Puerto Rico Sample Letter for Tax Exemption - Review of Sample Letter Received from Tax Collector

Description

How to fill out Sample Letter For Tax Exemption - Review Of Sample Letter Received From Tax Collector?

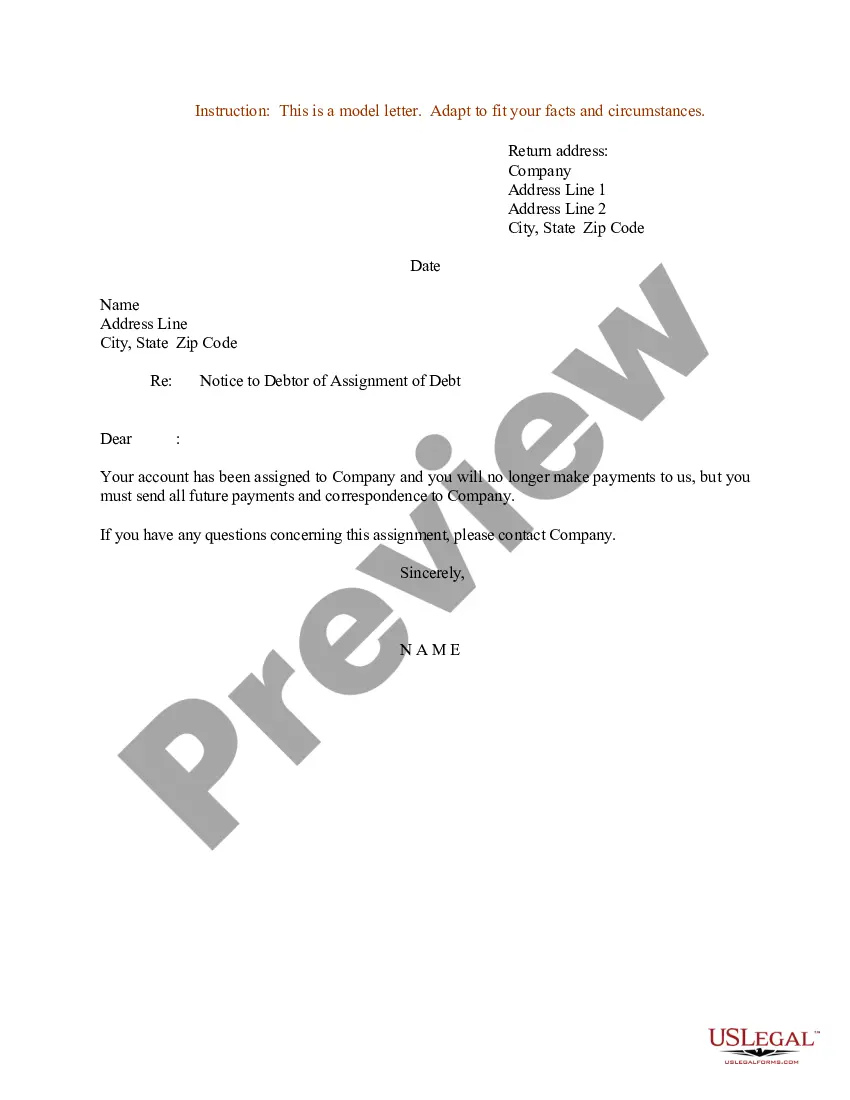

Discovering the right legitimate file web template can be a have a problem. Obviously, there are a variety of web templates available online, but how will you discover the legitimate form you need? Use the US Legal Forms site. The support delivers a huge number of web templates, including the Puerto Rico Sample Letter for Tax Exemption - Review of Sample Letter Received from Tax Collector, which you can use for organization and private requirements. Every one of the kinds are inspected by professionals and meet state and federal specifications.

When you are previously signed up, log in in your account and then click the Obtain switch to obtain the Puerto Rico Sample Letter for Tax Exemption - Review of Sample Letter Received from Tax Collector. Make use of your account to check with the legitimate kinds you might have acquired previously. Visit the My Forms tab of your account and get yet another version of the file you need.

When you are a brand new customer of US Legal Forms, listed below are easy instructions so that you can stick to:

- Initial, make sure you have chosen the correct form to your city/region. You are able to examine the form while using Preview switch and read the form description to guarantee this is basically the right one for you.

- If the form does not meet your preferences, take advantage of the Seach area to discover the appropriate form.

- When you are positive that the form is suitable, select the Acquire now switch to obtain the form.

- Choose the pricing strategy you desire and enter in the essential information and facts. Create your account and purchase the transaction using your PayPal account or credit card.

- Choose the submit structure and down load the legitimate file web template in your system.

- Full, modify and produce and signal the attained Puerto Rico Sample Letter for Tax Exemption - Review of Sample Letter Received from Tax Collector.

US Legal Forms may be the greatest local library of legitimate kinds in which you can discover various file web templates. Use the service to down load skillfully-created documents that stick to status specifications.

Form popularity

FAQ

Steps to respond online to your REVIEW LETTER: Log in CRA MyAccount, and select ?Submit documents? on the left side of the page. Again, select ?Submit Documents?. ?Do you have a case or reference number?? Select ? Yes?. Upload your prepared documents. Save the confirmation page for future reference.

If the CRA tells you that your tax return is being reviewed, it is simply to ensure that the amounts you have claimed are reported accurately. It might also be because some documents are required to support your claim.

Any U.S. source income is still subject to U.S. taxes at the regular rate, but under the tax exemption decrees, Puerto Rico source income for an individual may be taxed at 0% for Federal and Puerto Rico purposes. Puerto Rico-sourced income may include interest and dividends from sources in Puerto Rico.

Travelers are required to complete the online Request for Room Tax Exemption through Puerto Rico's Tourism Bureau. Once the form is approved, the traveler will be provided a tax exemption letter that must be provided to the hotel.

What this letter is about. We received a federal income tax return, Form 1040-series, filed under your Social Security number (SSN) or individual tax identification number (ITIN). We need you to verify your identity and your tax return so we can continue processing it. If you didn't file a tax return, let us know.

Our goal is to issue your notice of reassessment or a letter within 20 weeks of receiving your adjustment request. For faster service you can submit your requests for changes electronically, using Change My Return in My Account or ReFILE.

(updated ) We issue most refunds in less than 21 calendar days. However, if you filed a paper return and expect a refund, it could take four weeks or more to process your return.

If the IRS decides that your return merits a second glance, you'll be issued a CP05 Notice. This notice lets you know that your return is being reviewed to verify any or all of the following: Your income. Your tax withholding.