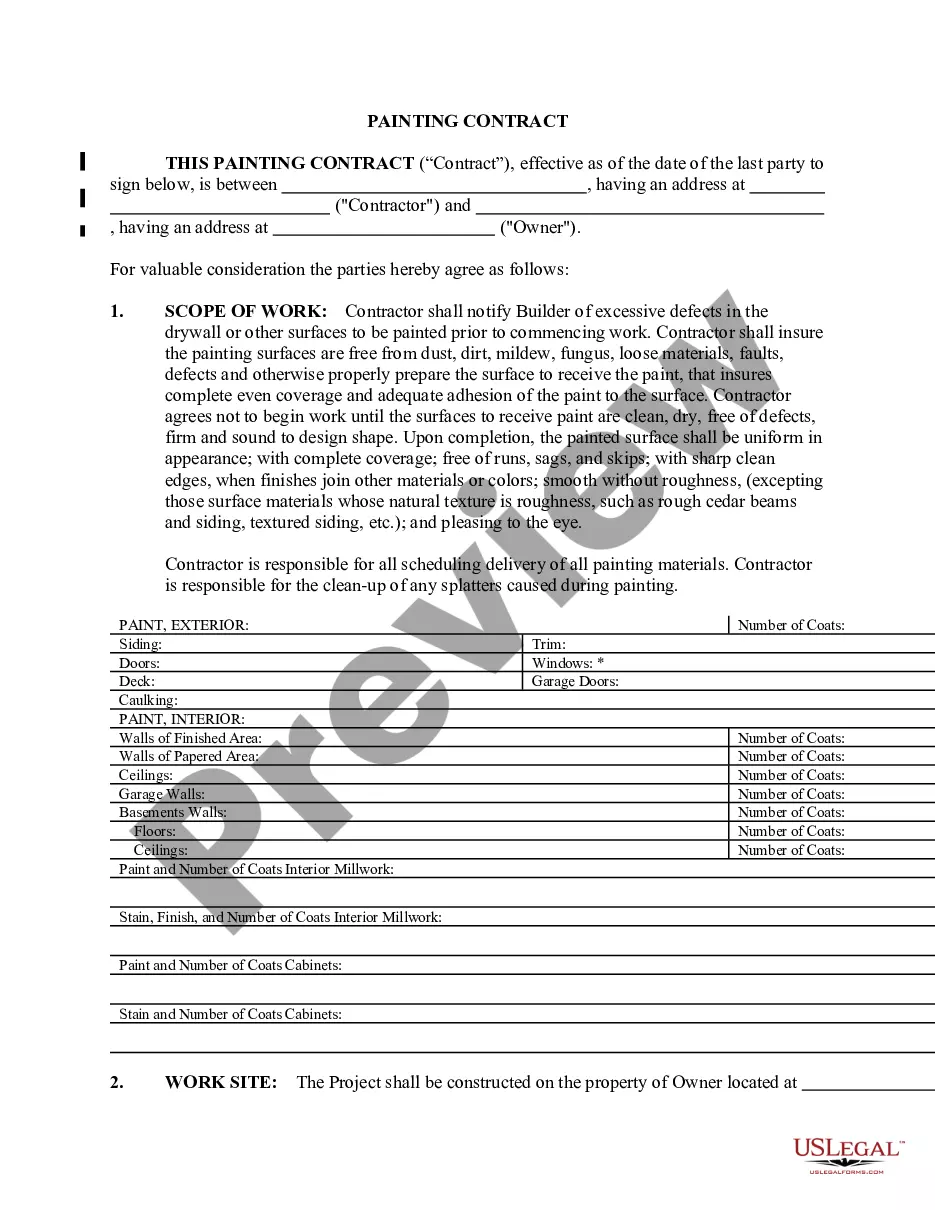

- Very first, be sure you have chosen the right type for your personal town/state. You may check out the shape using the Review option and look at the shape information to ensure this is the right one for you.

- When the type will not satisfy your requirements, utilize the Seach industry to find the proper type.

- When you are positive that the shape is acceptable, click on the Acquire now option to find the type.

- Pick the rates program you desire and enter in the necessary info. Design your profile and buy the transaction making use of your PayPal profile or Visa or Mastercard.

- Choose the data file file format and acquire the authorized document template for your product.

- Complete, edit and printing and indicator the acquired Puerto Rico Agreement for Auditing Services between Accounting Firm and Municipality.

US Legal Forms is definitely the most significant catalogue of authorized types where you can see different document layouts. Use the company to acquire professionally-produced files that adhere to condition demands.

Form popularity

FAQ

Along with Puerto Rico Tax Act 20, Puerto Rico adopted an additional incentive, the ?Act to Promote the Relocation of Individual Investors,? Puerto Rico Tax Act 22, to stimulate economic development by offering nonresident individuals 100% tax exemptions on all interest, all dividends, and all long-term capital gains.

While the Commonwealth government has its own tax laws, Puerto Rico residents are also not required to pay US federal taxes, but most residents do not have to pay the federal personal income tax.

Accounting records must be prepared in ance with the GAAP followed in the United States.

Act 60 was intended to boost the Puerto Rican economy by encouraging mainland U.S. citizens to do business and live in Puerto Rico, and as is the case with many incentive programs, the opportunity and temptation to abuse these programs has led some to do just that.

Puerto Ricans do pay federal taxes, but the majority of them do not contribute to income taxes which are only paid by Puerto Rico residents who work for the federal government, those who are in the U.S. military, others who earn money from outside the country and those who work with the federal government.

A foreign corporation may be engaged in trade or business in Puerto Rico as a division or branch of that foreign corporation, or as a separate corporation or subsidiary.

Audited financial statements Accounting records must be prepared in ance with the GAAP followed in the United States.