Puerto Rico Barter Bill of Sale

Description

How to fill out Barter Bill Of Sale?

It is feasible to spend hours online attempting to locate the legal document template that meets the state and federal specifications you need.

US Legal Forms provides thousands of legal forms that are assessed by experts.

You can conveniently download or print the Puerto Rico Barter Bill of Sale from our service.

If available, use the Review button to examine the document template as well.

- If you have a US Legal Forms account, you can Log In and click on the Download button.

- After that, you can complete, edit, print, or sign the Puerto Rico Barter Bill of Sale.

- Every legal document template you purchase is yours indefinitely.

- To obtain another copy of the acquired form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the easy steps below.

- First, ensure that you have selected the correct document template for the county/area of your choice.

- Review the form outline to make sure you selected the appropriate form.

Form popularity

FAQ

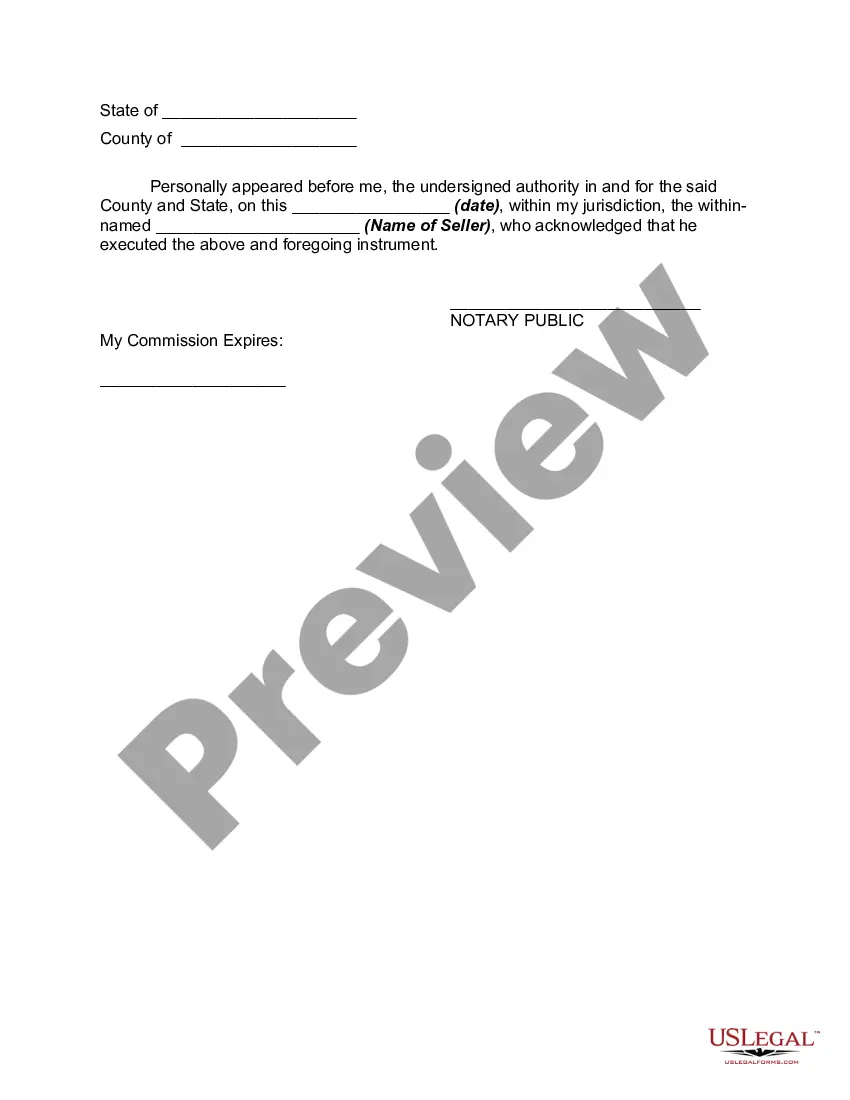

Yes, both parties typically need to be present for notarization of a Puerto Rico Barter Bill of Sale. This requirement helps ensure that both individuals willingly agree to the terms outlined in the document. If one party cannot be present, alternative arrangements may need to be made, such as remote notarization options available in some states.

In Oklahoma, a bill of sale does not have to be notarized for it to be considered valid. However, notarization can serve as an added layer of protection against disputes. For transactions involving significant values or vehicles, it's wise to consult local laws or seek legal advice.

A Puerto Rico Barter Bill of Sale is legal even if it is not notarized, but notarization can strengthen the document's validity. The primary requirement is that both parties agree to the terms and sign the document. To avoid potential disputes down the line, consider having the bill of sale notarized, especially for higher-value items.

Yes, you can obtain a title with a handwritten Puerto Rico Barter Bill of Sale, but requirements can vary by state. Generally, you will need to present the bill of sale along with any additional paperwork required by the Department of Motor Vehicles or relevant authority. It's a good practice to check local regulations to ensure a smooth process.

A handwritten Puerto Rico Barter Bill of Sale is indeed legitimate as long as it contains accurate information and is signed by both parties. While it's always recommended to keep it clear and concise, the legality is maintained through mutual agreement. For added assurance, consider documenting the transaction with witnesses.

Filing your Puerto Rico annual report online is a straightforward process. You need to visit the Department of State's website and navigate to their business filing section. After filling out the required forms and submitting them, make sure to keep copies for your records. Maintaining your business compliance is key, especially when handling matters related to the Puerto Rico Barter Bill of Sale.

Yes, Puerto Rico offers sales tax exemption certificates for certain entities and transactions. Non-profit organizations and specific purchases may qualify for these exemptions. If your transaction involves the Puerto Rico Barter Bill of Sale and you believe you qualify for an exemption, be sure to obtain and present the appropriate certificate to avoid unnecessary taxes.

To establish a sales tax nexus in Puerto Rico, your business must have a physical presence, such as an office or warehouse, or engage in economic activities that exceed certain thresholds. Activities like making sales or delivering goods within Puerto Rico can create a nexus. Understanding these requirements is essential, especially when documenting your sales under the Puerto Rico Barter Bill of Sale.

Filing a DBA, or 'Doing Business As,' in Puerto Rico requires a few steps. First, you should check the availability of your desired business name through the Department of State. Once confirmed, fill out the necessary application and submit it to the appropriate local office. This process is important for formalizing your transactions, including those involving the Puerto Rico Barter Bill of Sale.

The sales tax in Puerto Rico for business-to-business transactions is currently set at 11.5%. This tax applies to the sale of tangible personal property and certain services. When engaging in transactions such as the Puerto Rico Barter Bill of Sale, it is crucial to include this tax in your calculations to ensure compliance with local regulations.