Establishing a Qualified Personal Residence Trust (QPRT) involves transferring the residence to a trust that names the persons who are to receive the residence at the end of the stated term, usually a child or children of the donor. The donor is the tr

Puerto Rico Qualified Personal Residence Trust

Description

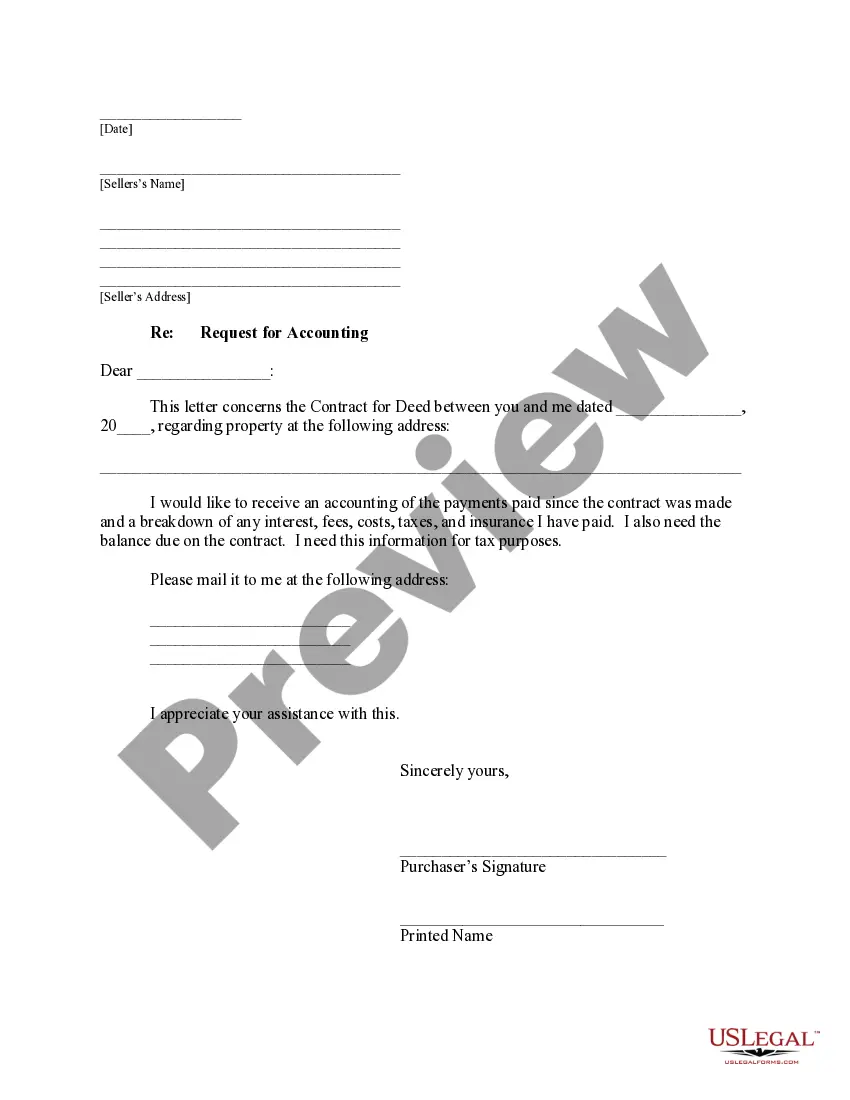

How to fill out Qualified Personal Residence Trust?

US Legal Forms - one of many biggest libraries of authorized varieties in the States - provides a wide range of authorized record layouts you are able to down load or printing. While using website, you will get 1000s of varieties for business and person uses, categorized by categories, states, or key phrases.You will discover the most up-to-date types of varieties like the Puerto Rico Qualified Personal Residence Trust in seconds.

If you already possess a membership, log in and down load Puerto Rico Qualified Personal Residence Trust in the US Legal Forms library. The Acquire key can look on each and every kind you look at. You gain access to all previously acquired varieties from the My Forms tab of your account.

If you wish to use US Legal Forms the very first time, listed below are straightforward directions to obtain started off:

- Be sure you have picked the right kind for your personal area/state. Click on the Preview key to check the form`s content. See the kind explanation to ensure that you have selected the right kind.

- In case the kind doesn`t satisfy your requirements, take advantage of the Lookup area near the top of the display screen to find the the one that does.

- If you are happy with the form, affirm your choice by visiting the Get now key. Then, select the pricing strategy you prefer and provide your accreditations to register for the account.

- Method the financial transaction. Use your Visa or Mastercard or PayPal account to finish the financial transaction.

- Find the format and down load the form on your gadget.

- Make changes. Fill up, edit and printing and indicator the acquired Puerto Rico Qualified Personal Residence Trust.

Every web template you included with your account does not have an expiry date which is your own property forever. So, if you want to down load or printing another copy, just visit the My Forms segment and click on the kind you want.

Obtain access to the Puerto Rico Qualified Personal Residence Trust with US Legal Forms, one of the most considerable library of authorized record layouts. Use 1000s of expert and status-specific layouts that fulfill your organization or person demands and requirements.

Form popularity

FAQ

A QPRT is a grantor trust for income tax purposes. As a result, during the trust term the grantor can claim an income tax deduction for any real estate taxes he or she pays.

In a recent decision TVA obtained for the Chapter 7 bankruptcy trustee, the U.S. Bankruptcy Court held that a QPRT - generally irrevocable and commonly used in estate planning to hold personal residences - may nonetheless be revoked when the debtor retains an right to reacquire ownership of the residence.

A qualified personal residence trust (QPRT) is a specific type of irrevocable trust that allows its creator to remove a personal home from their estate for the purpose of reducing the amount of gift tax that is incurred when transferring assets to a beneficiary.

What are the Disadvantages of a Trust?Costs. When a decedent passes with only a will in place, the decedent's estate is subject to probate.Record Keeping. It is essential to maintain detailed records of property transferred into and out of a trust.No Protection from Creditors.

The sale of the residence without any reinvestment of the proceeds in a new residence will cause the QPRT status to terminate as to all of the assets.

Specifically, a QPRT is an irrevocable grantor trust, which allows an individual to take advantage of the gift tax exemption by putting a personal residence, either primary or secondary, into a trust.

A qualified personal residence trust (QPRT) is a trust to which a person (called the settlor, donor, or grantor) transfers his personal residence. The grantor reserves the right to live in the house for a period of years; this retained interest reduces the current value of the gift for gift tax purposes.

The Qualified Personal Residence Trust offers the benefits of a trust to protect a residence. At the same time, the owner can still live in the house while the trust is in effect. This means while the residence is held within the QPRT it is protected from judgments and creditors.

Because there's no limit on how long the QPRT must run, it's not uncommon to see QPRTs that were created 10 to 15 years ago finally expire today.

The biggest benefit of a QPRT is that it removes the value of your primary or second home and its appreciation from your taxable estate. Continued use of the property. With your home in a QPRT, you can still live in the property rent-free and enjoy any income tax deductions associated with it.