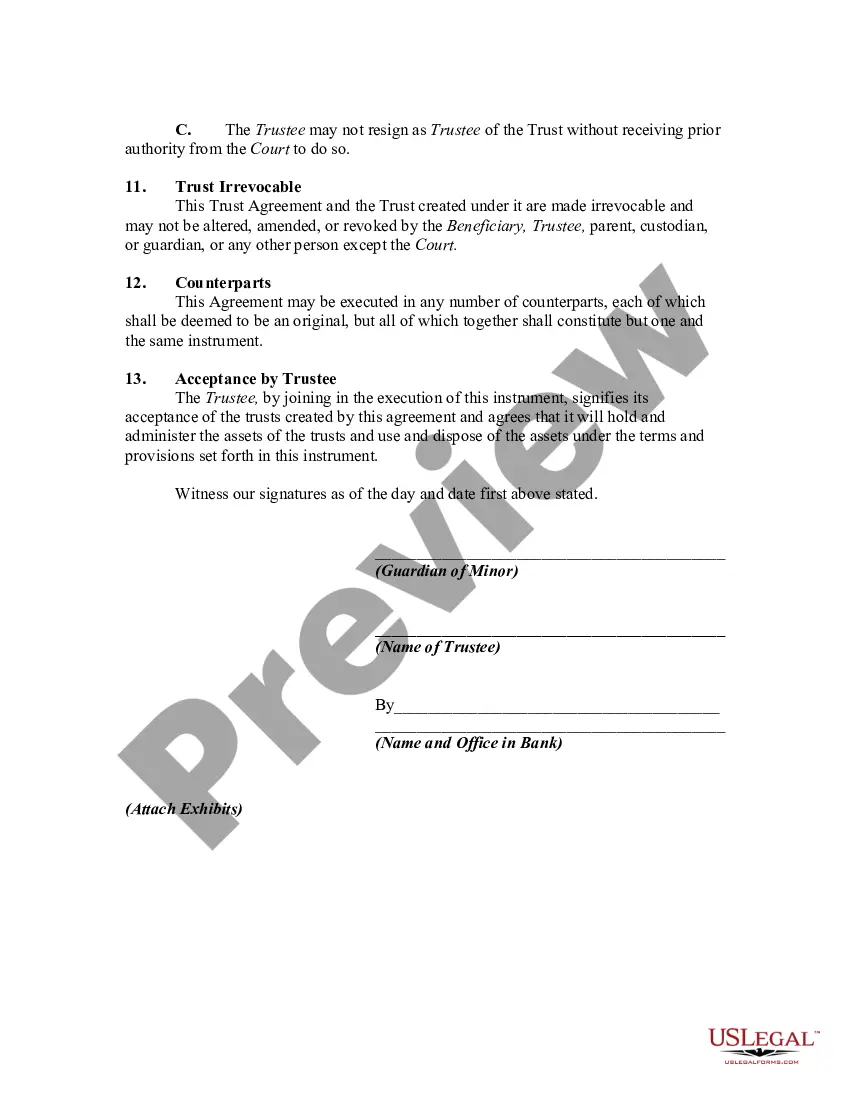

A trust is the legal relationship between one person, the trustee, having an equitable ownership or management of certain property and another person, the beneficiary, owning the legal title to that property. The beneficiary is entitled to the performance of certain duties and the exercise of certain powers by the trustee, which performance may be enforced by a court of equity. This form is an example of a trust that is subject to direct court oversight since the initial trust funds resulted from a civil judgment in favor of a minor.

Puerto Rico Trust Agreement for Funds for Recovery of Judgment for Minor

Description

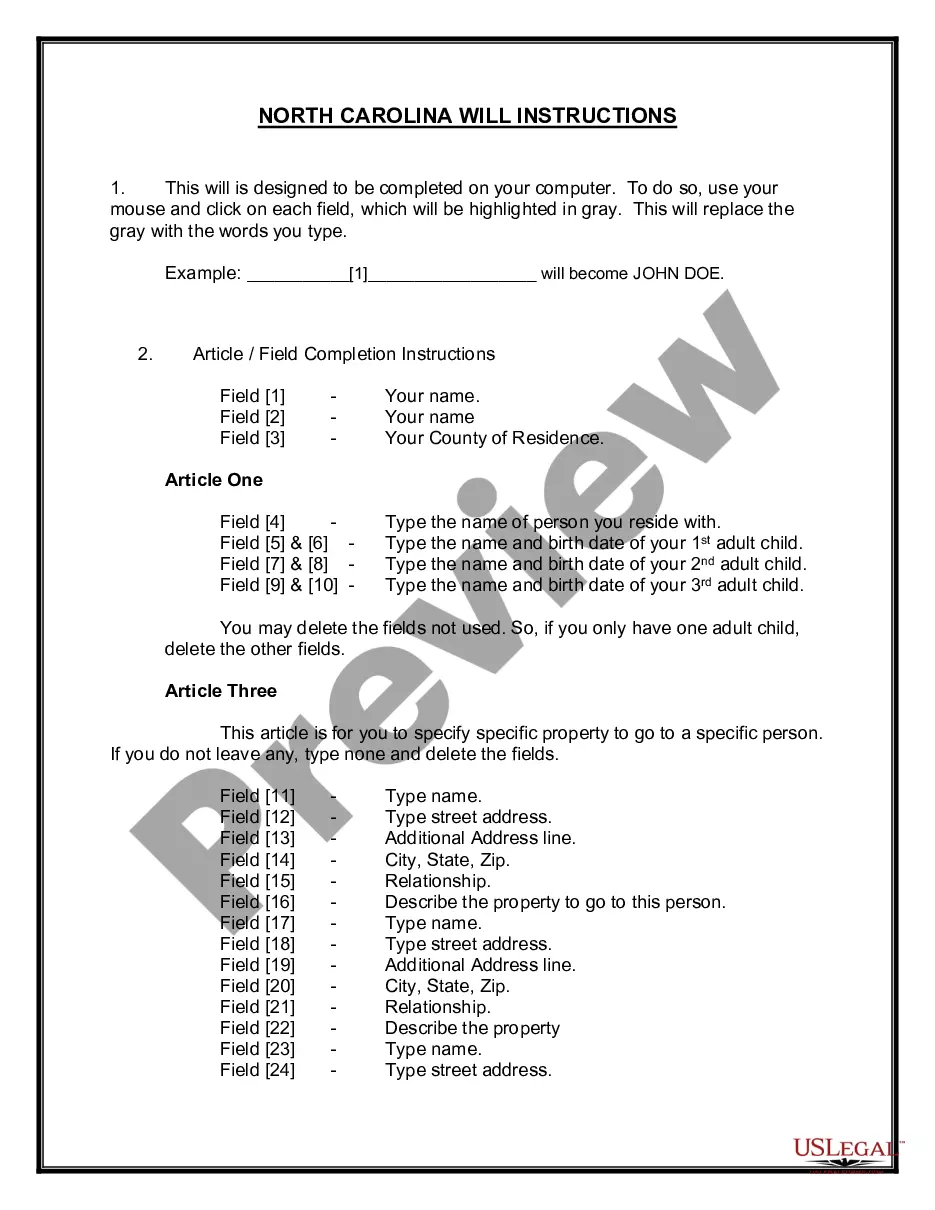

How to fill out Trust Agreement For Funds For Recovery Of Judgment For Minor?

If you need to comprehensive, acquire, or printing authorized papers web templates, use US Legal Forms, the biggest selection of authorized kinds, which can be found on the web. Take advantage of the site`s simple and hassle-free research to get the papers you require. Various web templates for company and personal purposes are sorted by classes and states, or keywords. Use US Legal Forms to get the Puerto Rico Trust Agreement for Funds for Recovery of Judgment for Minor in just a few clicks.

If you are already a US Legal Forms customer, log in for your bank account and click on the Acquire option to get the Puerto Rico Trust Agreement for Funds for Recovery of Judgment for Minor. You may also entry kinds you formerly saved inside the My Forms tab of your respective bank account.

If you work with US Legal Forms the first time, refer to the instructions beneath:

- Step 1. Be sure you have selected the form for your correct metropolis/country.

- Step 2. Utilize the Review option to examine the form`s information. Never forget to learn the explanation.

- Step 3. If you are not satisfied together with the form, take advantage of the Lookup discipline at the top of the monitor to get other models in the authorized form format.

- Step 4. When you have discovered the form you require, select the Acquire now option. Choose the prices prepare you choose and put your accreditations to sign up for an bank account.

- Step 5. Process the financial transaction. You may use your Мisa or Ьastercard or PayPal bank account to complete the financial transaction.

- Step 6. Choose the file format in the authorized form and acquire it in your device.

- Step 7. Total, edit and printing or signal the Puerto Rico Trust Agreement for Funds for Recovery of Judgment for Minor.

Each authorized papers format you acquire is yours permanently. You may have acces to every form you saved in your acccount. Click the My Forms segment and select a form to printing or acquire once again.

Compete and acquire, and printing the Puerto Rico Trust Agreement for Funds for Recovery of Judgment for Minor with US Legal Forms. There are many specialist and state-specific kinds you can utilize for the company or personal requirements.

Form popularity

FAQ

The instant Certificate is filed pursuant to Pa. C.S.A. §925, which permits the filing of a Certificate where an original death certificate cannot be obtained and it is not necessary to administer an estate but a public record of death is necessary.

The intestate share of a decedent's surviving spouse is: (1) If there is no surviving issue or parent of the decedent, the entire intestate estate. (2) If there is no surviving issue of the decedent but he is survived by a parent or parents, the first $30,000 plus one-half of the balance of the intestate estate.

Under Pennsylvania law, a surviving child is entitled to a portion of their deceased parent's estate, even if they died without a will. The share that each child is entitled to depends on the number of surviving children and whether the surviving spouse is also a parent of the child.

Intestate Share Of A Surviving Spouse If a decedent is survived by his or her spouse and has no surviving children or parents, the surviving spouse will receive the entire intestate estate.

Spousal rights after death Typically, they have rights to portions of the departed's assets, irrespective of the will. This is known as the ?elective share.? Joint assets? Usually, they transition directly to the spouse. Plus, pensions and insurances frequently offer inherent safeguards.

--Any employer of a person dying domiciled in this Commonwealth at any time after the death of the employee, whether or not a personal representative has been appointed, may pay wages, salary or any employee benefits due the deceased in an amount not exceeding $10,000 to the spouse, any child, the father or mother, or ...

Inheritance Rights of Spouse: But, Pennsylvania does give the surviving spouse the right to claim an elective share of one-third to one-half of the estate no matter what the will states. The surviving spouse must go to court in order to object what a will states or claim an elective share.

For example, if someone dies without a will in Pennsylvania and they have a spouse but no children, the spouse will receive the entire estate. However, if they have children, the estate will be divided equally among the surviving children and the spouse.