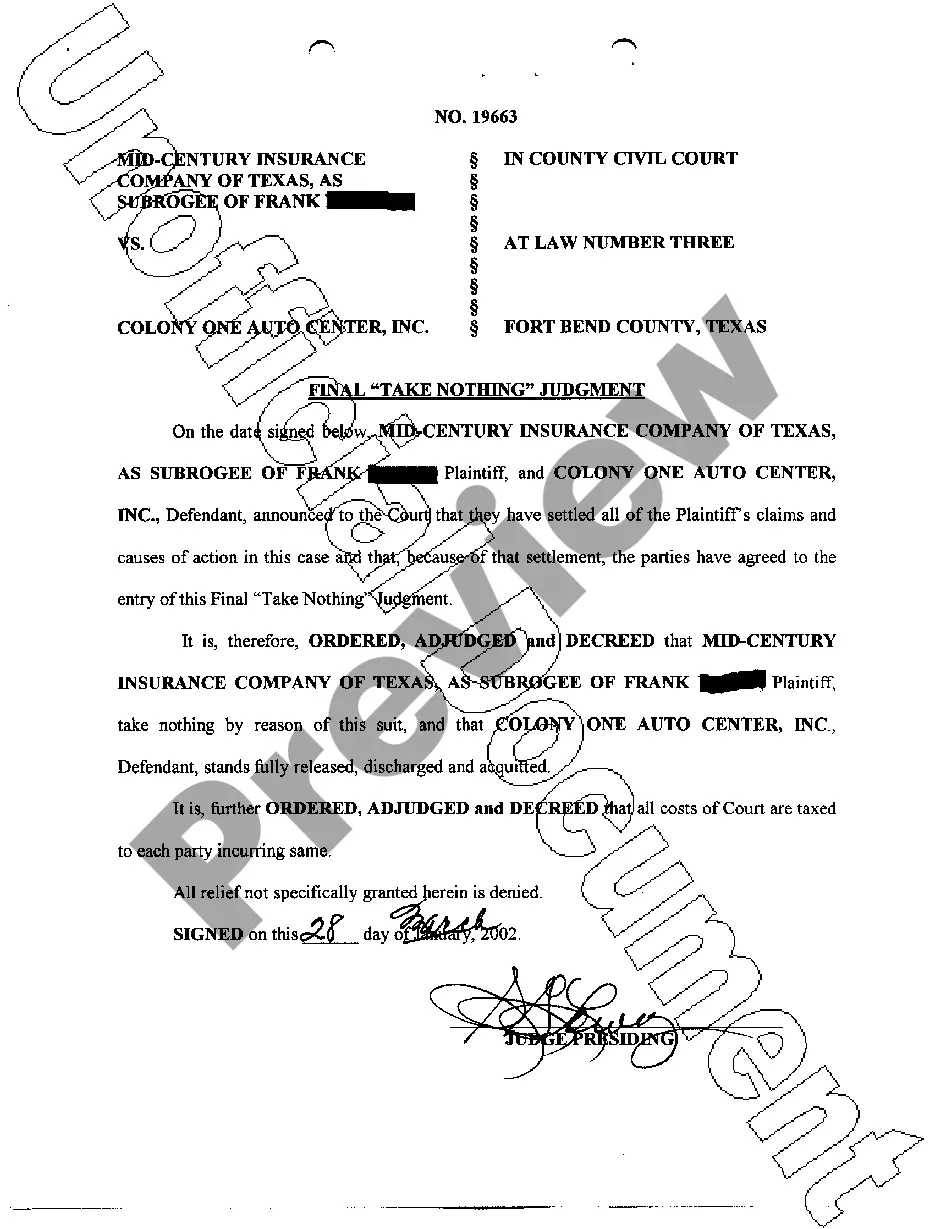

Puerto Rico Sample Letter for Withheld Delivery

Description

How to fill out Sample Letter For Withheld Delivery?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a diverse range of legal form templates that you can download or print.

By utilizing the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can obtain the latest versions of forms such as the Puerto Rico Sample Letter for Withheld Delivery within moments.

If you already have an account, Log In and download the Puerto Rico Sample Letter for Withheld Delivery from the US Legal Forms catalog. The Download button will appear on every form you view. You have access to all previously acquired forms in the My documents section of your account.

Process the payment. Use your credit card or PayPal account to complete the transaction.

Choose the format and download the form to your device. Make adjustments. Fill out, modify, print, and sign the downloaded Puerto Rico Sample Letter for Withheld Delivery. Each template you added to your account has no expiration date and is yours indefinitely. Thus, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you need. Access the Puerto Rico Sample Letter for Withheld Delivery with US Legal Forms, the most comprehensive collection of legal document templates. Utilize a vast number of professional and state-specific templates that cater to your business or personal requirements and specifications.

- If you are using US Legal Forms for the first time, here are simple instructions to assist you.

- Make sure you have selected the correct form for your region/area.

- Click the Preview button to review the form's content.

- Check the form's details to confirm that you have chosen the right form.

- If the form doesn’t meet your needs, use the Search area at the top of the screen to find the one that does.

- Once satisfied with the form, confirm your selection by clicking the Get now button.

- Then, choose the pricing plan you prefer and enter your credentials to create an account.

Form popularity

FAQ

The personal exemption in Puerto Rico allows individuals to deduct a specific amount from their taxable income, reducing their overall tax burden. This exemption can vary based on personal circumstances and filing status. If you’re preparing a Puerto Rico Sample Letter for Withheld Delivery, be sure to mention your personal exemptions for clarity.

Puerto Rico withholding refers to the income tax that is withheld from wages for residents and nonresidents working in Puerto Rico. This withholding ensures that residents fulfill their income tax responsibilities. If you have questions or need assistance, consider utilizing the Puerto Rico Sample Letter for Withheld Delivery to address any concerns directly.

Yes, foreign persons can be subject to backup withholding if they do not provide a taxpayer identification number or if the IRS notifies the payer of withholding requirements. Backup withholding is meant to ensure correct tax reporting and payment. A well-prepared Puerto Rico Sample Letter for Withheld Delivery can help clarify your compliance status in such situations.

The withholding tax on nonresident aliens and foreign entities is a tax deducted from payments made to individuals or businesses outside of the United States. This tax ensures that the U.S. government collects the necessary revenue on income earned by nonresidents. Understanding your obligations regarding this can greatly assist you in creating a Puerto Rico Sample Letter for Withheld Delivery.

Form 480.6 C is an essential tax document in Puerto Rico that reports certain types of income, such as dividends and interest. This form is critical for those receiving payments subject to withholding tax. Accurate completion of this form ensures compliance with Puerto Rican tax laws and reporting standards. To simplify this process, consider using a Puerto Rico Sample Letter for Withheld Delivery, which can help clarify your reporting obligations.

A safe harbor for tax purposes refers to specific guidelines or criteria that, if followed, protect taxpayers from additional liabilities or penalties. These provisions provide a level of certainty and can simplify the compliance process for individuals and businesses. By adhering to these safe harbor rules, you can reduce the risk of audits or disputes with tax authorities. Utilizing resources like a Puerto Rico Sample Letter for Withheld Delivery can guide you in meeting these requirements effectively.

Form 499R is a tax form used in Puerto Rico to report income and determine eligibility for certain tax benefits. This form is essential for businesses and individuals wanting to comply with local tax regulations. By accurately completing this form, you can ensure that you are taking full advantage of available tax incentives. Consider addressing your needs with a Puerto Rico Sample Letter for Withheld Delivery to make your tax documentation process easier.

To qualify for Puerto Rico tax exemption, you generally need to be a bona fide resident of the island with the right documentation. Factors such as the length of your stay, your tax home, and your post office address are critical in determining eligibility. Businesses may also need to meet specific requirements to take advantage of these exemptions. Consult a Puerto Rico Sample Letter for Withheld Delivery to ensure you meet all necessary criteria.

The tax loophole in Puerto Rico provides unique tax incentives for individuals and businesses. This allows qualifying residents to significantly reduce their tax liability by taking advantage of local tax laws. If you navigate these laws correctly, you can achieve substantial savings. Using a Puerto Rico Sample Letter for Withheld Delivery can help you understand how to effectively document your tax situation.

In Puerto Rico, residents receive a W2 form if they work for an employer who withholds federal income tax. However, the W2 may differ from the standard form issued in the mainland United States, as Puerto Rico has its own tax system. Ensure that your employment documentation is in order, as clear records will help you navigate your tax responsibilities. If you need assistance with documentation, a Puerto Rico Sample Letter for Withheld Delivery can provide a solid foundation.