Puerto Rico Receipt Template for Small Business

Description

How to fill out Receipt Template For Small Business?

US Legal Forms - one of the largest collections of authentic templates in the United States - offers a vast selection of legal document templates that you can download or print.

By using the website, you can access thousands of templates for business and personal purposes, organized by categories, states, or keywords. You can quickly find the latest versions of documents such as the Puerto Rico Receipt Template for Small Business.

If you have a monthly subscription, Log In and download the Puerto Rico Receipt Template for Small Business from the US Legal Forms library. The Download option will appear on every document you view. You have access to all previously saved templates in the My documents tab of your account.

Process the payment. Use your credit card or PayPal account to complete the transaction.

Select the format and download the template to your device. Edit it as needed and print and sign the saved Puerto Rico Receipt Template for Small Business.

Every template you add to your account has no expiration date and is yours forever. Thus, if you need to download or print another copy, simply visit the My documents section and click on the document you require.

Access the Puerto Rico Receipt Template for Small Business with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs.

- If you want to use US Legal Forms for the first time, here are simple instructions to get you started.

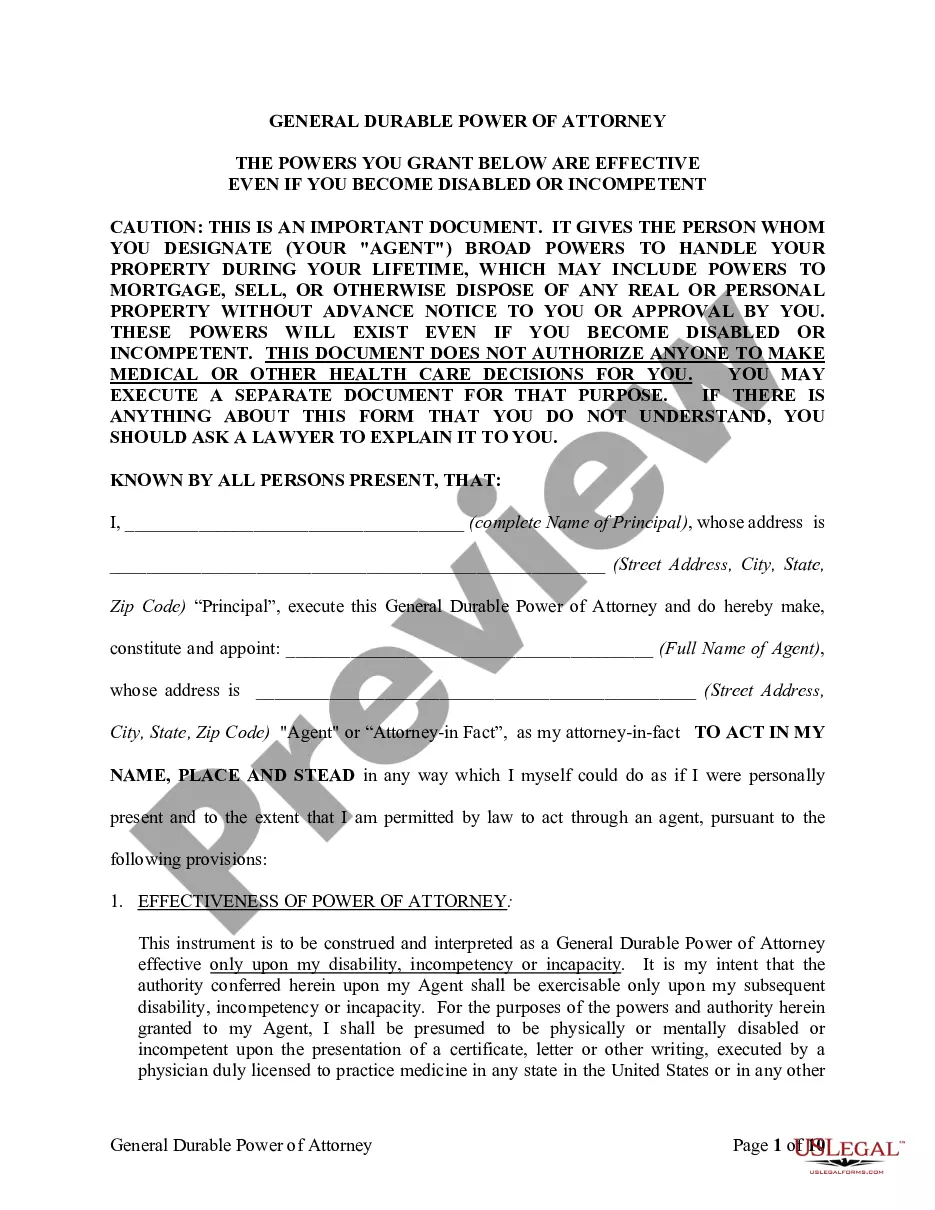

- Ensure you have selected the correct form for your city/state. Review the Preview option to check the document's content.

- Read the form description to confirm that you have chosen the right template.

- If the document doesn’t meet your needs, use the Search field at the top of the screen to find the one that does.

- Once you are satisfied with the form, confirm your selection by clicking the Purchase now button.

- Then, choose the pricing plan you prefer and provide your details to register for an account.

Form popularity

FAQ

To register for sales tax in Puerto Rico, visit the Puerto Rico Department of Treasury's website. You need to fill out the required forms for your business type and provide necessary documents for verification. Keeping a record of your transactions with a Puerto Rico Receipt Template for Small Business can provide the evidence needed when registering, ensuring compliance with local tax regulations.

When you file your taxes, include your sales tax amount on your return as a separate line item. You need to gather all sales tax collected during the year from your business activities. Utilizing a Puerto Rico Receipt Template for Small Business can help you capture all sales and sales tax information efficiently, making this process much simpler.

To file a Puerto Rico sales tax return, you must complete the necessary forms and submit them to the Puerto Rico Department of Treasury. Ensure that you accurately report all taxable sales and the corresponding tax collected. Using a Puerto Rico Receipt Template for Small Business will help you keep detailed records throughout the year, making it easier to file your sales tax return.

Yes, a US LLC can do business in Puerto Rico. However, it must register as a foreign entity with the Puerto Rico Department of State. To ensure compliance and smooth operation, it may be beneficial to maintain precise financial records using a Puerto Rico Receipt Template for Small Business that keeps track of all transactions related to your business activities.

To file your Puerto Rico annual report online, visit the official Puerto Rico Department of State website. You will need to access the Corporation Division section and follow the prompts to submit your report. Having your financial documents organized, potentially using a Puerto Rico Receipt Template for Small Business, can make this filing process much smoother.

Yes, residents and businesses in Puerto Rico must file a local tax return annually. This process ensures you report your income and any taxes owed to the Puerto Rican government. Using a Puerto Rico Receipt Template for Small Business can simplify your record-keeping and help ensure you have all necessary documentation when preparing your tax return.

Yes, if you are a resident of Puerto Rico and have income over a certain threshold, you must file a federal tax return. However, the income earned within Puerto Rico is usually not subject to federal tax. It's important to keep thorough records, which is where a Puerto Rico Receipt Template for Small Business can help you maintain accurate financial documentation.

Yes, keeping receipts for small business expenses is crucial for accurate record-keeping and tax purposes. They serve as proof of your spending and help you track your financial health. Utilizing a Puerto Rico Receipt Template for Small Business can ensure that you retain all necessary documentation in a clear and organized manner. This is essential for your financial reports and audits.

Creating a receipt for your small business is straightforward. You can use an online service or design one from scratch using a template. Utilizing a Puerto Rico Receipt Template for Small Business can save you time and effort while ensuring you include all essential information. This method can professionalize your documents and improve your branding.

Yes, Microsoft Word offers various templates, including receipts. You can easily find them by searching in the templates section of the application. However, for a specific fit for your business needs, you might consider using a Puerto Rico Receipt Template for Small Business. This template is tailored to ensure all relevant details are captured and complies with local regulations.