Puerto Rico Articles of Incorporation, Not for Profit Organization, with Tax Provisions

Description

The proper form and necessary content of articles or certificates of incorporation for a nonprofit corporation depend largely on the requirements of the state nonprofit corporation act in the state of incorporation. Typically nonprofit corporations have no capital stock and therefore have members, not stockholders. Because federal tax-exempt status will be sought for most nonprofit corporations, the articles or certificate of incorporation must be carefully drafted to include specific language designed to ensure qualification for tax-exempt status.

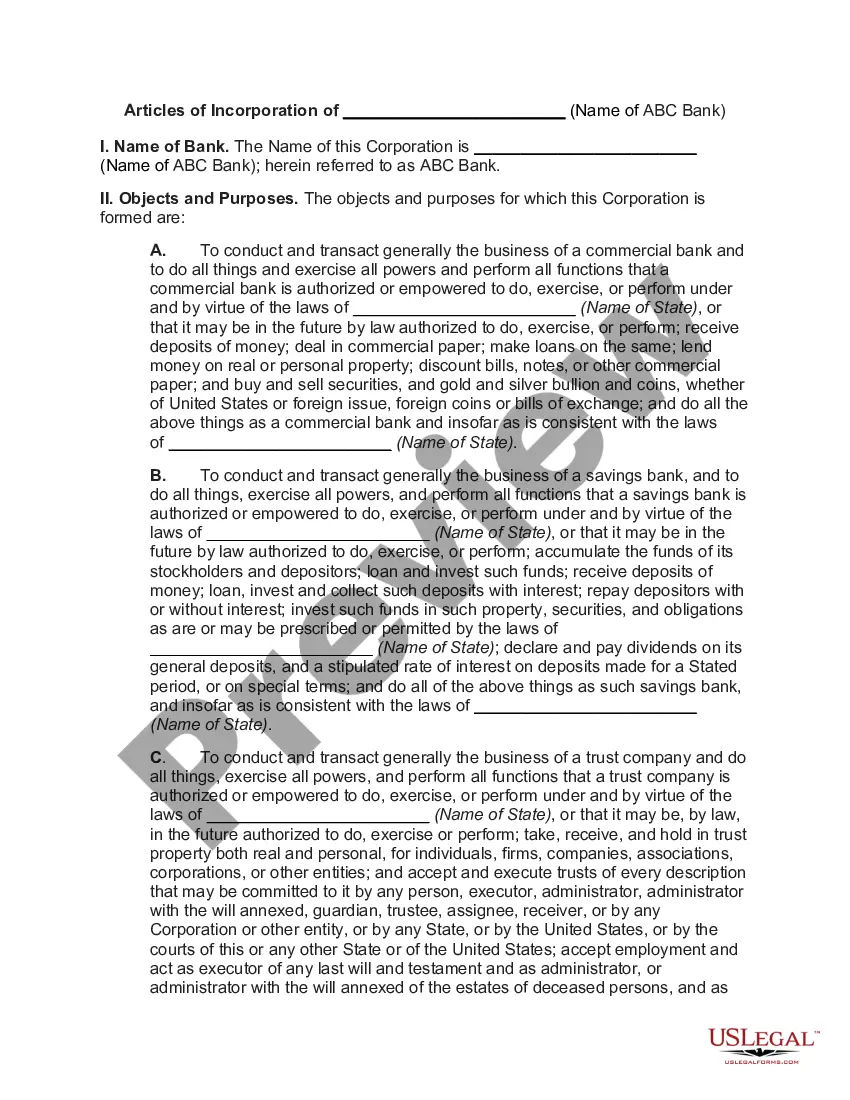

How to fill out Articles Of Incorporation, Not For Profit Organization, With Tax Provisions?

Are you within a place the place you require papers for possibly enterprise or specific functions nearly every day? There are a variety of legal papers themes accessible on the Internet, but finding types you can trust is not effortless. US Legal Forms provides thousands of form themes, like the Puerto Rico Articles of Incorporation, Not for Profit Organization, with Tax Provisions, which can be published to meet federal and state needs.

When you are already informed about US Legal Forms site and also have your account, just log in. Following that, you can download the Puerto Rico Articles of Incorporation, Not for Profit Organization, with Tax Provisions template.

Should you not come with an profile and would like to start using US Legal Forms, adopt these measures:

- Find the form you will need and ensure it is to the correct area/state.

- Take advantage of the Preview option to check the shape.

- See the information to ensure that you have chosen the right form.

- When the form is not what you are looking for, utilize the Look for area to discover the form that fits your needs and needs.

- Once you find the correct form, click on Acquire now.

- Select the costs program you desire, fill in the specified information to produce your money, and purchase the transaction with your PayPal or Visa or Mastercard.

- Choose a handy file structure and download your version.

Locate all the papers themes you might have bought in the My Forms menu. You can aquire a more version of Puerto Rico Articles of Incorporation, Not for Profit Organization, with Tax Provisions whenever, if possible. Just go through the needed form to download or printing the papers template.

Use US Legal Forms, the most extensive assortment of legal forms, in order to save efforts and prevent faults. The services provides professionally manufactured legal papers themes which can be used for a range of functions. Produce your account on US Legal Forms and initiate creating your life a little easier.

Form popularity

FAQ

As has been widely reported, Puerto Rico's Act #20 and Act #22 provides incentives for high net worth U.S. citizens to move to Puerto Rico and potentially reduce their 39.6% federal income tax (plus any applicable state tax) to a 0% ? 4% Puerto Rico income tax rate.

Law 68: Promotes acquisition and investment into the housing market on the island LEARN MORE. Law 187: Exempts buyers from paying property taxes for five years as well as certain closing costs for the purchase of the new residence as a primary residence, second home or investment property.

Register with Hacienda and Suri. Hacienda is the Department of Treasury in Puerto Rico, and Suri is the Department of Consumer Affairs. Both agencies regulate non-profits in Puerto Rico, and you will need to register with them in order to operate legally.

Therefore, in many cases, a U.S. citizen or resident cannot avoid U.S. income taxation on gains associated with appreciation in investment assets by establishing bona fide residence in Puerto Rico unless recognized after 10 years of bona fide residence in Puerto Rico.

Before conducting business locally, all corporations or limited liability companies must register at the Puerto Rico State Department. Puerto Rico corporations are treated as foreign corporations for U.S. income tax purposes.

Act 60 was intended to boost the Puerto Rican economy by encouraging mainland U.S. citizens to do business and live in Puerto Rico, and as is the case with many incentive programs, the opportunity and temptation to abuse these programs has led some to do just that.

A domestic corporation is taxable in Puerto Rico on its worldwide income. A foreign corporation engaged in trade or business in Puerto Rico is taxed at the regular corporate tax rates on income from Puerto Rico sources that is effectively connected income.

Attention all property owners in Puerto Rico! Don't forget that your property tax bills are due at the end of this month, January 2023. As a reminder, property taxes in Puerto Rico are paid twice a year, with the first installment due at the end of June and the second at the end of January.