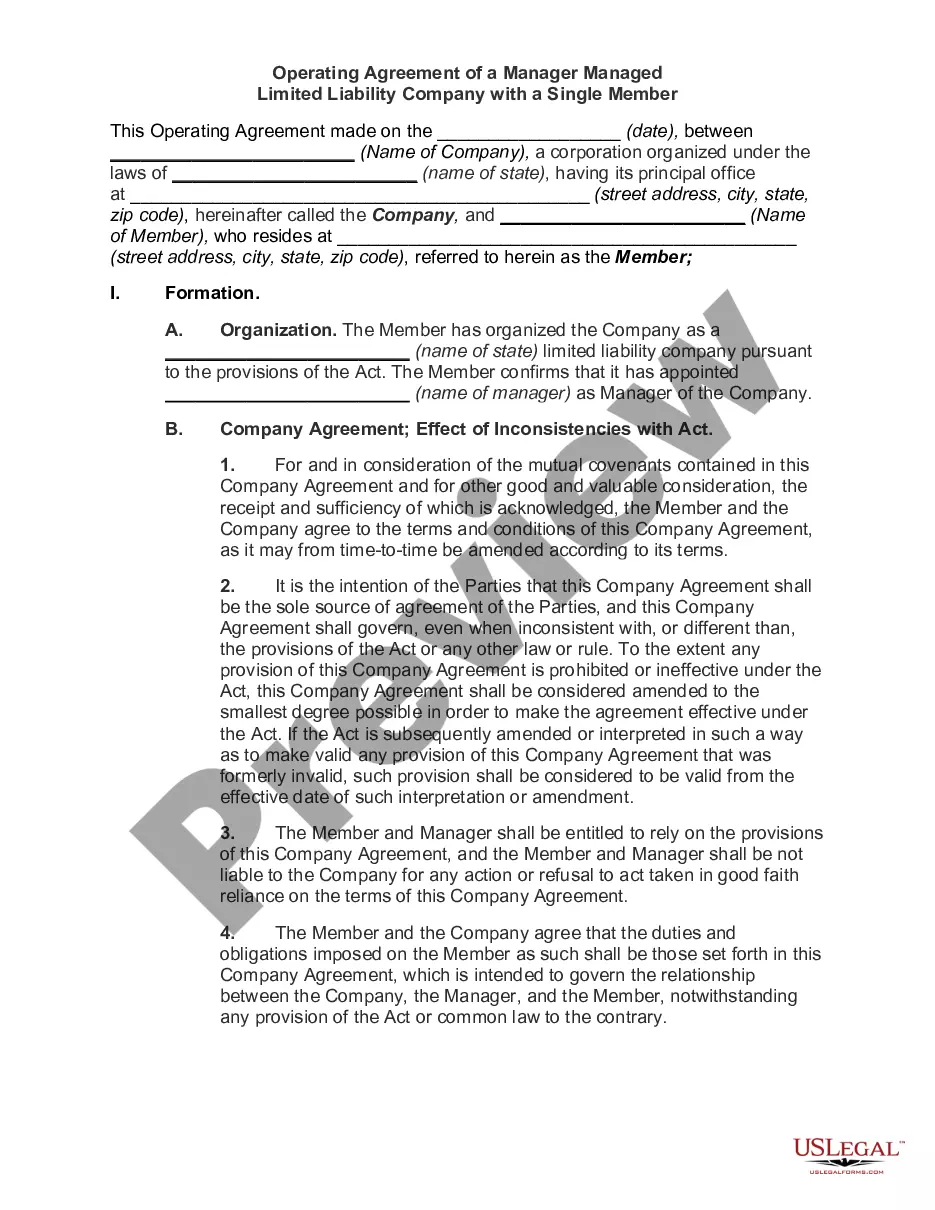

If you want to full, download, or print out legitimate record templates, use US Legal Forms, the largest selection of legitimate forms, which can be found on the Internet. Use the site`s easy and handy research to obtain the documents you will need. Different templates for organization and person purposes are sorted by categories and says, or search phrases. Use US Legal Forms to obtain the Puerto Rico Operating Agreement for States who have Adopted the Uniform Limited Liability Act and the Revised Uniform Limited Liability Act in just a handful of mouse clicks.

If you are previously a US Legal Forms customer, log in in your accounts and then click the Acquire key to find the Puerto Rico Operating Agreement for States who have Adopted the Uniform Limited Liability Act and the Revised Uniform Limited Liability Act. You may also gain access to forms you in the past downloaded within the My Forms tab of your own accounts.

Should you use US Legal Forms for the first time, follow the instructions beneath:

- Step 1. Ensure you have chosen the form for that correct city/nation.

- Step 2. Make use of the Preview option to check out the form`s articles. Never overlook to read the information.

- Step 3. If you are unhappy with the kind, make use of the Research discipline towards the top of the monitor to discover other versions from the legitimate kind template.

- Step 4. Upon having located the form you will need, go through the Purchase now key. Choose the rates plan you favor and include your accreditations to register on an accounts.

- Step 5. Method the financial transaction. You can utilize your credit card or PayPal accounts to finish the financial transaction.

- Step 6. Find the format from the legitimate kind and download it on the product.

- Step 7. Full, revise and print out or indication the Puerto Rico Operating Agreement for States who have Adopted the Uniform Limited Liability Act and the Revised Uniform Limited Liability Act.

Each legitimate record template you acquire is yours forever. You possess acces to each kind you downloaded in your acccount. Select the My Forms area and select a kind to print out or download again.

Contend and download, and print out the Puerto Rico Operating Agreement for States who have Adopted the Uniform Limited Liability Act and the Revised Uniform Limited Liability Act with US Legal Forms. There are millions of skilled and express-specific forms you may use for your organization or person requires.