Puerto Rico Unpaid Interns May be Eligible for Worker's Compensation

Description

How to fill out Unpaid Interns May Be Eligible For Worker's Compensation?

US Legal Forms - one of the premier collections of legal documents in the USA - provides an extensive selection of legal record templates available for download or printing.

Utilizing the website, you can access thousands of forms for business and personal use, categorized by type, state, or keywords. You can locate the most recent versions of forms such as the Puerto Rico Unpaid Interns May be Eligible for Worker's Compensation in seconds.

If you possess a membership, Log In and retrieve Puerto Rico Unpaid Interns May be Eligible for Worker's Compensation from the US Legal Forms library. The Download button will appear on each form you view. You can revisit all previously acquired forms from the My documents section of your account.

Make modifications. Fill out, edit, and print or sign the downloaded Puerto Rico Unpaid Interns May be Eligible for Worker's Compensation.

Each template you add to your account does not have an expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply visit the My documents section and click on the form you need. Access the Puerto Rico Unpaid Interns May be Eligible for Worker's Compensation with US Legal Forms, the largest collection of legal document templates. Utilize thousands of professional and state-specific templates that cater to your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are some simple instructions to get you started.

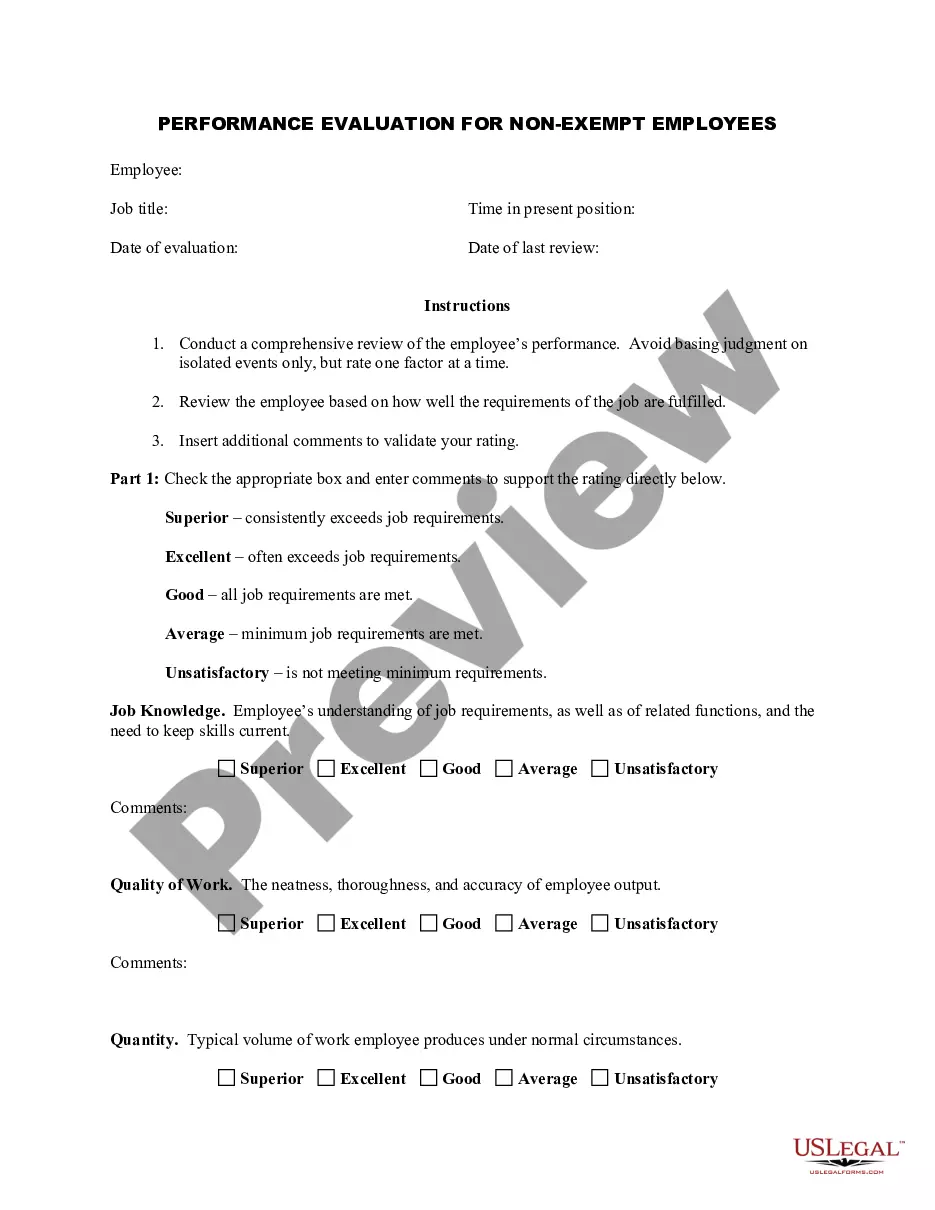

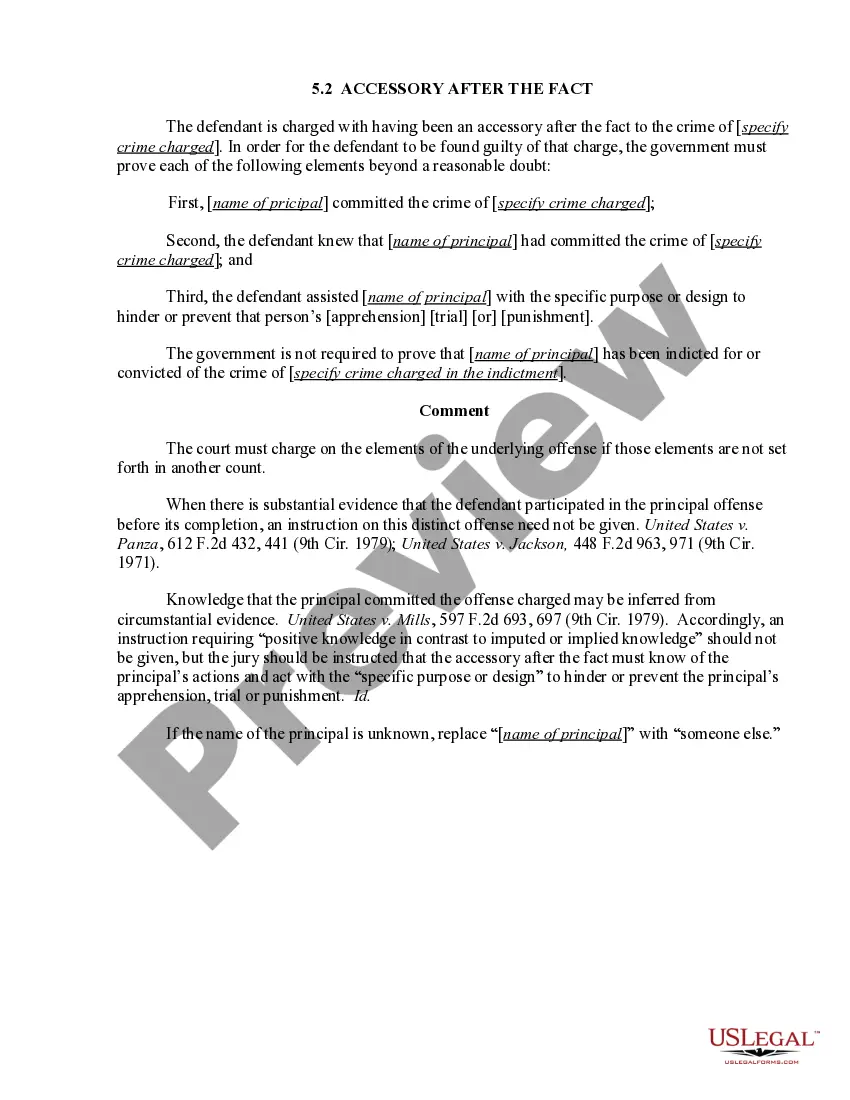

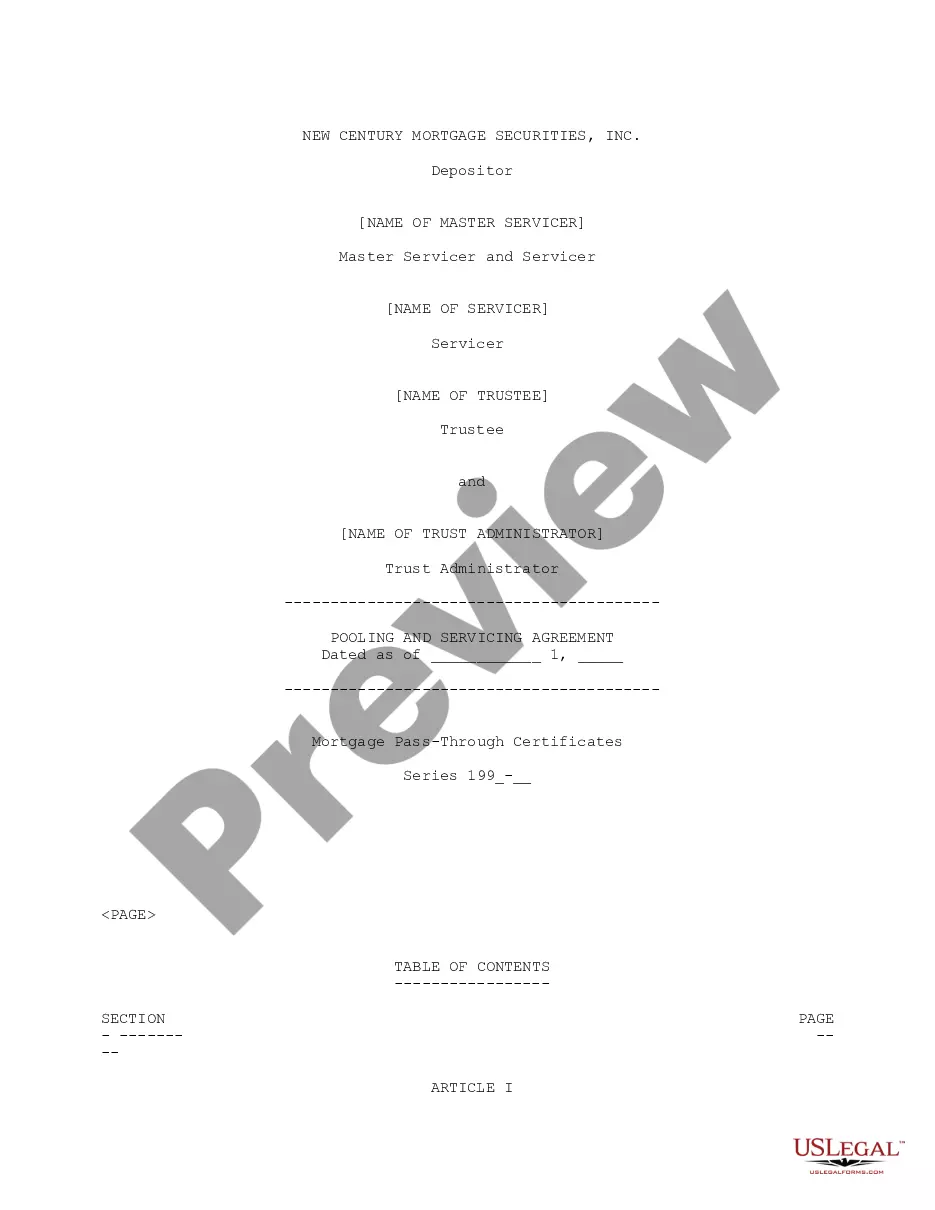

- Ensure you have chosen the correct form for your city/region. Click the Preview button to review the form’s content.

- Examine the form summary to confirm that you have selected the proper document.

- If the form does not meet your needs, utilize the Search bar at the top of the screen to find the one that does.

- If you are satisfied with the form, confirm your choice by clicking the Buy now button. Then, select your preferred pricing plan and provide your credentials to register for the account.

- Complete the transaction. Use your credit card or PayPal account to finish the payment.

- Select the format and download the form to your device.

Form popularity

FAQ

Section 403 of PROMESA modified Section 6(g) of the Fair Labor Standards Act (FLSA) to allow employers to pay employees in Puerto Rico who are under the age of 25 years a subminimum wage of not less than $4.25 per hour for the first 90 consecutive calendar days after initial employment by their employer.

Employment law in Puerto Rico is covered both by U.S. labor law and Puerto Rico's Constitution, which affirms the right of employees to choose their occupation, to have a reasonable minimum salary, a regular workday not exceeding eight hours, and to receive overtime compensation for work beyond eight hours.

In Puerto Rico, workers' compensation is compulsory, and no waivers are permitted. There is an exclusive state fund. Employers may not insure through private carriers, self-insurance, or through groups of employers. There is no exemption for employers with small numbers of employees.

Employment law in Puerto Rico is covered both by U.S. labor law and Puerto Rico's Constitution, which affirms the right of employees to choose their occupation, to have a reasonable minimum salary, a regular workday not exceeding eight hours, and to receive overtime compensation for work beyond eight hours.

An employer must make the salary payments on the 15th of the month. In Puerto Rico, 13th-month payments are mandatory. Employers with a workforce in excess of 21 employees must by law pay a 13th-month salary in December equating to 2% of the employees' wages or not more than 600 USD.

Companies looking to hire workers from Puerto Rico must comply with Public Law 87. It requires employers who are recruiting on the island to obtain authorization by the Secretary of Labor and Human Resources of Puerto Rico, according to Odemaris Chacon, a labor attorney with Estrella, based in Puerto Rico.

Section 403 of PROMESA modified Section 6(g) of the Fair Labor Standards Act (FLSA) to allow employers to pay employees in Puerto Rico who are under the age of 25 years a subminimum wage of not less than $4.25 per hour for the first 90 consecutive calendar days after initial employment by their employer.

Section 29 CFR 825.105(b) of the FMLA regulations states that the FMLA applies only to employees who are employed within any State of the United States, the District of Columbia or any Territory or possession of the United States. Territories or possessions of the United States include Puerto Rico, the Virgin Islands

2.3 Working Hours. According to Puerto Rico Act Number 379 of (Law No 379), which covers non-exempt (hourly) employees, eight hours of work constitutes a regular working day in Puerto Rico and 40 hours of work constitutes a workweek. Working hours exceeding these minimums must be compensated as overtime.

From an employment law perspective, this means federal statutes such as Title VII, FLSA, ADA, ADEA, FMLA, USERRA, OSHA, ERISA, COBRA, among others, apply to Puerto Rico.