This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Puerto Rico Second Amendment of Trust Agreement

Description

How to fill out Second Amendment Of Trust Agreement?

Are you presently in a circumstance where you require documents for either business or personal purposes almost every day.

There are numerous legal document templates available online, but locating trustworthy ones is challenging.

US Legal Forms offers a vast array of form templates, including the Puerto Rico Second Amendment of Trust Agreement, designed to comply with state and federal regulations.

If you've found the correct form, click Buy now.

Choose the payment plan you prefer, enter the required information to create your account, and make the payment using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Puerto Rico Second Amendment of Trust Agreement template.

- In case you don't have an account and are interested in using US Legal Forms, follow these instructions.

- Locate the form you need and ensure it is applicable for the correct city/region.

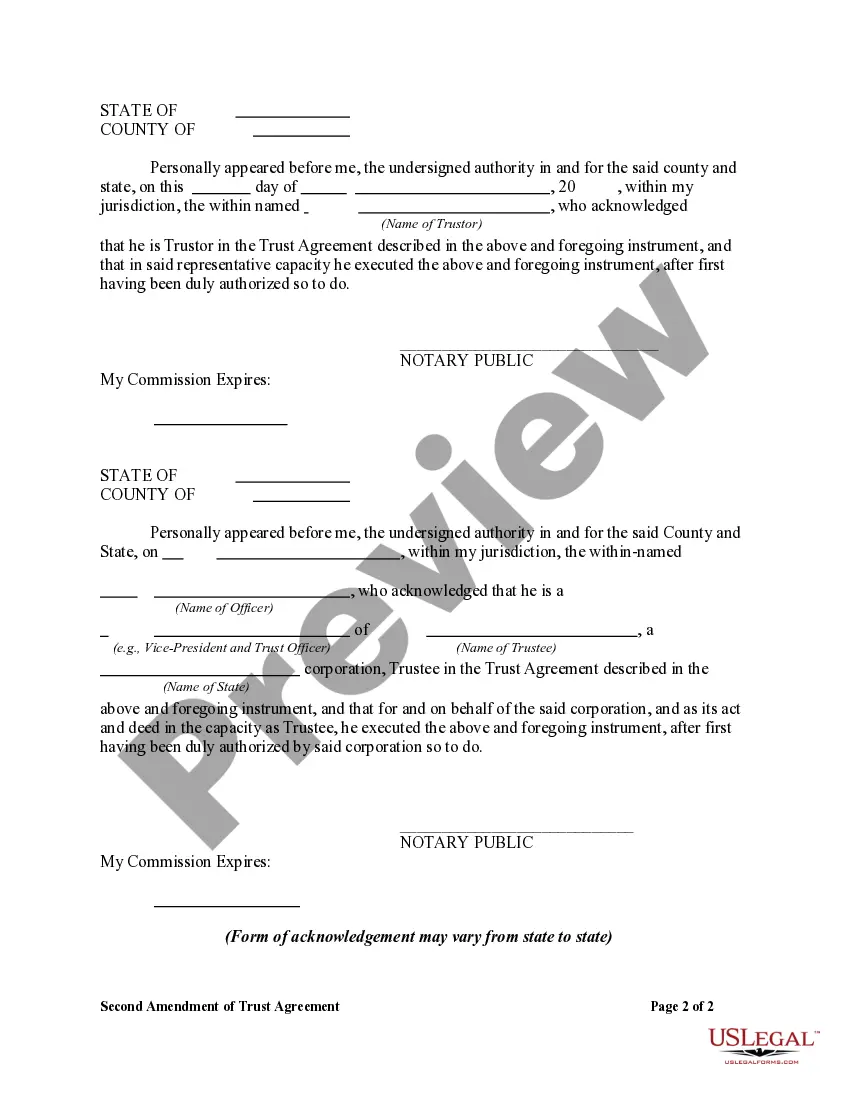

- Utilize the Preview button to review the document.

- Check the details to ensure you have selected the correct form.

- If the form is not what you are looking for, use the Search box to find the template that meets your needs and requirements.

Form popularity

FAQ

The 2nd Amendment's interpretation in Puerto Rico is a significant topic. Although the 2nd Amendment applies to the states, its application in Puerto Rico can vary due to U.S. federal laws and local regulations. To navigate this complex landscape, it's vital to understand how the Puerto Rico Second Amendment of Trust Agreement plays a role in establishing and managing trust assets. For tailored guidance on these matters, uslegalforms offers comprehensive resources and support.

The Second Amendment does apply to Puerto Rico, just as it does in the mainland United States. However, the way it is interpreted can differ due to local laws and regulations. Understanding the implications of the Puerto Rico Second Amendment of Trust Agreement is crucial for residents and those looking to navigate these legal waters. Whether you wish to protect your rights or manage trust agreements effectively, our platform provides the tools you need for clarity and compliance.

While Puerto Rico provides many unique advantages, the best state to own a trust can depend on individual circumstances. Factors such as tax rates, state laws, and your financial goals all play a role. Consulting with a trust professional can help you make an informed decision tailored to your needs.

The Puerto Rico Trust Act governs trust relationships in Puerto Rico and outlines the rules for establishing and managing trusts. This legislation supports various types of trusts, including those benefiting from the Puerto Rico Second Amendment of Trust Agreement. Understanding this act is essential for effective trust management.

You can create a trust in Puerto Rico, including those governed by the Puerto Rico Second Amendment of Trust Agreement. Establishing a local trust can provide various advantages for estate planning and tax efficiency. Be sure to consult with a legal professional to ensure compliance with local laws.

Yes, by moving to Puerto Rico and meeting certain residency criteria, you can significantly reduce or even eliminate income tax obligations. The Puerto Rico Second Amendment of Trust Agreement provides an attractive tax landscape. Consider working with tax experts to optimize your move for maximum benefit.

One way to legally avoid capital gains tax is by relocating to Puerto Rico and establishing bona fide residency. Utilizing the Puerto Rico Second Amendment of Trust Agreement can offer substantial tax benefits while residing on the island. Always consult with professionals to navigate these benefits safely.

If you're a bona fide resident of Puerto Rico, you typically do not need to file a federal tax return for income earned in Puerto Rico. However, if you have income from outside Puerto Rico or specific circumstances, you may still be required to file. Reviewing your tax obligations with an expert is a wise choice.

Puerto Rico form 482 is mandated for reporting certain tax credits and benefits related to income tax. This form can often be utilized by those taking advantage of the Puerto Rico Second Amendment of Trust Agreement and its tax incentives. Make sure you consult an expert to understand how to file properly.

Form 480.6 C is used in Puerto Rico for reporting income from sources like dividends and interest. This form is essential for both residents and those using the Puerto Rico Second Amendment of Trust Agreement to comply with local tax regulations. Filing accurately ensures you stay informed about your tax responsibilities.