No particular language is necessary for the acceptance or rejection of a claim or for subsequent notices and reports so long as the instruments used clearly convey the necessary information.

Puerto Rico Rejection of Claim and Report of Experience with Debtor

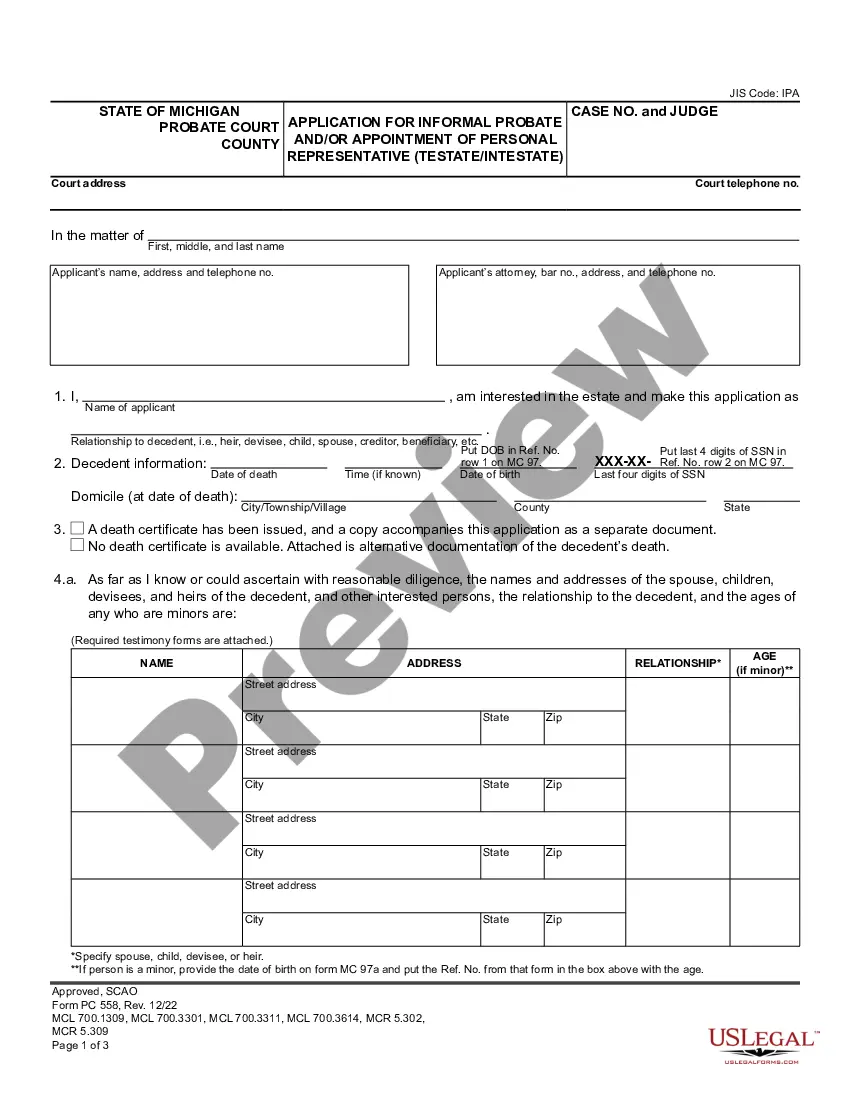

Description

How to fill out Rejection Of Claim And Report Of Experience With Debtor?

Selecting the appropriate legal document template can be challenging.

Certainly, there are numerous templates available online, but how do you find the legal form you need.

Access the US Legal Forms website.

If you are a new user of US Legal Forms, here are simple steps you can take: First, ensure that you have selected the correct form for your city or area. You can preview the form using the Review button and read the description to confirm it is the right one for you. If the form does not meet your expectations, use the Search field to find the appropriate one. When you are confident that the form is satisfactory, click the Purchase now button to obtain the form. Choose the payment plan you prefer and enter the required information. Create your account and complete your order using your PayPal account or credit card. Select the document format and download the legal document template to your device. Complete, revise, print, and sign the downloaded Puerto Rico Rejection of Claim and Report of Experience with Debtor. US Legal Forms boasts the largest collection of legal forms where you can find a variety of document templates. Use the service to download professionally crafted documents that adhere to state standards.

- The service offers a vast array of templates, such as the Puerto Rico Rejection of Claim and Report of Experience with Debtor, suitable for both business and personal purposes.

- All forms are reviewed by professionals and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Download button to retrieve the Puerto Rico Rejection of Claim and Report of Experience with Debtor.

- Utilize your account to browse the legal forms you have previously purchased.

- Navigate to the My documents tab in your account to obtain another copy of the documents you need.

Form popularity

FAQ

If a creditor fails to file a proof of claim, they generally waive their right to collect on the debt in the bankruptcy proceeding. This means they will not receive any payment from the debtor's estate during the bankruptcy process, as outlined in the Puerto Rico Rejection of Claim and Report of Experience with Debtor. Consequently, it's vital for creditors to act promptly and ensure their claims are filed. For assistance and templates, you can rely on the US Legal platform to navigate these important procedures.

Typically, the creditor files the proof of claim in a bankruptcy case, as part of the Puerto Rico Rejection of Claim and Report of Experience with Debtor process. The creditor must submit this document to establish the amount of the debt owed. Filing a proof of claim is important for creditors to participate in the distribution of the debtor's assets. If you're unsure about the requirements, the US Legal platform offers resources to guide you.

In the context of the Puerto Rico Rejection of Claim and Report of Experience with Debtor, any interested party may object to a proof of claim. This usually includes the debtor, creditors, or other stakeholders with a valid interest in the case. If you believe that the claim filed is inaccurate or does not meet legal standards, you can raise an objection. This crucial step ensures that only legitimate claims are honored in the bankruptcy process.

The PROMESA law, or the Puerto Rico Oversight, Management, and Economic Stability Act, was enacted to address the island's financial crisis by providing oversight and restructuring options for its debts. This law creates a mechanism for fiscal reform and aims to stabilize Puerto Rico's economy. Understanding how PROMESA interacts with the Puerto Rico Rejection of Claim and Report of Experience with Debtor can help you navigate the complexities of financial claims effectively.

Garnishment law in Puerto Rico allows creditors to collect debts by seizing part of a debtor's wages or bank accounts. This process follows specific legal protocols to inform debtors and ensure their rights are maintained. If you're managing situations related to the Puerto Rico Rejection of Claim and Report of Experience with Debtor, being aware of these laws can provide valuable strategies for resolution.

The statute of limitations for collections in Puerto Rico is defined by the type of obligation but usually spans between 3 to 15 years. Timely action is essential; otherwise, debtors may lose the right to challenge claims due to expired time limits. For those navigating the Puerto Rico Rejection of Claim and Report of Experience with Debtor, understanding this timeframe is vital for protecting your interests.

The statute of limitations on debt in Puerto Rico varies depending on the type of debt, but it generally ranges from 3 to 15 years. This differentiation affects how long creditors can pursue collections. For individuals dealing with the Puerto Rico Rejection of Claim and Report of Experience with Debtor, this knowledge is imperative to ensure all legal rights and deadlines are respected.

In Puerto Rico, the statute of limitations on debt collection is typically 15 years. This means creditors must initiate legal action to collect debts within this timeframe. Understanding the statute of limitations is vital for those involved in Puerto Rico Rejection of Claim and Report of Experience with Debtor, as it sets a clear boundary for taking action.

Puerto Rico's debt crisis stems from a combination of economic downturns, high unemployment rates, and mismanagement of funds. Decades of reliance on bond financing exacerbated the issue. For individuals navigating the Puerto Rico Rejection of Claim and Report of Experience with Debtor, knowing this context can help explain the legal and fiscal environment affecting claims.

The statute of repose in Puerto Rico limits the time period during which a lawsuit can be filed after a claim arises. This period is distinct from the statute of limitations, as it sets a deadline regardless of when the injury occurs. For those engaged in the Puerto Rico Rejection of Claim and Report of Experience with Debtor process, understanding this timeline is crucial for claiming rights effectively.