Puerto Rico Bill of Sale of Goods or Personal Property with Covenants

Description

How to fill out Bill Of Sale Of Goods Or Personal Property With Covenants?

Have you ever found yourself in a situation where you require documentation for either business or personal purposes nearly every day.

There is a wide array of legal document templates available online, but finding reliable ones can be challenging.

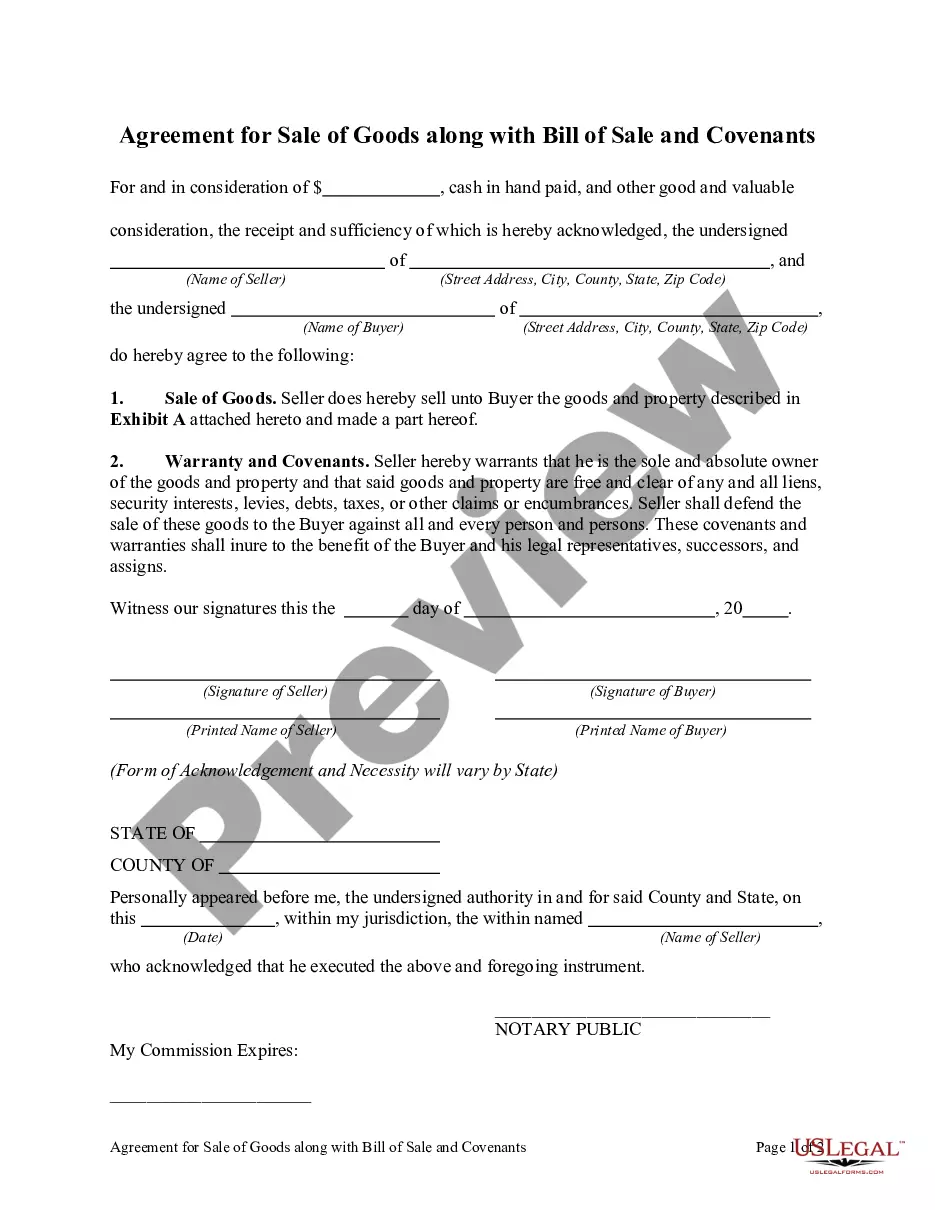

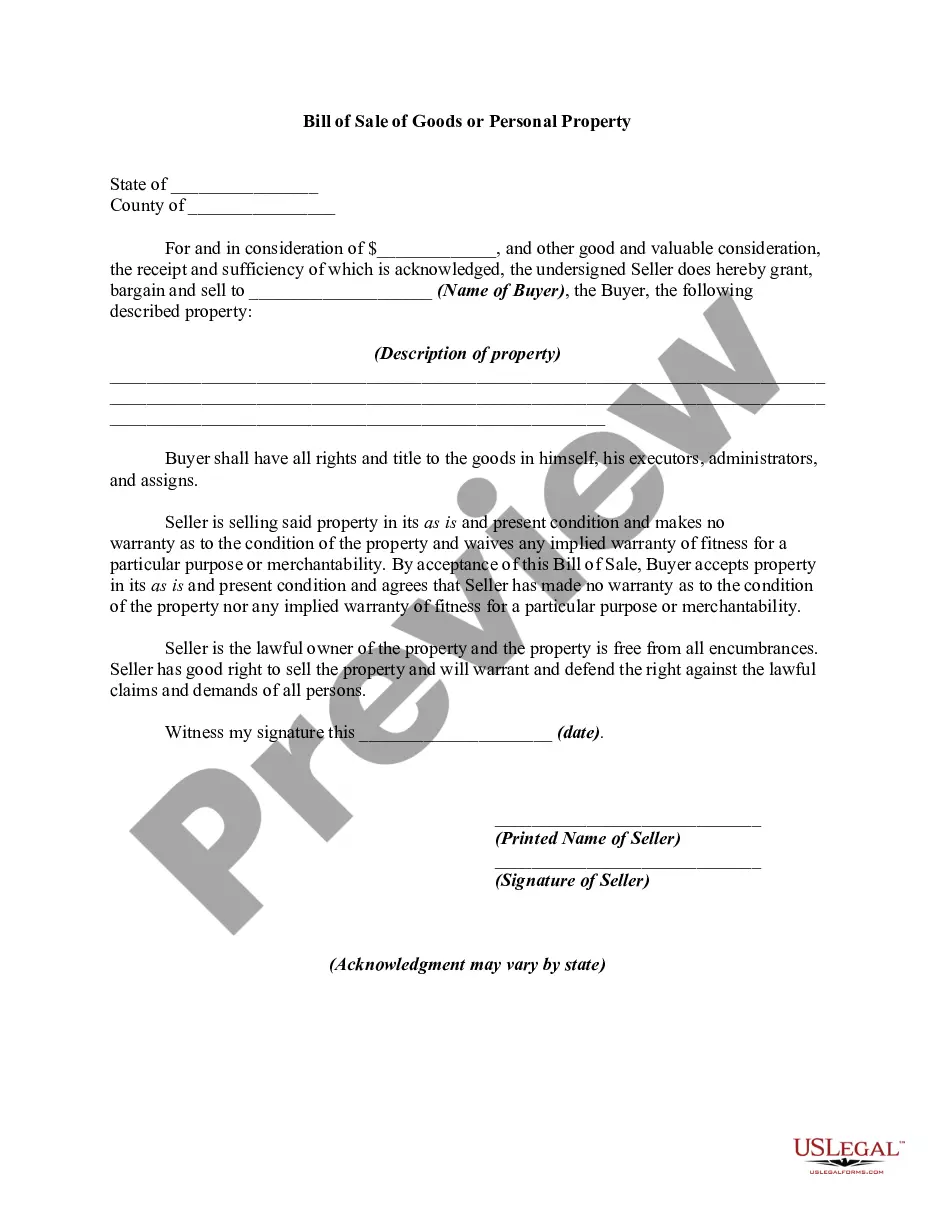

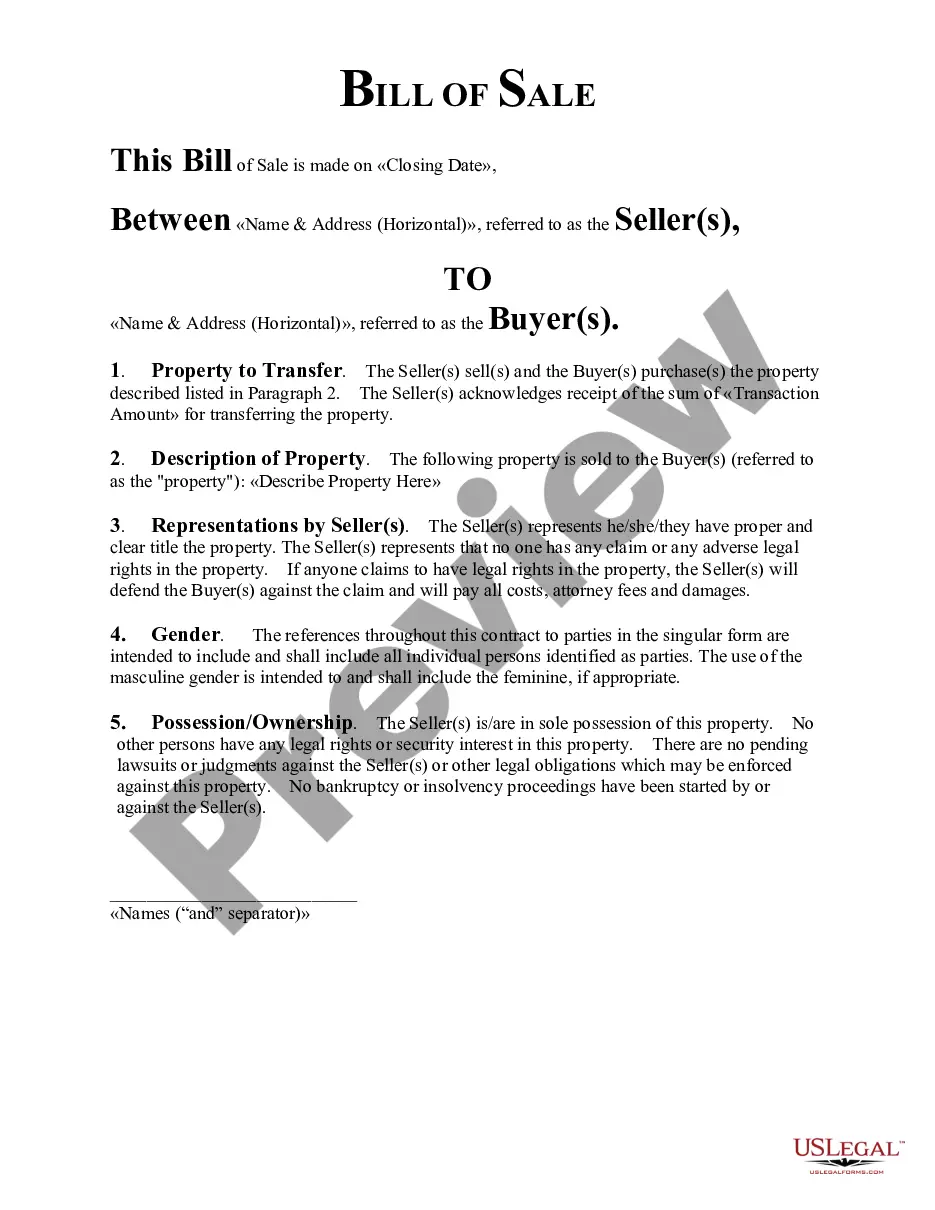

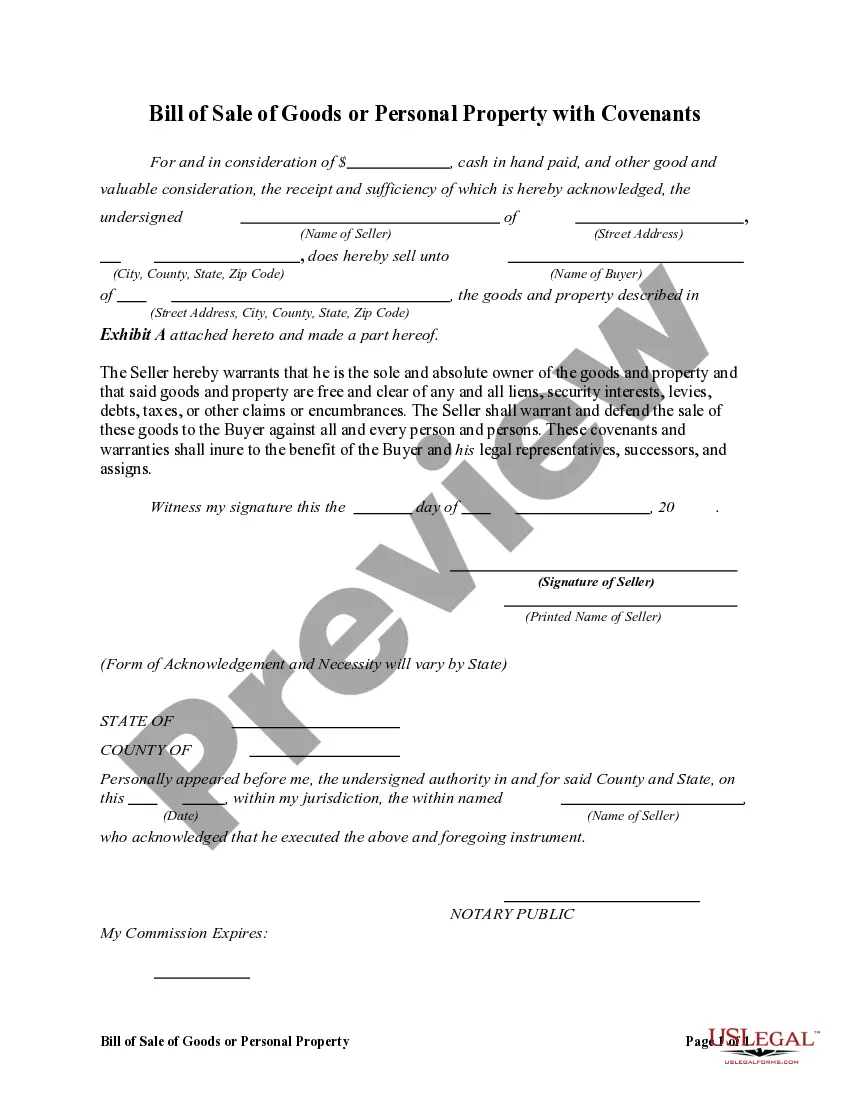

US Legal Forms provides thousands of template forms, such as the Puerto Rico Bill of Sale of Goods or Personal Property with Covenants, crafted to comply with state and federal regulations.

Once you find the appropriate form, click Get now.

Choose the pricing plan you prefer, fill in the necessary information to create your account, and complete the purchase using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Puerto Rico Bill of Sale of Goods or Personal Property with Covenants template.

- If you do not have an account and wish to begin utilizing US Legal Forms, follow these steps.

- Select the form you need and ensure it is for the correct city/state.

- Use the Preview button to examine the form.

- Review the summary to confirm you have chosen the right form.

- If the form is not what you are looking for, use the Lookup field to find the form that meets your requirements.

Form popularity

FAQ

Yes, a license is mandatory to sell real estate in Puerto Rico. This requirement ensures that real estate transactions are conducted legally and ethically. If you plan to facilitate real estate sales, consider incorporating a Puerto Rico Bill of Sale of Goods or Personal Property with Covenants to protect the interests of all parties involved.

Act 60, also known as the Incentives Code, provides various tax incentives to attract businesses to Puerto Rico. This Act encourages business development and investment in the region. If you're considering setting up a business that involves a Puerto Rico Bill of Sale of Goods or Personal Property with Covenants, understanding the implications of Act 60 can be beneficial for your long-term success.

Getting a seller's permit in Puerto Rico involves completing an application through the Department of Treasury. You will need to provide details about your business, including your tax identification number. Once you receive your seller's permit, you are prepared to create a Puerto Rico Bill of Sale of Goods or Personal Property with Covenants to facilitate your sales transactions.

To obtain a merchant certificate in Puerto Rico, you need to register your business with the Department of Treasury. This process includes submitting necessary documentation and paying any associated fees. Having this certificate is crucial for conducting transactions that involve a Puerto Rico Bill of Sale of Goods or Personal Property with Covenants, as it establishes your legitimacy as a vendor.

Yes, Puerto Rico does provide resale certificates. These certificates are essential for businesses buying goods for resale without paying sales tax up front. To effectively use a Puerto Rico Bill of Sale of Goods or Personal Property with Covenants, you may need to present a resale certificate to avoid tax on products intended for resale.

A vendor's license and a seller's permit serve similar purposes but are not identical. A vendor's license typically allows you to operate as a seller, while a seller's permit allows you to collect sales tax on goods sold. If you're engaging in transactions that involve a Puerto Rico Bill of Sale of Goods or Personal Property with Covenants, you will need to ensure you have the correct paperwork in place.

Transferring a deed in Puerto Rico involves a few critical steps, starting with drafting a sales contract. After both parties sign, you must present the contract to a notary public to officially execute the deed. This is where a Puerto Rico Bill of Sale of Goods or Personal Property with Covenants may come into play. It ensures that obligations and agreements are clear, protecting all parties involved during the transfer process.

Inheritance laws in Puerto Rico dictate that property typically passes to legal heirs according to established guidelines. Generally, spouses and children have primary rights to inherit property. If you want to ensure a smooth transition of your assets, using a Puerto Rico Bill of Sale of Goods or Personal Property with Covenants can help clarify ownership and intentions. Consulting legal advice is key to understanding your family's rights in these situations.

Yes, US citizens can own property in Puerto Rico without any restrictions. Given Puerto Rico's status as a US territory, residents and non-residents alike can buy and sell property freely. It is advisable to consult a legal expert to navigate local laws, including the need for a Puerto Rico Bill of Sale of Goods or Personal Property with Covenants. This document helps protect both the buyer’s and seller’s interests.

The property sale tax in Puerto Rico varies based on the transaction and location. While there is no direct property tax specifically on sales, buyers and sellers should consider potential transfer taxes. These taxes apply during property transfers and can significantly affect overall costs. Utilizing a Puerto Rico Bill of Sale of Goods or Personal Property with Covenants ensures that all legal obligations during the sale are met.