Puerto Rico Inventory Report

Description

How to fill out Inventory Report?

US Legal Forms - one of the most extensive collections of legal documents in the United States - offers numerous legal document formats that you can download or print.

By using the website, you can find thousands of forms for business and personal use, organized by categories, states, or keywords. You can access the most recent versions of forms like the Puerto Rico Inventory Report in just minutes.

If you already have an account, Log In to download the Puerto Rico Inventory Report from your US Legal Forms library. The Download button will appear on every document you view. You have access to all previously acquired forms in the My documents section of your account.

Process the transaction. Use your credit card or PayPal account to finalize the purchase.

Select the format and obtain the document to your device. Make edits. Complete, modify, and print and sign the downloaded Puerto Rico Inventory Report. Every template saved in your account has no expiration date and belongs to you permanently. So, if you want to download or print another copy, simply go back to the My documents section and click on the form you need.

Access the Puerto Rico Inventory Report with US Legal Forms, one of the most extensive collections of legal document formats. Utilize a multitude of professional and state-specific formats that meet your business or personal requirements and preferences.

- Ensure you have chosen the correct form for your area/county.

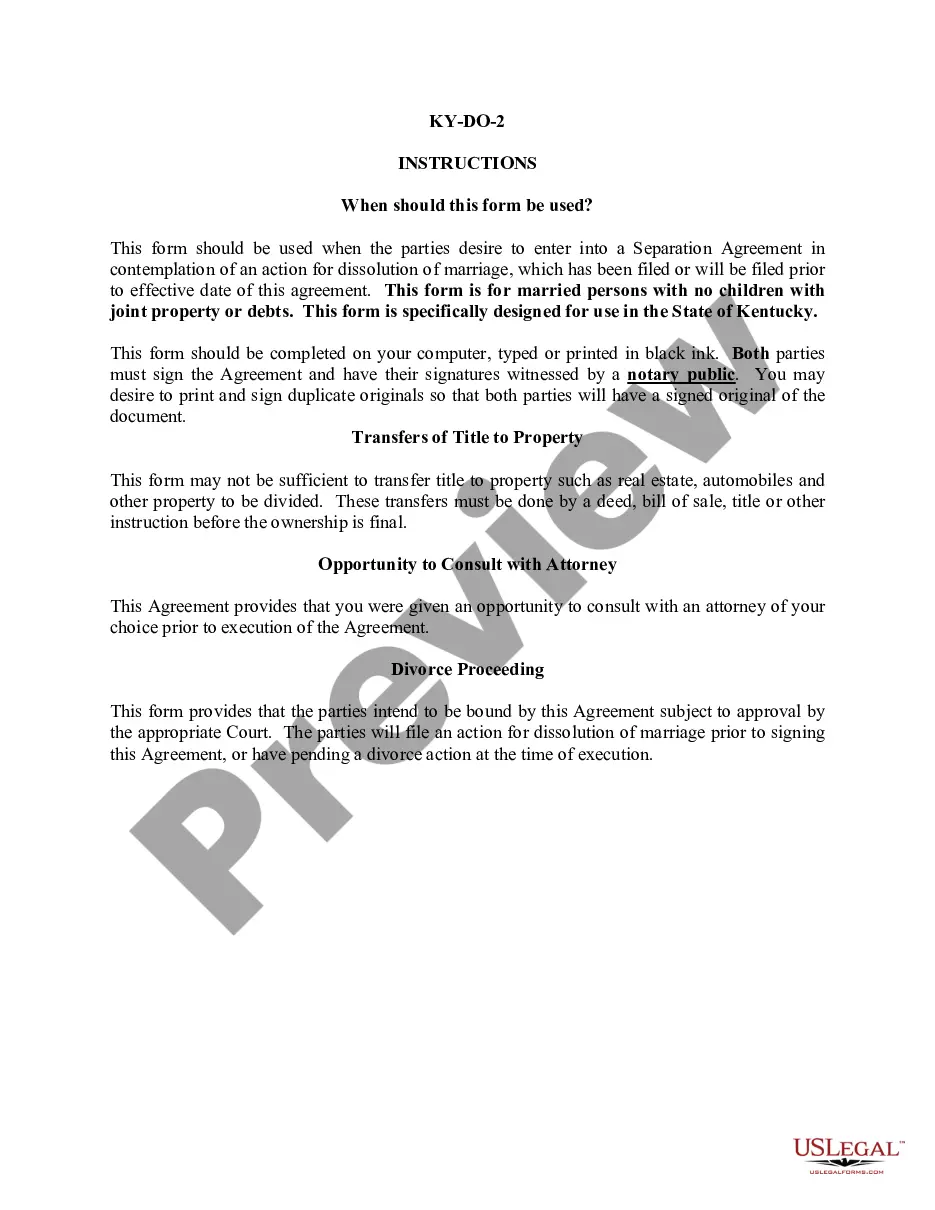

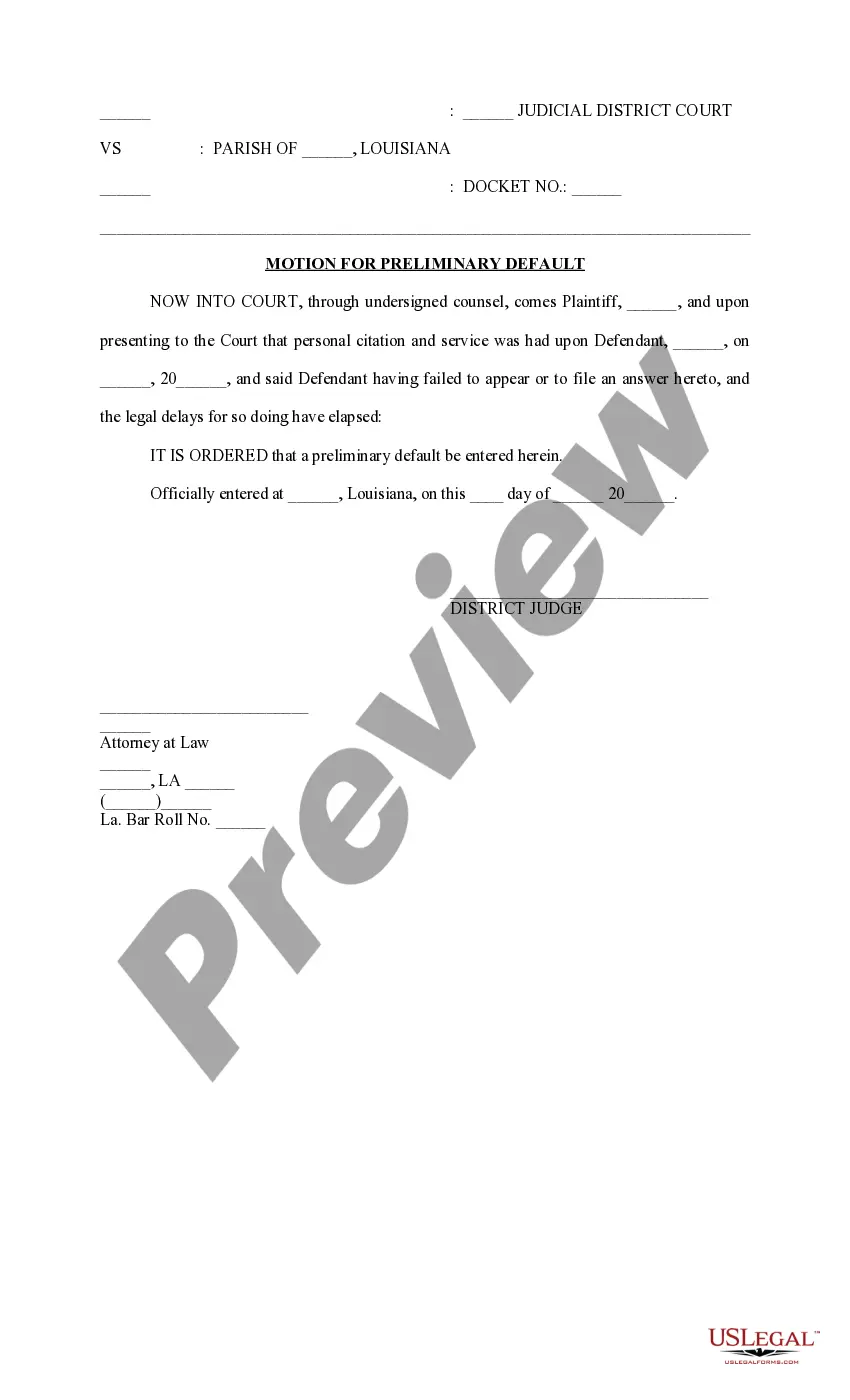

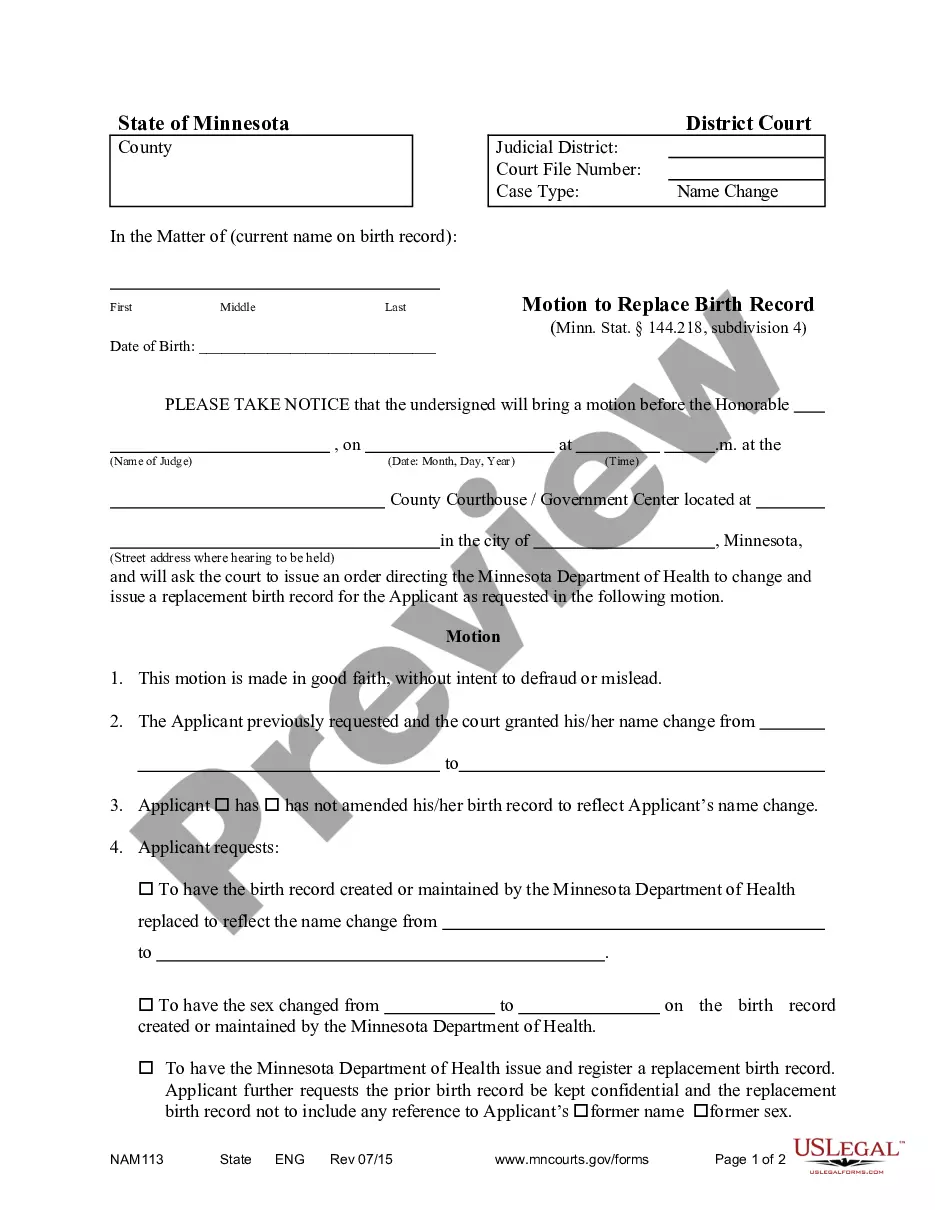

- Click the Review button to examine the form's contents.

- Read the form description to confirm you have selected the right document.

- If the form does not fulfill your requirements, utilize the Search field at the top of the screen to find one that does.

- If you are satisfied with the document, affirm your selection by clicking the Buy now button.

- Then, select the pricing plan you prefer and enter your information to create an account.

Form popularity

FAQ

To report Puerto Rico income, residents must file a Puerto Rico income tax return with the Department of Treasury. It's important to gather all relevant documents, such as your Puerto Rico Inventory Report, to ensure your income is reported accurately and on time. Consider using professional tax services to guide you through the process, ensuring you maximize any applicable deductions.

In Puerto Rico, the equivalent of the 1099 form is referred to as the ‘Informative Return’ or ‘Planilla de Información’. This form is used to report income to the Puerto Rico Department of Treasury. Utilizing an accurate Puerto Rico Inventory Report can help in generating and submitting these Informative Returns easily, ensuring you meet all requirements.

The requirement to file a Foreign Bank Account Report (FBAR) applies to residents with financial accounts outside of the US. Since Puerto Rico is a US territory, US citizens living there typically do not need to file an FBAR for their Puerto Rico accounts. Ensuring compliance with FBAR regulations is critical, and your Puerto Rico Inventory Report can aid in managing your financial records effectively.

Income generated in Puerto Rico by its residents is generally not subject to US federal income tax. However, individuals must still report their Puerto Rico income on their tax returns. It's crucial to assess your specific situation to determine any potential tax obligations to avoid penalties. A Puerto Rico Inventory Report can facilitate accurate reporting of income and enhance tax preparedness.

The IRS maintains specific regulations regarding Puerto Rico, treating it as a territory rather than a state. This means that while some IRS rules apply, others differ significantly. Understanding these distinctions is essential for citizens and businesses operating in Puerto Rico to ensure compliance. For many, utilizing a Puerto Rico Inventory Report can help navigate these complexities.

To file Puerto Rico sales tax, you must register for a sales tax permit with the Treasury Department. After registering, gather necessary sales data to complete your tax forms accurately. Ensure that your records, including the Puerto Rico Inventory Report, are up to date to reflect your sales accurately. You can file your sales tax online through the Treasury's eServices platform, making the process more efficient.

The annual report of Puerto Rico is a document that provides a summary of your company's activities and financial performance over the year. It highlights key financial data, including profits, losses, and the composition of assets, which should be reflected in your Puerto Rico Inventory Report. Filing this report is mandatory for maintaining compliance with local laws and supports your business's credibility.

To file your Puerto Rico annual report online, visit the Department of State's official website and navigate to the business services section. You will need to log in using your credentials, or create an account if you do not have one. Fill out the form accurately and have your Puerto Rico Inventory Report ready to input any required details about your assets. Submit the report once completed to finalize the process.

If you neglect to file an annual report for your LLC in Puerto Rico, your business may face fines and penalties. Additionally, your LLC may lose its good standing status, which can complicate future business dealings. It's crucial to maintain accurate records, such as your Puerto Rico Inventory Report, to ensure compliance with state regulations. Regular filing helps demonstrate your commitment to business responsibilities.

Filing an annual report in Puerto Rico involves accessing the online portal of the Department of State. You will need to provide essential company information, including your business address and financial details. Be sure to review your Puerto Rico Inventory Report, as it will detail your company assets and liabilities. Submit your report before the deadline to avoid penalties.