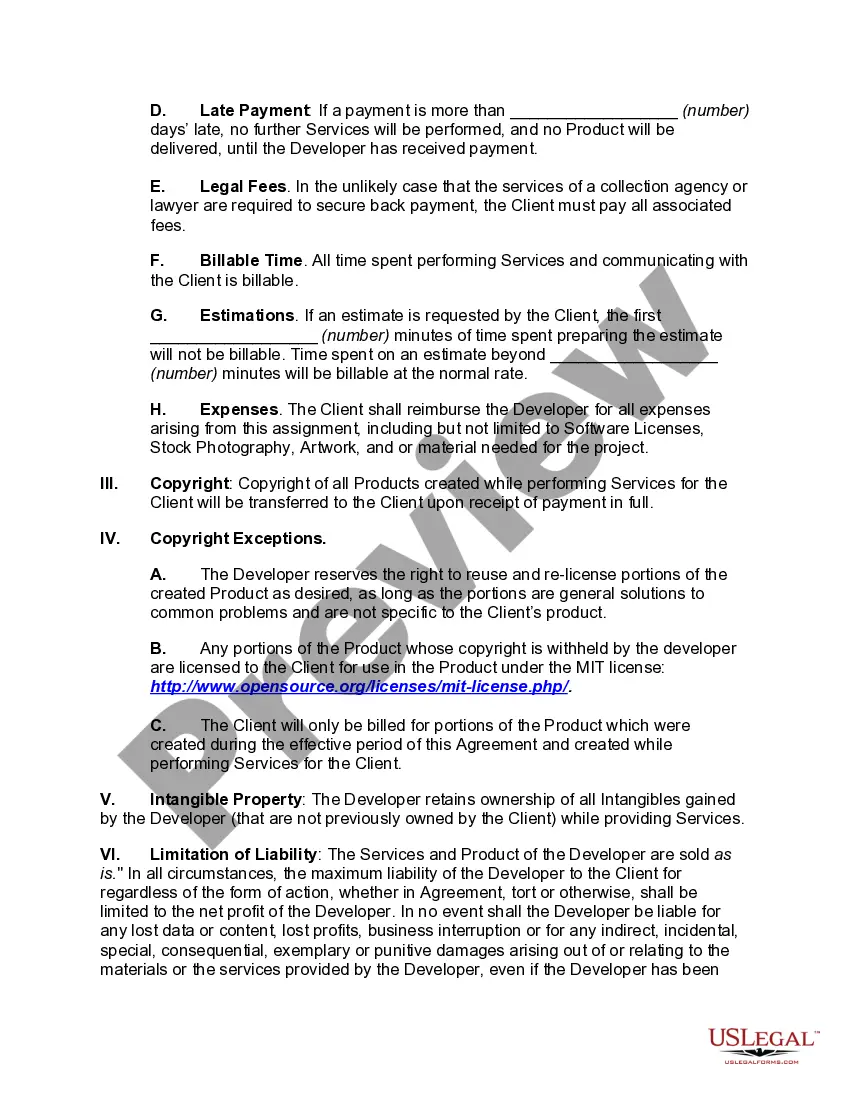

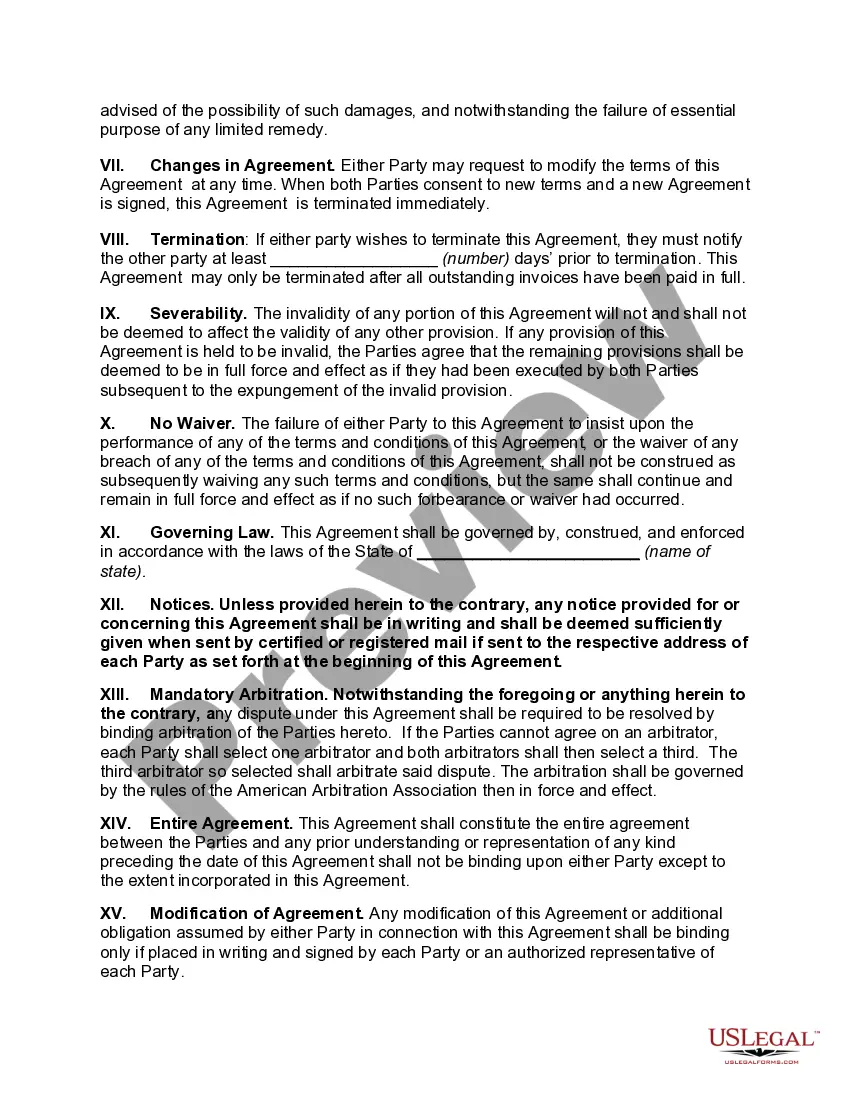

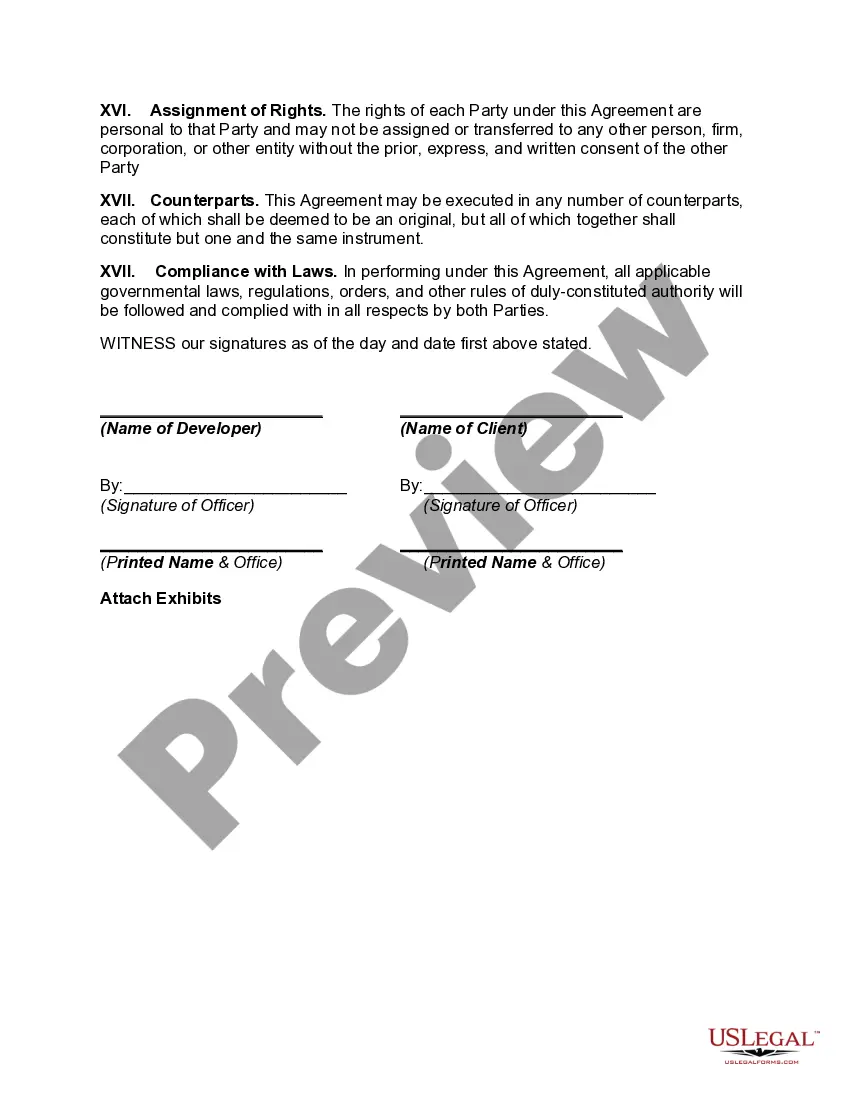

Puerto Rico Service Agreement for Development

Description

How to fill out Service Agreement For Development?

Are you presently in a position where you need documents for occasional organizational or personal reasons almost every day.

There are numerous legal document templates available online, but locating ones you can trust is not straightforward.

US Legal Forms offers thousands of form templates, such as the Puerto Rico Service Agreement for Development, designed to meet state and federal regulations.

Once you find the right form, click on Buy now.

Choose a suitable pricing plan, fill in the required information to create your account, and complete the purchase using your PayPal or credit card. Select a convenient file format and download your copy.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Puerto Rico Service Agreement for Development template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it is for your appropriate region/county.

- Use the Review button to examine the document.

- Check the description to make sure you have chosen the correct form.

- If the form isn’t what you’re looking for, utilize the Search section to find the template that meets your needs.

Form popularity

FAQ

Puerto Rico offers businesses the security and stability to operate in a US jurisdiction, while providing an unmatched variety of tax incentives that make it an attractive destination for businesses, large and small.

Puerto Rico Act 60: How You Can Lower Your Federal and State Tax Rates Under the Resident Tax Incentive Code. July 12, 2021. The Tax Incentive Code, known as Act 60, provides tax exemptions to businesses and investors that relocate to, or are established in, Puerto Rico.

1. You were present in the relevant territory for at least 183 days during the tax year. 2. You were present in the relevant territory for at least 549 days during the 3-year period that includes the current tax year and the 2 immediately preceding tax years.

Only Bona Fide Puerto Rico Residents Qualify for Act 60 Tax Benefits. The first question the IRS asks is whether an individual has been physically present on Puerto Rican soil for at least 183 days during the taxable year. Note that there are additional methods for satisfying this requirement.

An individual is considered to be a bona fide resident of Puerto Rico if three tests are met. The individual must be present for at least 183 days during the taxable year in Puerto Rico or satisfy one of the other four presence tests (the presence test).

Act 20 and Act 22 were enacted in Puerto Rico in 2012 to promote the exportation of services by companies and individuals providing such services from Puerto Rico and the relocation of high-net-worth individuals to Puerto Rico.

Further, Resident Individuals must apply for and obtain a tax exemption decree under Act 60. To obtain access to the approved and signed tax exemption decree, a one-time fee of $5,000 must be satisfied and deposited into a special fund to promote the relocation of Resident Individuals to Puerto Rico.

An individual is considered to be a bona fide resident of Puerto Rico if three tests are met. The individual must be present for at least 183 days during the taxable year in Puerto Rico or satisfy one of the other four presence tests (the presence test).

You spent at least 549 days in Puerto Rico throughout the current and previous two tax years, including at least 60 days per tax year. You spent no more than 90 days in the mainland U.S. throughout the tax year.

Act 60 - Resident Individual InvestorWith total exemption from local income taxes on certain passive income earned after they become bona fide residents of Puerto Rico. These new residents of Puerto Rico are entitled to 100% income tax exemption on dividends, interest and certain capital gains.