Puerto Rico Private Annuity Agreement

Description

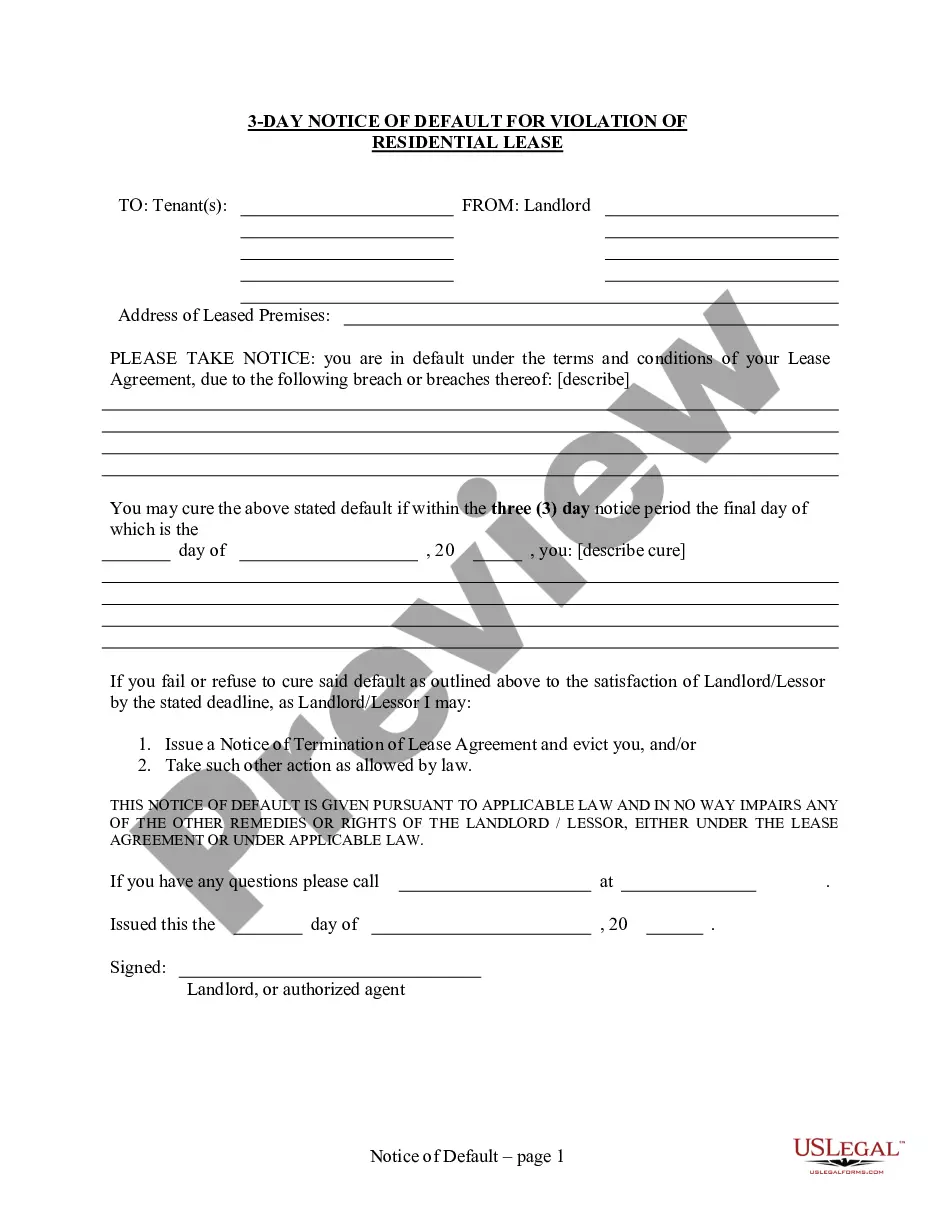

How to fill out Private Annuity Agreement?

US Legal Forms - one of the most prominent collections of legal documents in the USA - offers an extensive selection of legal form templates that you can download or print.

By using the website, you can discover thousands of forms for business and personal use, organized by categories, states, or keywords.

You can quickly access the latest versions of forms such as the Puerto Rico Private Annuity Agreement in just moments.

Check the form summary to verify you have chosen the right document.

If the form doesn't meet your needs, use the Search field at the top of the page to find one that does.

- If you already have a subscription, Log In to download the Puerto Rico Private Annuity Agreement from the US Legal Forms repository.

- The Download button will appear on every form you view.

- You have access to all previously saved forms in the My documents section of your account.

- If you are new to US Legal Forms, here are some simple steps to get started.

- Ensure you have selected the correct form for your city/county.

- Click the Preview button to review the form's content.

Form popularity

FAQ

The monthly payout from a $100,000 annuity depends on several factors, including the type of annuity and the selected payout period. Generally, you can expect a range based on interest rates and contract specifics. With a Puerto Rico Private Annuity Agreement, you can optimize these payouts to ensure consistent income.

As long as you do not withdraw your investment gains and keep them in the annuity, they are not taxed. A variable annuity is linked to market performance. If you do not withdraw your earnings from the investments in the annuity, they are tax-deferred until you withdraw them.

The transaction provides the annuitant, or a beneficiary, with regular payments that are generally only taxable as income.

Excise tax: depends on the category of goods. Sales and use tax: 11.5 percent on most goods and services. 10.5 percent on goods and services not subject to municipal SUT.

Before retiring, I worked in Puerto Rico as well as in the United States. Do I have to include all pension income in my Puerto Rico Income Tax Return? Yes. Since you are a Puerto Rico resident you must include the total income received in your Puerto Rico Income Tax Return.

If you're a bona fide resident of Puerto Rico during the entire tax year, you generally aren't required to file a U.S. federal income tax return if your only income is from sources within Puerto Rico.

The new tax contributes 1% to the municipality level and 10.5% to the "state" level. The IVU was scheduled to expire on 1 April 2016, to be replaced with a value-added tax (VAT) of 10.5% for the state level, with the 1% IVU continuing for the municipalities.