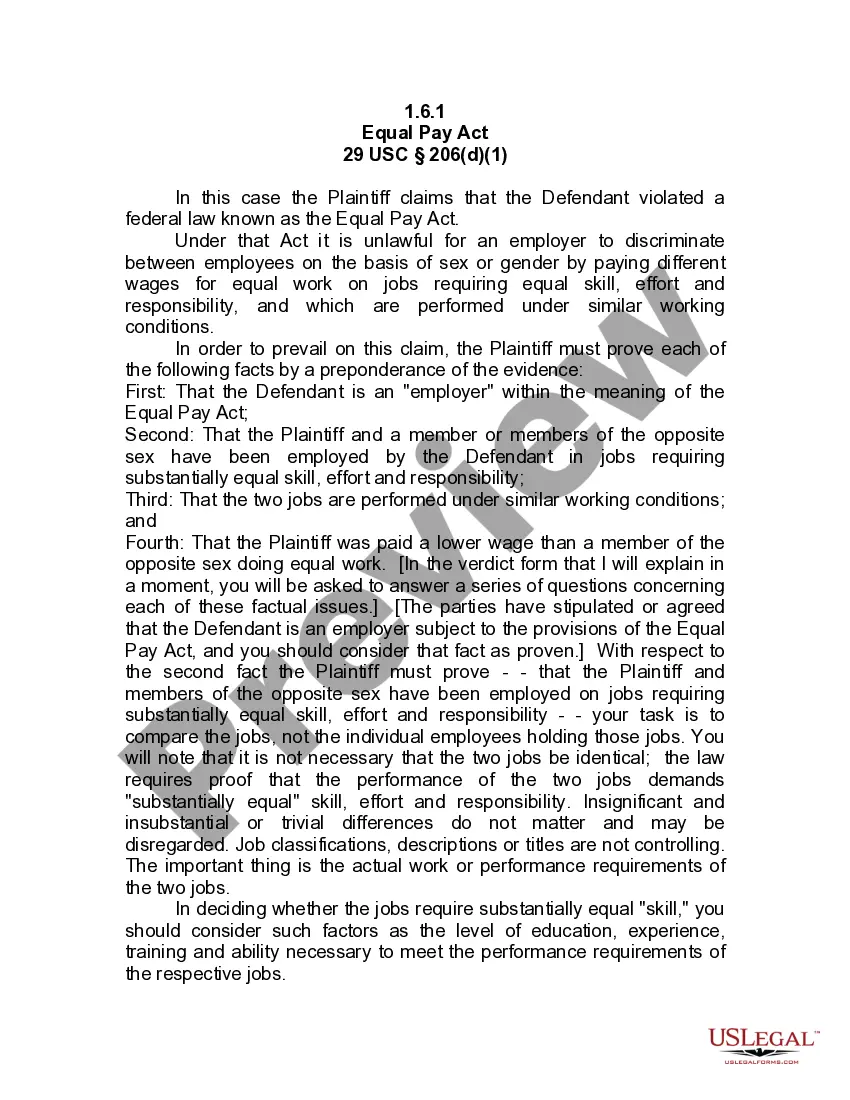

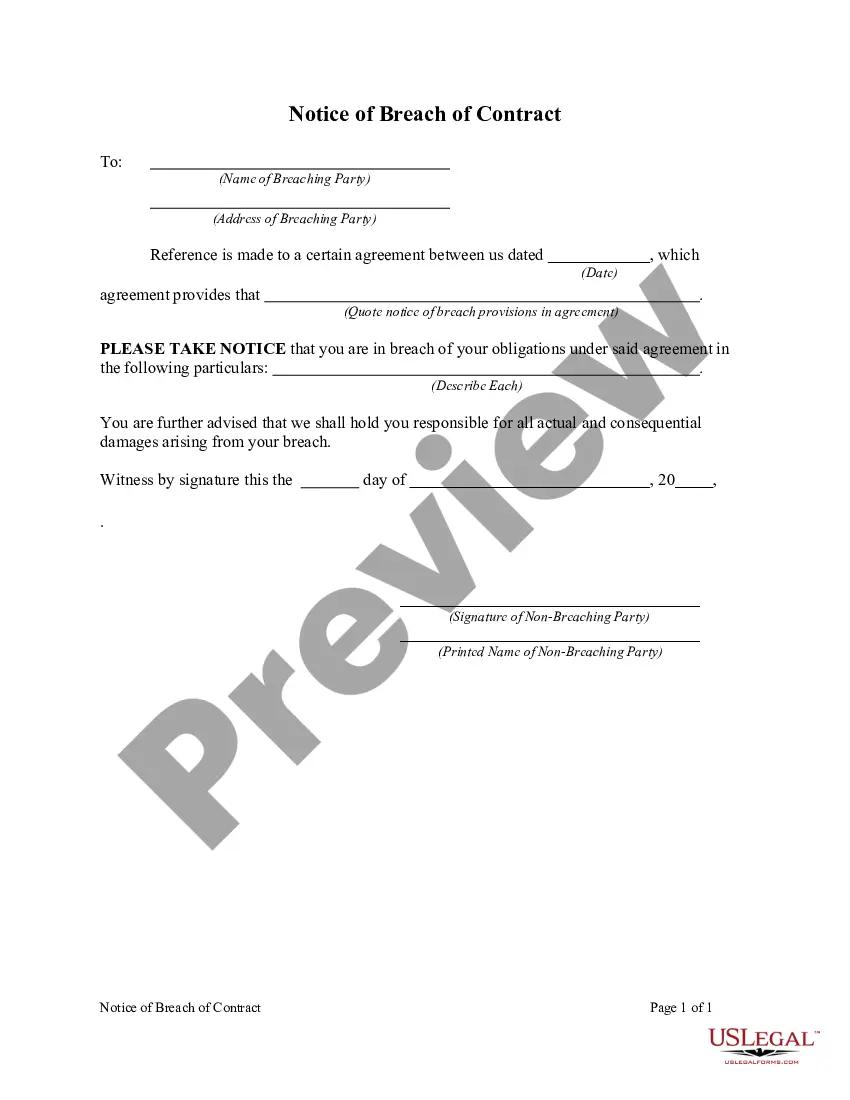

Under the Fair Credit Reporting Act, whenever credit or insurance for personal, family, or household purposes, or employment involving a consumer is denied, or the charge for such credit or insurance is increased, either wholly or partly because of information contained in a consumer report from a consumer reporting agency, the user of the consumer report must:

notify the consumer of the adverse action,

identify the consumer reporting agency making the report, and

notify the consumer of the consumer's right to obtain a free copy of a consumer report on the consumer from the consumer reporting agency and to dispute with the reporting agency the accuracy or completeness of any information in the consumer report furnished by the agency.

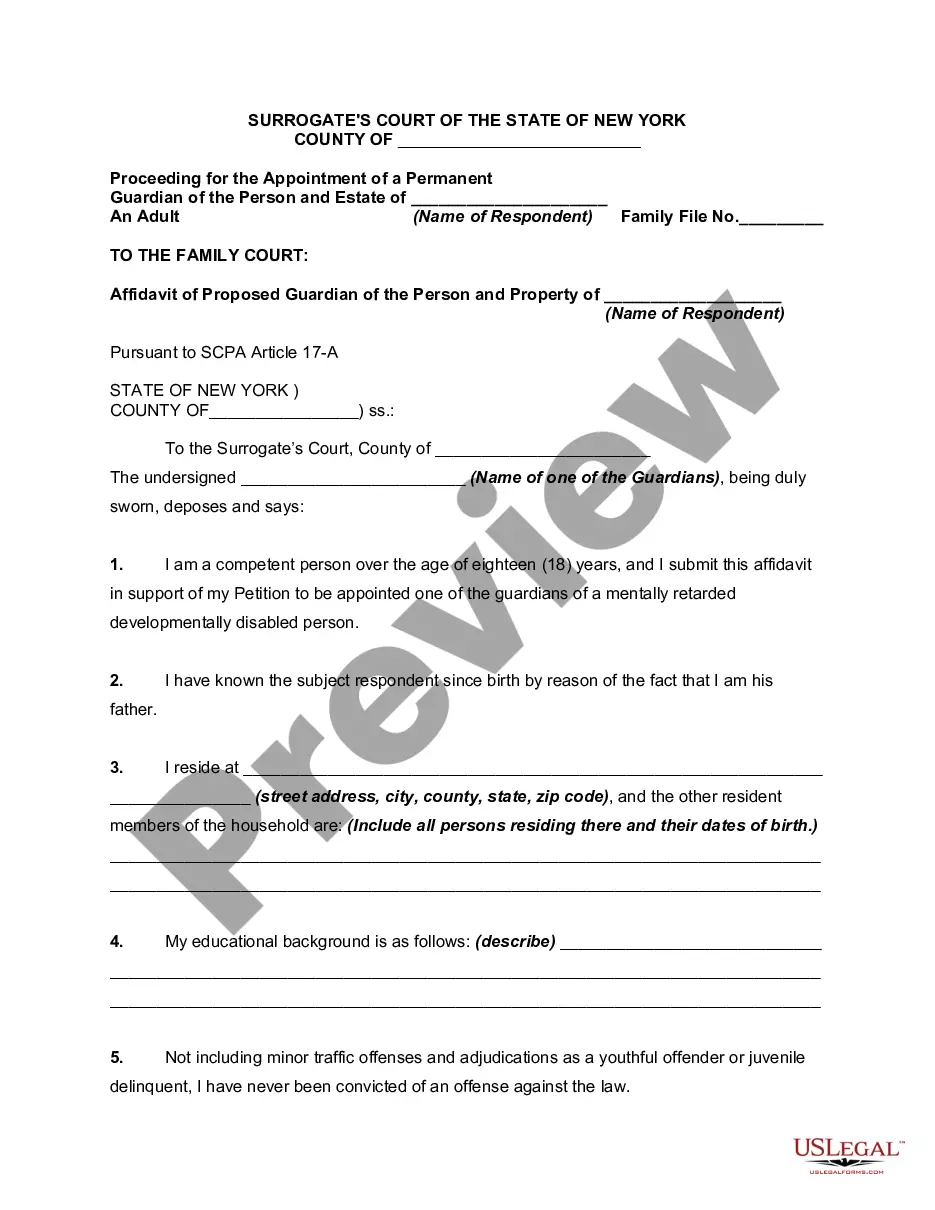

Puerto Rico Notice of Increase in Charge for Credit or Insurance Based on Information Received From Consumer Reporting Agency

Description

How to fill out Notice Of Increase In Charge For Credit Or Insurance Based On Information Received From Consumer Reporting Agency?

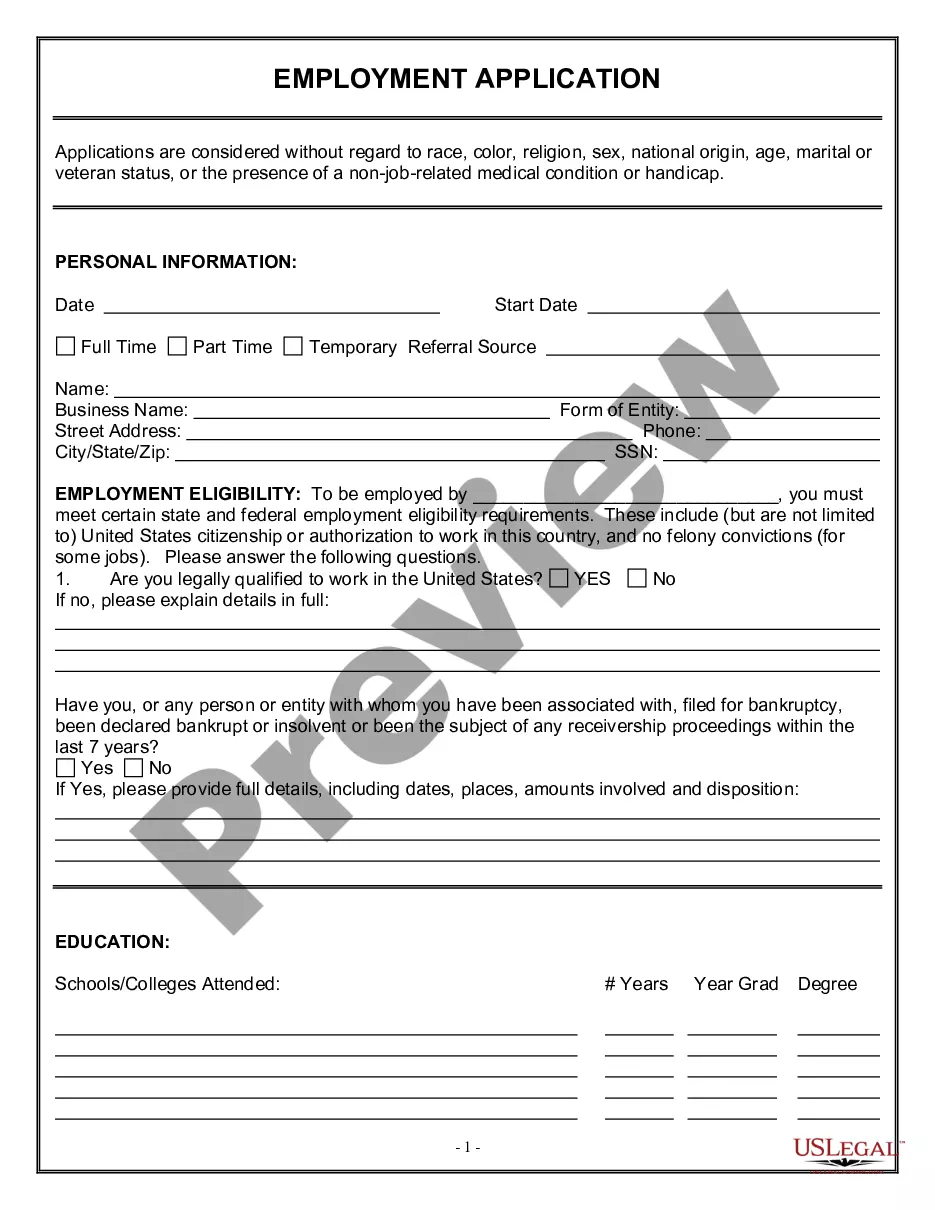

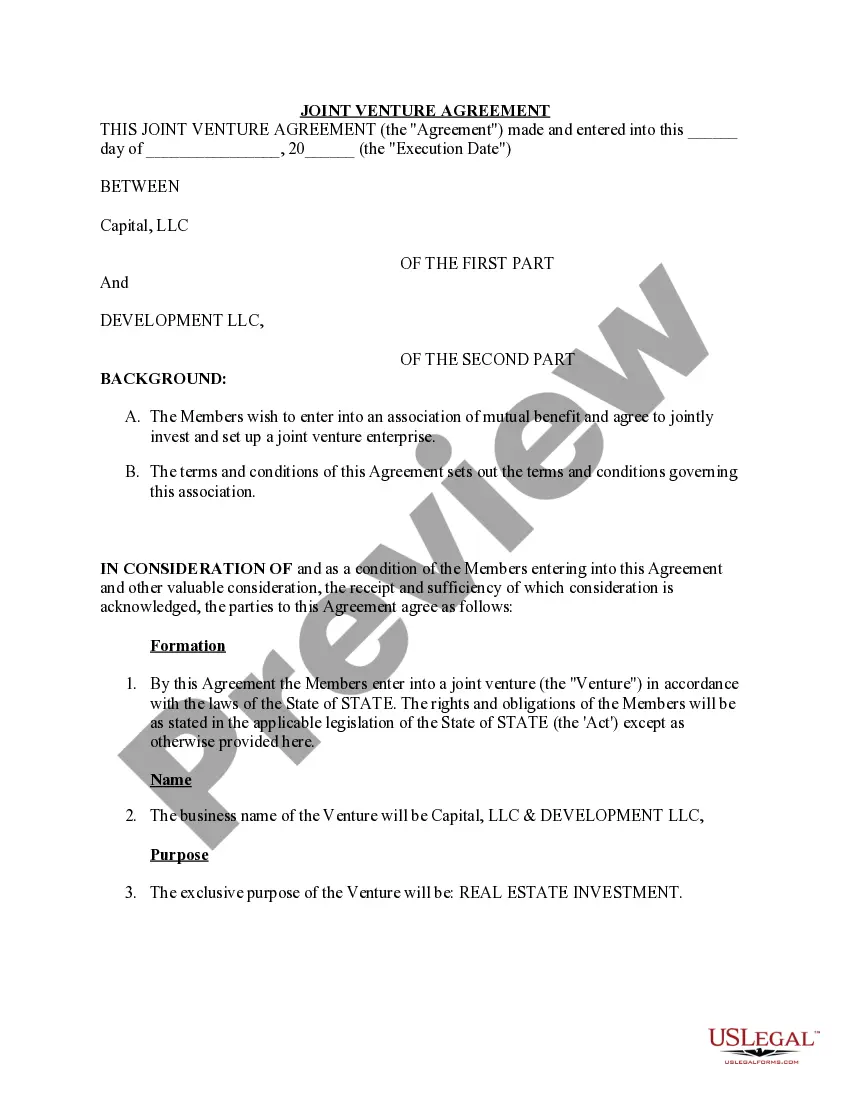

Are you inside a position where you will need documents for sometimes business or personal uses virtually every working day? There are a variety of lawful record themes available online, but finding types you can trust isn`t straightforward. US Legal Forms offers 1000s of kind themes, like the Puerto Rico Notice of Increase in Charge for Credit or Insurance Based on Information Received From Consumer Reporting Agency, which are published to satisfy federal and state needs.

When you are presently familiar with US Legal Forms web site and possess a free account, just log in. After that, you may obtain the Puerto Rico Notice of Increase in Charge for Credit or Insurance Based on Information Received From Consumer Reporting Agency format.

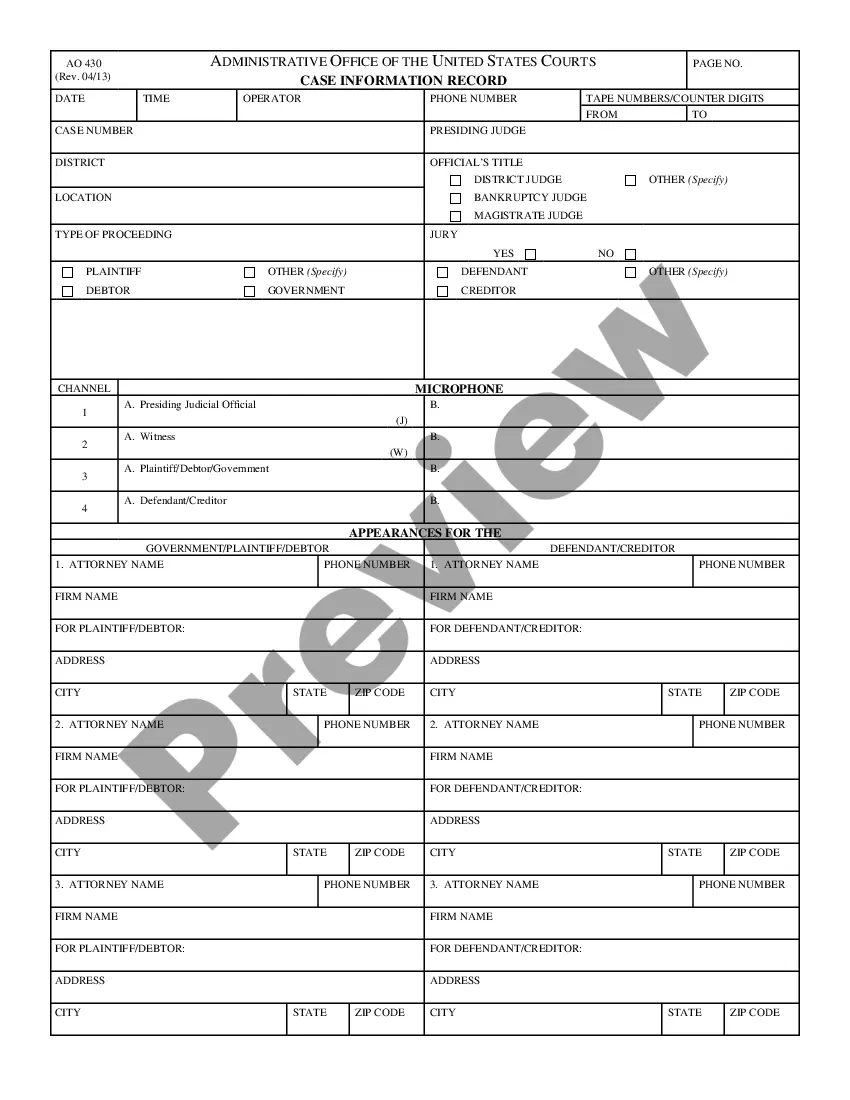

If you do not offer an bank account and want to start using US Legal Forms, follow these steps:

- Obtain the kind you will need and ensure it is for your proper town/county.

- Make use of the Review key to analyze the shape.

- Read the outline to ensure that you have chosen the proper kind.

- In the event the kind isn`t what you are looking for, make use of the Look for discipline to find the kind that meets your requirements and needs.

- Once you obtain the proper kind, click on Purchase now.

- Pick the prices plan you would like, submit the necessary details to generate your money, and buy the transaction making use of your PayPal or credit card.

- Select a convenient document formatting and obtain your copy.

Discover each of the record themes you may have purchased in the My Forms menus. You can aquire a extra copy of Puerto Rico Notice of Increase in Charge for Credit or Insurance Based on Information Received From Consumer Reporting Agency whenever, if possible. Just click on the necessary kind to obtain or print the record format.

Use US Legal Forms, by far the most substantial variety of lawful forms, in order to save efforts and steer clear of blunders. The support offers expertly manufactured lawful record themes which can be used for a range of uses. Make a free account on US Legal Forms and begin making your daily life a little easier.

Form popularity

FAQ

The FCRA gives you the right to be told if information in your credit file is used against you to deny your application for credit, employment or insurance. The FCRA also gives you the right to request and access all the information a consumer reporting agency has about you (this is called "file disclosure").

Duty to Promptly Correct and Update Information. Section 623(a) of the FCRA also requires a person who regularly furnishes information to CRAs to promptly notify a CRA if the person determines the previously furnished information is not complete or accurate.

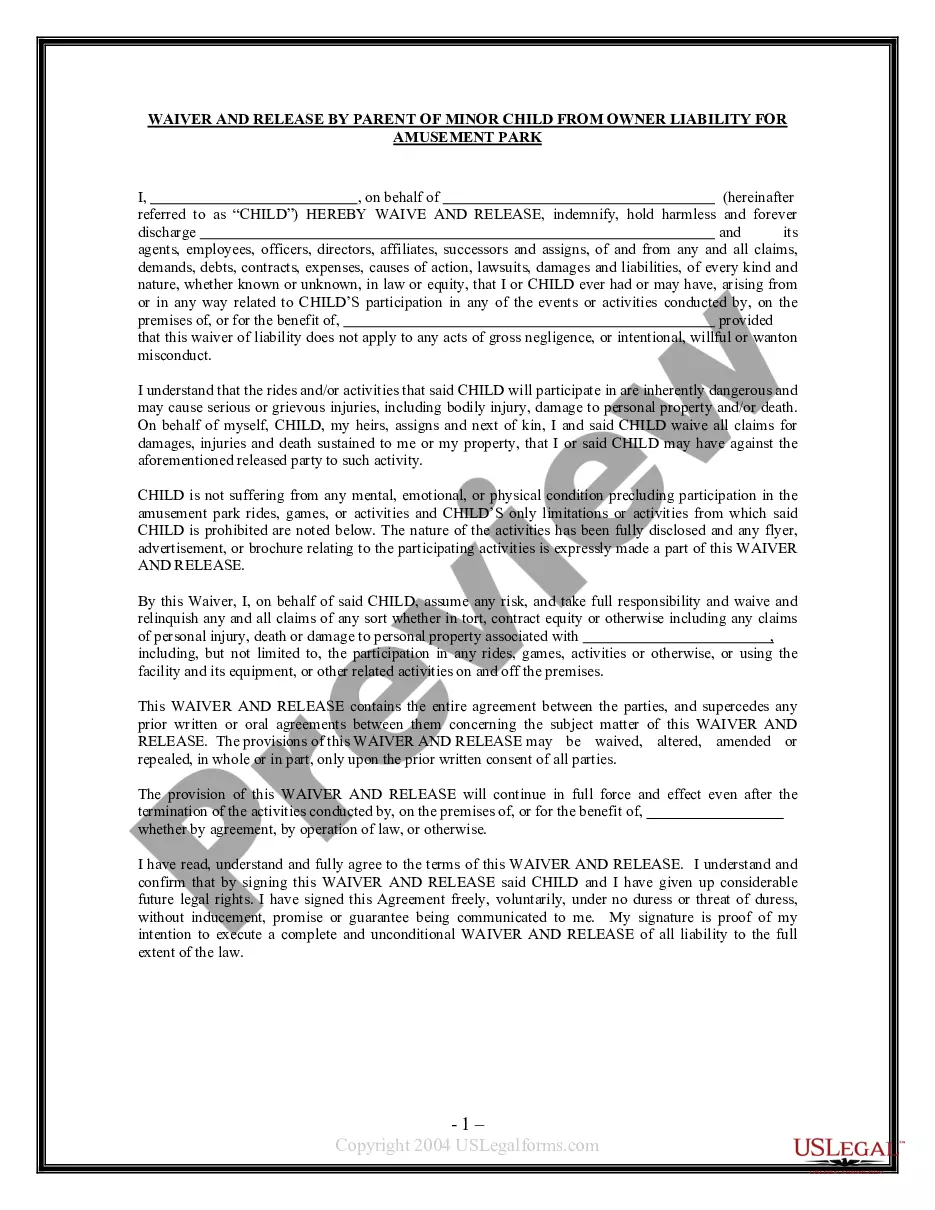

Thus, under the FCRA, certain consumer information will be subject to two opt-out notices, a sharing opt-out notice (Section 603(d)) and a marketing use opt-out notice (Section 624). These two opt-out notices may be consolidated. Federal Register to implement this section (72 FR 62910).

A dispute notice from a consumer must include: 1) Sufficient information to identify the account or other relationship that is in dispute, such as an account number and the name, address, and telephone number of the consumer; 2) The specific information that the consumer is disputing and an explanation of the basis for ...

The Fair Credit Reporting Act (FCRA), 15 U.S.C. 1681-1681y, requires that this notice be provided to inform users of consumer reports of their legal obligations. State law may impose additional requirements.

A 613 Letter serves as a notification that derogatory information was found in a criminal database background check that could influence their ability to be hired. Normally it is used to save time and money in verifying a record at the county court.

It may also include employment information, present and previous addresses, whether they have ever filed for bankruptcy or owe child support, and any arrest record. In some, but not all, instances, consumers must have initiated a transaction or agreed in writing before the credit bureau can release their report.

The FCRA specifies those with a valid need for access. You must give your consent for reports to be provided to employers. A consumer reporting agency may not give out information about you to your employer, or a potential employer, without your written consent given to the employer.